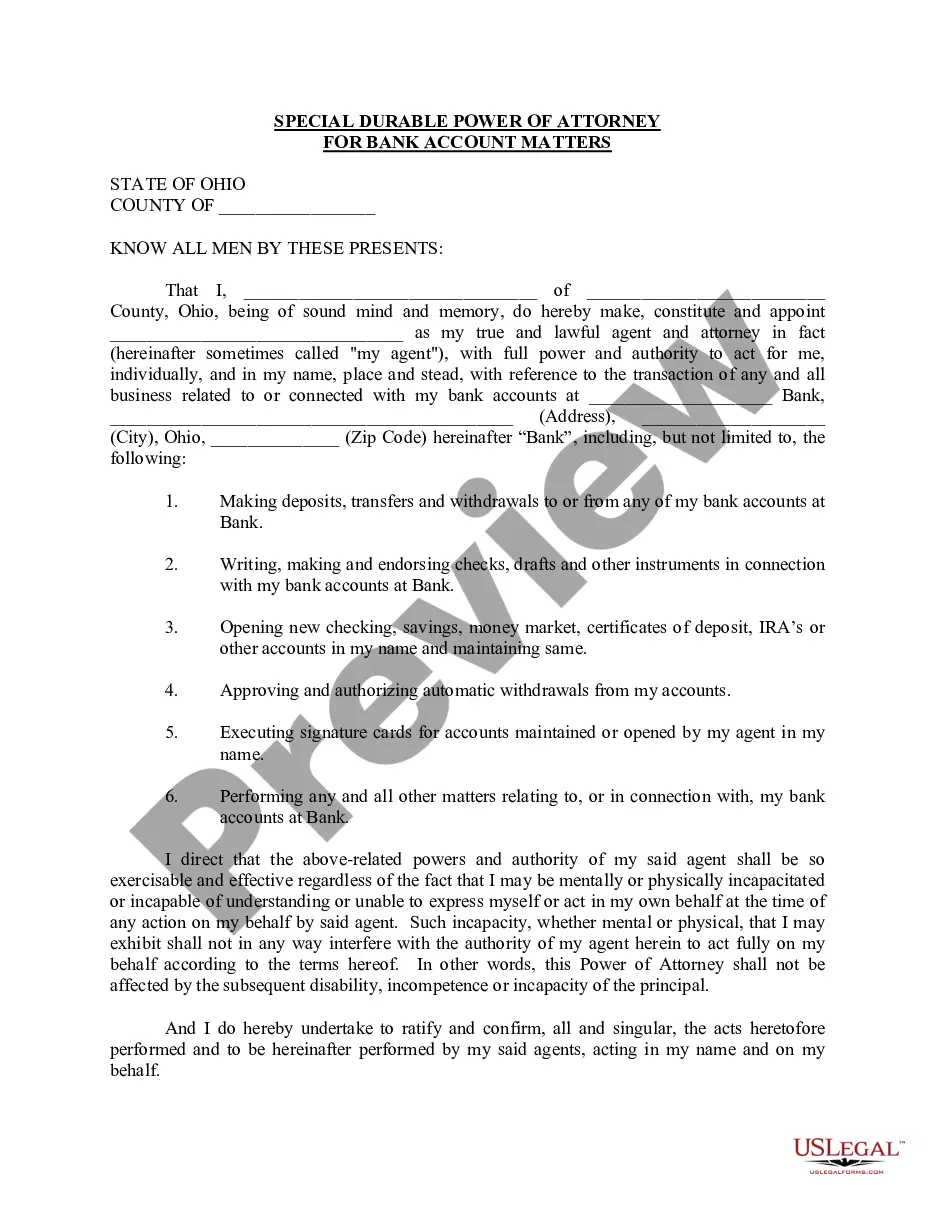

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

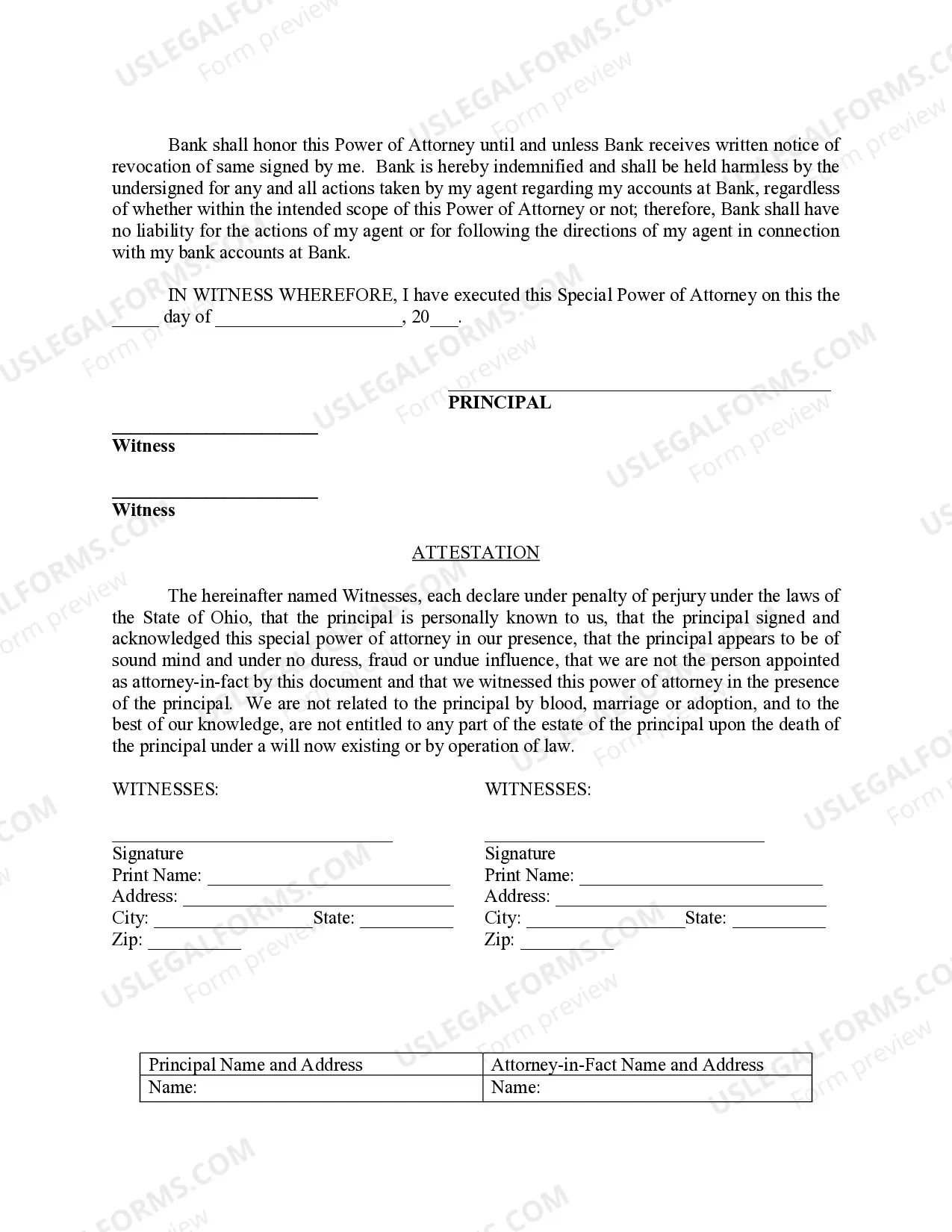

The Franklin Ohio Special Durable Power of Attorney for Bank Account Matters is a legal document that grants someone the authority to handle specific banking transactions on behalf of another individual. This power of attorney form is designed to provide a trusted person with the ability to manage various financial matters related to bank accounts when the account holder is unable to do so due to incapacitation, illness, or any other reason. Key Features: 1. Comprehensive Authorization: The Franklin Ohio Special Durable Power of Attorney for Bank Account Matters allows the appointed individual, known as the attorney-in-fact, to undertake a wide range of actions pertaining to the designated bank accounts. This may include depositing or withdrawing funds, writing checks, transferring money between accounts, and conducting online or mobile banking transactions. 2. Durable Power of Attorney: The "durable" aspect of this power of attorney means that it remains effective even if the account holder becomes mentally or physically incapacitated. It offers greater protection and allows the attorney-in-fact to act on behalf of the account holder in potentially challenging circumstances. 3. Specific Scope: Although this power of attorney grants broad authority over bank account matters, it is important to note that it specifically pertains to banking transactions only. The attorney-in-fact is not authorized to handle other areas of the account holder's financial affairs such as real estate transactions, investments, or healthcare decisions. Different Types: 1. Limited Franklin Ohio Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney restricts the attorney-in-fact's authority to specific transactions or a particular duration. It can be tailored to meet the unique needs and preferences of the account holder, offering more control over the delegation of powers. 