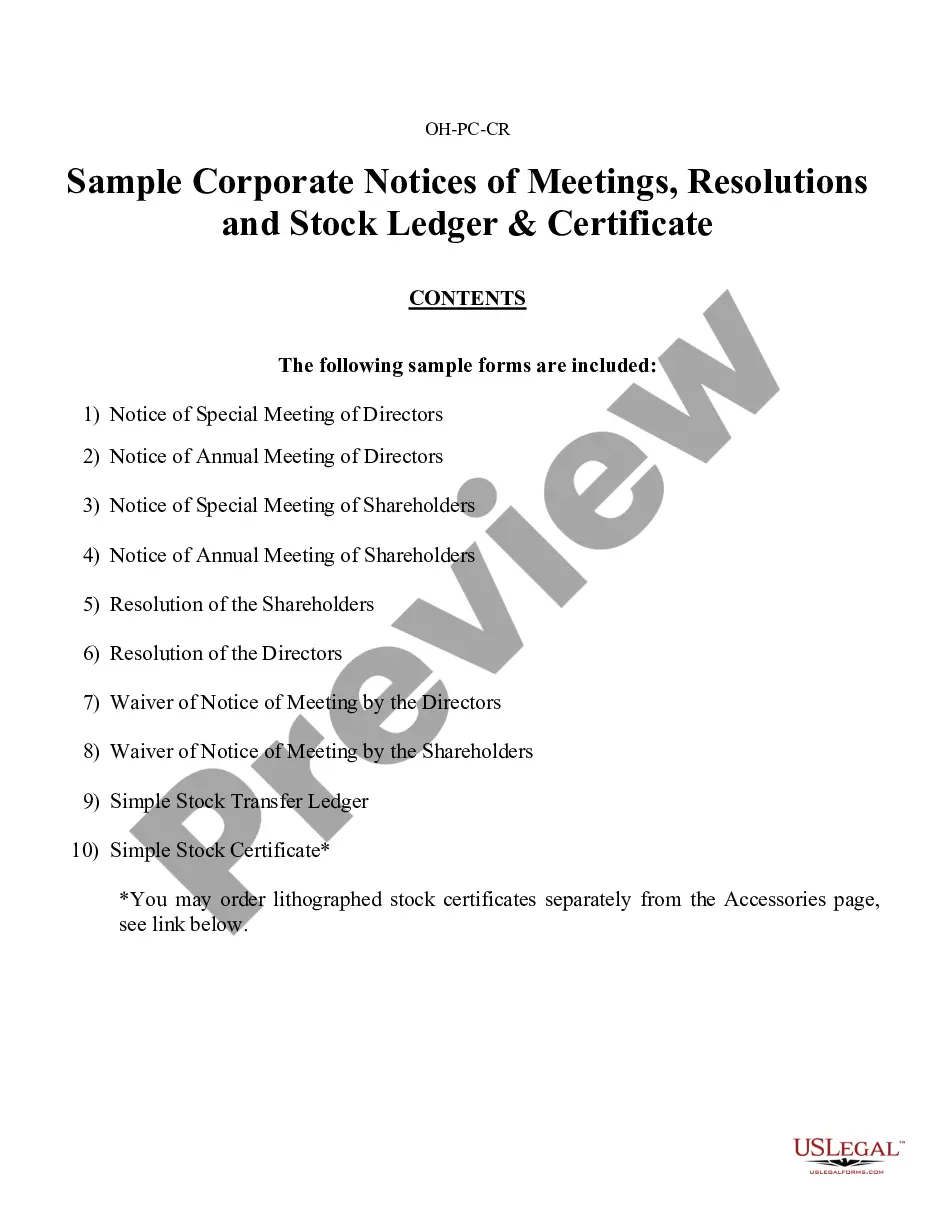

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

Title: Akron Sample Corporate Records for Ohio Professional Corporations (Professional Associations) Introduction: In this article, we will provide a detailed description of Akron Sample Corporate Records for an Ohio Professional Corporation, also known as a Professional Association. We will explore different types of corporate records that are essential for maintaining proper documentation and compliance within such organizations. The aim is to offer a comprehensive overview of the records required to ensure the smooth operation and legal standing of an Ohio Professional Corporation. 1. Articles of Incorporation: The Articles of Incorporation is the foundational document that establishes a Professional Corporation in Ohio. It includes essential details about the corporation's name, purpose, duration, registered agent, and share structure. These records need to be prepared and filed with the Ohio Secretary of State to legally create the Professional Corporation. 2. Bylaws: Bylaws serve as the governing rules for the Professional Corporation and define its internal structure and operations. Akron Sample Corporate Records often include a comprehensive set of bylaws that address voting procedures, board responsibilities, officers' roles, and membership guidelines. Following and updating the bylaws is crucial for maintaining compliance and ensuring effective governance. 3. Minutes of Meetings: Minutes of meetings play a vital role in documenting important decisions and actions taken by the Professional Corporation's board of directors and shareholders. Akron Sample Corporate Records should include properly recorded minutes for both board meetings and shareholder meetings. These minutes provide an official account of discussions, resolutions, and voting results, enhancing transparency and legal defensibility. 4. Shareholder Agreements: Shareholder agreements define the rights, obligations, and responsibilities of individual shareholders within a Professional Corporation. These agreements typically cover topics such as restrictions on share transfers, provisions for dispute resolution, buy-sell provisions, and mechanisms for handling shareholder disagreements. Akron Sample Corporate Records may include various types of shareholder agreements tailored to the needs of different Ohio Professional Corporations. 5. Financial Statements: Accurate financial records are crucial for any corporation, including Ohio Professional Corporations. Akron Sample Corporate Records should demonstrate proper bookkeeping and financial reporting practices. Financial statements, such as balance sheets, income statements, and cash flow statements, allow for transparent monitoring of the company's financial health and compliance with taxation and accounting standards. 6. Annual Reports: Ohio law requires Professional Corporations to file annual reports with the Secretary of State. These reports provide updated information about the corporation's principal address, registered agents, and current directors and officers. Akron Sample Corporate Records should include a well-prepared and timely submitted annual report to maintain the Professional Corporation's active status. Conclusion: Maintaining accurate and up-to-date corporate records is essential for Ohio Professional Corporations, also known as Professional Associations. Akron Sample Corporate Records should include crucial documents such as Articles of Incorporation, Bylaws, Minutes of Meetings, Shareholder Agreements, Financial Statements, and Annual Reports. These records ensure legal compliance, effective governance, and transparent communication within the Professional