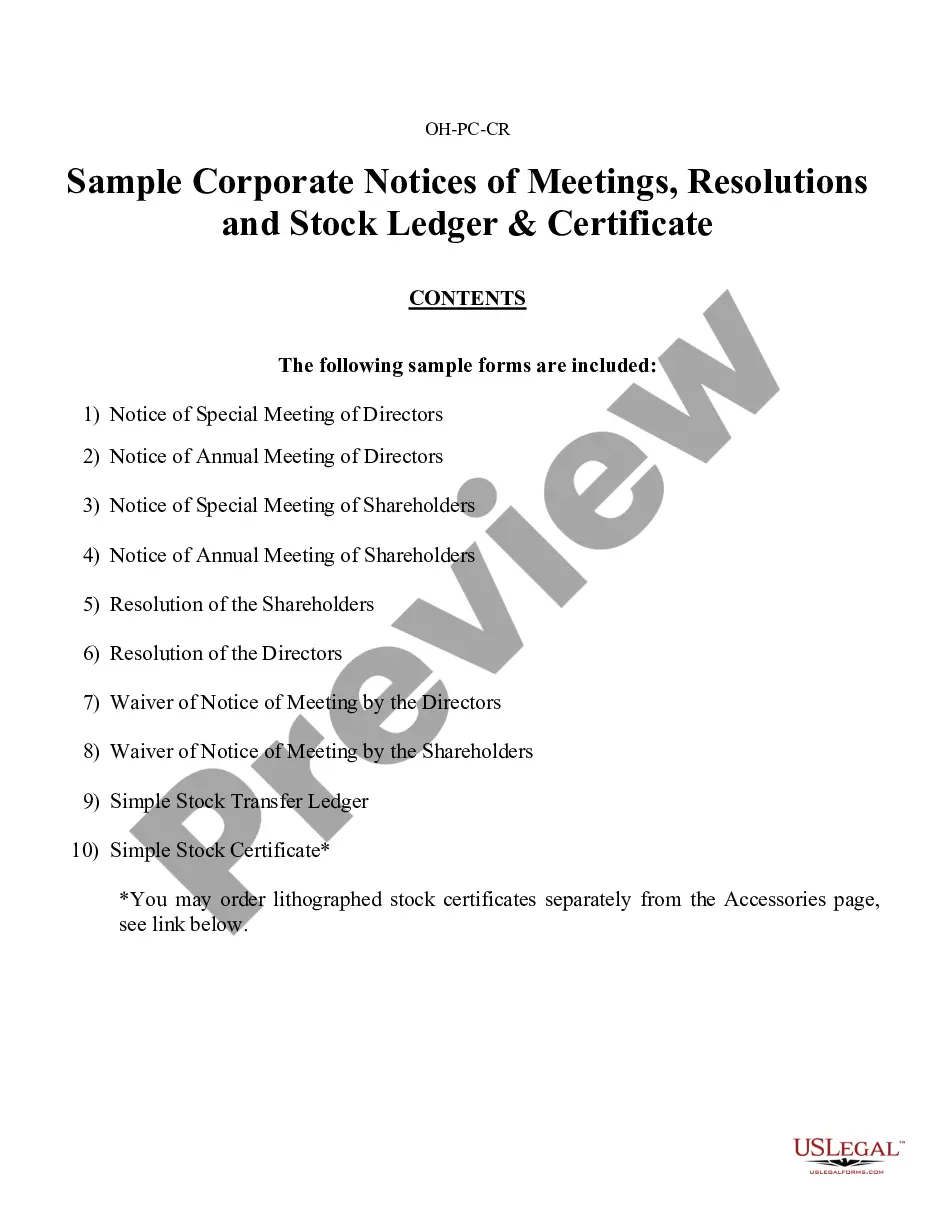

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

Dayton Sample Corporate Records for an Ohio Professional Corporation aka Professional Association play a vital role in documenting and maintaining the legal and operational aspects of the organization. These records act as a comprehensive reference point for the corporation's activities and serve various purposes, including compliance with state regulations and providing documentation for internal and external stakeholders. The following are some essential Dayton Sample Corporate Records that an Ohio Professional Corporation should maintain: 1. Articles of Incorporation: This record represents the initial legal filing document submitted to the Ohio Secretary of State's office to establish the corporation. It includes important information such as the corporation's name, purpose, registered agent details, and the names of the incorporates. 2. Bylaws: These records outline the internal rules and regulations that govern the corporation's operations. Dayton Sample Corporate Records may include specific provisions related to the structure, governance, and decision-making processes of the corporation. 3. Board of Directors and Shareholders' Meeting Minutes: These records document the discussions, decisions, and actions taken during board meetings and shareholders' meetings. It includes details of the attendees, agenda, votes, and resolutions adopted. Minutes serve as evidence of compliance with corporate governance and legal requirements. 4. Shareholder Agreements: In cases where multiple shareholders are involved, these agreements outline the rights, obligations, and responsibilities of each shareholder. They are critical in resolving disputes and clarifying the expectations of the shareholders. 5. Stock Ledger: This record maintains a detailed ownership history of the corporation's shares. It includes information such as the shareholders' names, addresses, number of shares held, issuance dates, and any transfers or changes in ownership. 6. Annual Reports and Statements: Dayton Sample Corporate Records encompass the annual filing requirements that Ohio Professional Corporations must fulfill. These include the Annual Report to the Ohio Secretary of State and the Annual Statement or Report of Professional Associations to the respective professional licensing board. These reports provide updates on the corporation's current status, business activities, and any changes in key personnel. 7. Business Licenses and Permits: Dayton Sample Corporate Records should include copies of all the necessary licenses and permits obtained by the professional corporation to operate legally in Ohio. This ensures compliance with local regulations and professional standards. 8. Tax Returns and Financial Statements: These records disclose the corporation's financial performance and tax filings. They include federal, state, and local tax returns, balance sheets, income statements, cash flow statements, and any accompanying schedules or documentation. 9. Contracts and Agreements: Dayton Sample Corporate Records may include copies of all contracts, agreements, and legal documents entered into by the corporation. This encompasses client contracts, vendor agreements, leases, employment contracts, and other legal obligations undertaken by the organization. 10. Corporate Resolutions and Resolutions Registers: These records document formal decisions made by the corporation's board of directors. Resolutions can cover a wide range of matters, including approving financial transactions, authorizing contracts, amending bylaws, or making strategic decisions. Registers help in maintaining a comprehensive record of all resolutions passed. It is crucial for Ohio Professional Corporations to organize and maintain these Dayton Sample Corporate Records in a secure and easily accessible manner. Organizing these records appropriately ensures compliance, facilitates efficient operations, and provides accurate information