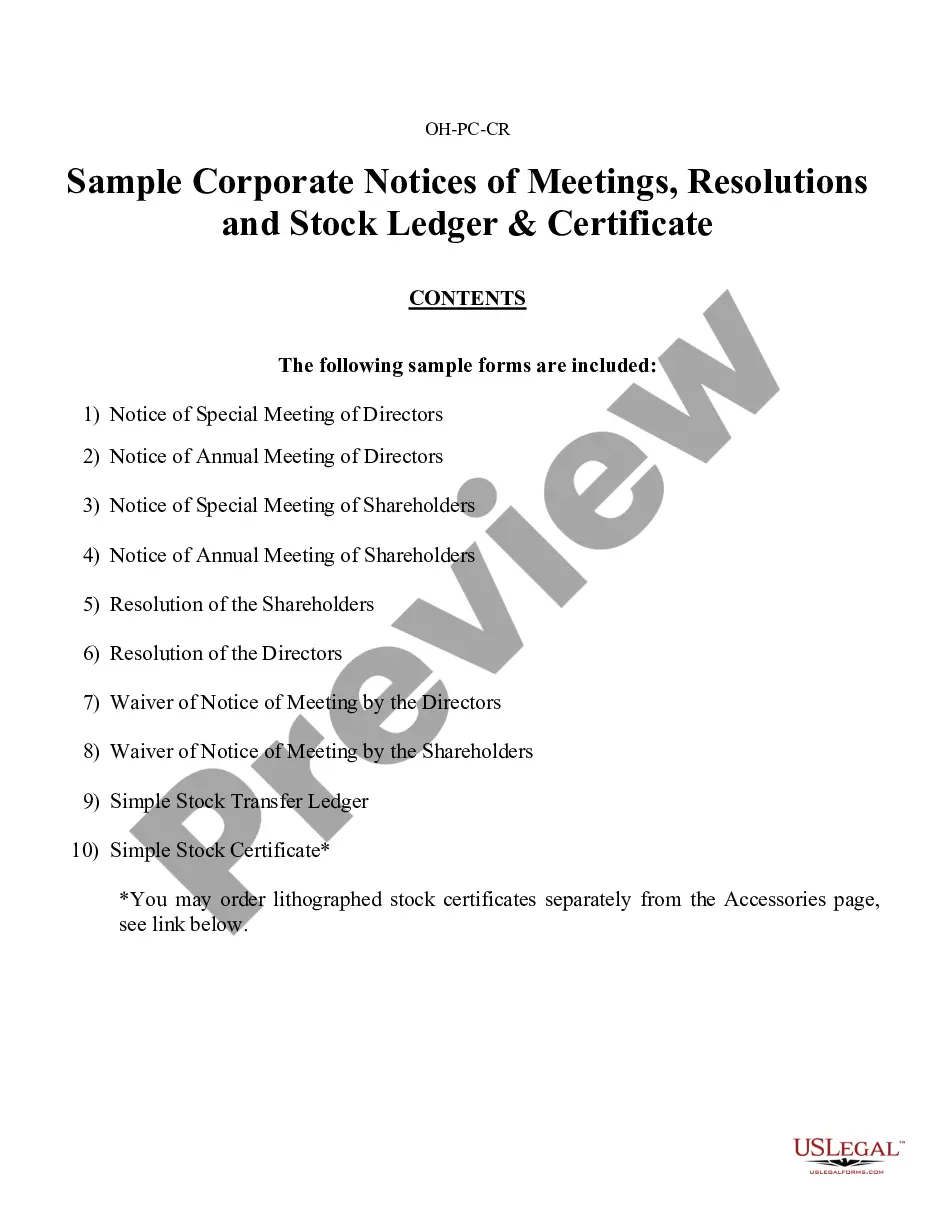

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

Franklin Sample Corporate Records for an Ohio Professional Corporation (Professional Association) are a set of documents and official records that are essential for the proper functioning and compliance of the corporation/legal entity under Ohio law. These records help to establish and maintain the corporation's identity, structure, and operations. Here, we will discuss the various types of Franklin Sample Corporate Records that are significant for an Ohio Professional Corporation. 1. Articles of Incorporation: This is a foundational document that legally establishes the existence of the Ohio Professional Corporation. It includes details such as the corporation's name, purpose, duration, registered agent, shareholders' information, and the number and type of shares issued. The Articles of Incorporation provide legal recognition to the corporation. 2. Bylaws: The Bylaws outline the rules and regulations that govern the internal management and operations of the Ohio Professional Corporation. They define the responsibilities and powers of the directors, officers, and shareholders, as well as the procedures for meetings, voting, and decision-making. Bylaws help ensure corporate compliance and provide a clear structure for the corporation's activities. 3. Meeting Minutes: Meeting minutes are a detailed record of the discussions, decisions, and actions taken during board of directors' and shareholders' meetings of the Ohio Professional Corporation. They document important corporate matters, including approvals of contracts, election of officers, amendments to bylaws or articles, and any other significant actions or resolutions taken by the corporation. 4. Shareholder Records: These records contain information about the shareholders of the Ohio Professional Corporation. They include the names, addresses, and shareholdings of each shareholder, as well as any transfers of shares or changes in ownership. These records are essential for determining shareholders' voting rights and distributing dividends. 5. Financial Statements: Financial statements, such as balance sheets, income statements, and cash flow statements, provide a snapshot of the Ohio Professional Corporation's financial position and performance. These records are crucial for assessing the corporation's profitability, liquidity, and overall financial health. Financial statements are often required for tax filings, audits, or when seeking financing or partnerships. 6. Contracts and Agreements: All contracts and agreements entered into by the Ohio Professional Corporation should be documented and maintained in its corporate records. This includes contracts with clients, vendors, employees, or any other party with whom the corporation engages in business transactions. These records serve as proof of legal obligations, rights, and responsibilities of the corporation and its counterparts. It is important for an Ohio Professional Corporation to maintain accurate and up-to-date corporate records as required by law. Proper documentation ensures compliance with Ohio state regulations, facilitates effective corporate governance, protects shareholders' interests, and helps establish the