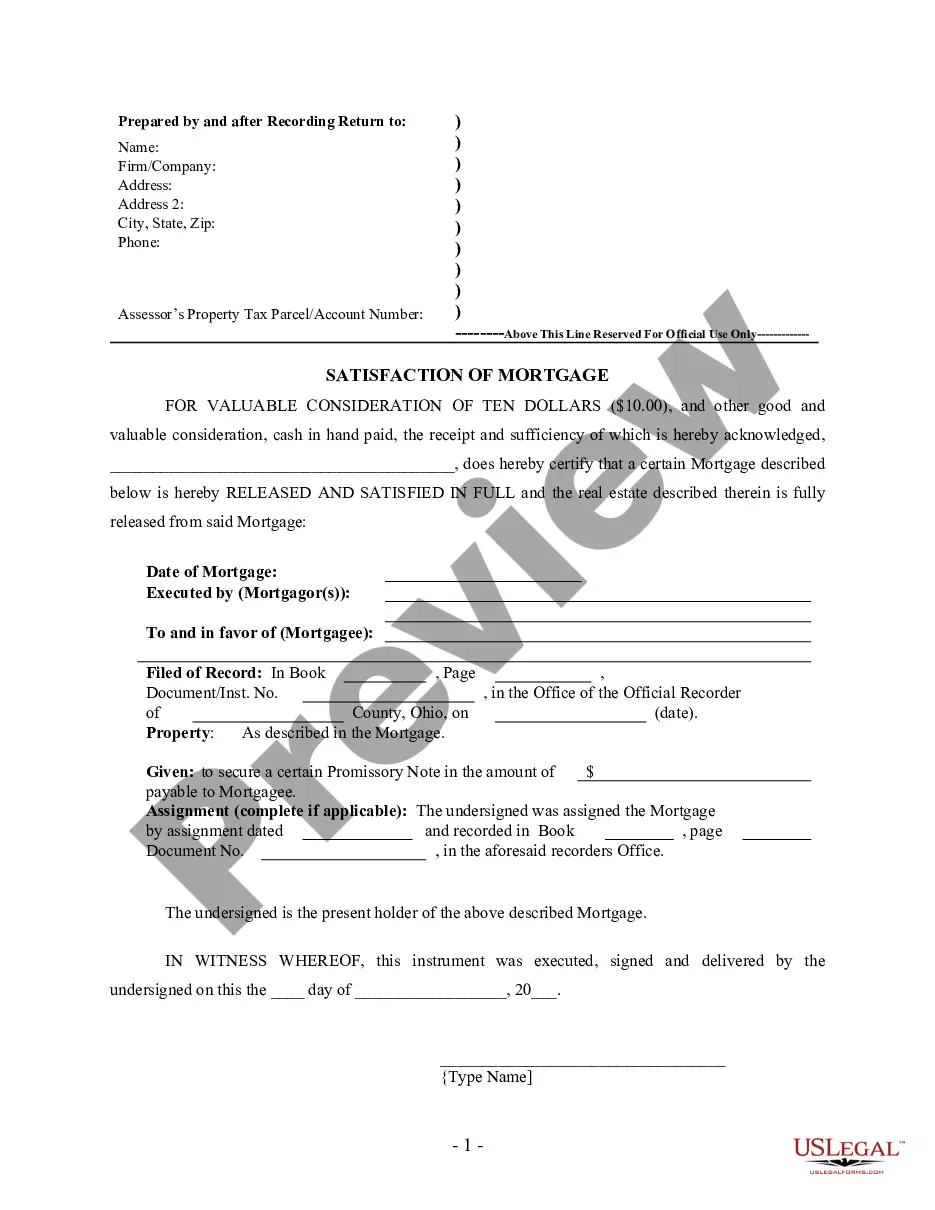

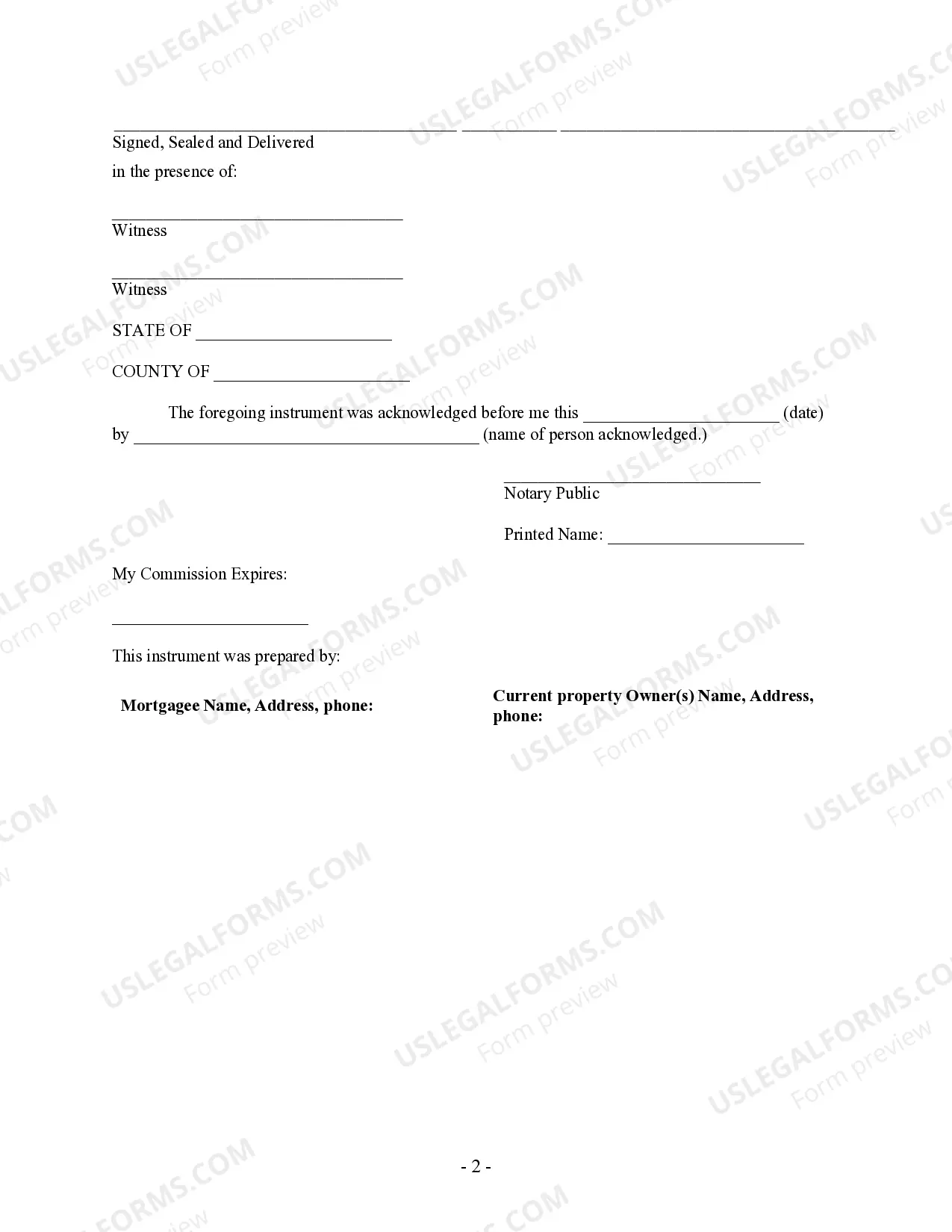

This form is for the satisfaction or release of a deed of trust for the state of Ohio by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Title: Understanding Cuyahoga Ohio Satisfaction, Release, or Cancellation of Mortgage by Individual Introduction: The process of Cuyahoga Ohio Satisfaction, Release, or Cancellation of Mortgage by Individual refers to the legal documentation required to signify the satisfaction or release of a mortgage by an individual borrower. This article aims to describe this procedure in detail, shedding light on the significance, steps involved, and the different types of satisfaction, release, or cancellation of mortgages that may occur in Cuyahoga County, Ohio. Keywords: Cuyahoga Ohio, Satisfaction of Mortgage, Release of Mortgage, Cancellation of Mortgage, Individual borrower I. The Importance of Cuyahoga Ohio Satisfaction, Release, or Cancellation of Mortgage by Individual: — Explaining the importance of satisfying, releasing, or canceling a mortgage after the loan is fully paid. — Discussing the significance of proper documentation for legal purposes. II. Steps Involved in Cuyahoga Ohio Satisfaction, Release, or Cancellation of Mortgage by Individual: 1. Paying off the loan: — Elaborating on the borrower's responsibility to make final payments to fulfill the mortgage obligations. — Emphasizing the necessity of obtaining a statement or confirmation of the full loan repayment. 2. Requesting a Satisfaction, Release, or Cancellation: — Describing the process of formally requesting the necessary documents from the lender or mortgage service. — Highlighting the importance of providing accurate and complete information. 3. Preparing the Satisfaction, Release, or Cancellation document: — Outlining the essential elements and legal requirements of the document. — Advising individuals to seek assistance from a legal professional or title company to ensure accuracy. 4. Notarization and Recording: — Explaining the need for notarization to validate the document's authenticity and the borrower's identity. — Discussing the importance of recording the document with the Cuyahoga County Recorder's Office for public notice. III. Different Types of Cuyahoga Ohio Satisfaction, Release, or Cancellation of Mortgage by Individual: 1. Full Satisfaction of Mortgage: — Defining a full satisfaction of mortgage as the complete repayment of the loan and the release of all lien rights by the lender. 