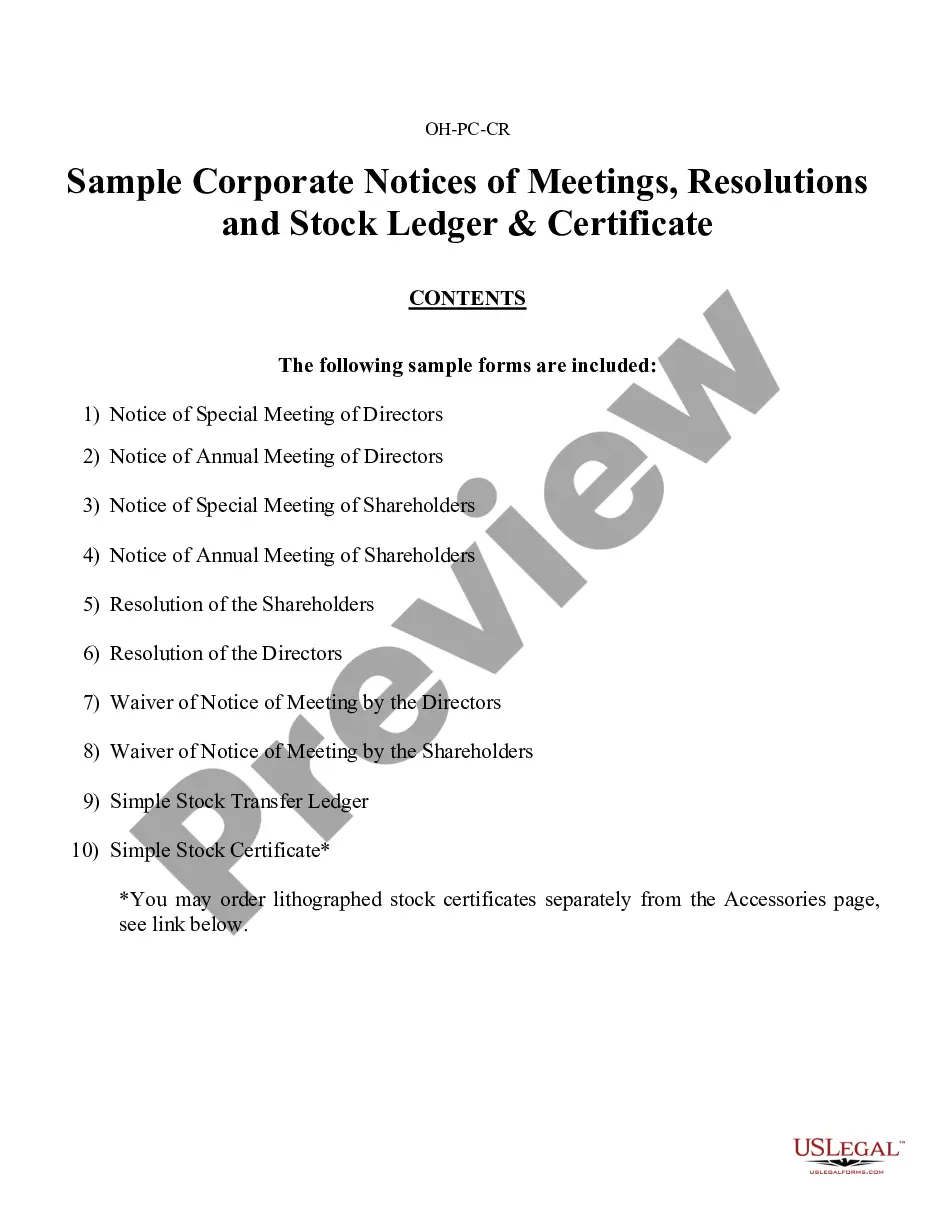

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

Toledo Sample Corporate Records for an Ohio Professional Corporation or Professional Association are essential documents that provide a detailed record of the corporation's activities and vital information. These records help ensure legal compliance, maintain transparency, and serve as evidence for the corporation's decision-making processes. Here are the main types of Toledo Sample Corporate Records for an Ohio Professional Corporation: 1. Articles of Incorporation: This is a legal document filed with the Ohio Secretary of State to establish the corporation. It includes information such as the corporation's name, purpose, duration, registered agent, and the names of the incorporates. 2. Bylaws: These are rules and regulations that govern the internal affairs of the corporation. Bylaws typically cover procedures for holding meetings, electing directors and officers, identifying their roles and responsibilities, establishing committees, and other essential corporate governance matters. 3. Meeting Minutes: Minutes serve as a detailed record of discussions, decisions, and actions taken during corporate meetings, such as board of directors' meetings or shareholder meetings. They include attendees, date, time, location, agenda items, and voting outcomes. 4. Shareholder Records: These records contain information about the shareholders, including their names, addresses, share ownership, and any voting rights they may have. They are used to maintain an accurate record of the corporation's ownership structure. 5. Annual Reports: Ohio requires professional corporations to file Annual Reports with the Secretary of State. These reports provide updates on the corporation's current contact information, principal activities, and the names and addresses of officers and directors. 6. Stock Certificates: If the Ohio Professional Corporation issues shares of stock, stock certificates serve as physical or electronic proof of ownership, specifying details such as the shareholder's name, the number of shares held, and the class of stock. 7. Financial Statements: These records include balance sheets, income statements, and cash flow statements that provide an overview of the corporation's financial health. Financial statements may be required periodically, typically annually or quarterly. 8. Operating Agreements/Partnership Agreements: In the case of a Professional Association, an operating agreement or partnership agreement outlines the rights, responsibilities, and profit-sharing arrangements among the professionals in the organization. These Toledo Sample Corporate Records are crucial for maintaining accurate and up-to-date information about the Ohio Professional Corporation. They serve as a reference point for regulatory compliance, support accountable decision-making processes, and protect