2. General Franklin Ohio Special Durable Power of Attorney for Bank Account Matters: In contrast to the limited power of attorney, this type grants the attorney-in-fact broad authority to manage all aspects of the account holder's banking matters. It covers a wide range of transactions and allows the attorney-in-fact to handle important financial affairs comprehensively. 3. Springing Franklin Ohio Special Durable Power of Attorney for Bank Account Matters: This power of attorney becomes effective only when a specific event or condition mentioned in the document occurs. For example, it may come into effect when the account holder is deemed mentally incompetent by a medical professional. It is important to consult with an attorney to ensure that the Franklin Ohio Special Durable Power of Attorney for Bank Account Matters meets all legal requirements and conforms to the specific needs of the account holder. This document offers valuable peace of mind by ensuring that a trusted individual can manage important banking matters efficiently and responsibly when the account holder is unable to do so.The Franklin Ohio Special Durable Power of Attorney for Bank Account Matters is a legal document that grants someone the authority to handle specific banking transactions on behalf of another individual. This power of attorney form is designed to provide a trusted person with the ability to manage various financial matters related to bank accounts when the account holder is unable to do so due to incapacitation, illness, or any other reason. Key Features: 1. Comprehensive Authorization: The Franklin Ohio Special Durable Power of Attorney for Bank Account Matters allows the appointed individual, known as the attorney-in-fact, to undertake a wide range of actions pertaining to the designated bank accounts. This may include depositing or withdrawing funds, writing checks, transferring money between accounts, and conducting online or mobile banking transactions. 