2. Partial Satisfaction of Mortgage: — Describing a partial satisfaction of mortgage as the release of a portion of the collateral property from the mortgage lien due to partial repayment. 3. Subordination and Partial Release: — Explaining when a lender agrees to subordinate its lien position on a portion of the property to another lender, usually enabling refinancing or securing additional financing. 4. Release of Li's Pendent: — Discussing the process of lifting a notice of pending litigation (is pendent) on a property once the legal dispute is resolved. Conclusion: Understanding the process of Cuyahoga Ohio Satisfaction, Release, or Cancellation of Mortgage by Individual is crucial for borrowers to ensure their legal rights are protected and the mortgage lien is properly released. By following the necessary steps and obtaining the correct documentation, individuals can successfully conclude their mortgage obligations and gain clear title to their property. Keywords: Cuyahoga Ohio, Satisfaction of Mortgage, Release of Mortgage, Cancellation of Mortgage, Individual borrower, Full Satisfaction, Partial Satisfaction, Subordination and Partial Release, Release of Li's Pendent.Title: Understanding Cuyahoga Ohio Satisfaction, Release, or Cancellation of Mortgage by Individual Introduction: The process of Cuyahoga Ohio Satisfaction, Release, or Cancellation of Mortgage by Individual refers to the legal documentation required to signify the satisfaction or release of a mortgage by an individual borrower. This article aims to describe this procedure in detail, shedding light on the significance, steps involved, and the different types of satisfaction, release, or cancellation of mortgages that may occur in Cuyahoga County, Ohio. Keywords: Cuyahoga Ohio, Satisfaction of Mortgage, Release of Mortgage, Cancellation of Mortgage, Individual borrower I. The Importance of Cuyahoga Ohio Satisfaction, Release, or Cancellation of Mortgage by Individual: — Explaining the importance of satisfying, releasing, or canceling a mortgage after the loan is fully paid. — Discussing the significance of proper documentation for legal purposes. II. Steps Involved in Cuyahoga Ohio Satisfaction, Release, or Cancellation of Mortgage by Individual: 1. Paying off the loan: — Elaborating on the borrower's responsibility to make final payments to fulfill the mortgage obligations. — Emphasizing the necessity of obtaining a statement or confirmation of the full loan repayment. 