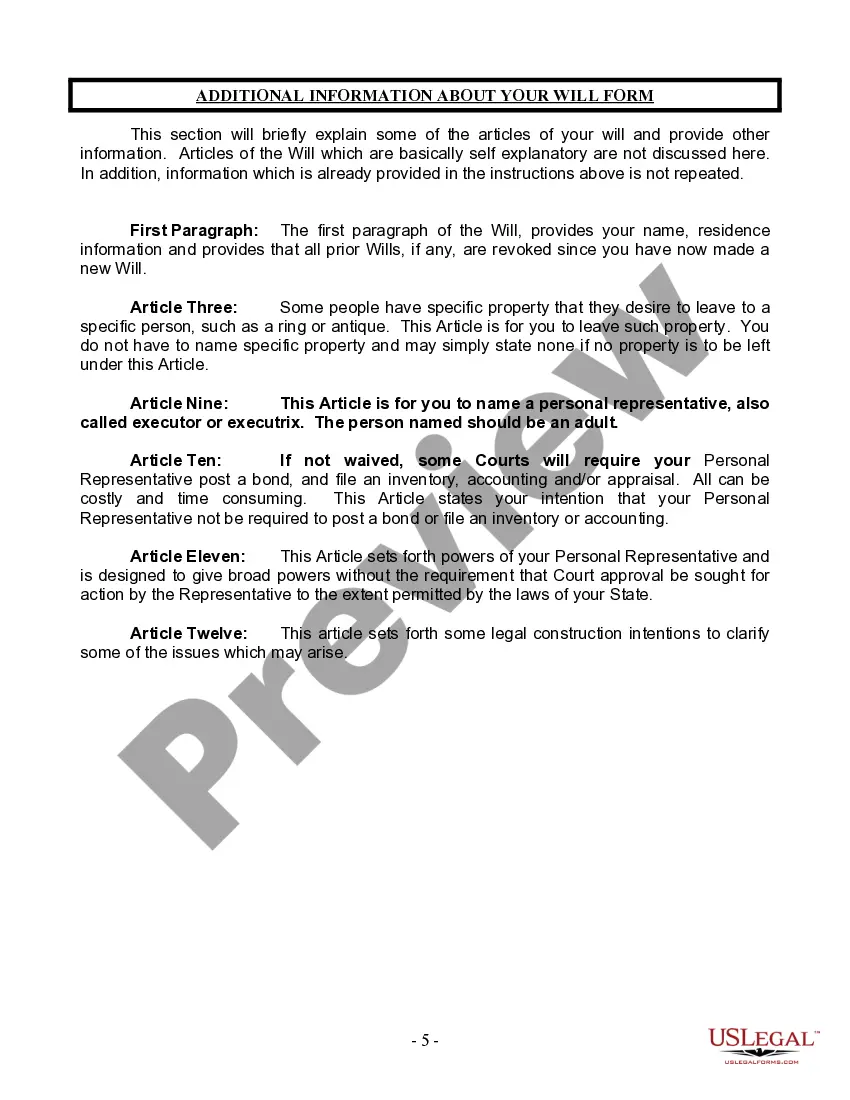

The Legal Last Will and Testament you have found, is for a single person with minor children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your children. It also includes provisions for the appointment of a trustee for the estate of the minor children.

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

The Columbus Ohio Legal Last Will and Testament Form for a Single Person with Minor Children is a legal document that allows individuals residing in Columbus, Ohio, who are single and have minor children, to outline their wishes regarding the distribution of their assets and the care of their children after their passing. This form is specifically designed for single individuals with minor children and caters to the unique circumstances of their situation. It ensures that the individual's assets are distributed according to their wishes and that arrangements are made for the care and support of their children. The Columbus Ohio Legal Last Will and Testament Form for a Single Person with Minor Children typically includes the following key provisions: 1. Appointment of a Personal Representative: The form allows the individual to designate a trusted person, known as the personal representative or executor, who will be responsible for administering the estate, settling debts, and distributing assets according to the will. 2. Guardianship for Minor Children: One of the most crucial aspects of this form is appointing a guardian for the care of any minor children. The individual can specify their preferred choice as a guardian, ensuring that someone they trust will be responsible for the physical and emotional well-being of their children. 3. Asset Distribution: The form provides space for the individual to detail how they would like their assets, such as properties, bank accounts, investments, and personal belongings, to be distributed among their beneficiaries. It allows them to specify specific bequests or divide assets equally among their children. 4. Trust Provisions: If desired, the form allows for the creation of a trust fund to manage and distribute assets on behalf of minor children until they reach a designated age or milestone, ensuring their financial security and well-being. 5. Disposition of Remains: In addition to financial matters, this form may include instructions regarding the individual's preferred method of burial or cremation, funeral arrangements, or any specific wishes concerning their remains. While the Columbus Ohio Legal Last Will and Testament Form for a Single Person with Minor Children may not have different types or variations, it is essential to consult with an attorney or legal professional to ensure compliance with the specific laws and regulations of Columbus, Ohio. Additionally, individuals may want to consider periodically updating their will to reflect any changes in personal circumstances or assets.The Columbus Ohio Legal Last Will and Testament Form for a Single Person with Minor Children is a legal document that allows individuals residing in Columbus, Ohio, who are single and have minor children, to outline their wishes regarding the distribution of their assets and the care of their children after their passing. This form is specifically designed for single individuals with minor children and caters to the unique circumstances of their situation. It ensures that the individual's assets are distributed according to their wishes and that arrangements are made for the care and support of their children. The Columbus Ohio Legal Last Will and Testament Form for a Single Person with Minor Children typically includes the following key provisions: 1. Appointment of a Personal Representative: The form allows the individual to designate a trusted person, known as the personal representative or executor, who will be responsible for administering the estate, settling debts, and distributing assets according to the will. 2. Guardianship for Minor Children: One of the most crucial aspects of this form is appointing a guardian for the care of any minor children. The individual can specify their preferred choice as a guardian, ensuring that someone they trust will be responsible for the physical and emotional well-being of their children. 3. Asset Distribution: The form provides space for the individual to detail how they would like their assets, such as properties, bank accounts, investments, and personal belongings, to be distributed among their beneficiaries. It allows them to specify specific bequests or divide assets equally among their children. 4. Trust Provisions: If desired, the form allows for the creation of a trust fund to manage and distribute assets on behalf of minor children until they reach a designated age or milestone, ensuring their financial security and well-being. 5. Disposition of Remains: In addition to financial matters, this form may include instructions regarding the individual's preferred method of burial or cremation, funeral arrangements, or any specific wishes concerning their remains. While the Columbus Ohio Legal Last Will and Testament Form for a Single Person with Minor Children may not have different types or variations, it is essential to consult with an attorney or legal professional to ensure compliance with the specific laws and regulations of Columbus, Ohio. Additionally, individuals may want to consider periodically updating their will to reflect any changes in personal circumstances or assets.