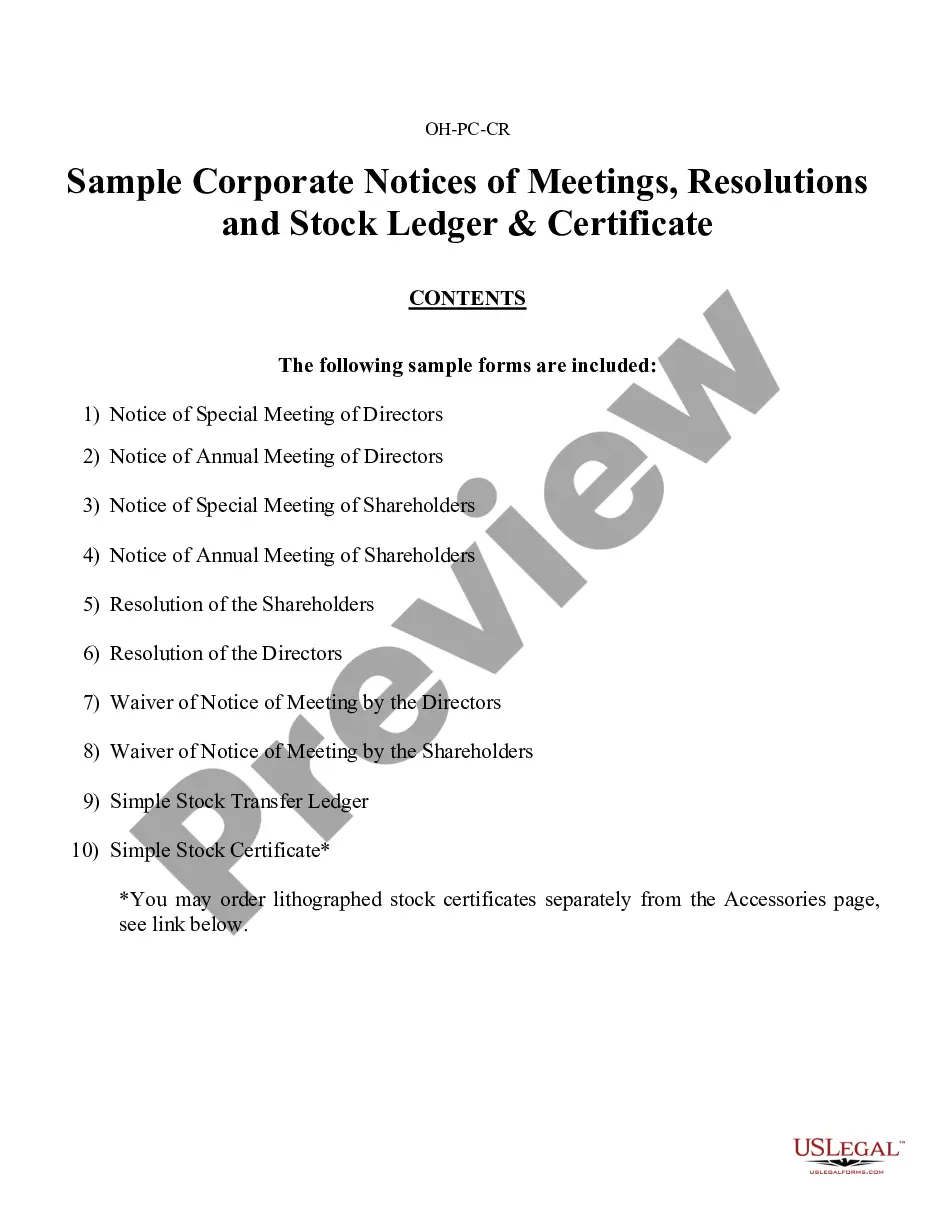

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

Cuyahoga Sample Corporate Records for an Ohio Professional Corporation, also commonly known as Professional Association, refer to the official documents and records that a professional corporation in Cuyahoga County, Ohio, must maintain to ensure compliance with local laws and regulations. These records are essential for establishing the legal and operational aspects of the corporation. Here are some types of Cuyahoga Sample Corporate Records that an Ohio Professional Corporation may need to maintain: 1. Articles of Incorporation: These are the foundational documents that establish the existence of the professional corporation. The articles typically include the corporation's name, purpose, registered agent, initial directors or officers, and other pertinent information. 2. Bylaws: Bylaws are a set of rules and regulations that govern the internal operations of the professional corporation. They outline procedures for holding meetings, electing directors or officers, handling finances, and other corporate governance matters. 3. Meeting Minutes: Meeting minutes document the proceedings and decisions made during board of directors' meetings and shareholder meetings. They provide a written record of discussions, resolutions, votes, and any other important actions taken during the meetings. 4. Stock Ledger: If the professional corporation issues shares of stock to its shareholders, a stock ledger must be maintained. This ledger records the names and addresses of shareholders, the number and class of shares held, and any transfers or changes in ownership. 5. Financial Records: Financial records, including accounting ledgers, balance sheets, income statements, and cash flow statements, should be kept to accurately track the corporation's financial activities. These records are crucial for tax purposes, audits, and financial analysis. 6. Shareholder Agreements: Shareholder agreements outline the rights, responsibilities, and obligations of the shareholders within the professional corporation. These agreements can cover topics such as stock transfers, buy-sell provisions, dividend distributions, and dispute resolution mechanisms. 7. Annual Reports: Ohio law requires professional corporations to file annual reports with the Secretary of State's office. These reports provide an update on the corporation's activities, including changes in management, shares issued or transferred, and any other pertinent information. 8. Licenses and Certifications: If applicable, copies of licenses, permits, or certifications obtained by the professional corporation or its employees should be kept as part of the corporate records. 9. Employment and Contractor Agreements: Copies of employment contracts, independent contractor agreements, and non-disclosure agreements with employees and contractors should be maintained to ensure compliance with labor laws and protect the corporation's interests. 10. Insurance Policies: Documentation of the professional corporation's insurance policies, including general liability insurance, professional liability insurance (malpractice insurance), and workers' compensation insurance, should be included in the corporate records. These are some key types of Cuyahoga Sample Corporate Records that an Ohio Professional Corporation, or Professional Association, may need to maintain. It's important to consult with legal and accounting professionals to ensure full compliance with local regulations