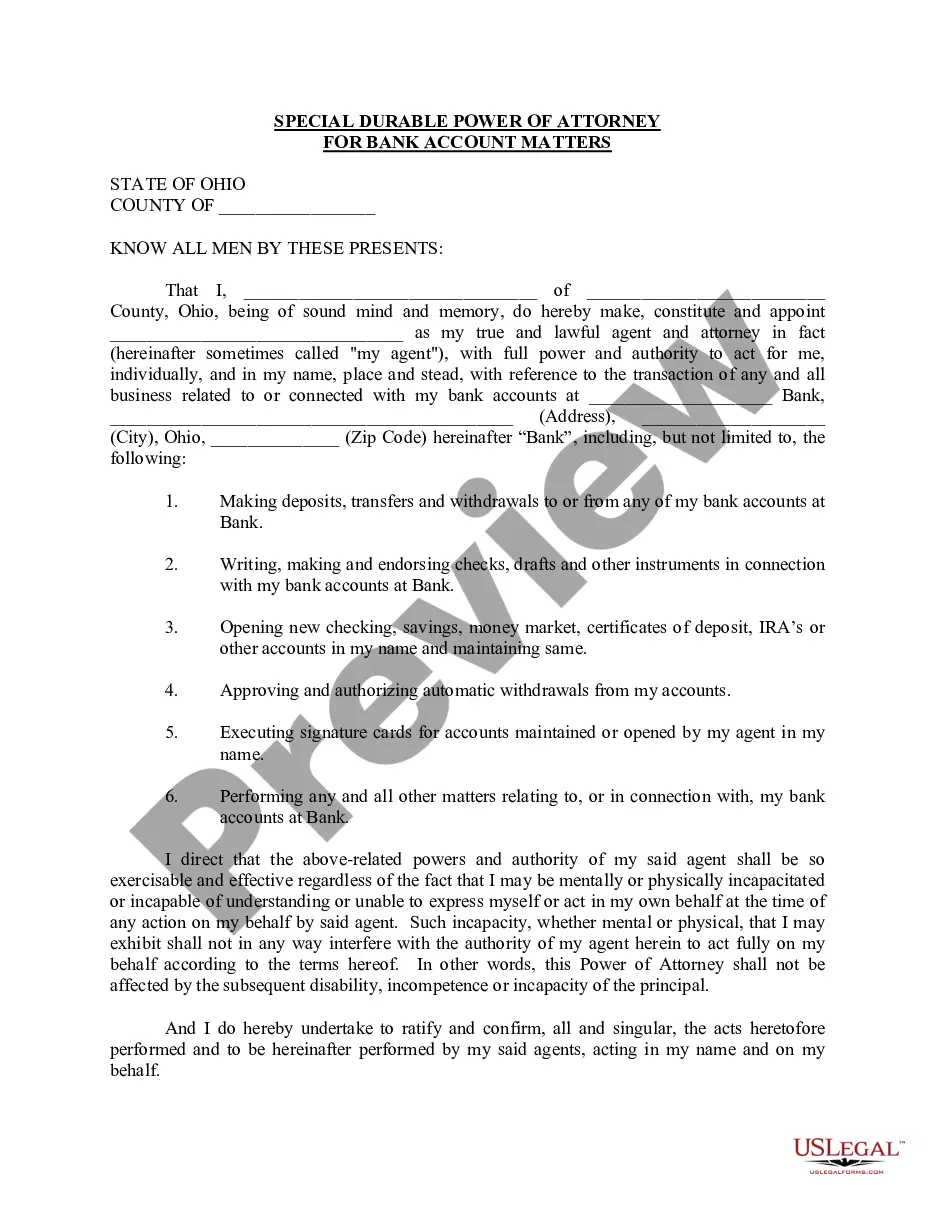

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

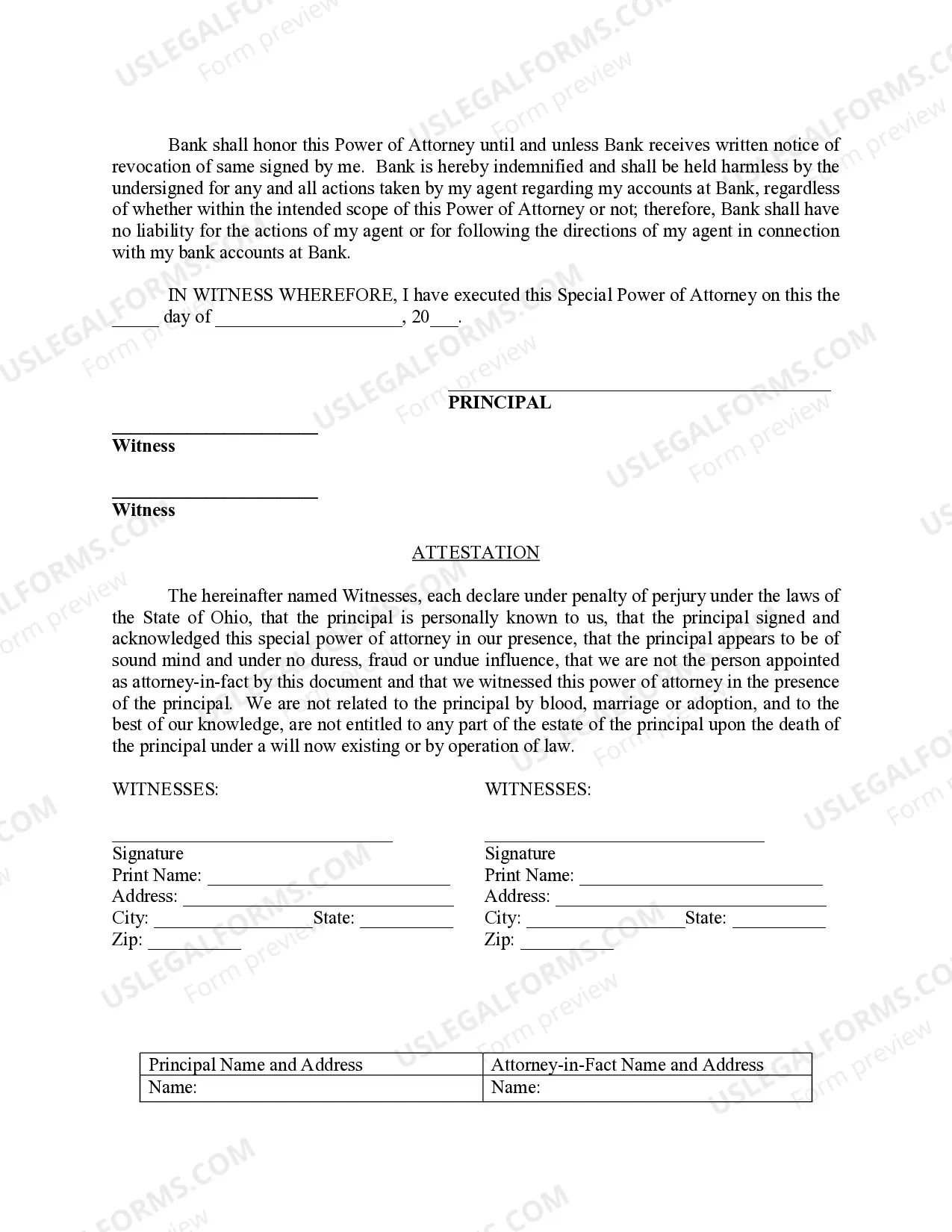

Akron Ohio Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a trusted individual, known as the attorney-in-fact or agent, the authority to manage specific bank account-related matters on behalf of the principal. This power of attorney is specifically designed for situations where individuals want to ensure seamless management of their financial affairs in the event of their incapacity or absence. The Akron Ohio Special Durable Power of Attorney for Bank Account Matters allows the agent to perform a variety of tasks related to the principal's bank accounts. These tasks may include making deposits, withdrawals, transfers, and payments, checking balances, reviewing account statements, and opening or closing accounts. The agent is also empowered to sign checks, drafts, or electronic transactions, endorse or negotiate checks, and obtain account information from financial institutions. It is important to note that there are different types of Akron Ohio Special Durable Power of Attorney for Bank Account Matters, each catering to different needs and preferences. Some common types include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent authority over specific bank accounts or a particular financial institution. The agent can only perform tasks related to the designated accounts and does not have control over other financial matters. 2. General Special Durable Power of Attorney for Bank Account Matters: With this type, the agent possesses broader authority and can manage multiple bank accounts held by the principal across different financial institutions. They are authorized to handle all matters concerning the principal's bank accounts, subject to any limitations imposed in the document. 3. Springing Special Durable Power of Attorney for Bank Account Matters: This power of attorney becomes effective only when a specific event defined in the document occurs. It can be triggered by the principal's incapacitation or any other specified condition, ensuring that the agent can only act when necessary. When creating an Akron Ohio Special Durable Power of Attorney for Bank Account Matters, it is essential to consult with an experienced attorney to ensure compliance with relevant state laws and to customize the document to meet specific requirements. Furthermore, the principal should carefully choose a trustworthy agent who will act in their best