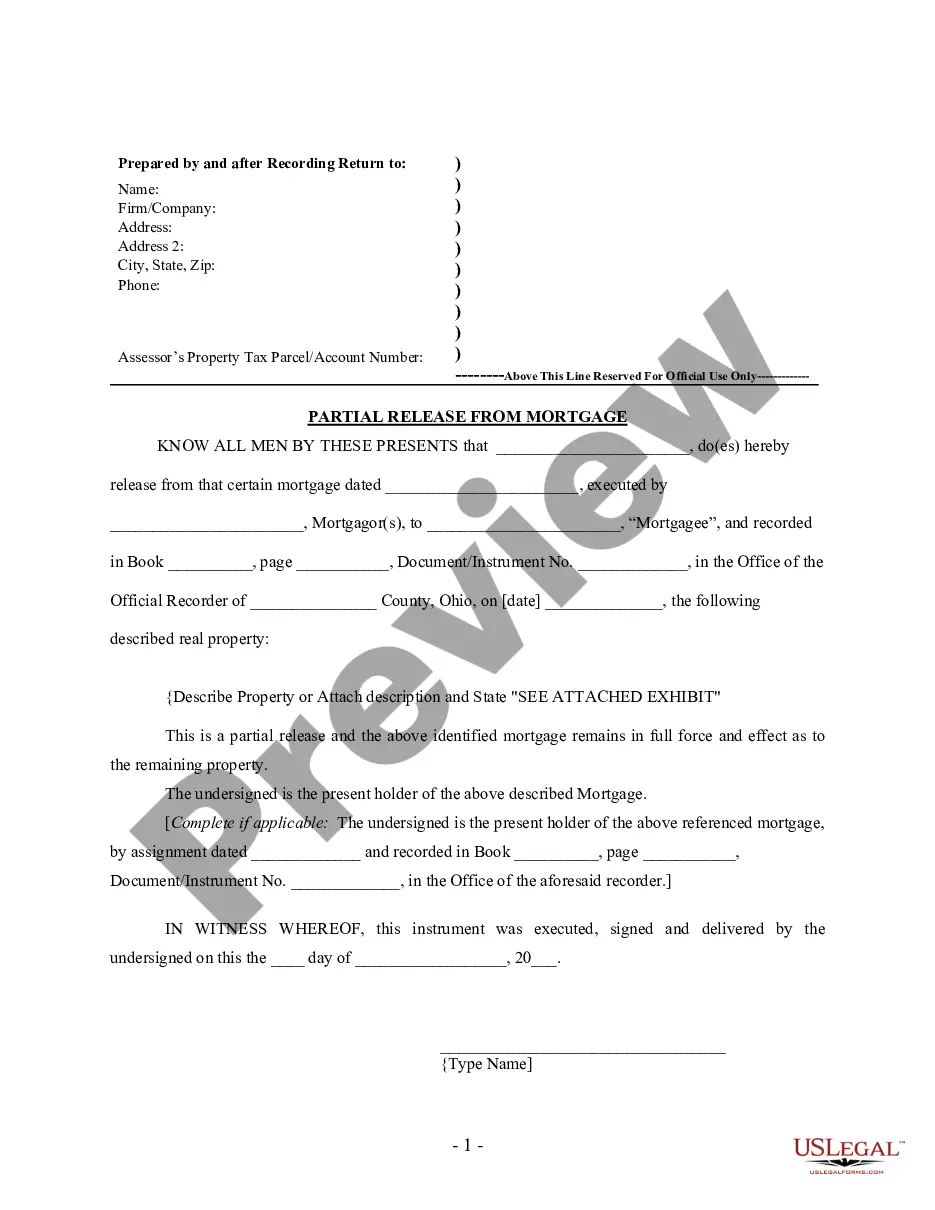

This form is for a holder of a deed of trust or mortgage (see title) to release a portion of the real property described as security. It asserts that the identified and referenced deed of trust or mortgage remains in full force or effect as to the remaining property.

