This is a Last Will and Testament Form for Married Person with Adult and Minor Children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your spouse and children. It also establishes a trust and provides for the appointment of a trustee for the estate of the minor children.

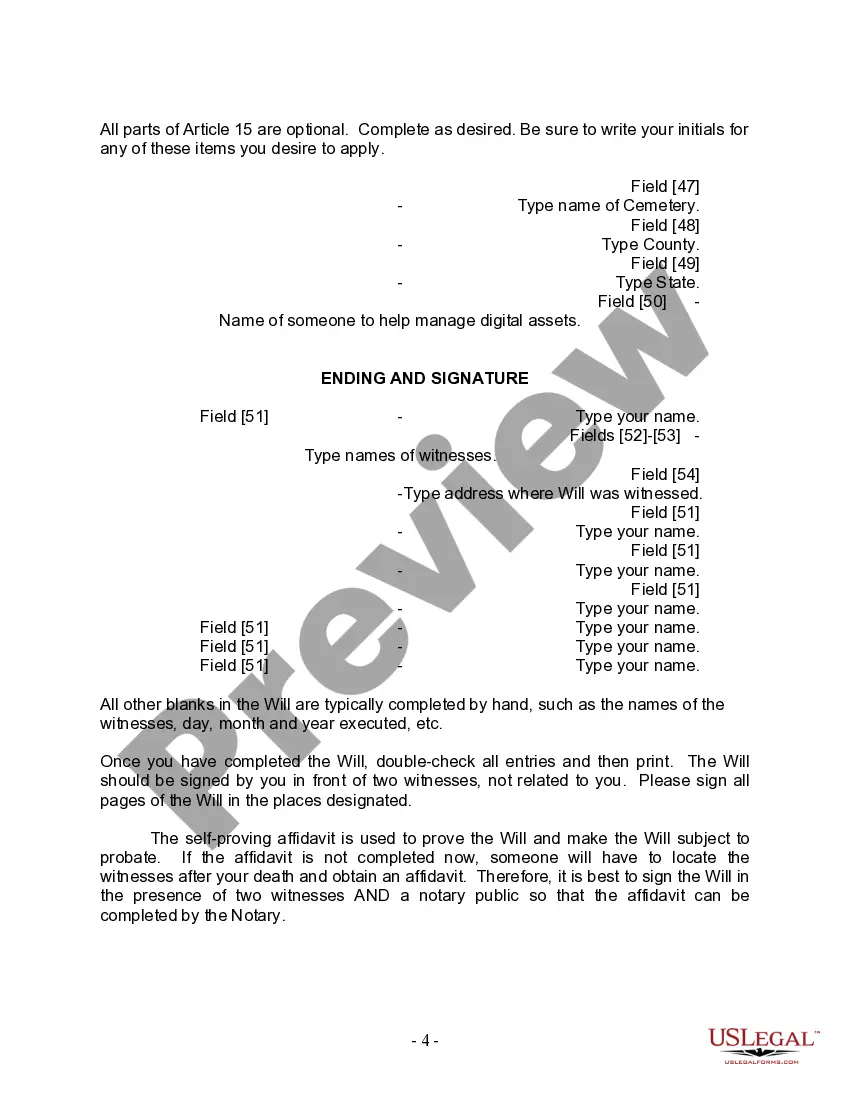

This will must be signed in the presence of two witnesses, not related to you or named in your will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the will.

