The Legal Last Will and Testament Form with Instructions you have found, is for a widow or widower with adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions, including provisions for your adult children.

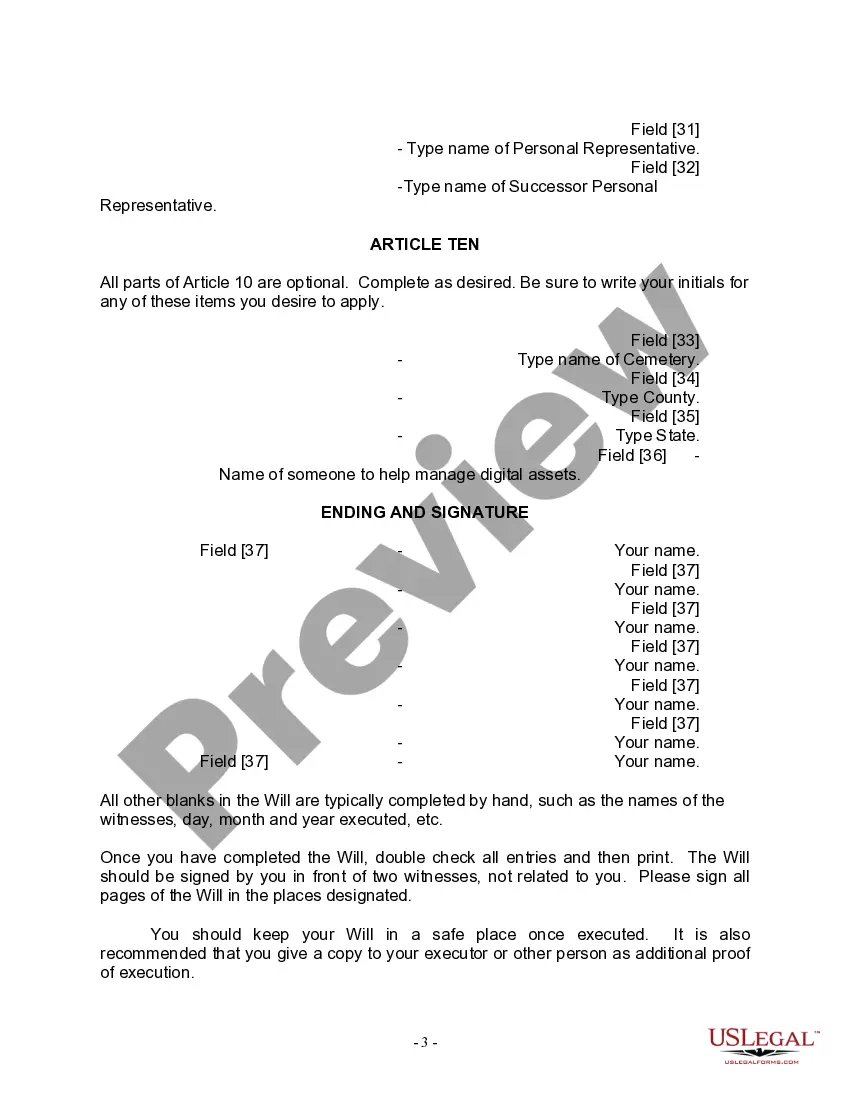

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

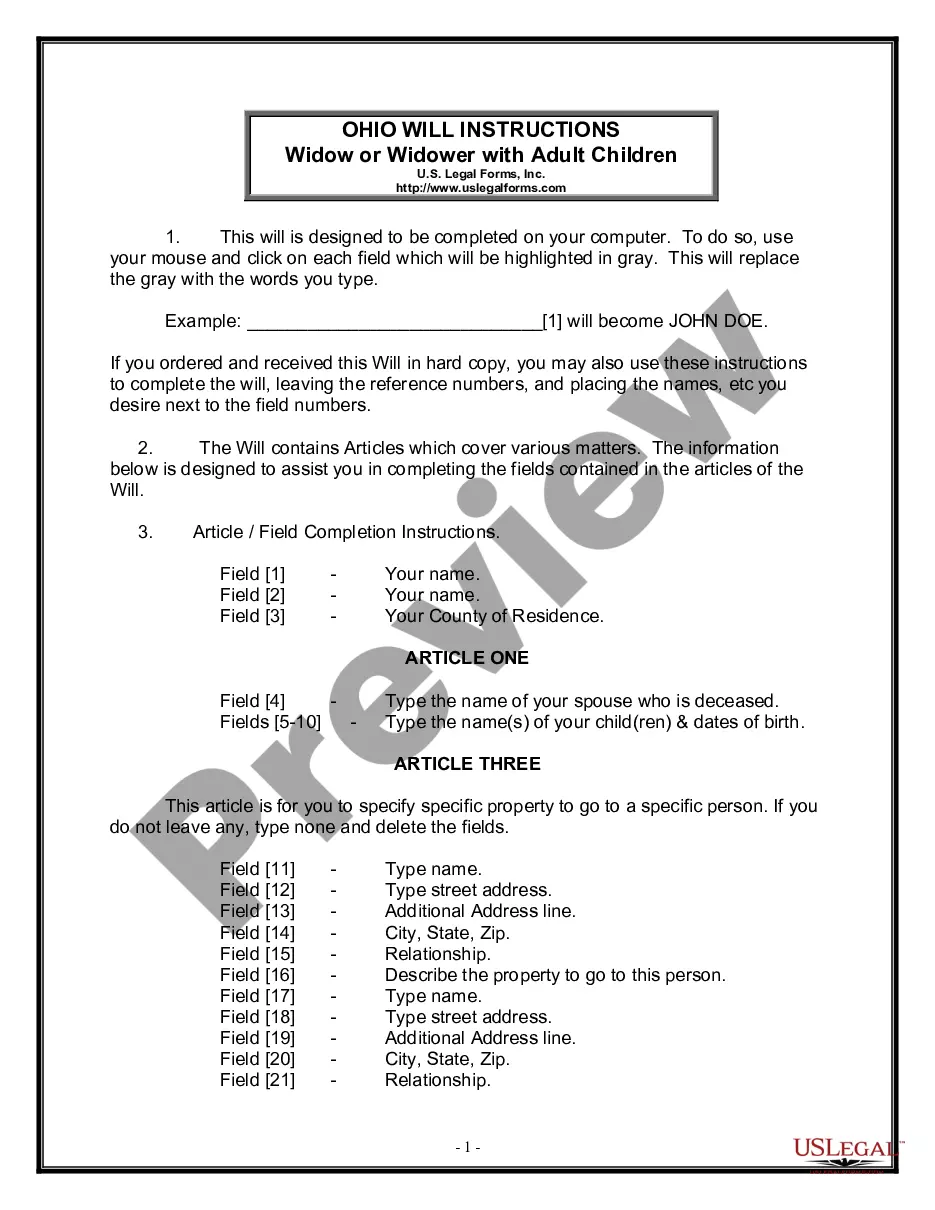

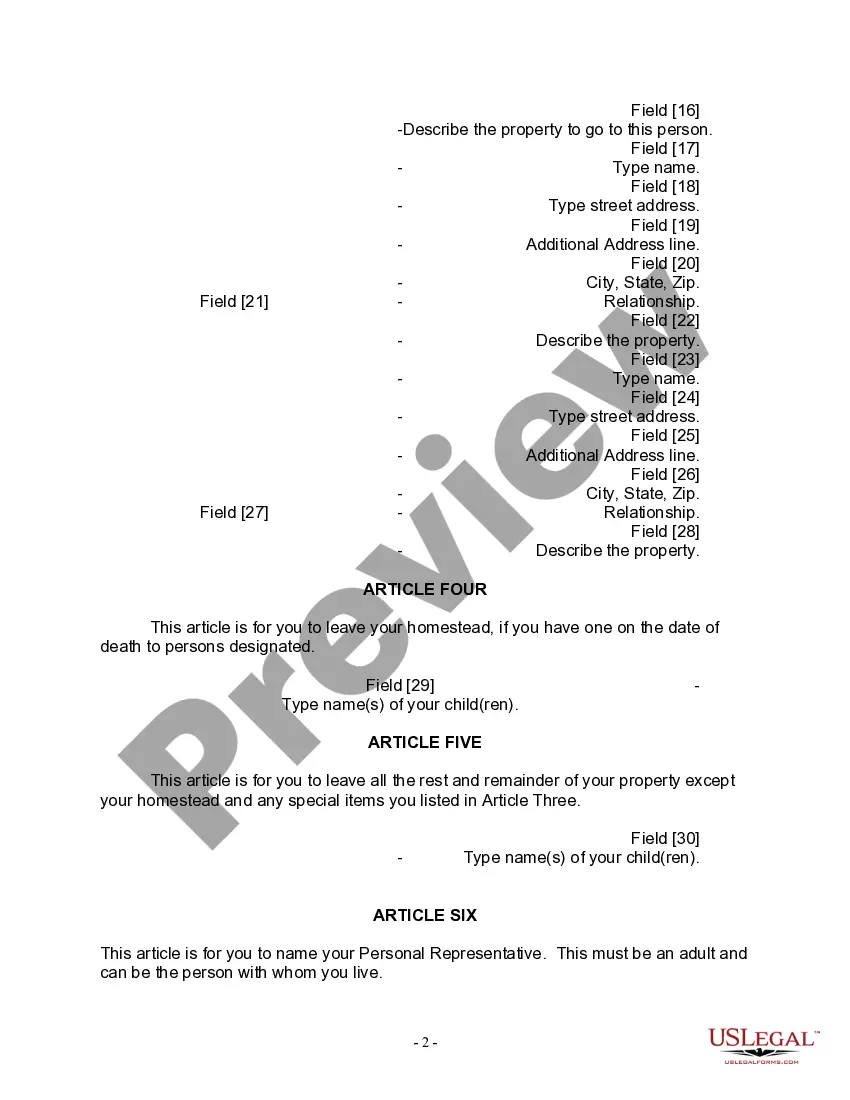

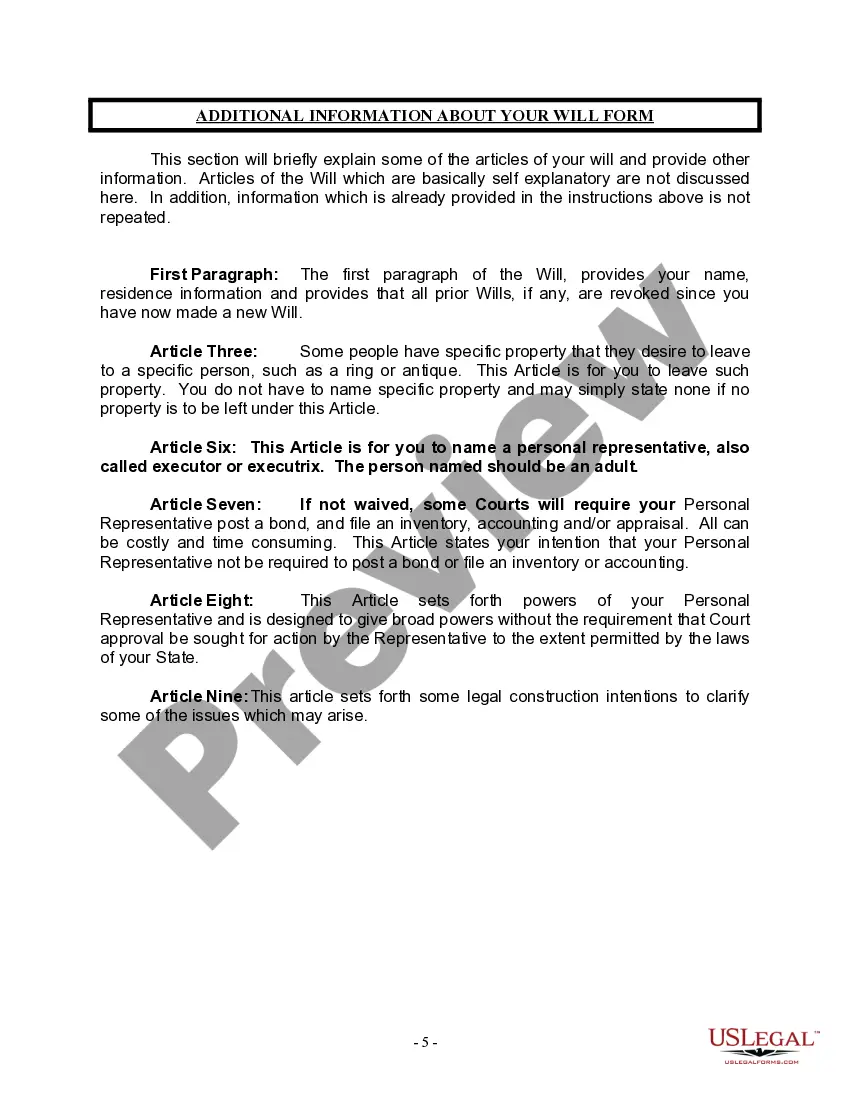

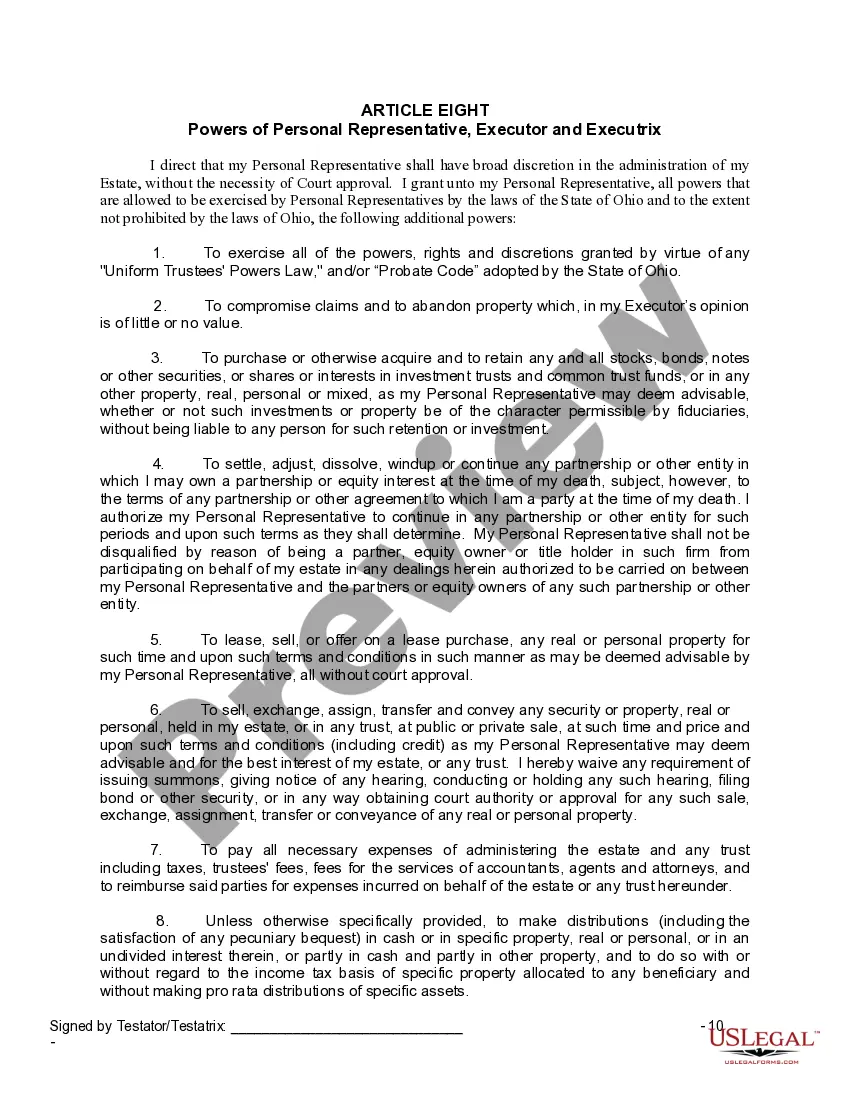

Dayton Ohio Legal Last Will and Testament Form for a Widow or Widower with Adult Children is a legally binding document that outlines the instructions and wishes of an individual regarding the distribution of their assets and property after their death. It is specifically designed for individuals who have lost their spouse and have adult children. This comprehensive legal form ensures that the wishes of the deceased are accurately documented and carried out according to Ohio state laws. The main purpose of this document is to protect the rights and interests of the widowed individual and ensure a smooth transfer of assets to their adult