The Last Will and Testament Form with Instructions you have found is for a single person with adult and minor children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

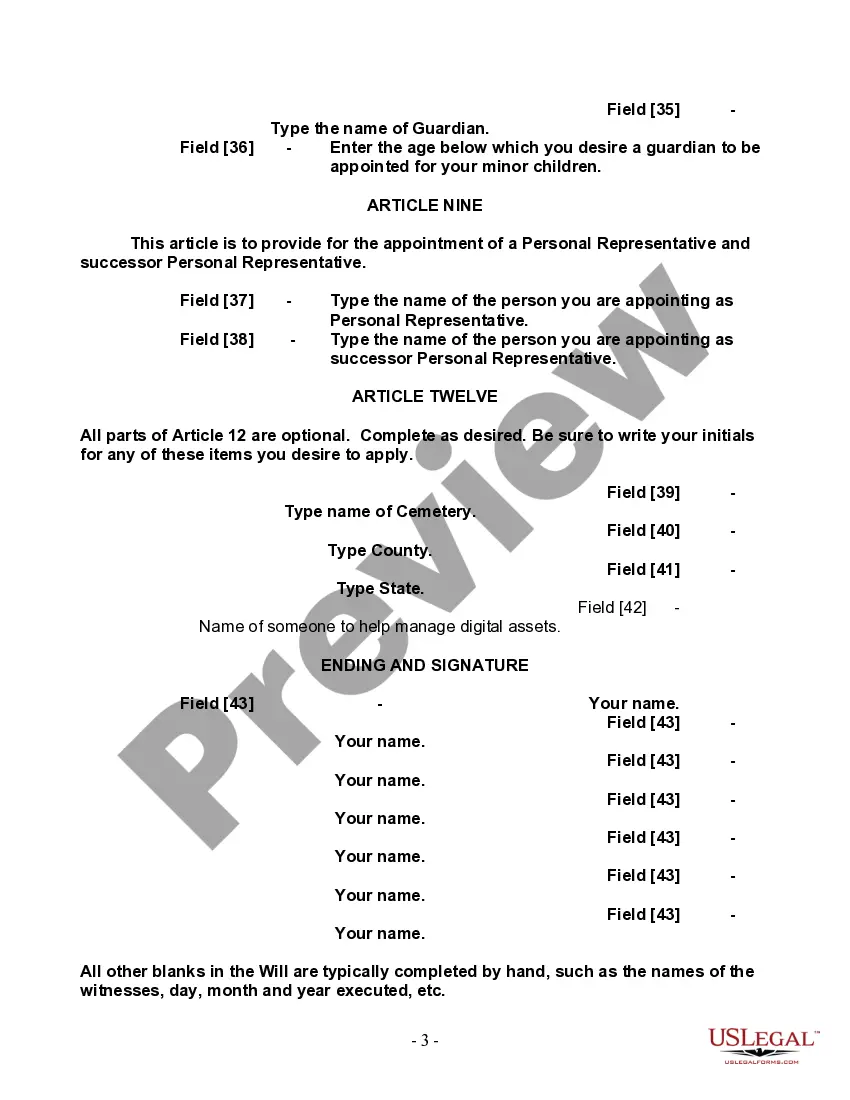

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

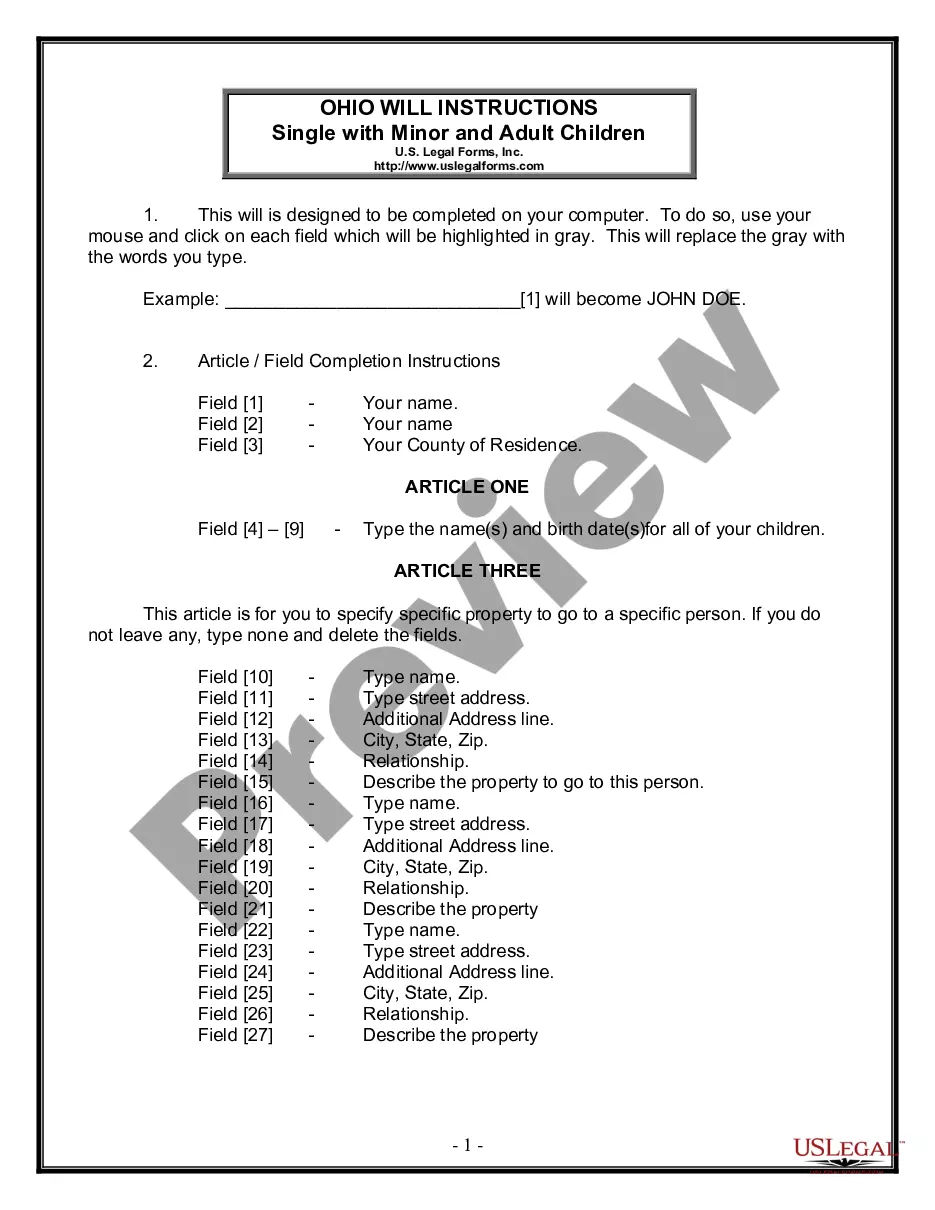

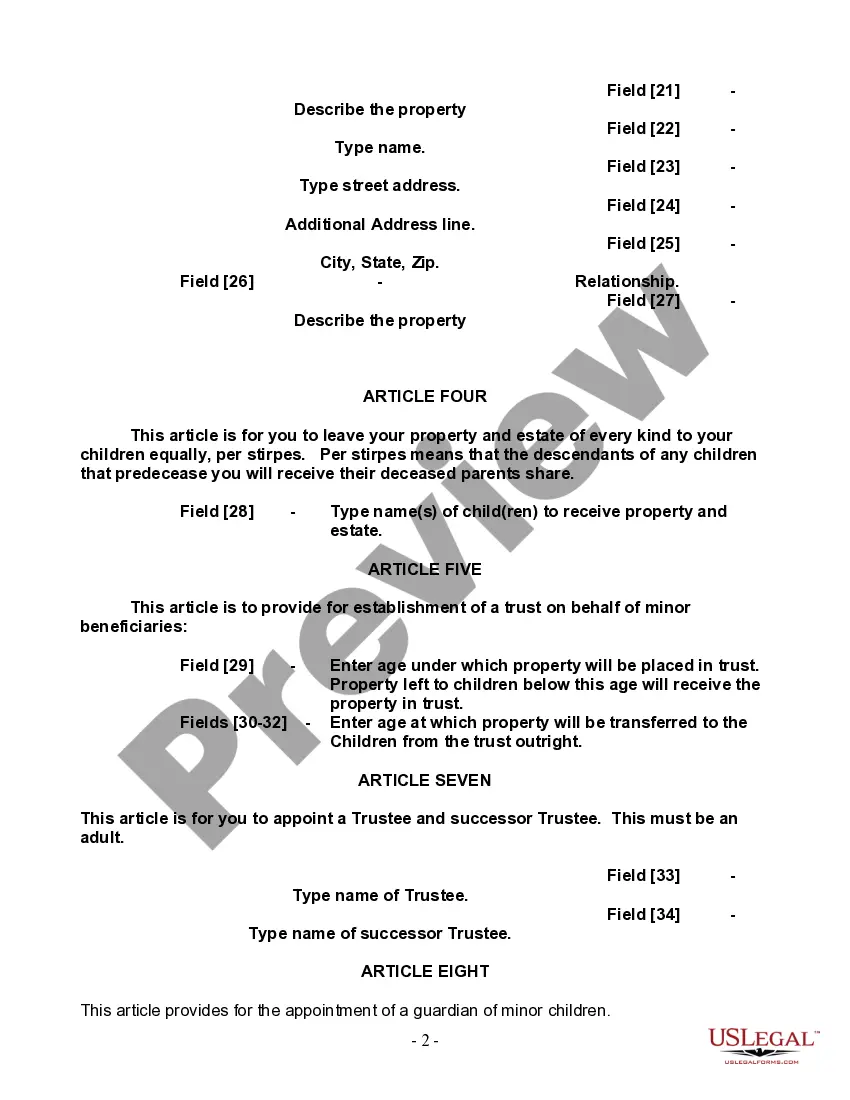

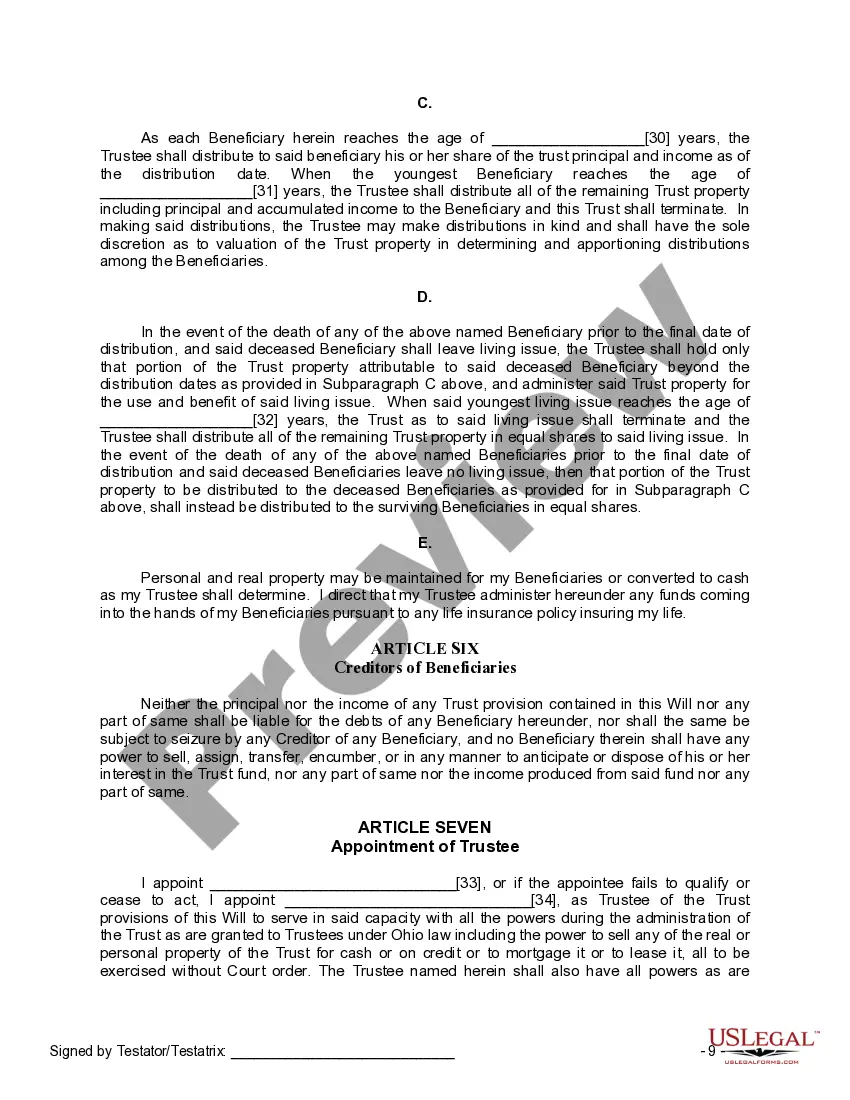

A Franklin Ohio Legal Last Will and Testament Form for Single Person with Adult and Minor Children is a legal document that allows an individual residing in Franklin, Ohio, to outline their final wishes regarding the distribution of their assets and the care of their minor children after their passing. This form is specifically designed for individuals who are not married and have both adult and minor children. This legally binding document serves as a comprehensive guide for the individual's loved ones, outlining their preferences for the division of their estate, appointment of executors, guardianship of minor children, and other important details. The Franklin Ohio Legal Last Will and