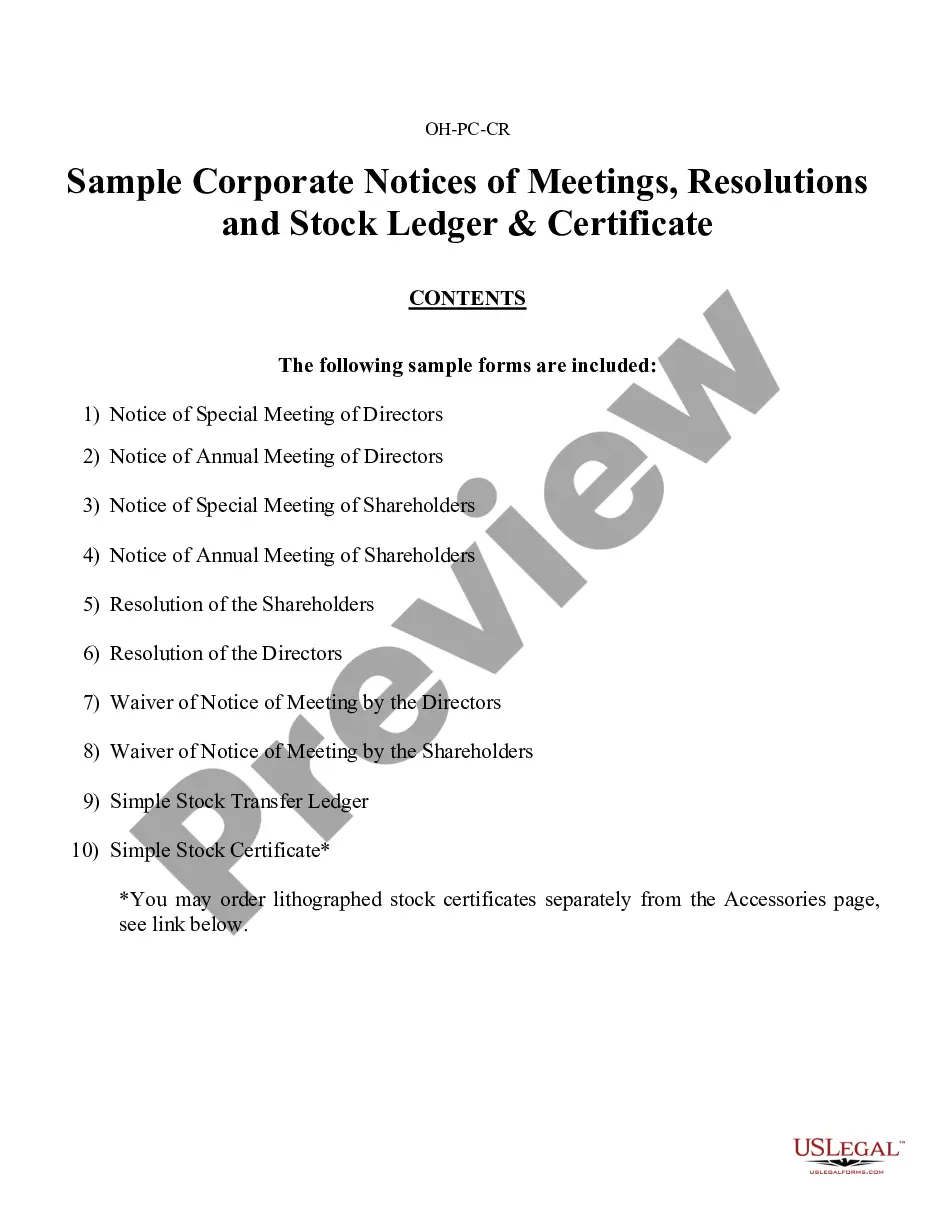

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

Cincinnati Sample Corporate Records for an Ohio Professional Corporation, also known as a Professional Association, refer to the official documents and records that a professional corporation must maintain in compliance with Ohio state laws. These records are essential for ensuring legal and financial transparency, maintaining regulatory compliance, and protecting the corporation's interests. Cincinnati Sample Corporate Records for an Ohio Professional Corporation typically includes: 1. Articles of Incorporation: This is the founding legal document filed with the Ohio Secretary of State that establishes the professional corporation. It contains essential information such as the corporation's name, purpose, registered agent, and the names of its incorporates. 2. Bylaws: These are the rules and guidelines that govern how the professional corporation will be managed and operated. Bylaws cover various aspects, including meeting procedures, roles and responsibilities of directors and officers, voting rights, and procedures for amending the bylaws. 3. Meeting Minutes: Detailed records of all official meetings held by the professional corporation's governing bodies, such as the board of directors and shareholders. Meeting minutes typically include the date, time, location, attendees, agenda items, discussions, decisions, and resolutions made during the meeting. 4. Shareholder Agreements: If there are multiple shareholders in the professional corporation, a shareholder agreement may be present. This document outlines the rights and obligations of each shareholder, including voting rights, dividend distribution, restrictions on share transfers, and dispute resolution procedures. 5. Stock Ledger: A stock ledger tracks the issuance, ownership, and transfer of the corporation's shares. It maintains an accurate record of shareholders' names, addresses, the number of shares held, and any changes related to share ownership. 6. Financial Statements: Detailed financial reports, including balance sheets, income statements, and cash flow statements, prepared regularly to assess the financial health of the professional corporation. These records are crucial for tax purposes, obtaining loans, and making informed business decisions. 7. Annual Reports: Every year, professional corporations in Ohio are required to file an annual report with the Ohio Secretary of State. This report provides updated information about the corporation's registered agent, principal office address, and names and addresses of directors and officers. 8. Licenses and Permits: Any licenses or permits obtained by the professional corporation to carry out its specific services or operations should be maintained as part of the corporate records. By keeping these Cincinnati Sample Corporate Records organized, up-to-date, and easily accessible, professional corporations can demonstrate compliance with Ohio state laws, maintain their legal status, and protect the interests of shareholders and stakeholders. It is crucial to consult with legal professionals or corporate governance experts to ensure complete understanding and compliance with the specific requirements of Cincinnati Sample Corporate