The Will you have found is for a single person with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

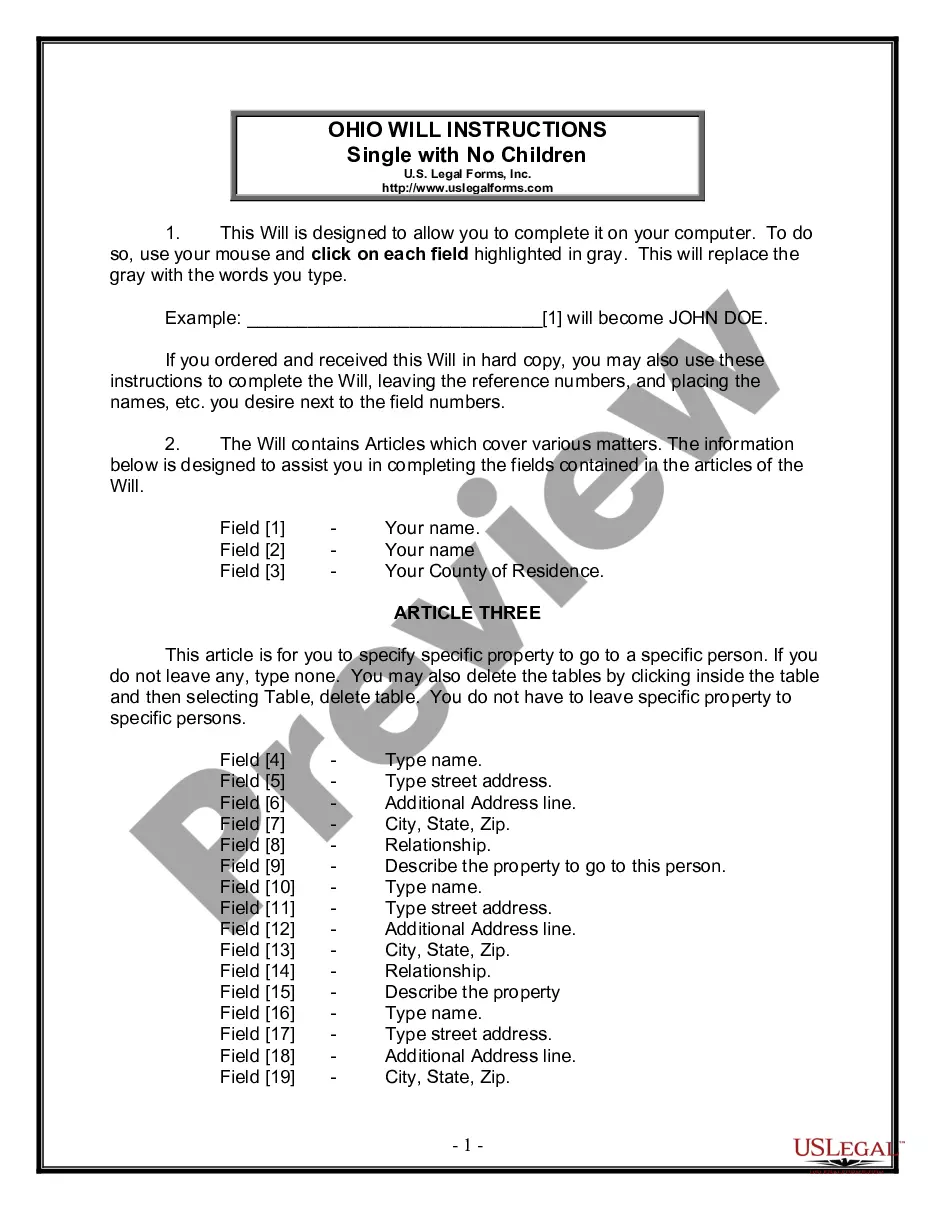

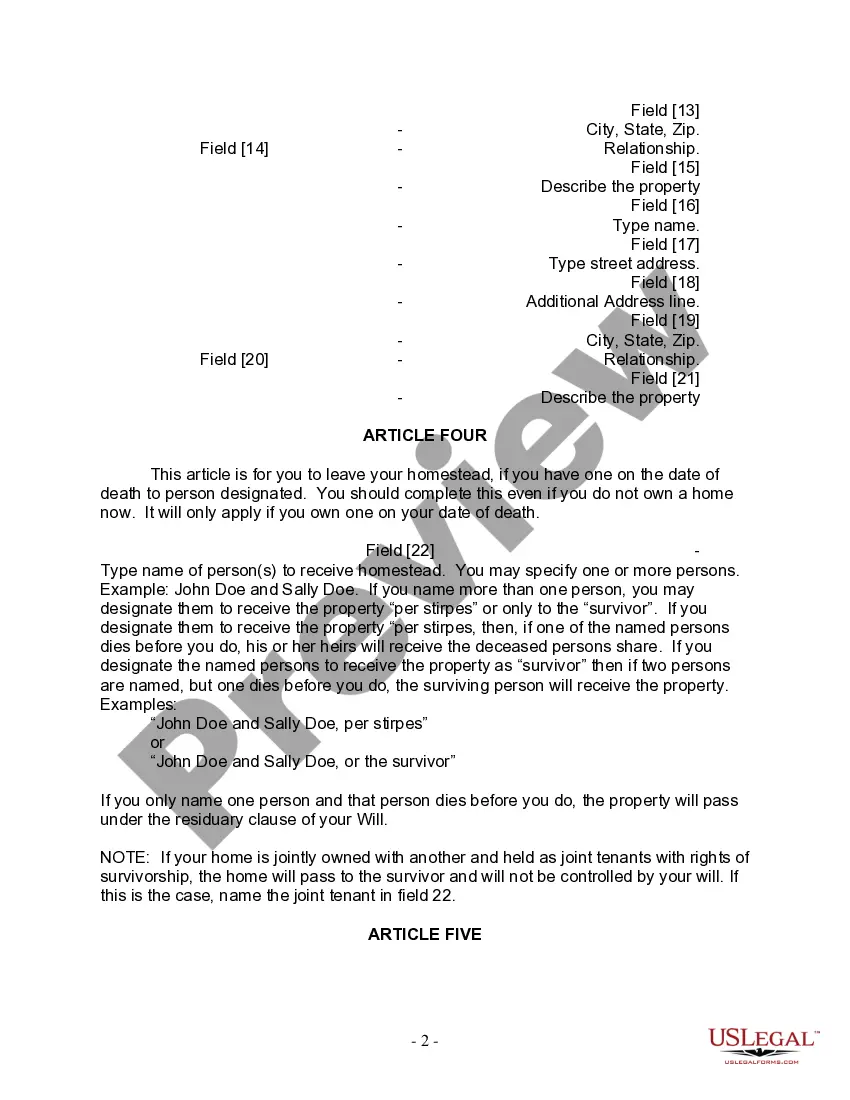

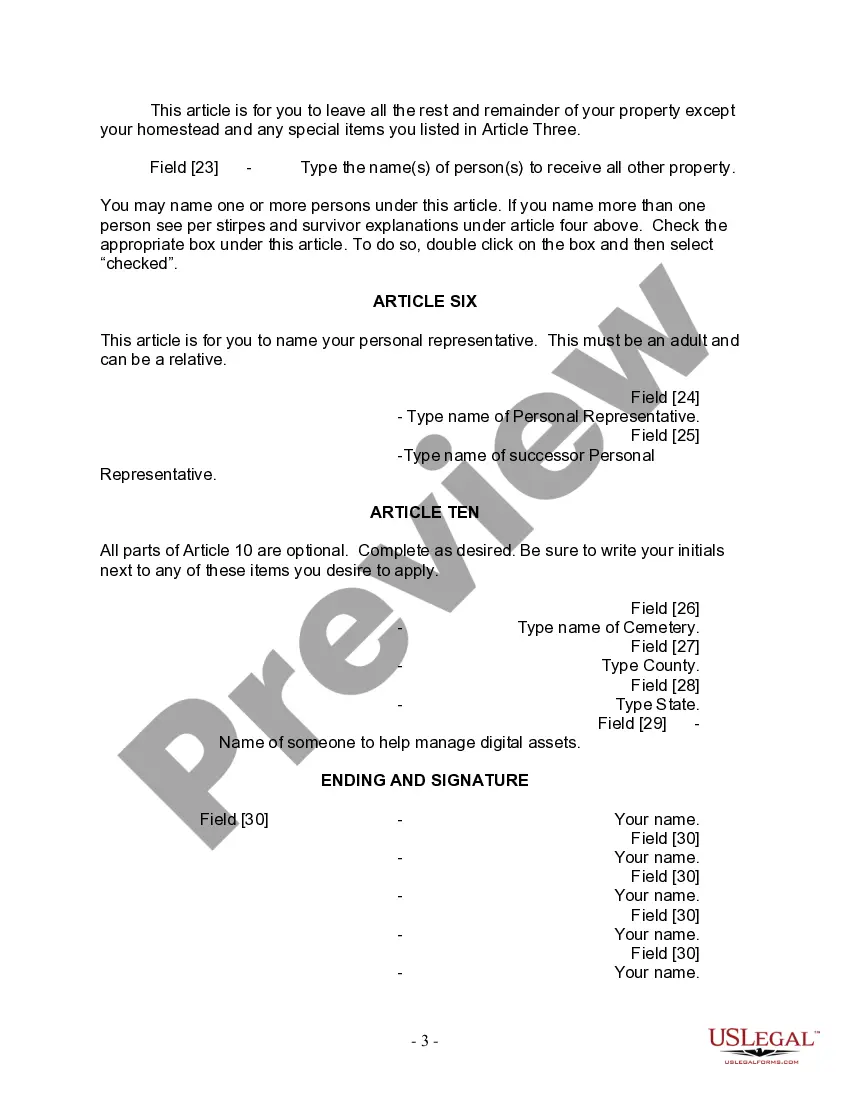

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. Title: Cuyahoga Ohio Legal Last Will and Testament Form for Single Person with No Children: A Comprehensive Guide Introduction: Creating a comprehensive and legally binding Last Will and Testament is essential to ensure that your final wishes are carried out as intended. For residents of Cuyahoga County, Ohio, it is important to understand the specifics of the Cuyahoga Ohio Legal Last Will and Testament Form for Single Person with No Children. This article dives into the details of this document, providing a well-rounded understanding of its purpose, key elements, and its different variations, if any. Key Elements of the Cuyahoga Ohio Legal Last Will and Testament Form for Single Person with No Children: 1. Declaration of Testator: The form begins with a clear declaration of the testator's identity, stating that they are of sound mind, over the legal age, and not being unduly influenced to create the will. 2. Appointment of Executor: The testator designates an executor, someone trusted to handle the distribution of assets and handle any legal matters. 3. Asset Distribution: The form allows the testator to specify how their assets, including property, finances, and personal belongings, should be distributed among beneficiaries. 4. Appointment of Guardian: If the testator has dependents or individuals under their care, they can designate a guardian to provide care and support for them. 5. Residual Clause: This section addresses any remaining assets that have not been explicitly mentioned, ensuring they are distributed according to the testator's intent. In the case of a single person with no children, this may include charitable contributions or bequeathing assets to close friends or other loved ones. 6. Witnesses and