corporation's credibility in the business community.Franklin Sample Corporate Records for an Ohio Professional Corporation (Professional Association) are a set of documents and official records that are essential for the proper functioning and compliance of the corporation/legal entity under Ohio law. These records help to establish and maintain the corporation's identity, structure, and operations. Here, we will discuss the various types of Franklin Sample Corporate Records that are significant for an Ohio Professional Corporation. 1. Articles of Incorporation: This is a foundational document that legally establishes the existence of the Ohio Professional Corporation. It includes details such as the corporation's name, purpose, duration, registered agent, shareholders' information, and the number and type of shares issued. The Articles of Incorporation provide legal recognition to the corporation. 2. Bylaws: The Bylaws outline the rules and regulations that govern the internal management and operations of the Ohio Professional Corporation. They define the responsibilities and powers of the directors, officers, and shareholders, as well as the procedures for meetings, voting, and decision-making. Bylaws help ensure corporate compliance and provide a clear structure for the corporation's activities. 3. Meeting Minutes: Meeting minutes are a detailed record of the discussions, decisions, and actions taken during board of directors' and shareholders' meetings of the Ohio Professional Corporation. They document important corporate matters, including approvals of contracts, election of officers, amendments to bylaws or articles, and any other significant actions or resolutions taken by the corporation. 4. Shareholder Records: These records contain information about the shareholders of the Ohio Professional Corporation. They include the names, addresses, and shareholdings of each shareholder, as well as any transfers of shares or changes in ownership. These records are essential for determining shareholders' voting rights and distributing dividends. 5. Financial Statements: Financial statements, such as balance sheets, income statements, and cash flow statements, provide a snapshot of the Ohio Professional Corporation's financial position and performance. These records are crucial for assessing the corporation's profitability, liquidity, and overall financial health. Financial statements are often required for tax filings, audits, or when seeking financing or partnerships. 6. Contracts and Agreements: All contracts and agreements entered into by the Ohio Professional Corporation should be documented and maintained in its corporate records. This includes contracts with clients, vendors, employees, or any other party with whom the corporation engages in business transactions. These records serve as proof of legal obligations, rights, and responsibilities of the corporation and its counterparts. It is important for an Ohio Professional Corporation to maintain accurate and up-to-date corporate records as required by law. Proper documentation ensures compliance with Ohio state regulations, facilitates effective corporate governance, protects shareholders' interests, and helps establish the corporation's credibility in the business community.