the interests of shareholders and stakeholders.Toledo Sample Corporate Records for an Ohio Professional Corporation or Professional Association are essential documents that provide a detailed record of the corporation's activities and vital information. These records help ensure legal compliance, maintain transparency, and serve as evidence for the corporation's decision-making processes. Here are the main types of Toledo Sample Corporate Records for an Ohio Professional Corporation: 1. Articles of Incorporation: This is a legal document filed with the Ohio Secretary of State to establish the corporation. It includes information such as the corporation's name, purpose, duration, registered agent, and the names of the incorporates. 2. Bylaws: These are rules and regulations that govern the internal affairs of the corporation. Bylaws typically cover procedures for holding meetings, electing directors and officers, identifying their roles and responsibilities, establishing committees, and other essential corporate governance matters. 3. Meeting Minutes: Minutes serve as a detailed record of discussions, decisions, and actions taken during corporate meetings, such as board of directors' meetings or shareholder meetings. They include attendees, date, time, location, agenda items, and voting outcomes. 4. Shareholder Records: These records contain information about the shareholders, including their names, addresses, share ownership, and any voting rights they may have. They are used to maintain an accurate record of the corporation's ownership structure. 5. Annual Reports: Ohio requires professional corporations to file Annual Reports with the Secretary of State. These reports provide updates on the corporation's current contact information, principal activities, and the names and addresses of officers and directors. 6. Stock Certificates: If the Ohio Professional Corporation issues shares of stock, stock certificates serve as physical or electronic proof of ownership, specifying details such as the shareholder's name, the number of shares held, and the class of stock. 7. Financial Statements: These records include balance sheets, income statements, and cash flow statements that provide an overview of the corporation's financial health. Financial statements may be required periodically, typically annually or quarterly. 8. Operating Agreements/Partnership Agreements: In the case of a Professional Association, an operating agreement or partnership agreement outlines the rights, responsibilities, and profit-sharing arrangements among the professionals in the organization. These Toledo Sample Corporate Records are crucial for maintaining accurate and up-to-date information about the Ohio Professional Corporation. They serve as a reference point for regulatory compliance, support accountable decision-making processes, and protect the interests of shareholders and stakeholders.