Signatures: To make the will legally valid, it must be signed by the testator and witnessed by two individuals who are not beneficiaries or guardians mentioned in the will. Types of Cuyahoga Ohio Legal Last Will and Testament Form for Single Person with No Children: 1. Basic Last Will and Testament Form: This is the standard form commonly used by individuals with no unique or complex circumstances for asset distribution. 2. Living Will: Alternatively, some individuals may choose to create a "Living Will" alongside their Last Will and Testament. This separate document expresses their medical and end-of-life care preferences. Conclusion: The Cuyahoga Ohio Legal Last Will and Testament Form for Single Person with No Children serves as a crucial legal document, allowing individuals to articulate their final wishes clearly. By utilizing this form, single individuals in Cuyahoga County without children can ensure that their assets are distributed according to their preferences. It is recommended to consult with an attorney to ensure the accurate completion and notarization of the form to guarantee its validity and compliance with relevant state laws.

Title: Cuyahoga Ohio Legal Last Will and Testament Form for Single Person with No Children: A Comprehensive Guide Introduction: Creating a comprehensive and legally binding Last Will and Testament is essential to ensure that your final wishes are carried out as intended. For residents of Cuyahoga County, Ohio, it is important to understand the specifics of the Cuyahoga Ohio Legal Last Will and Testament Form for Single Person with No Children. This article dives into the details of this document, providing a well-rounded understanding of its purpose, key elements, and its different variations, if any. Key Elements of the Cuyahoga Ohio Legal Last Will and Testament Form for Single Person with No Children: 1. Declaration of Testator: The form begins with a clear declaration of the testator's identity, stating that they are of sound mind, over the legal age, and not being unduly influenced to create the will. 2. Appointment of Executor: The testator designates an executor, someone trusted to handle the distribution of assets and handle any legal matters. 