The Will you have found is for a single person with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

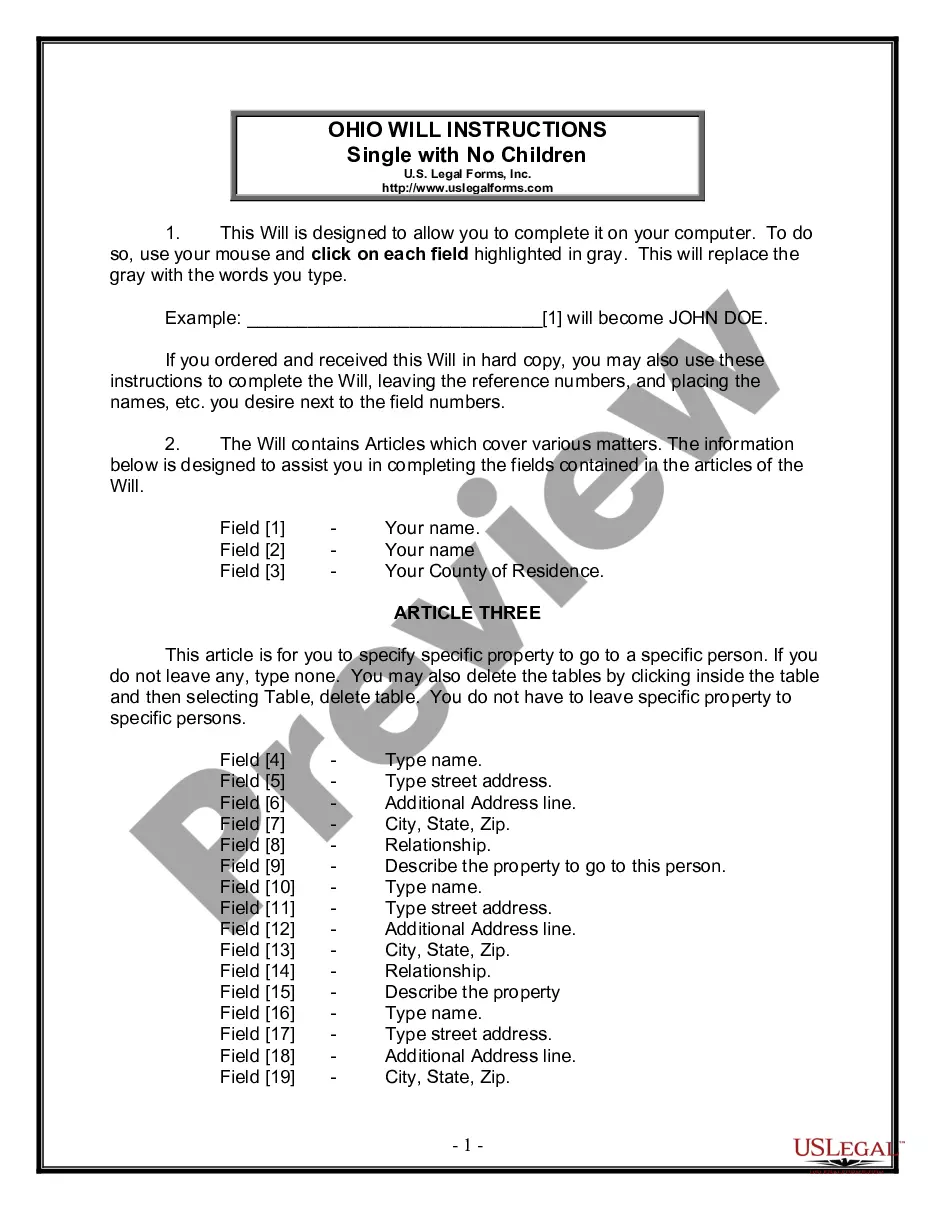

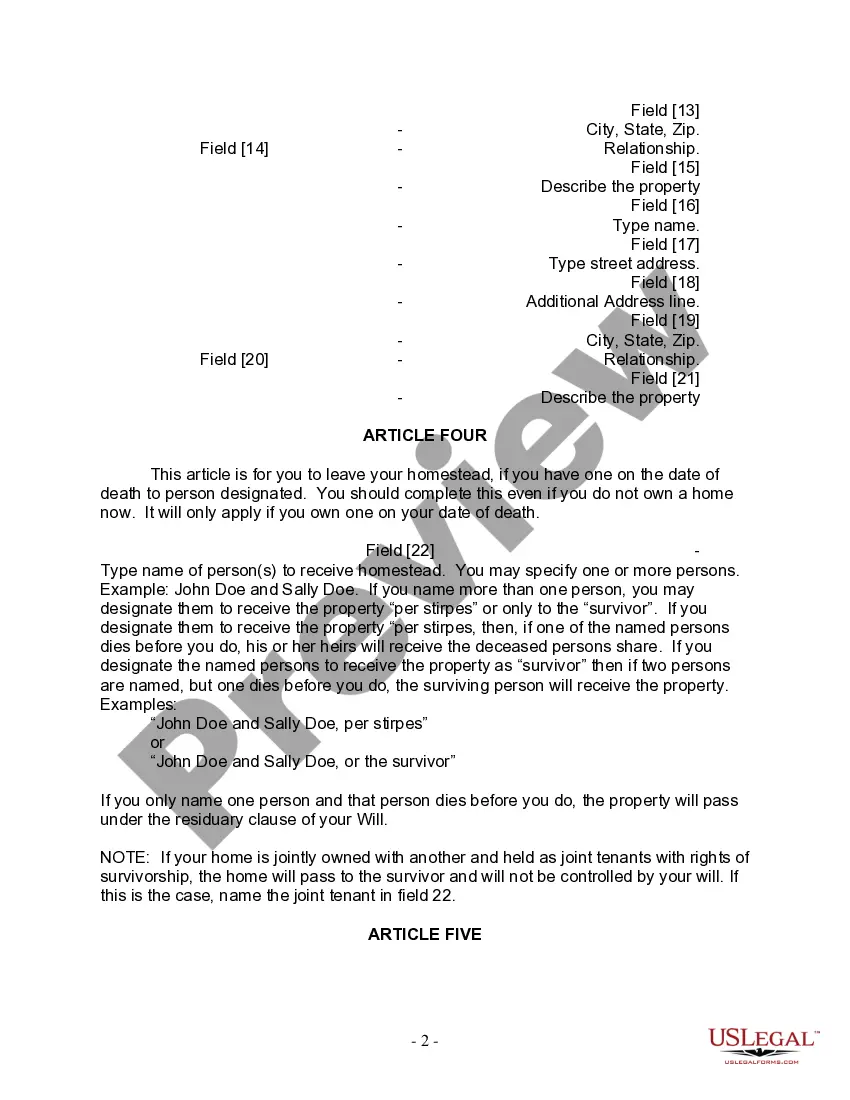

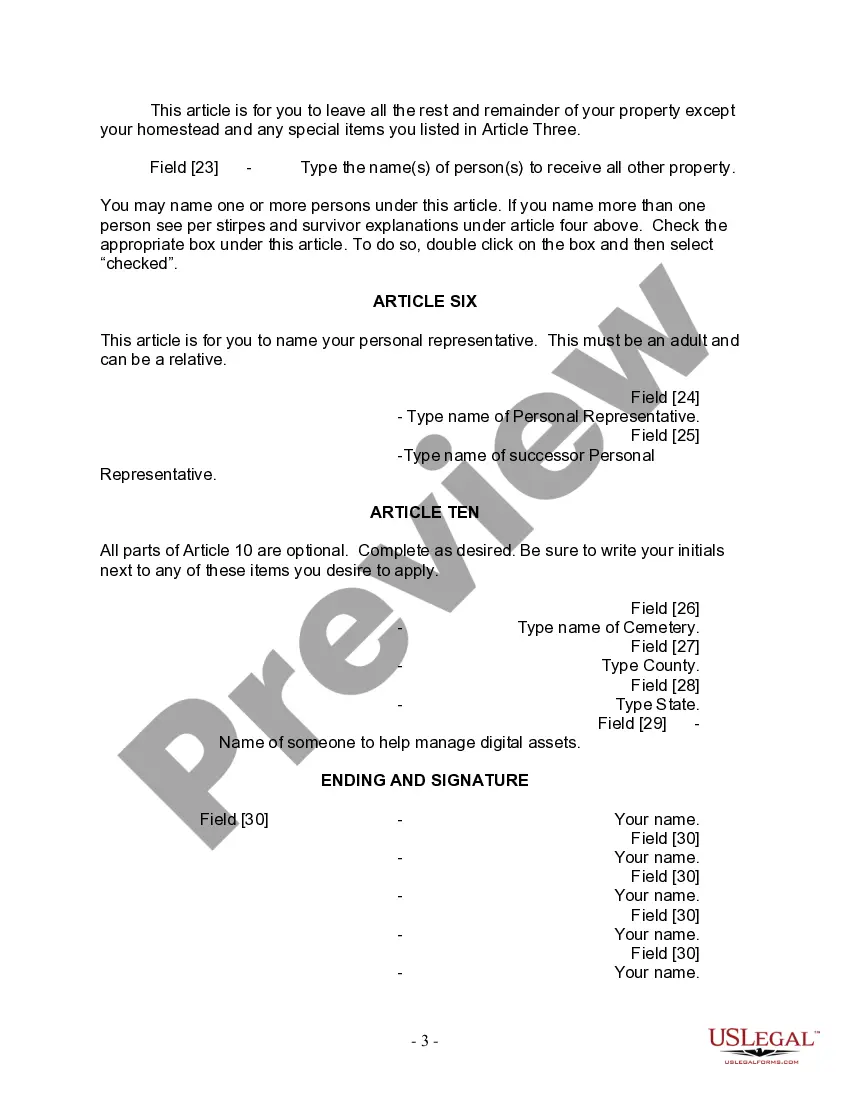

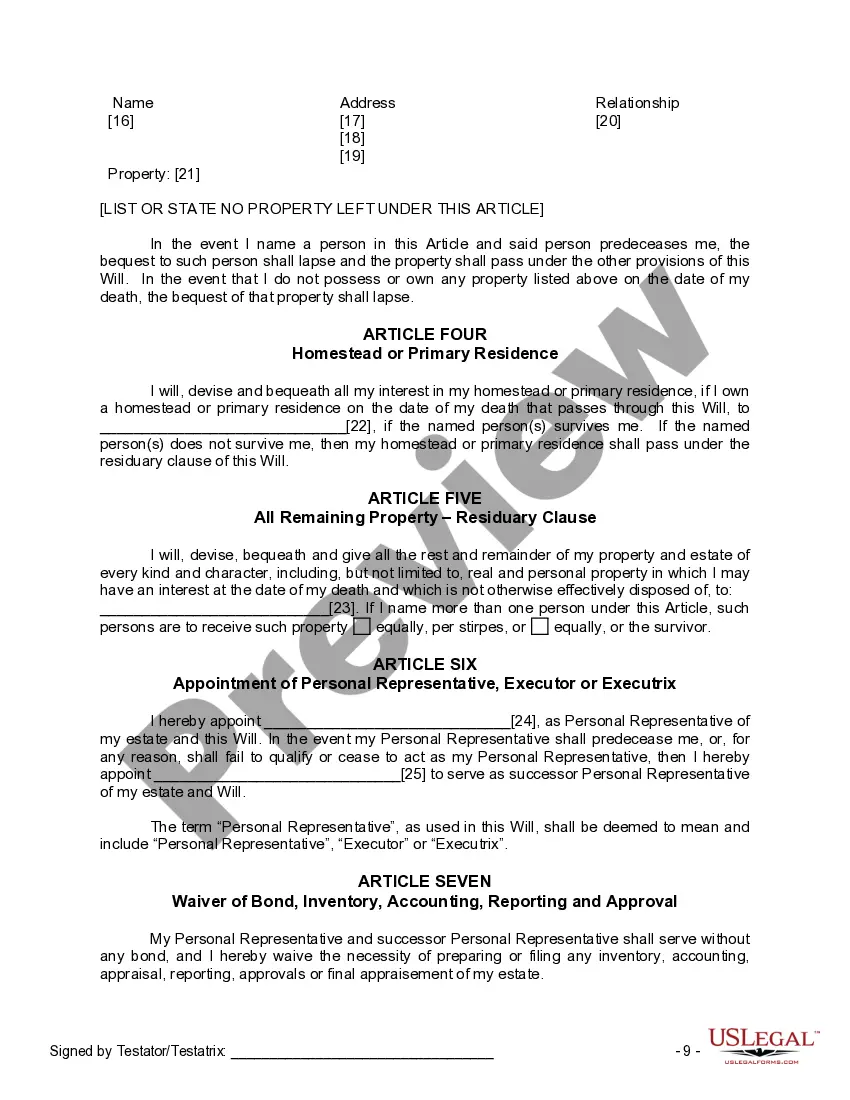

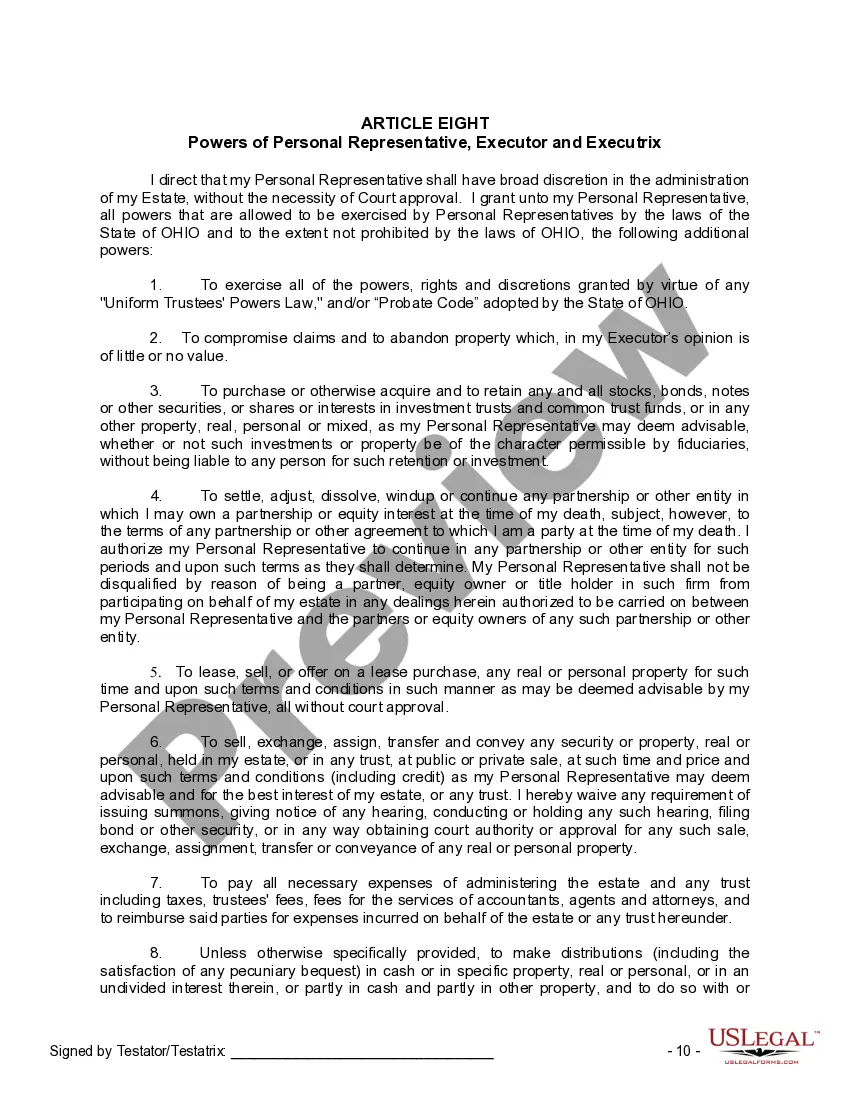

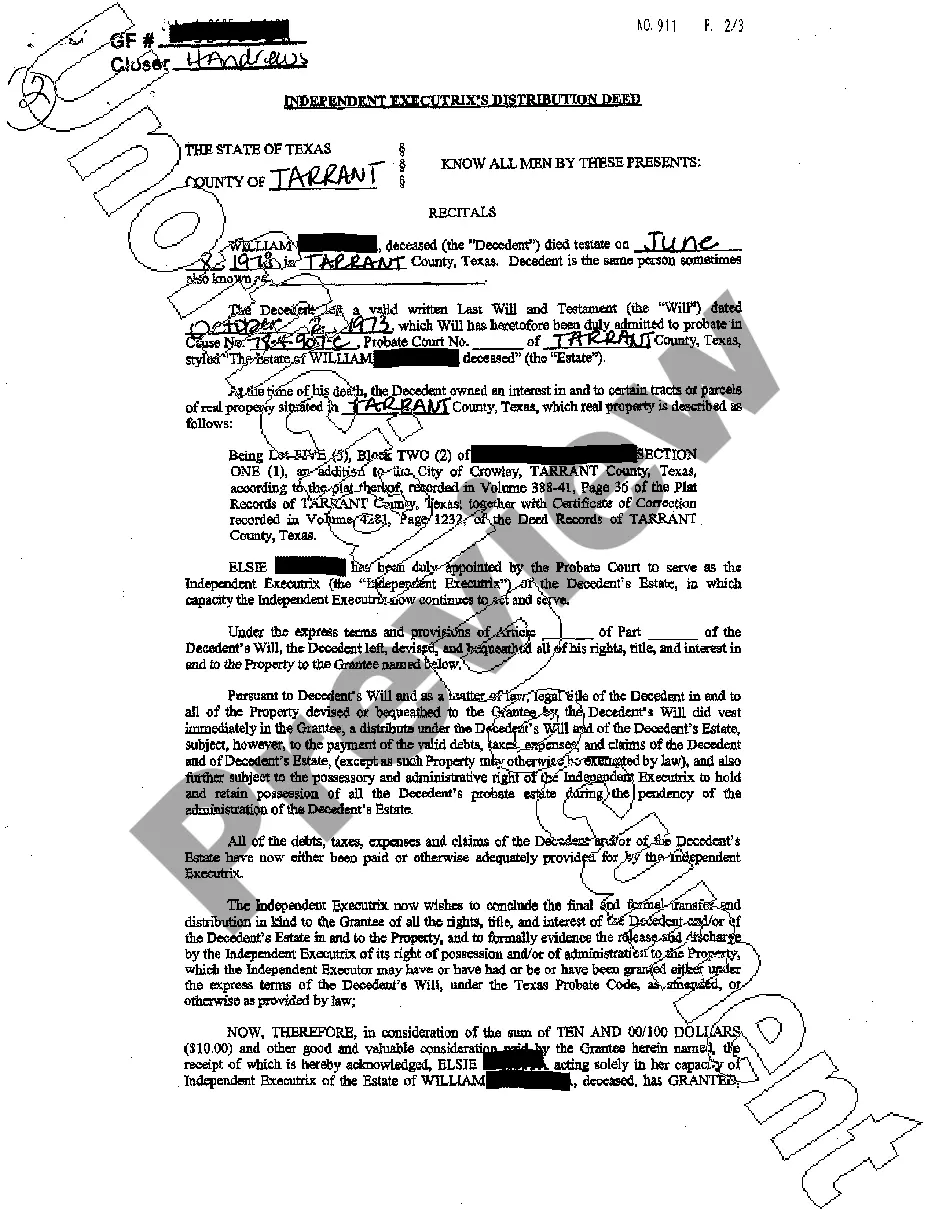

The Franklin Ohio Legal Last Will and Testament Form for Single Person with No Children is a crucial legal document that ensures your wishes are clearly stated and legally binding after your passing. This particular form is tailored for individuals who are not married or have no children, allowing them to outline their final arrangements