2. Durable Power of Attorney: The "durable" aspect of this power of attorney means that it remains effective even if the account holder becomes mentally or physically incapacitated. It offers greater protection and allows the attorney-in-fact to act on behalf of the account holder in potentially challenging circumstances. 3. Specific Scope: Although this power of attorney grants broad authority over bank account matters, it is important to note that it specifically pertains to banking transactions only. The attorney-in-fact is not authorized to handle other areas of the account holder's financial affairs such as real estate transactions, investments, or healthcare decisions. Different Types: 1. Limited Franklin Ohio Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney restricts the attorney-in-fact's authority to specific transactions or a particular duration. It can be tailored to meet the unique needs and preferences of the account holder, offering more control over the delegation of powers. 2. General Franklin Ohio Special Durable Power of Attorney for Bank Account Matters: In contrast to the limited power of attorney, this type grants the attorney-in-fact broad authority to manage all aspects of the account holder's banking matters. It covers a wide range of transactions and allows the attorney-in-fact to handle important financial affairs comprehensively. 3. Springing Franklin Ohio Special Durable Power of Attorney for Bank Account Matters: This power of attorney becomes effective only when a specific event or condition mentioned in the document occurs. For example, it may come into effect when the account holder is deemed mentally incompetent by a medical professional. It is important to consult with an attorney to ensure that the Franklin Ohio Special Durable Power of Attorney for Bank Account Matters meets all legal requirements and conforms to the specific needs of the account holder. This document offers valuable peace of mind by ensuring that a trusted individual can manage important banking matters efficiently and responsibly when the account holder is unable to do so.