3. Asset Distribution: The form allows the testator to specify how their assets, including property, finances, and personal belongings, should be distributed among beneficiaries. 4. Appointment of Guardian: If the testator has dependents or individuals under their care, they can designate a guardian to provide care and support for them. 5. Residual Clause: This section addresses any remaining assets that have not been explicitly mentioned, ensuring they are distributed according to the testator's intent. In the case of a single person with no children, this may include charitable contributions or bequeathing assets to close friends or other loved ones. 6. Witnesses and Signatures: To make the will legally valid, it must be signed by the testator and witnessed by two individuals who are not beneficiaries or guardians mentioned in the will. Types of Cuyahoga Ohio Legal Last Will and Testament Form for Single Person with No Children: 1. Basic Last Will and Testament Form: This is the standard form commonly used by individuals with no unique or complex circumstances for asset distribution. 2. Living Will: Alternatively, some individuals may choose to create a "Living Will" alongside their Last Will and Testament. This separate document expresses their medical and end-of-life care preferences. Conclusion: The Cuyahoga Ohio Legal Last Will and Testament Form for Single Person with No Children serves as a crucial legal document, allowing individuals to articulate their final wishes clearly. By utilizing this form, single individuals in Cuyahoga County without children can ensure that their assets are distributed according to their preferences. It is recommended to consult with an attorney to ensure the accurate completion and notarization of the form to guarantee its validity and compliance with relevant state laws.