2. Requesting a Satisfaction, Release, or Cancellation: — Describing the process of formally requesting the necessary documents from the lender or mortgage service. — Highlighting the importance of providing accurate and complete information. 3. Preparing the Satisfaction, Release, or Cancellation document: — Outlining the essential elements and legal requirements of the document. — Advising individuals to seek assistance from a legal professional or title company to ensure accuracy. 4. Notarization and Recording: — Explaining the need for notarization to validate the document's authenticity and the borrower's identity. — Discussing the importance of recording the document with the Cuyahoga County Recorder's Office for public notice. III. Different Types of Cuyahoga Ohio Satisfaction, Release, or Cancellation of Mortgage by Individual: 1. Full Satisfaction of Mortgage: — Defining a full satisfaction of mortgage as the complete repayment of the loan and the release of all lien rights by the lender. 2. Partial Satisfaction of Mortgage: — Describing a partial satisfaction of mortgage as the release of a portion of the collateral property from the mortgage lien due to partial repayment. 3. Subordination and Partial Release: — Explaining when a lender agrees to subordinate its lien position on a portion of the property to another lender, usually enabling refinancing or securing additional financing. 4. Release of Li's Pendent: — Discussing the process of lifting a notice of pending litigation (is pendent) on a property once the legal dispute is resolved. Conclusion: Understanding the process of Cuyahoga Ohio Satisfaction, Release, or Cancellation of Mortgage by Individual is crucial for borrowers to ensure their legal rights are protected and the mortgage lien is properly released. By following the necessary steps and obtaining the correct documentation, individuals can successfully conclude their mortgage obligations and gain clear title to their property. Keywords: Cuyahoga Ohio, Satisfaction of Mortgage, Release of Mortgage, Cancellation of Mortgage, Individual borrower, Full Satisfaction, Partial Satisfaction, Subordination and Partial Release, Release of Li's Pendent.