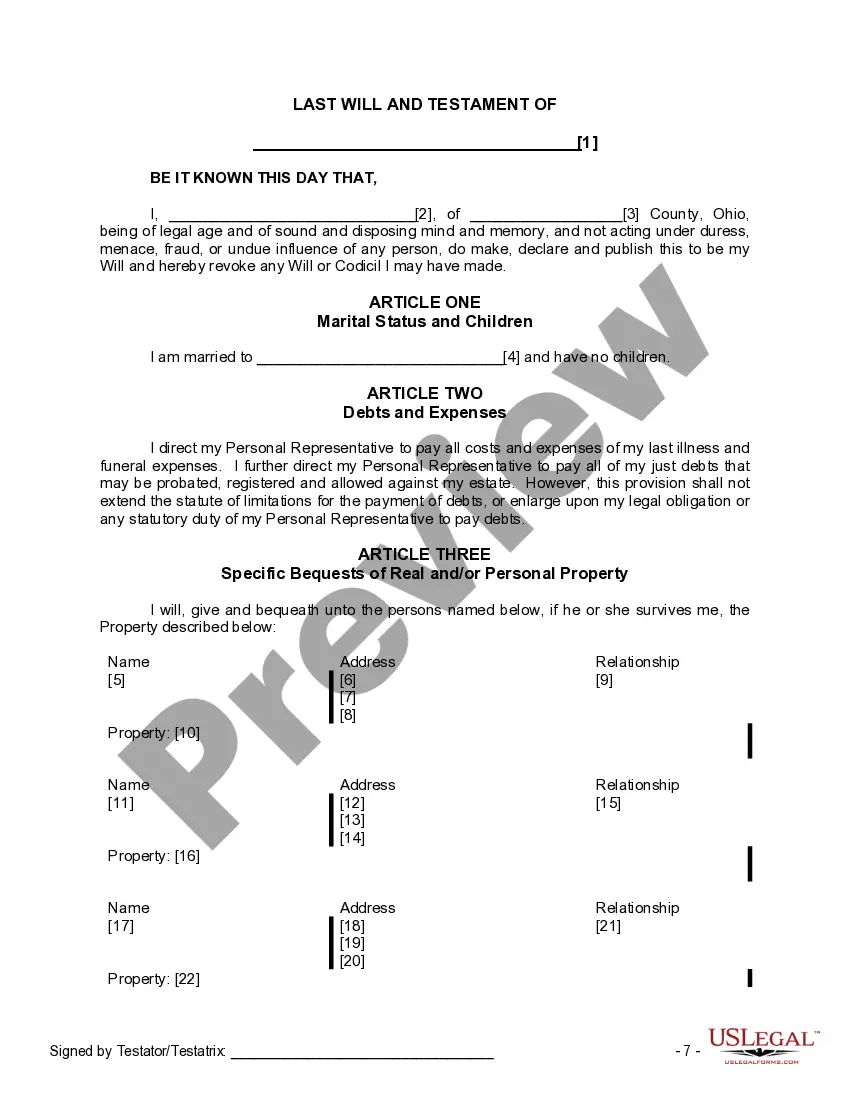

The Will you have found is for a married person with no children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your spouse.