children. The Dayton Ohio Legal Last Will and Testament Form for a Widow or Widower with Adult Children typically includes the following key provisions: 1. Appointment of an Executor: The testator, or the person creating the will, appoints an executor who will handle the administration and distribution of assets according to the will's instructions. 2. Distribution of Assets: The testator specifies how their assets, including real estate, personal belongings, investments, and financial accounts, should be divided among their adult children. This may include specific gifts, percentages, or instructions for liquidation. 3. Appointment of Guardians: If there are minor children involved, the testator can name a guardian who will have custody of the children in the event of their death. However, in this specific form, we focus on adult children, so this provision may not be applicable. 4. Alternate Beneficiaries: In case any of the adult children named as beneficiaries in they will predecease the testator, alternate beneficiaries can be named to ensure the smooth transfer of assets. 5. Funeral and Burial Instructions: The will may include specific instructions regarding funeral arrangements, burial preferences, or funeral expense coverage. Some variations or types of Dayton Ohio Legal Last Will and Testament Form for a Widow or Widower with Adult Children may include customization options based on individual preferences and circumstances. However, it is always advisable to consult with an experienced attorney to ensure the form appropriately reflects the testator's intentions and adheres to Ohio state laws. Remember, preparing a will is a crucial step in securing the future of your loved ones and ensuring that your assets are distributed according to your wishes. This legal document helps minimize potential conflicts among family members and provides a sense of security in uncertain times.Dayton Ohio Legal Last Will and Testament Form for a Widow or Widower with Adult Children is a legally binding document that outlines the instructions and wishes of an individual regarding the distribution of their assets and property after their death. It is specifically designed for individuals who have lost their spouse