Records for an Ohio Professional Corporation.Cincinnati Sample Corporate Records for an Ohio Professional Corporation, also known as a Professional Association, refer to the official documents and records that a professional corporation must maintain in compliance with Ohio state laws. These records are essential for ensuring legal and financial transparency, maintaining regulatory compliance, and protecting the corporation's interests. Cincinnati Sample Corporate Records for an Ohio Professional Corporation typically includes: 1. Articles of Incorporation: This is the founding legal document filed with the Ohio Secretary of State that establishes the professional corporation. It contains essential information such as the corporation's name, purpose, registered agent, and the names of its incorporates. 2. Bylaws: These are the rules and guidelines that govern how the professional corporation will be managed and operated. Bylaws cover various aspects, including meeting procedures, roles and responsibilities of directors and officers, voting rights, and procedures for amending the bylaws. 3. Meeting Minutes: Detailed records of all official meetings held by the professional corporation's governing bodies, such as the board of directors and shareholders. Meeting minutes typically include the date, time, location, attendees, agenda items, discussions, decisions, and resolutions made during the meeting. 4. Shareholder Agreements: If there are multiple shareholders in the professional corporation, a shareholder agreement may be present. This document outlines the rights and obligations of each shareholder, including voting rights, dividend distribution, restrictions on share transfers, and dispute resolution procedures. 5. Stock Ledger: A stock ledger tracks the issuance, ownership, and transfer of the corporation's shares. It maintains an accurate record of shareholders' names, addresses, the number of shares held, and any changes related to share ownership. 6. Financial Statements: Detailed financial reports, including balance sheets, income statements, and cash flow statements, prepared regularly to assess the financial health of the professional corporation. These records are crucial for tax purposes, obtaining loans, and making informed business decisions. 7. Annual Reports: Every year, professional corporations in Ohio are required to file an annual report with the Ohio Secretary of State. This report provides updated information about the corporation's registered agent, principal office address, and names and addresses of directors and officers. 8. Licenses and Permits: Any licenses or permits obtained by the professional corporation to carry out its specific services or operations should be maintained as part of the corporate records. By keeping these Cincinnati Sample Corporate Records organized, up-to-date, and easily accessible, professional corporations can demonstrate compliance with Ohio state laws, maintain their legal status, and protect the interests of shareholders and stakeholders. It is crucial to consult with legal professionals or corporate governance experts to ensure complete understanding and compliance with the specific requirements of Cincinnati Sample Corporate Records for an Ohio Professional Corporation.