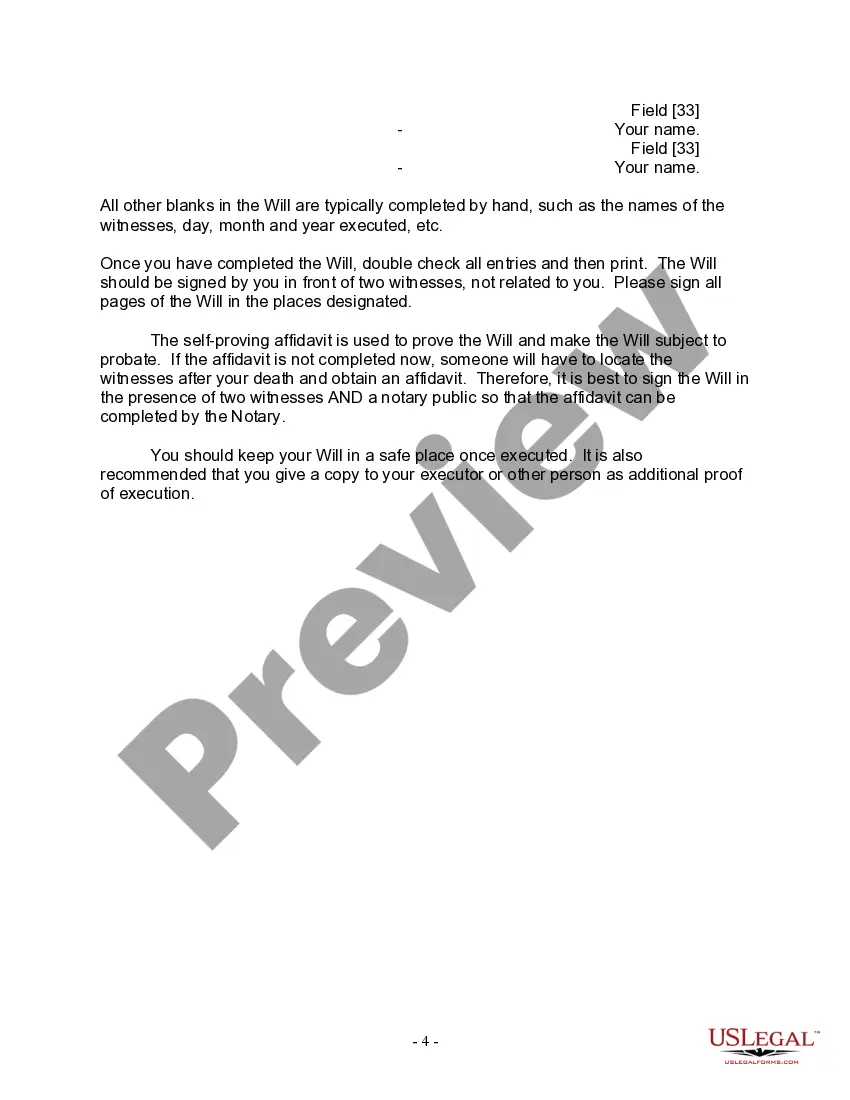

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

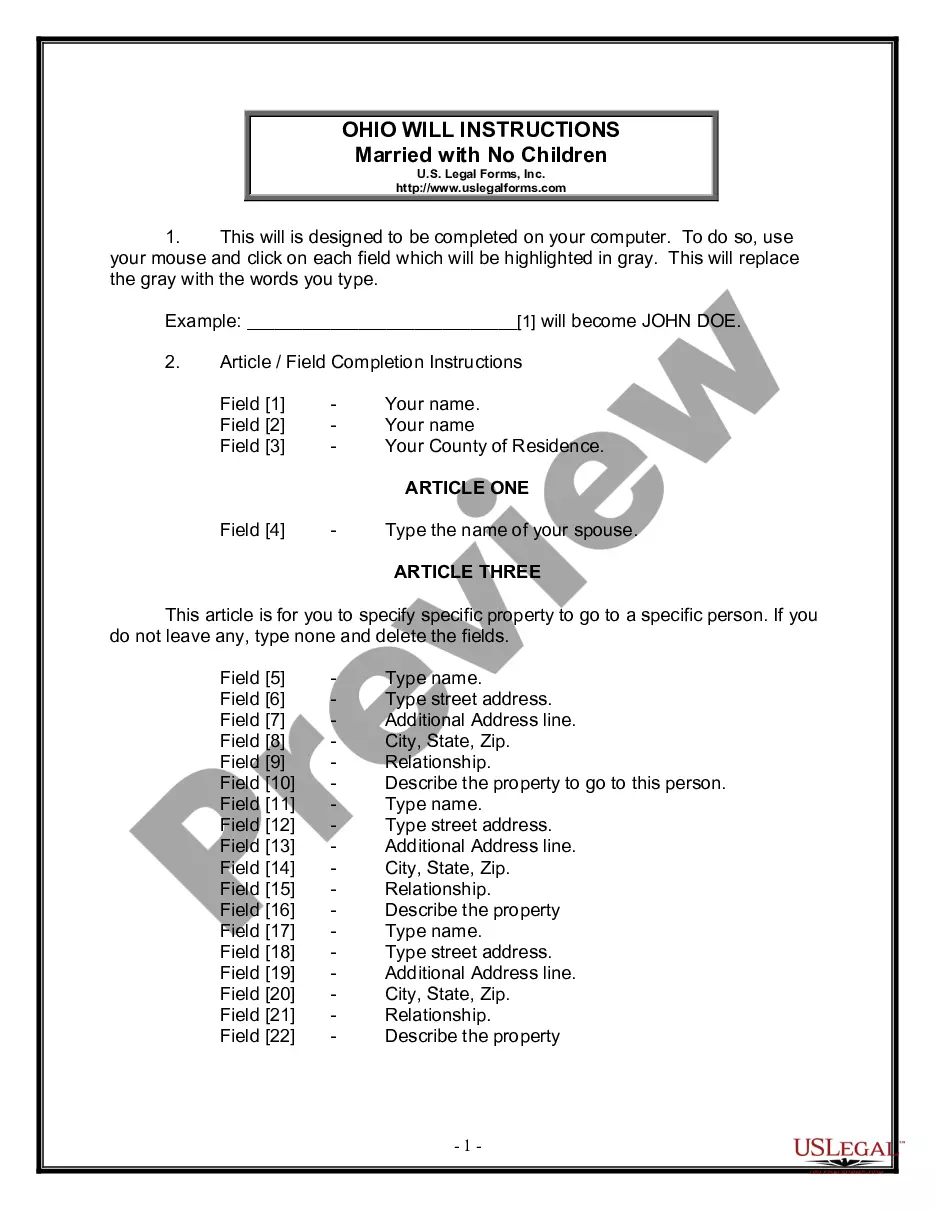

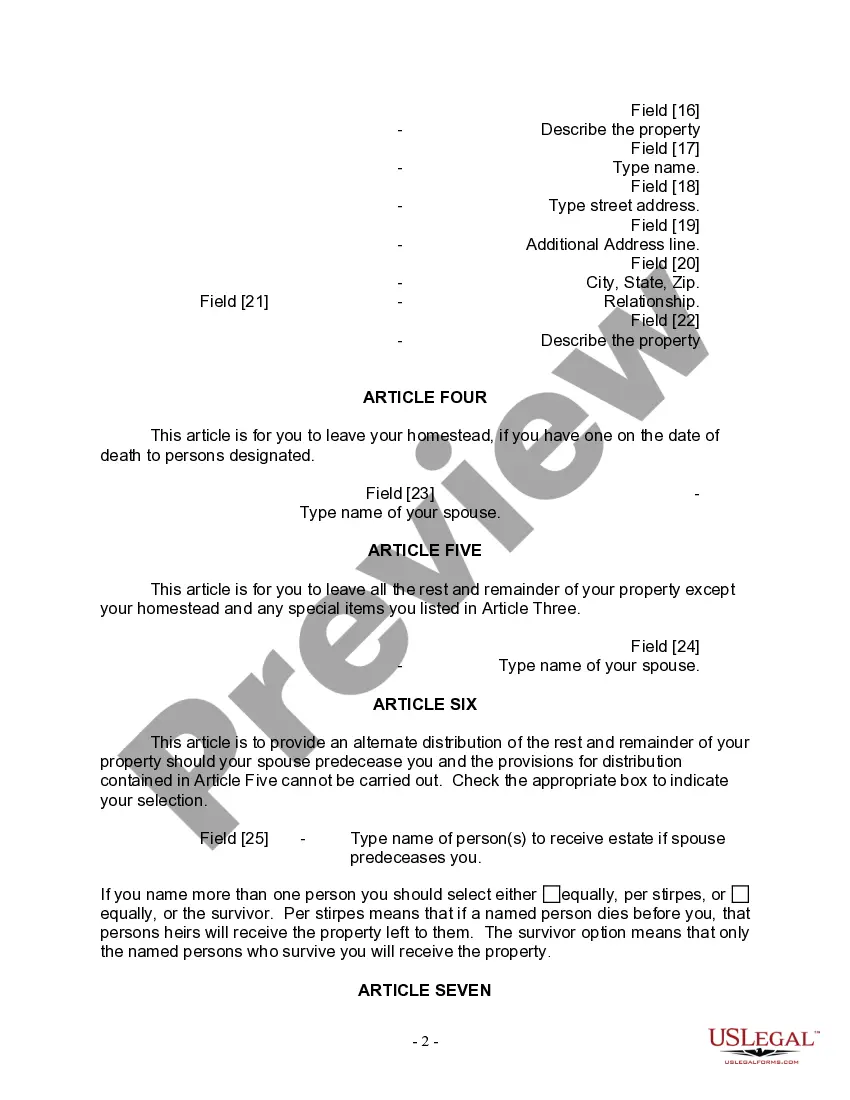

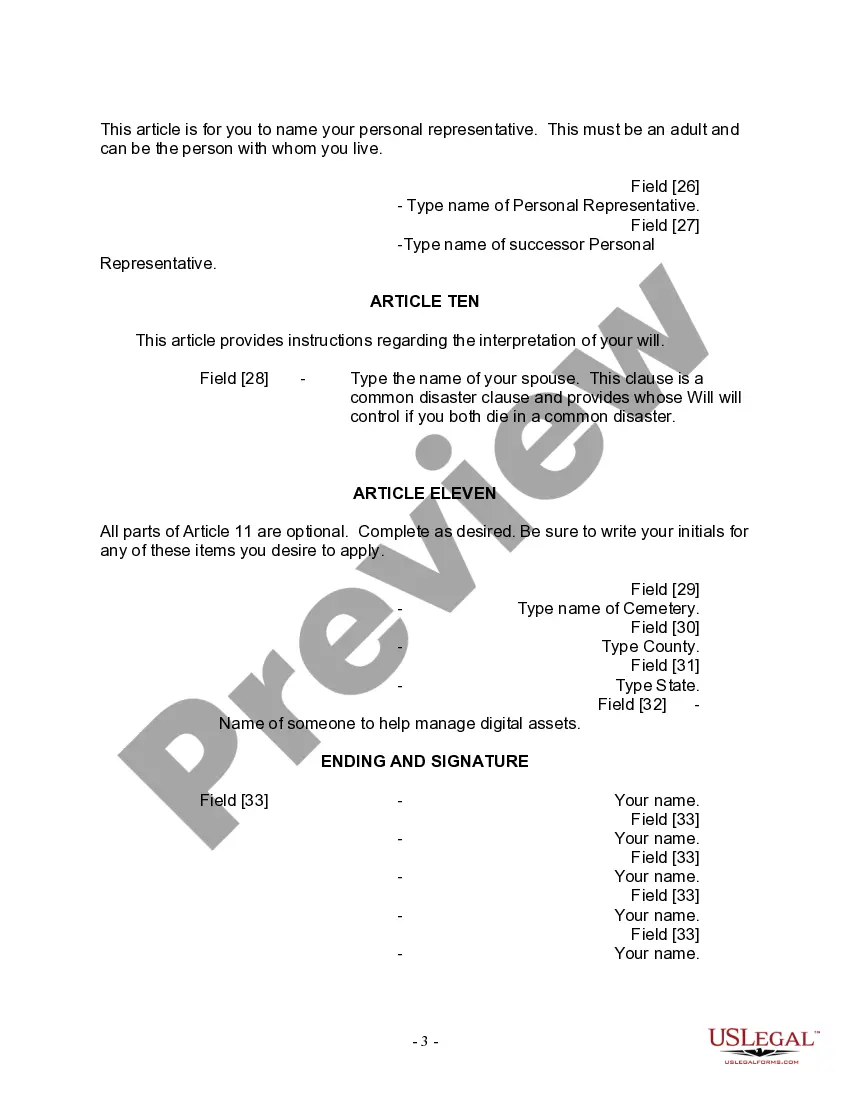

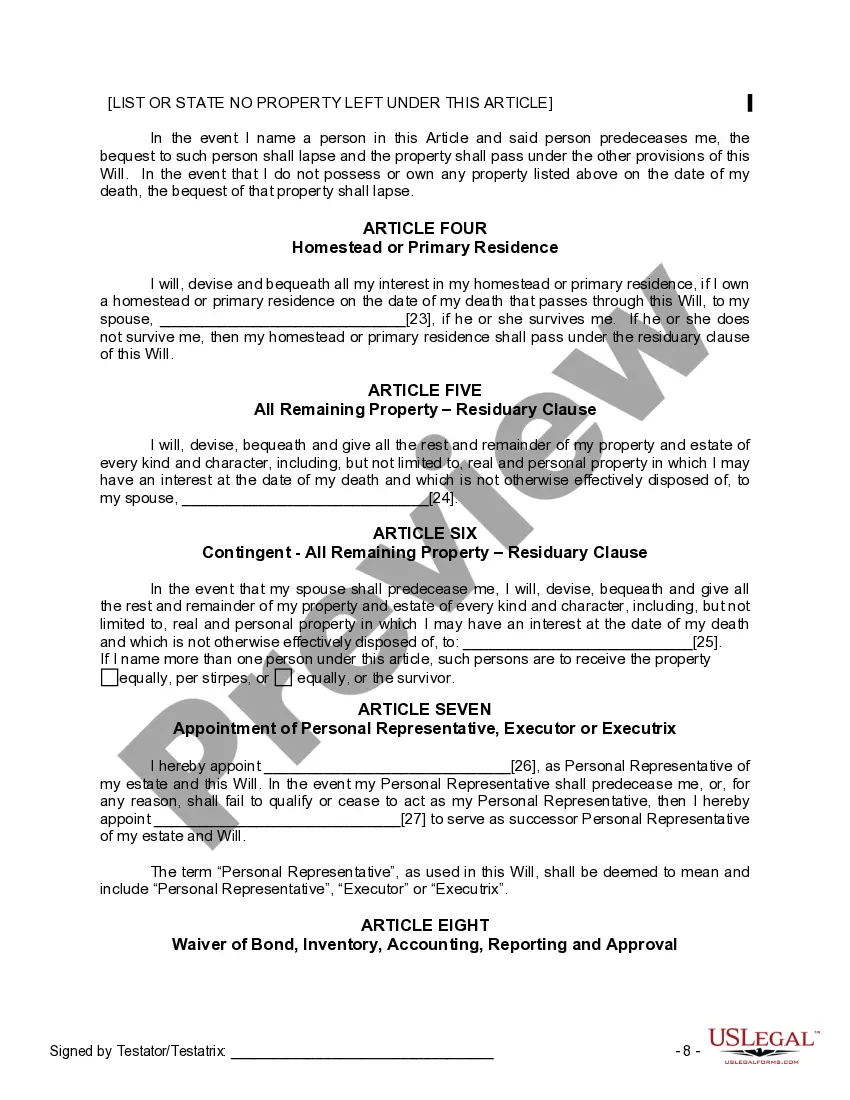

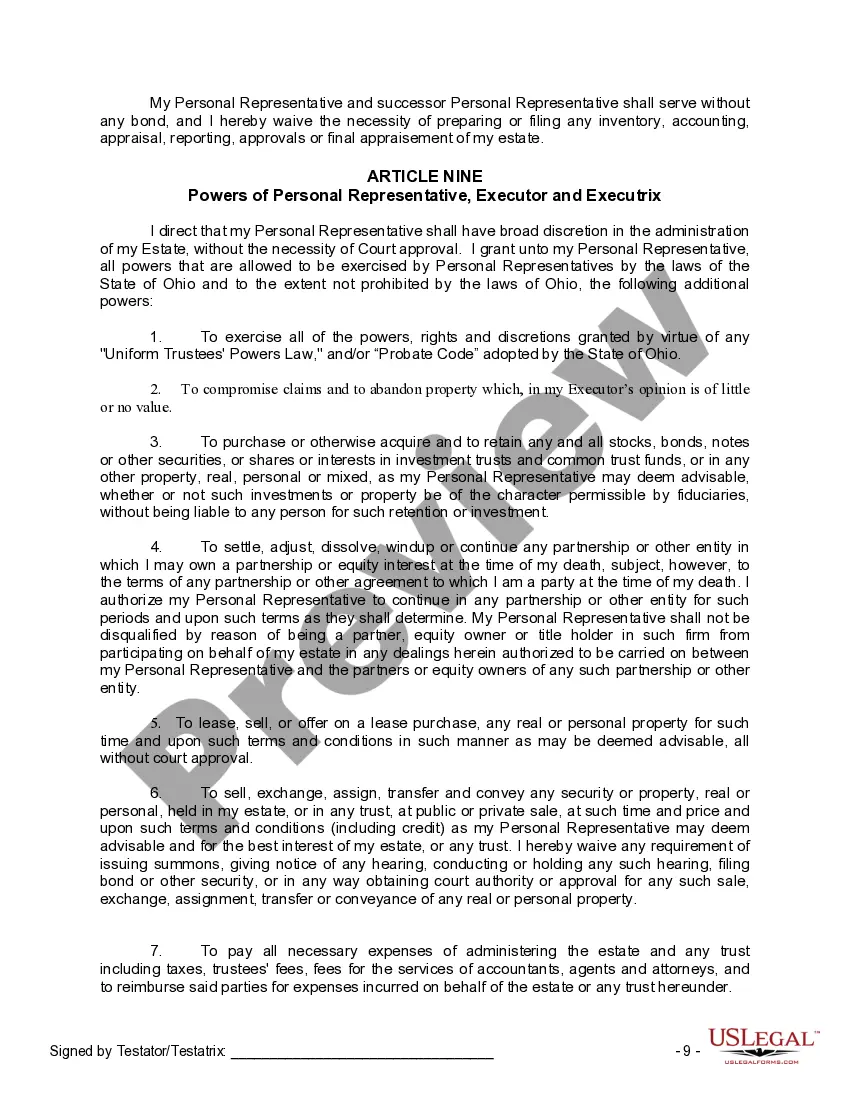

In Dayton, Ohio, a Legal Last Will and Testament Form for a Married Person with No Children is a crucial legal document that allows individuals to ensure their assets and wishes are distributed according to their wishes after they pass away. This legally binding document serves as a blueprint for the distribution of one's estate, personal belongings, and even provides guidance for funeral arrangements. Creating a Last Will and Testament Form is especially important for married individuals with no children, as the absence of direct heirs can lead to complex legal complications without a proper estate plan in place. By utilizing this form, individuals can specify their beneficiaries, appoint an executor to oversee the distribution of assets, and make provisions for any charitable donations or