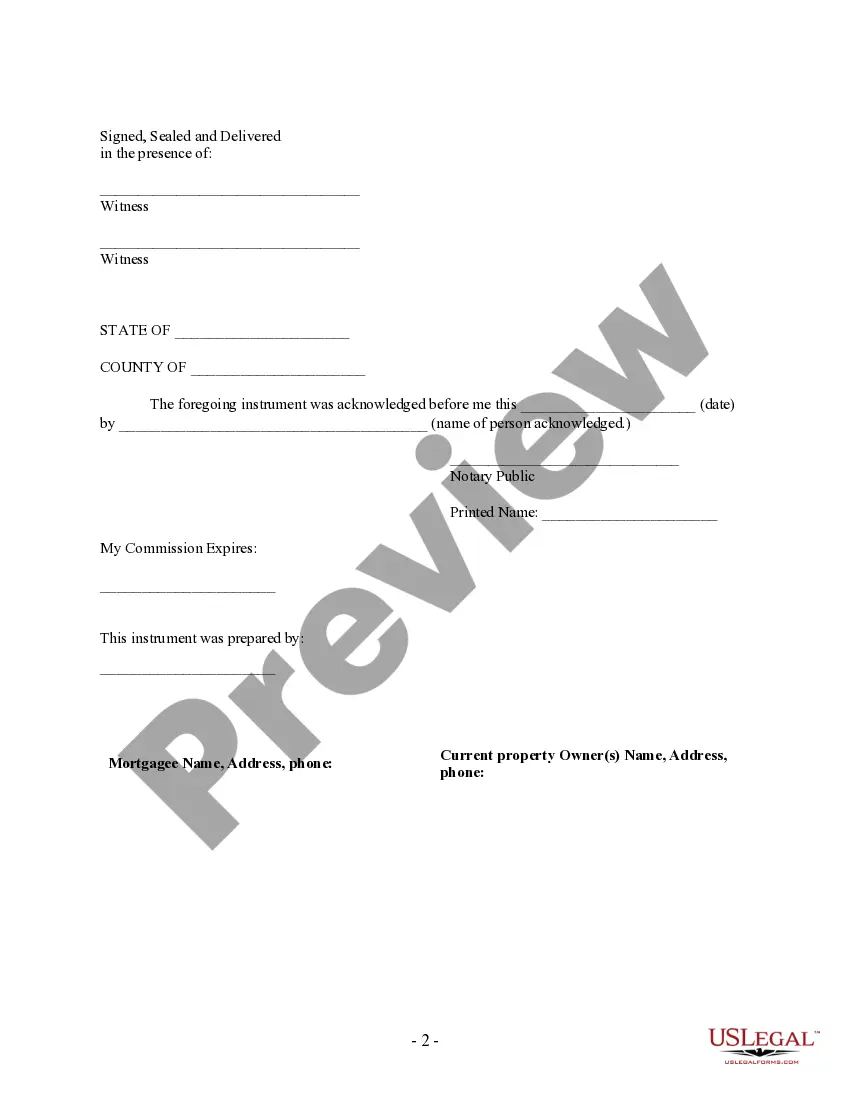

Title: Cuyahoga Ohio Partial Release of Property From Mortgage by Individual Holder: A Comprehensive Overview Introduction: In Cuyahoga County, Ohio, individuals holding mortgages have the option to opt for a partial release of their property. This process allows property owners to release a specific portion of their property from the mortgage lien, providing more flexibility in managing their real estate assets. This article explores the details of the Cuyahoga Ohio Partial Release of Property From Mortgage by Individual Holder, considering its types and significance. Types of Cuyahoga Ohio Partial Release of Property From Mortgage by Individual Holder: 1. Partial Release for Residential Properties: Individual mortgage holders in Cuyahoga, Ohio, can apply for a partial release of their residential property from the mortgage. This option is particularly helpful when the owner wants to sell a part of their residential land while maintaining a mortgage lien on the remaining portion. 2. Partial Release for Commercial Properties: For commercial properties, owners in Cuyahoga County can also avail themselves of the partial release option. The release allows commercial property owners to divide their properties into separate units or parcels, enabling them to sell or refinance individual units without impacting the overall mortgage. Detailed description of Cuyahoga Ohio Partial Release of Property From Mortgage by Individual Holder: A Cuyahoga Ohio Partial Release of Property From Mortgage by Individual Holder is a legal document that modifies the terms of an existing mortgage by releasing a percentage or particular area of a property from the mortgage lien. By pursuing this option, individual holders can alleviate financial burdens on specific portions of their properties while preserving the original mortgage on the remaining land. This partial release process involves a series of steps: 1. Determining Eligibility: To qualify for a partial release, the property owner must first ensure compliance with specific criteria set by lending institutions or the mortgage service provider. This typically includes maintaining a positive equity position, fulfilling timely obligations, and seeking approval from the lender. 2. Application Process: The individual holder needs to complete and submit a formal application to the mortgage lender or servicing agency. This application generally comprises property information, proof of ownership, description of the portion to be released, and other relevant documentation specified by the lender. 3. Property Valuation: Upon receiving the application, the lender assesses the value of the portion to be released, considering factors like market conditions, appraisals, and comparable property values. The lender may also engage a professional appraiser or conduct an internal property valuation before determining the partial release amount. 4. Legal Procedures: Once the valuation is finalized, the lender prepares the necessary legal paperwork, including a partial release agreement, which clearly outlines the details of the release. This agreement specifies the property portion to be released, its boundaries, any remaining obligations, and potential consequences. 5. Recording and Filing: To make the partial release official, the lender records the agreement with the county recorder's office in Cuyahoga County. This step ensures public notice and protection of the partial release rights and establishes the priority in case of future property transactions. Conclusion: A Cuyahoga Ohio Partial Release of Property From Mortgage by Individual Holder offers property owners the flexibility to leverage their real estate assets strategically. Whether for residential or commercial properties, this option enables property owners in Cuyahoga County to release specific portions of their properties from the mortgage lien, facilitating various financial transactions while maintaining the original mortgage