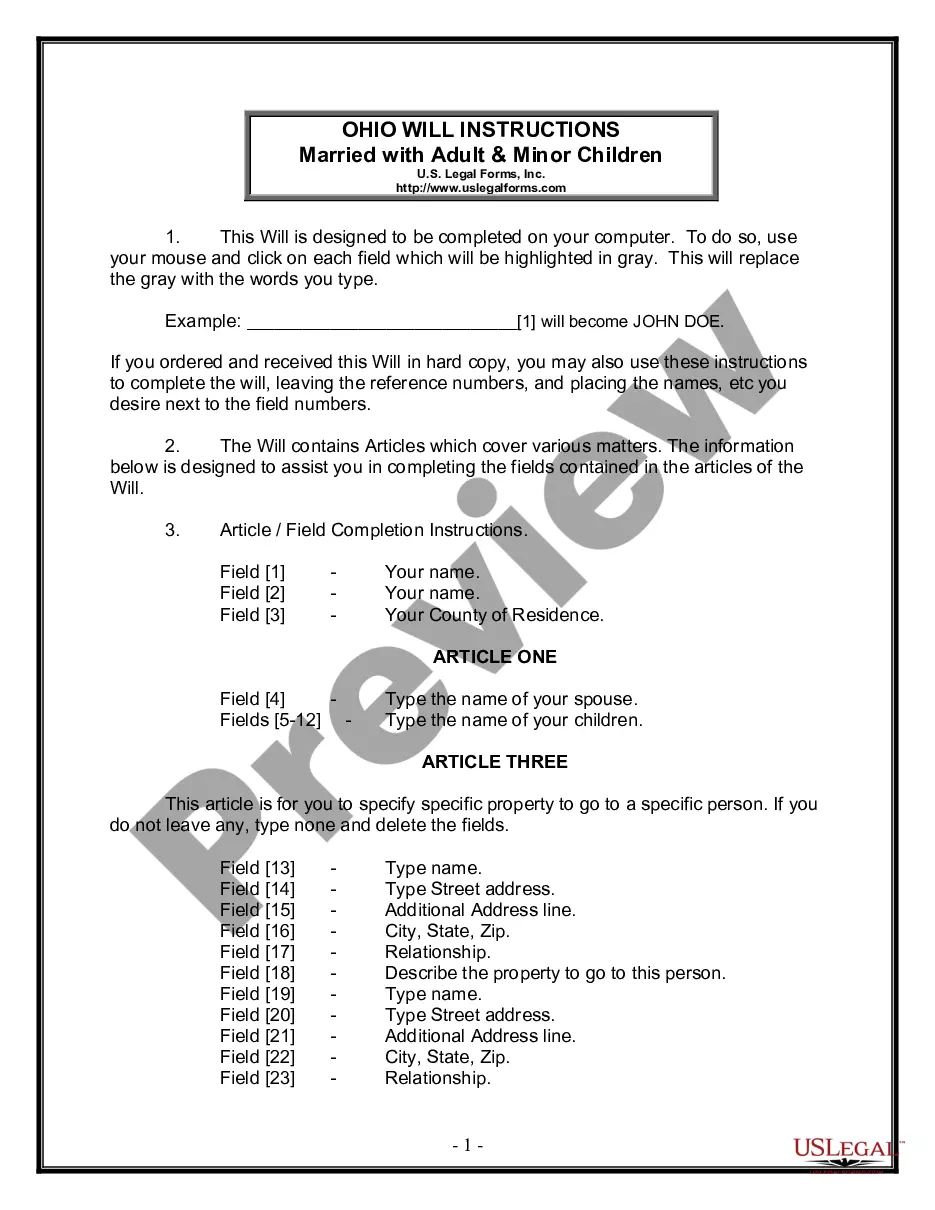

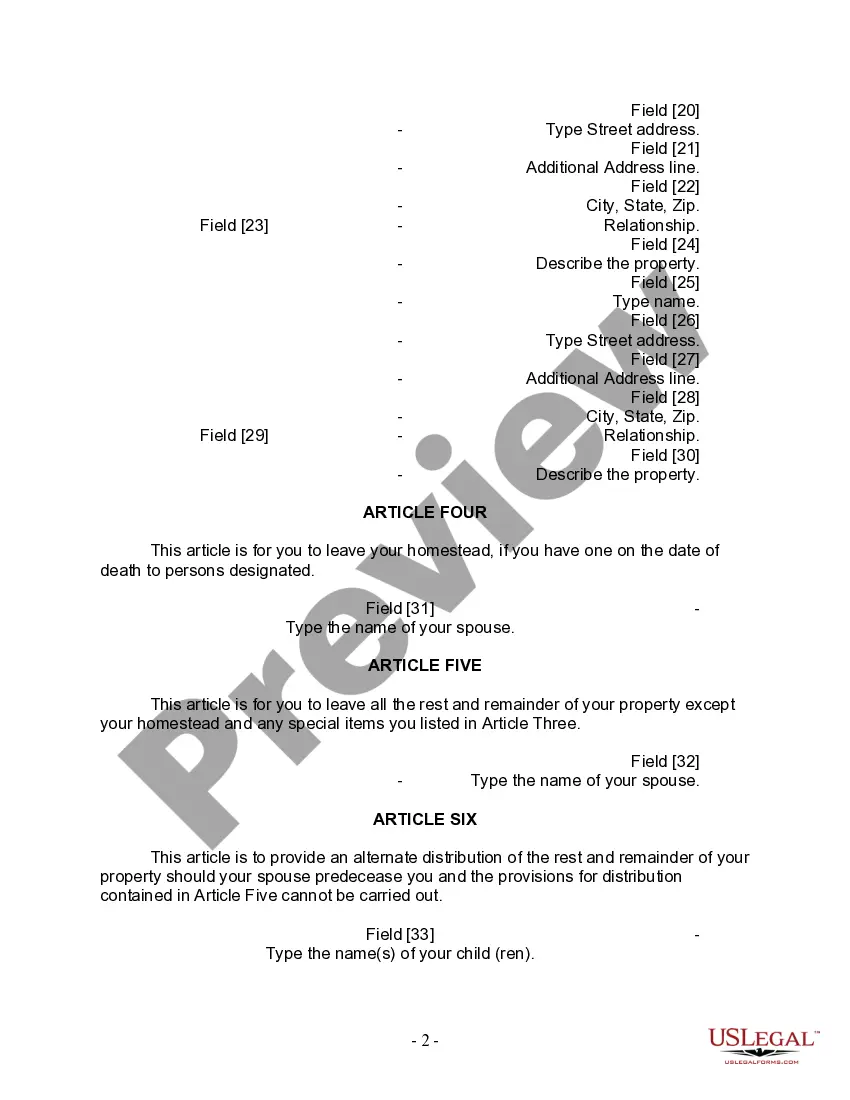

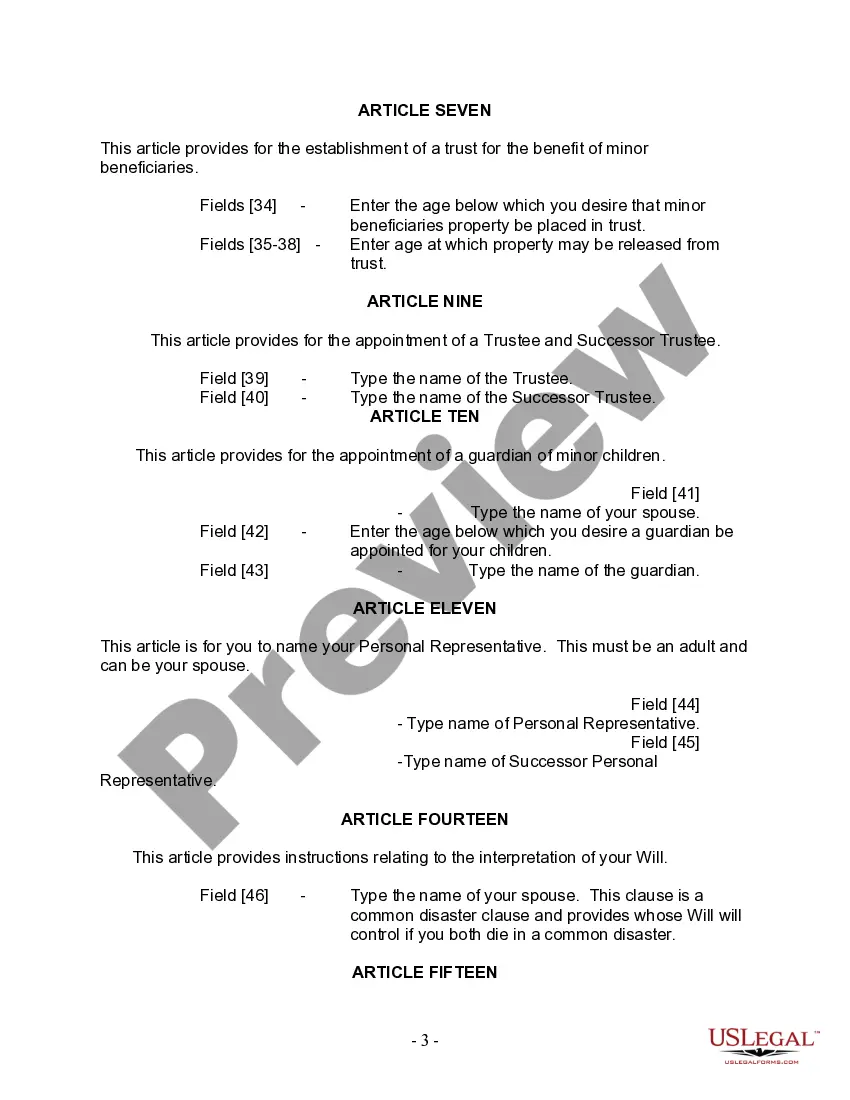

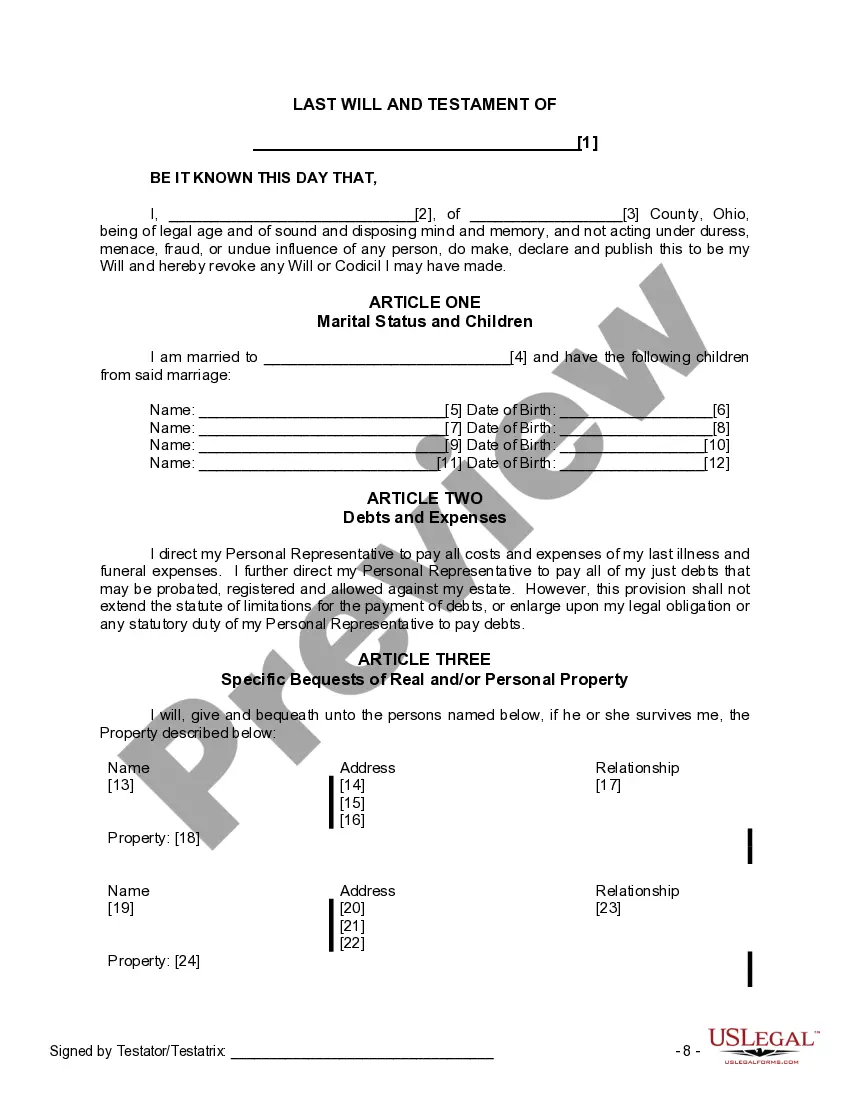

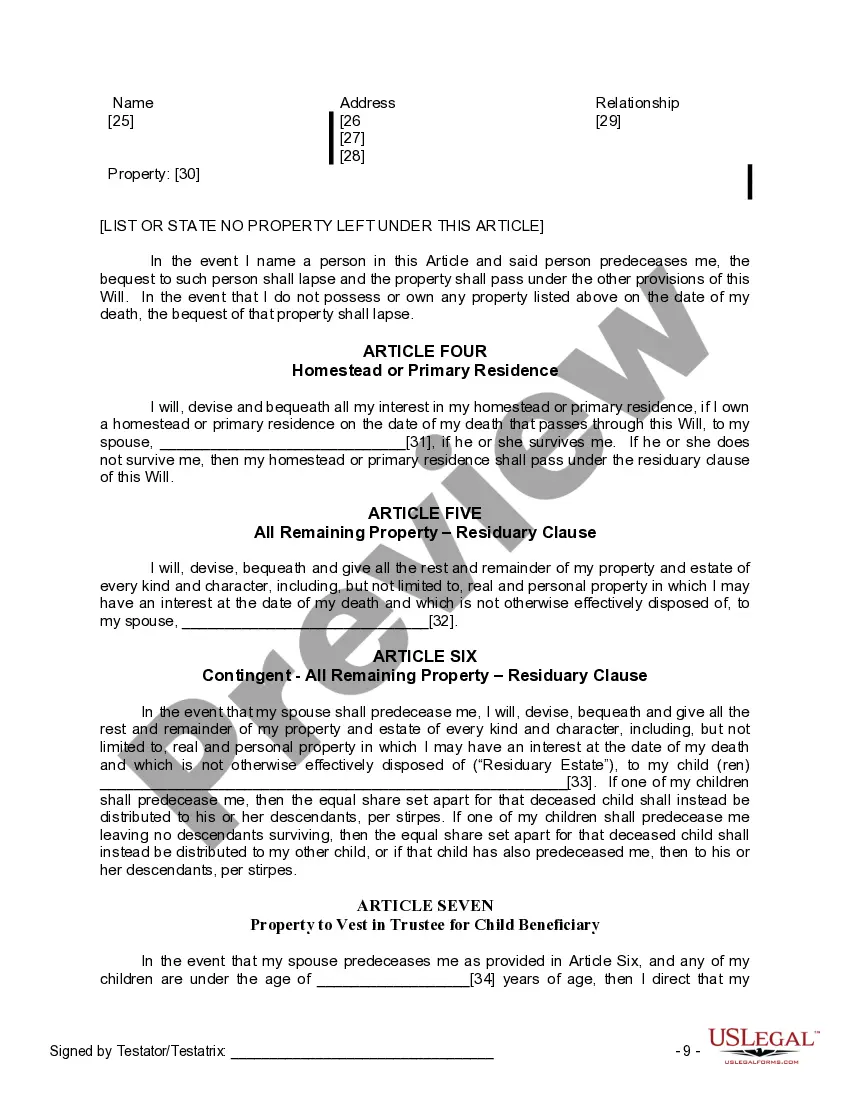

The Columbus Ohio Legal Last Will and Testament Form for Married Person with Adult and Minor Children is a legal document that allows individuals who are married and have both adult and minor children to outline their final wishes and distribute their assets after their passing. This form specifically caters to residents of Columbus, Ohio, ensuring adherence to state-specific laws and regulations. This form serves as a crucial document for married individuals as it helps them designate beneficiaries, name guardians for their minor children, and establish a plan for the distribution of their assets and properties. It provides peace of mind by ensuring that their wishes are respected and that their loved ones are well taken care of in the event of their death. Some key components included in this specific will form typically are: 1. Identification: The form begins with a section where the individual provides their personal details such as full name, address, and marital status. 