specific bequests. Some essential elements typically covered in a Dayton, Ohio Legal Last Will and Testament Form for a Married Person with No Children include: 1. Identifying Information: The form usually begins by including personal details of the testator (the person making the will), such as their full name, address, and date of birth. 2. Appointment of Executor: This section allows individuals to appoint a trusted person to handle the administration of their estate and carry out the instructions mentioned in the will. It is important to select an executor who is willing and able to fulfill this responsibility. 3. Distribution of Assets: The main purpose of a Last Will and Testament is to distribute one's assets amongst chosen beneficiaries. In this section, individuals can allocate specific assets, such as real estate, vehicles, investments, or personal belongings, to named individuals or organizations. It is crucial to provide detailed descriptions of the assets and specify how they should be divided. 4. Contingency Plans: In the event that the primary beneficiaries mentioned in they will predecease the testator or are unable to accept the bequest, it is essential to name alternate beneficiaries. This ensures that assets are not left unallocated or subjected to the intestate laws of Ohio. 5. Funeral Arrangements: While not legally binding, including funeral and burial wishes within a Last Will and Testament form can provide guidance to family members. These provisions may include preferences for burial or cremation, funeral ceremony details, and any specific requests the individual wishes to be fulfilled. 6. Residual Clause: This section addresses any remaining assets that were not specifically distributed in the above sections. It states how the residue of the estate should be distributed, whether equally amongst the primary beneficiaries or designated to specific individuals or charitable organizations. It is important to note that there may be different versions or variations of the Dayton Ohio Legal Last Will and Testament Form for a Married Person with No Children. Some forms may be provided by legal professionals or local organizations, such as the Ohio State Bar Association. It