and to meet the specific needs of the corporation.Cuyahoga Sample Corporate Records for an Ohio Professional Corporation, also commonly known as Professional Association, refer to the official documents and records that a professional corporation in Cuyahoga County, Ohio, must maintain to ensure compliance with local laws and regulations. These records are essential for establishing the legal and operational aspects of the corporation. Here are some types of Cuyahoga Sample Corporate Records that an Ohio Professional Corporation may need to maintain: 1. Articles of Incorporation: These are the foundational documents that establish the existence of the professional corporation. The articles typically include the corporation's name, purpose, registered agent, initial directors or officers, and other pertinent information. 2. Bylaws: Bylaws are a set of rules and regulations that govern the internal operations of the professional corporation. They outline procedures for holding meetings, electing directors or officers, handling finances, and other corporate governance matters. 3. Meeting Minutes: Meeting minutes document the proceedings and decisions made during board of directors' meetings and shareholder meetings. They provide a written record of discussions, resolutions, votes, and any other important actions taken during the meetings. 4. Stock Ledger: If the professional corporation issues shares of stock to its shareholders, a stock ledger must be maintained. This ledger records the names and addresses of shareholders, the number and class of shares held, and any transfers or changes in ownership. 5. Financial Records: Financial records, including accounting ledgers, balance sheets, income statements, and cash flow statements, should be kept to accurately track the corporation's financial activities. These records are crucial for tax purposes, audits, and financial analysis. 6. Shareholder Agreements: Shareholder agreements outline the rights, responsibilities, and obligations of the shareholders within the professional corporation. These agreements can cover topics such as stock transfers, buy-sell provisions, dividend distributions, and dispute resolution mechanisms. 7. Annual Reports: Ohio law requires professional corporations to file annual reports with the Secretary of State's office. These reports provide an update on the corporation's activities, including changes in management, shares issued or transferred, and any other pertinent information. 8. Licenses and Certifications: If applicable, copies of licenses, permits, or certifications obtained by the professional corporation or its employees should be kept as part of the corporate records. 9. Employment and Contractor Agreements: Copies of employment contracts, independent contractor agreements, and non-disclosure agreements with employees and contractors should be maintained to ensure compliance with labor laws and protect the corporation's interests. 10. Insurance Policies: Documentation of the professional corporation's insurance policies, including general liability insurance, professional liability insurance (malpractice insurance), and workers' compensation insurance, should be included in the corporate records. These are some key types of Cuyahoga Sample Corporate Records that an Ohio Professional Corporation, or Professional Association, may need to maintain. It's important to consult with legal and accounting professionals to ensure full compliance with local regulations and to meet the specific needs of the corporation.