Testament Form for Single Person with Adult and Minor Children addresses the unique circumstances of single individuals who have both adult and minor children. This distinction is crucial as it allows the person to specifically address the needs of both their adult children, who might require less guidance and financial assistance, and their minor children, who require guardianship and support until they reach adulthood. Different variations or types of Franklin Ohio Legal Last Will and Testament Forms may include specific provisions for: 1. Division of Assets: This section allows the individual to dictate how their assets, including financial accounts, real estate property, vehicles, personal possessions, and investments, should be distributed among their beneficiaries. It may include bequests, the establishment of trusts, or other arrangements to ensure a fair distribution. 2. Appointment of Executor: This section allows the individual to designate a trusted person, known as the executor, who will be responsible for managing the probate process, handling debts, paying taxes, and ensuring that their wishes are carried out as stated in the will. 3. Guardianship of Minor Children: A crucial aspect for individuals with minor children, this section allows the individual to nominate a guardian who will assume responsibility for the care, upbringing, and support of their children in the event of their passing. The individual may also outline preferences for visitation rights of non-custodial parents or other family members. 4. Trusts or Trustee Designation: The individual may choose to establish one or more trusts to manage the assets left to their minor children, protecting their inheritances until they reach a certain age or milestone. They can designate a trustee who will oversee the distribution and management of these assets on their behalf. It is essential for individuals considering a Franklin Ohio Legal Last Will and Testament Form for Single Person with Adult and Minor Children to consult with an attorney experienced in estate planning to ensure that the document aligns with their specific circumstances and adheres to Ohio's laws and regulations.