2. Appointment of Executor: The individual appoints an executor, who is responsible for carrying out the instructions outlined in the will. The executor can be a trusted family member, friend, or a professional. 3. Guardianship of Minor Children: Parents can designate guardians to care for their minor children if both parents pass away. This provision is crucial for ensuring that the children's well-being and upbringing remain in the hands of trusted individuals. 4. Asset Distribution: The will enables the individual to outline how their assets, including financial accounts, real estate, investments, and personal possessions, should be distributed. This may involve specifying percentages or specific inheritors for each asset. 5. Bequests and Legacies: Individuals may choose to leave specific bequests to family members, friends, or charitable organizations. These bequests could be in the form of cash, assets, or personal items. 6. Care and Maintenance of Pets: Pet owners can use this form to designate a caretaker for their beloved pets and allocate funds for their care and maintenance. 7. Residuary Estate: Any part of the estate that has not been specifically mentioned can be designated as the residuary estate, which is distributed among the beneficiaries as outlined in the will. It's important to note that there may be variations of the Columbus Ohio Legal Last Will and Testament Form for Married Person with Adult and Minor Children, depending on factors such as complexity, specific requests, or unique circumstances. Some specialized variations may cater to blended families, individuals with substantial assets, or those with specific business-related considerations. However, it is recommended to consult with a lawyer or legal professional to ensure the accuracy and legality of the will, as well as to address any specific needs or variations that may arise based on personal circumstances.The Columbus Ohio Legal Last Will and Testament Form for Married Person with Adult and Minor Children is a legal document that allows individuals who are married and have both adult and minor children to outline their final wishes and distribute their assets after their passing. This form specifically caters to residents of Columbus, Ohio, ensuring adherence to state-specific laws and regulations. This form serves as a crucial document for married individuals as it helps them designate