on the remaining land.Title: Cuyahoga Ohio Partial Release of Property From Mortgage by Individual Holder: A Comprehensive Overview Introduction: In Cuyahoga County, Ohio, individuals holding mortgages have the option to opt for a partial release of their property. This process allows property owners to release a specific portion of their property from the mortgage lien, providing more flexibility in managing their real estate assets. This article explores the details of the Cuyahoga Ohio Partial Release of Property From Mortgage by Individual Holder, considering its types and significance. Types of Cuyahoga Ohio Partial Release of Property From Mortgage by Individual Holder: 1. Partial Release for Residential Properties: Individual mortgage holders in Cuyahoga, Ohio, can apply for a partial release of their residential property from the mortgage. This option is particularly helpful when the owner wants to sell a part of their residential land while maintaining a mortgage lien on the remaining portion. 2. Partial Release for Commercial Properties: For commercial properties, owners in Cuyahoga County can also avail themselves of the partial release option. The release allows commercial property owners to divide their properties into separate units or parcels, enabling them to sell or refinance individual units without impacting the overall mortgage. Detailed description of Cuyahoga Ohio Partial Release of Property From Mortgage by Individual Holder: A Cuyahoga Ohio Partial Release of Property From Mortgage by Individual Holder is a legal document that modifies the terms of an existing mortgage by releasing a percentage or particular area of a property from the mortgage lien. By pursuing this option, individual holders can alleviate financial burdens on specific portions of their properties while preserving the original mortgage on the remaining land. This partial release process involves a series of steps: 1. Determining Eligibility: To qualify for a partial release, the property owner must first ensure compliance with specific criteria set by lending institutions or the mortgage service provider. This typically includes maintaining a positive equity position, fulfilling timely obligations, and seeking approval from the lender. 2. Application Process: The individual holder needs to complete and submit a formal application to the mortgage lender or servicing agency. This application generally comprises property information, proof of ownership, description of the portion to be released, and other relevant documentation specified by the lender. 3. Property Valuation: Upon receiving the application, the lender assesses the value of the portion to be released, considering factors like market conditions, appraisals, and comparable property values. The lender may also engage a professional appraiser or conduct an internal property valuation before determining the partial release amount. 4. Legal Procedures: Once the valuation is finalized, the lender prepares the necessary legal paperwork, including a partial release agreement, which clearly outlines the details of the release. This agreement specifies the property portion to be released, its boundaries, any remaining obligations, and potential consequences. 5. Recording and Filing: To make the partial release official, the lender records the agreement with the county recorder's office in Cuyahoga County. This step ensures public notice and protection of the partial release rights and establishes the priority in case of future property transactions. Conclusion: A Cuyahoga Ohio Partial Release of Property From Mortgage by Individual Holder offers property owners the flexibility to leverage their real estate assets strategically. Whether for residential or commercial properties, this option enables property owners in Cuyahoga County to release specific portions of their properties from the mortgage lien, facilitating various financial transactions while maintaining the original mortgage on the remaining land.