interests and regularly review and update the power of attorney as needed.Akron Ohio Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a trusted individual, known as the attorney-in-fact or agent, the authority to manage specific bank account-related matters on behalf of the principal. This power of attorney is specifically designed for situations where individuals want to ensure seamless management of their financial affairs in the event of their incapacity or absence. The Akron Ohio Special Durable Power of Attorney for Bank Account Matters allows the agent to perform a variety of tasks related to the principal's bank accounts. These tasks may include making deposits, withdrawals, transfers, and payments, checking balances, reviewing account statements, and opening or closing accounts. The agent is also empowered to sign checks, drafts, or electronic transactions, endorse or negotiate checks, and obtain account information from financial institutions. It is important to note that there are different types of Akron Ohio Special Durable Power of Attorney for Bank Account Matters, each catering to different needs and preferences. Some common types include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent authority over specific bank accounts or a particular financial institution. The agent can only perform tasks related to the designated accounts and does not have control over other financial matters. 2. General Special Durable Power of Attorney for Bank Account Matters: With this type, the agent possesses broader authority and can manage multiple bank accounts held by the principal across different financial institutions. They are authorized to handle all matters concerning the principal's bank accounts, subject to any limitations imposed in the document. 3. Springing Special Durable Power of Attorney for Bank Account Matters: This power of attorney becomes effective only when a specific event defined in the document occurs. It can be triggered by the principal's incapacitation or any other specified condition, ensuring that the agent can only act when necessary. When creating an Akron Ohio Special Durable Power of Attorney for Bank Account Matters, it is essential to consult with an experienced attorney to ensure compliance with relevant state laws and to customize the document to meet specific requirements. Furthermore, the principal should carefully choose a trustworthy agent who will act in their best interests and regularly review and update the power of attorney as needed.