and have adult children. This comprehensive legal form ensures that the wishes of the deceased are accurately documented and carried out according to Ohio state laws. The main purpose of this document is to protect the rights and interests of the widowed individual and ensure a smooth transfer of assets to their adult children. The Dayton Ohio Legal Last Will and Testament Form for a Widow or Widower with Adult Children typically includes the following key provisions: 1. Appointment of an Executor: The testator, or the person creating the will, appoints an executor who will handle the administration and distribution of assets according to the will's instructions. 2. Distribution of Assets: The testator specifies how their assets, including real estate, personal belongings, investments, and financial accounts, should be divided among their adult children. This may include specific gifts, percentages, or instructions for liquidation. 3. Appointment of Guardians: If there are minor children involved, the testator can name a guardian who will have custody of the children in the event of their death. However, in this specific form, we focus on adult children, so this provision may not be applicable. 4. Alternate Beneficiaries: In case any of the adult children named as beneficiaries in they will predecease the testator, alternate beneficiaries can be named to ensure the smooth transfer of assets. 5. Funeral and Burial Instructions: The will may include specific instructions regarding funeral arrangements, burial preferences, or funeral expense coverage. Some variations or types of Dayton Ohio Legal Last Will and Testament Form for a Widow or Widower with Adult Children may include customization options based on individual preferences and circumstances. However, it is always advisable to consult with an experienced attorney to ensure the form appropriately reflects the testator's intentions and adheres to Ohio state laws. Remember, preparing a will is a crucial step in securing the future of your loved ones and ensuring that your assets are distributed according to your wishes. This legal document helps minimize potential conflicts among family members and provides a sense of security in uncertain times.