beneficiaries, name guardians for their minor children, and establish a plan for the distribution of their assets and properties. It provides peace of mind by ensuring that their wishes are respected and that their loved ones are well taken care of in the event of their death. Some key components included in this specific will form typically are: 1. Identification: The form begins with a section where the individual provides their personal details such as full name, address, and marital status. 2. Appointment of Executor: The individual appoints an executor, who is responsible for carrying out the instructions outlined in the will. The executor can be a trusted family member, friend, or a professional. 3. Guardianship of Minor Children: Parents can designate guardians to care for their minor children if both parents pass away. This provision is crucial for ensuring that the children's well-being and upbringing remain in the hands of trusted individuals. 4. Asset Distribution: The will enables the individual to outline how their assets, including financial accounts, real estate, investments, and personal possessions, should be distributed. This may involve specifying percentages or specific inheritors for each asset. 5. Bequests and Legacies: Individuals may choose to leave specific bequests to family members, friends, or charitable organizations. These bequests could be in the form of cash, assets, or personal items. 6. Care and Maintenance of Pets: Pet owners can use this form to designate a caretaker for their beloved pets and allocate funds for their care and maintenance. 7. Residuary Estate: Any part of the estate that has not been specifically mentioned can be designated as the residuary estate, which is distributed among the beneficiaries as outlined in the will. It's important to note that there may be variations of the Columbus Ohio Legal Last Will and Testament Form for Married Person with Adult and Minor Children, depending on factors such as complexity, specific requests, or unique circumstances. Some specialized variations may cater to blended families, individuals with substantial assets, or those with specific business-related considerations. However, it is recommended to consult with a lawyer or legal professional to ensure the accuracy and legality of the will, as well as to address any specific needs or variations that may arise based on personal circumstances.