for any internal audits or external inquiries.Dayton Sample Corporate Records for an Ohio Professional Corporation aka Professional Association play a vital role in documenting and maintaining the legal and operational aspects of the organization. These records act as a comprehensive reference point for the corporation's activities and serve various purposes, including compliance with state regulations and providing documentation for internal and external stakeholders. The following are some essential Dayton Sample Corporate Records that an Ohio Professional Corporation should maintain: 1. Articles of Incorporation: This record represents the initial legal filing document submitted to the Ohio Secretary of State's office to establish the corporation. It includes important information such as the corporation's name, purpose, registered agent details, and the names of the incorporates. 2. Bylaws: These records outline the internal rules and regulations that govern the corporation's operations. Dayton Sample Corporate Records may include specific provisions related to the structure, governance, and decision-making processes of the corporation. 3. Board of Directors and Shareholders' Meeting Minutes: These records document the discussions, decisions, and actions taken during board meetings and shareholders' meetings. It includes details of the attendees, agenda, votes, and resolutions adopted. Minutes serve as evidence of compliance with corporate governance and legal requirements. 4. Shareholder Agreements: In cases where multiple shareholders are involved, these agreements outline the rights, obligations, and responsibilities of each shareholder. They are critical in resolving disputes and clarifying the expectations of the shareholders. 5. Stock Ledger: This record maintains a detailed ownership history of the corporation's shares. It includes information such as the shareholders' names, addresses, number of shares held, issuance dates, and any transfers or changes in ownership. 6. Annual Reports and Statements: Dayton Sample Corporate Records encompass the annual filing requirements that Ohio Professional Corporations must fulfill. These include the Annual Report to the Ohio Secretary of State and the Annual Statement or Report of Professional Associations to the respective professional licensing board. These reports provide updates on the corporation's current status, business activities, and any changes in key personnel. 7. Business Licenses and Permits: Dayton Sample Corporate Records should include copies of all the necessary licenses and permits obtained by the professional corporation to operate legally in Ohio. This ensures compliance with local regulations and professional standards. 8. Tax Returns and Financial Statements: These records disclose the corporation's financial performance and tax filings. They include federal, state, and local tax returns, balance sheets, income statements, cash flow statements, and any accompanying schedules or documentation. 9. Contracts and Agreements: Dayton Sample Corporate Records may include copies of all contracts, agreements, and legal documents entered into by the corporation. This encompasses client contracts, vendor agreements, leases, employment contracts, and other legal obligations undertaken by the organization. 10. Corporate Resolutions and Resolutions Registers: These records document formal decisions made by the corporation's board of directors. Resolutions can cover a wide range of matters, including approving financial transactions, authorizing contracts, amending bylaws, or making strategic decisions. Registers help in maintaining a comprehensive record of all resolutions passed. It is crucial for Ohio Professional Corporations to organize and maintain these Dayton Sample Corporate Records in a secure and easily accessible manner. Organizing these records appropriately ensures compliance, facilitates efficient operations, and provides accurate information for any internal audits or external inquiries.