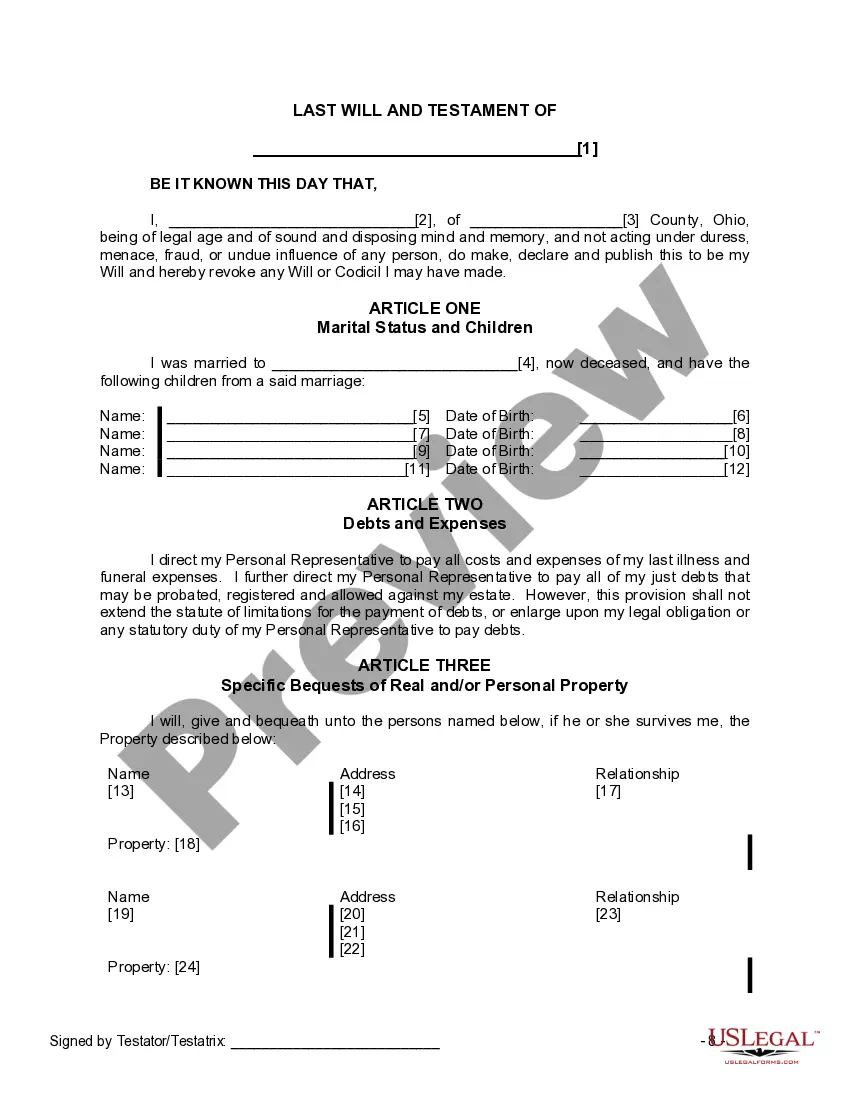

This Legal Last Will and Testament Form with Instructions for a Widow or Widower with Adult and Minor Children is for a widow or widower with minor and adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions. It also provides for the appointment of a trustee for assets left to the minor children.