and distribution of assets according to their preferences. Characterized by its comprehensiveness and adherence to state-specific laws, the Franklin Ohio Legal Last Will and Testament Form for Single Person with No Children addresses various important aspects. Some keywords relevant to this document include: 1. Last Will and Testament: This phrase signifies the formal declaration of an individual's wishes regarding the distribution of their property and assets upon death. 2. Legal Document: The Franklin Ohio Legal Last Will and Testament Form for Single Person with No Children holds the legitimacy of a legally binding document, ensuring that all instructions stated within it can be enforced with legal implications. 3. Executor: The person chosen by the testator (creator of the will) to carry out the instructions outlined in the will. This term refers to an individual responsible for managing the estate, including distributing assets, paying debts, and fulfilling legal obligations. 4. Beneficiary: Individuals named in the will to receive assets or property upon the testator's death. Without explicit naming, the distribution may follow state-specific laws of intestacy. 5. Personal Property: The term referring to any tangible assets, such as vehicles, jewelry, art, or furniture, that may be included in the will for distribution to specific beneficiaries or organizations. 6. Real Property: This term pertains to any immovable assets, such as land, houses, or buildings, that the testator may want to bequeath to specific beneficiaries. 7. Debts and Liabilities: This section addresses specific instructions and guidelines regarding the payment or forgiveness of debts, loans, and obligations the testator may have at the time of their passing. 8. Residue and Contingent Beneficiaries: These keywords refer to any remaining assets or property not explicitly assigned to named beneficiaries. A residual clause designates who will receive these remaining assets, either to individuals or specified organizations. Various Franklin Ohio Legal Last Will and Testament Forms exist to cater to different circumstances and preferences. Some forms may differ based on the marital status of the individual (married vs. single) or the presence of children. However, for single individuals with no children, there may not be any additional specific forms apart from the standard Franklin Ohio Legal Last Will and Testament Form designed for this scenario. In summary, the Franklin Ohio Legal Last Will and Testament Form for Single Person with No Children is a vital legal document enabling individuals to dictate the distribution of their assets, execute their final wishes, and determine the management of their estate after death, all while adhering to relevant state laws and regulations.