is recommended to consult with an attorney specializing in estate planning to ensure compliance with the applicable laws and regulations in Dayton, Ohio.In Dayton, Ohio, a Legal Last Will and Testament Form for a Married Person with No Children is a crucial legal document that allows individuals to ensure their assets and wishes are distributed according to their wishes after they pass away. This legally binding document serves as a blueprint for the distribution of one's estate, personal belongings, and even provides guidance for funeral arrangements. Creating a Last Will and Testament Form is especially important for married individuals with no children, as the absence of direct heirs can lead to complex legal complications without a proper estate plan in place. By utilizing this form, individuals can specify their beneficiaries, appoint an executor to oversee the distribution of assets, and make provisions for any charitable donations or specific bequests. Some essential elements typically covered in a Dayton, Ohio Legal Last Will and Testament Form for a Married Person with No Children include: 1. Identifying Information: The form usually begins by including personal details of the testator (the person making the will), such as their full name, address, and date of birth. 2. Appointment of Executor: This section allows individuals to appoint a trusted person to handle the administration of their estate and carry out the instructions mentioned in the will. It is important to select an executor who is willing and able to fulfill this responsibility. 3. Distribution of Assets: The main purpose of a Last Will and Testament is to distribute one's assets amongst chosen beneficiaries. In this section, individuals can allocate specific assets, such as real estate, vehicles, investments, or personal belongings, to named individuals or organizations. It is crucial to provide detailed descriptions of the assets and specify how they should be divided. 4. Contingency Plans: In the event that the primary beneficiaries mentioned in they will predecease the testator or are unable to accept the bequest, it is essential to name alternate beneficiaries. This ensures that assets are not left unallocated or subjected to the intestate laws of Ohio. 5. Funeral Arrangements: While not legally binding, including funeral and burial wishes within a Last Will and Testament form can provide guidance to family members. These provisions may include preferences for burial or cremation, funeral ceremony details, and any specific requests the individual wishes to be fulfilled. 6. Residual Clause: This section addresses any remaining assets that were not specifically distributed in the above sections. It states how the residue of the estate should be distributed, whether equally amongst the primary beneficiaries or designated to specific individuals or charitable organizations. It is important to note that there may be different versions or variations of the Dayton Ohio Legal Last Will and Testament Form for a Married Person with No Children. Some forms may be provided by legal professionals or local organizations, such as the Ohio State Bar Association. It is recommended to consult with an attorney specializing in estate planning to ensure compliance with the applicable laws and regulations in Dayton, Ohio.