Corporation while supporting its long-term success.Title: Akron Sample Corporate Records for Ohio Professional Corporations (Professional Associations) Introduction: In this article, we will provide a detailed description of Akron Sample Corporate Records for an Ohio Professional Corporation, also known as a Professional Association. We will explore different types of corporate records that are essential for maintaining proper documentation and compliance within such organizations. The aim is to offer a comprehensive overview of the records required to ensure the smooth operation and legal standing of an Ohio Professional Corporation. 1. Articles of Incorporation: The Articles of Incorporation is the foundational document that establishes a Professional Corporation in Ohio. It includes essential details about the corporation's name, purpose, duration, registered agent, and share structure. These records need to be prepared and filed with the Ohio Secretary of State to legally create the Professional Corporation. 2. Bylaws: Bylaws serve as the governing rules for the Professional Corporation and define its internal structure and operations. Akron Sample Corporate Records often include a comprehensive set of bylaws that address voting procedures, board responsibilities, officers' roles, and membership guidelines. Following and updating the bylaws is crucial for maintaining compliance and ensuring effective governance. 3. Minutes of Meetings: Minutes of meetings play a vital role in documenting important decisions and actions taken by the Professional Corporation's board of directors and shareholders. Akron Sample Corporate Records should include properly recorded minutes for both board meetings and shareholder meetings. These minutes provide an official account of discussions, resolutions, and voting results, enhancing transparency and legal defensibility. 4. Shareholder Agreements: Shareholder agreements define the rights, obligations, and responsibilities of individual shareholders within a Professional Corporation. These agreements typically cover topics such as restrictions on share transfers, provisions for dispute resolution, buy-sell provisions, and mechanisms for handling shareholder disagreements. Akron Sample Corporate Records may include various types of shareholder agreements tailored to the needs of different Ohio Professional Corporations. 5. Financial Statements: Accurate financial records are crucial for any corporation, including Ohio Professional Corporations. Akron Sample Corporate Records should demonstrate proper bookkeeping and financial reporting practices. Financial statements, such as balance sheets, income statements, and cash flow statements, allow for transparent monitoring of the company's financial health and compliance with taxation and accounting standards. 6. Annual Reports: Ohio law requires Professional Corporations to file annual reports with the Secretary of State. These reports provide updated information about the corporation's principal address, registered agents, and current directors and officers. Akron Sample Corporate Records should include a well-prepared and timely submitted annual report to maintain the Professional Corporation's active status. Conclusion: Maintaining accurate and up-to-date corporate records is essential for Ohio Professional Corporations, also known as Professional Associations. Akron Sample Corporate Records should include crucial documents such as Articles of Incorporation, Bylaws, Minutes of Meetings, Shareholder Agreements, Financial Statements, and Annual Reports. These records ensure legal compliance, effective governance, and transparent communication within the Professional Corporation while supporting its long-term success.