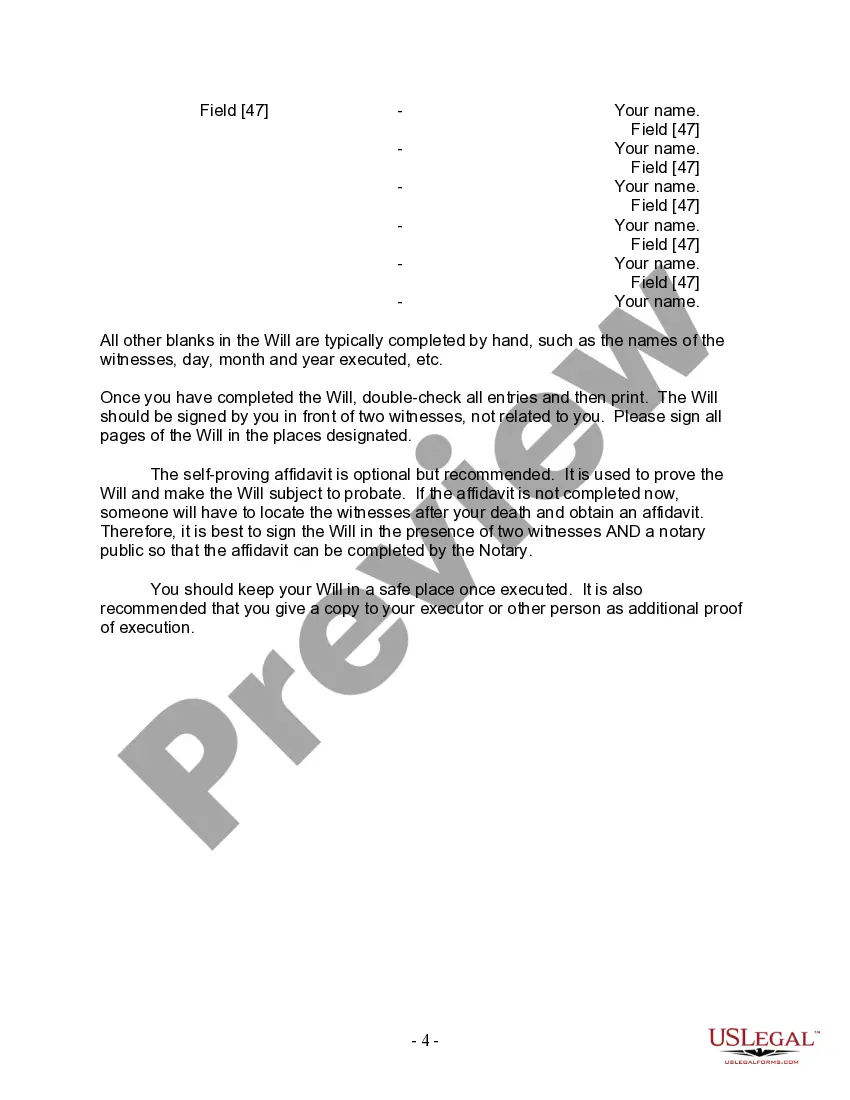

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

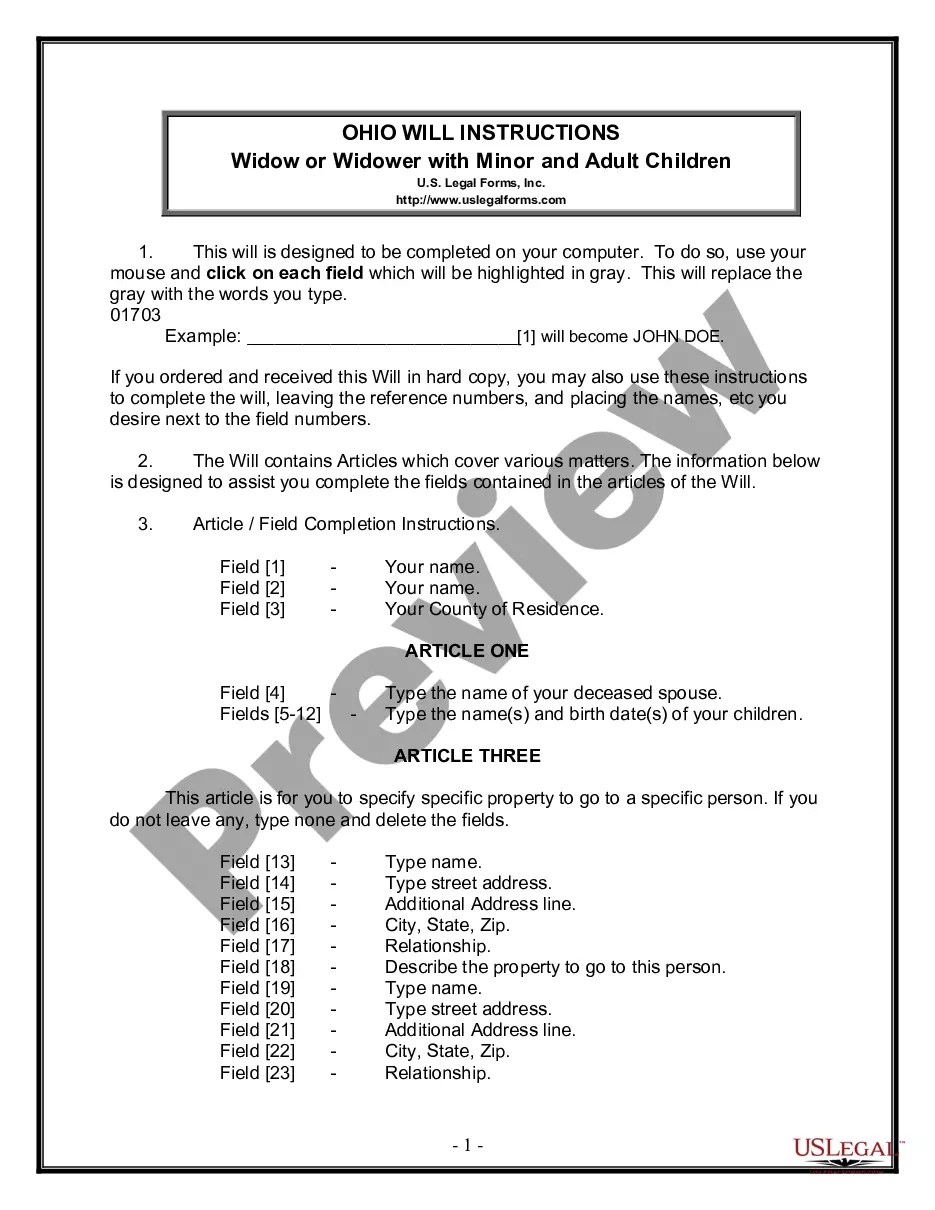

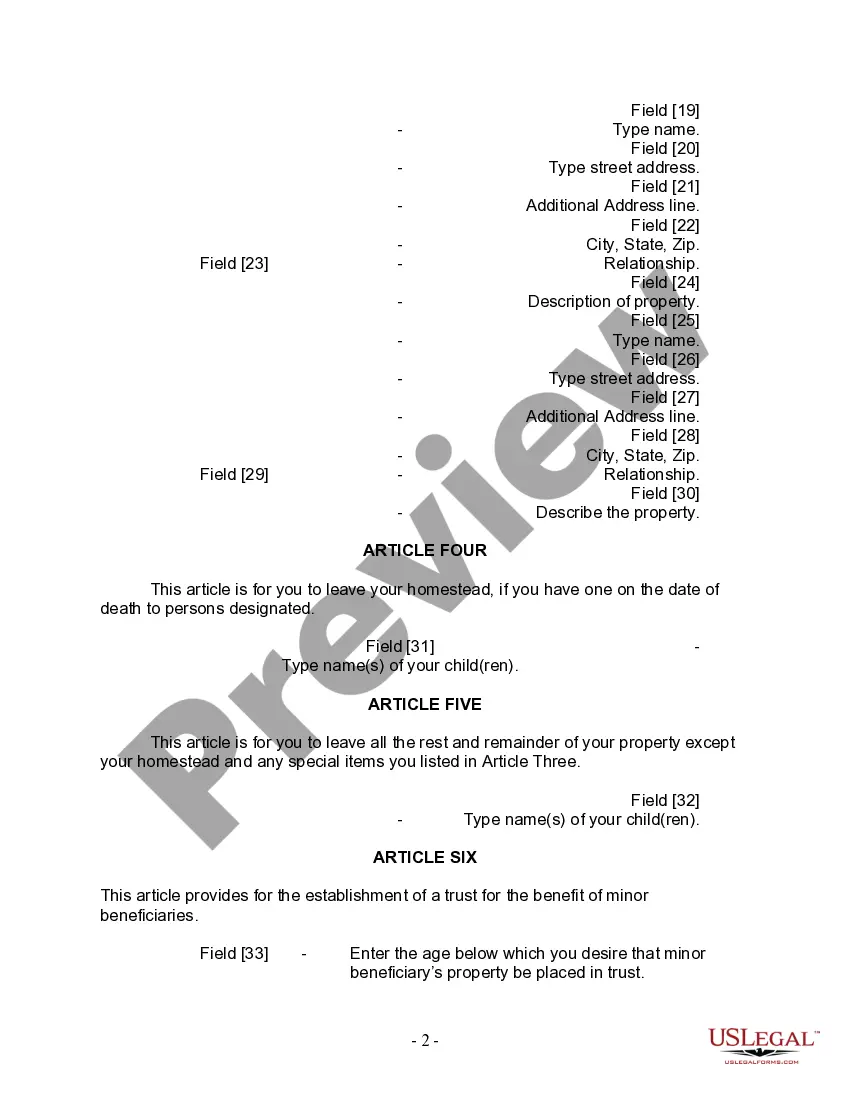

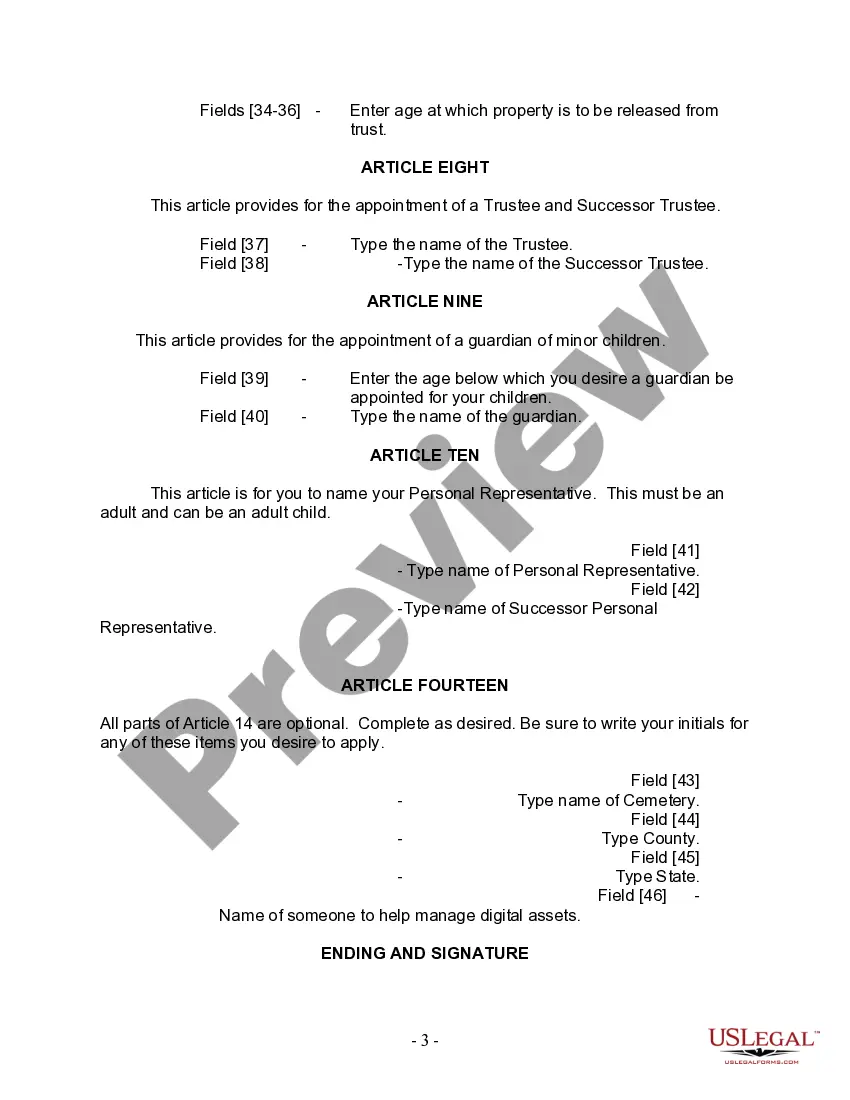

The Akron Ohio Legal Last Will and Testament Form for a Widow or Widower with Adult and Minor Children is a legally binding document that allows individuals in Akron, Ohio, who have lost their spouse and have both adult and minor children to outline their wishes concerning the distribution of their assets and care for their children upon their passing. This form serves as a crucial tool for safeguarding the well-being of both the surviving spouse and their children. The Akron Ohio Legal Last Will and Testament Form for a Widow or Widower with Adult and Minor Children addresses several key aspects that widows or widowers must consider when creating their will. It enables them to designate a trusted executor or personal representative who will be responsible for managing their estate and ensuring that their wishes are carried out accurately. This executor could be a family member, a close friend, or even a professional individual, such as an attorney or a trusted advisor. Additionally, this form allows individuals to specify their beneficiaries, including both adult and minor children. For adult children, the form provides an opportunity to outline the distribution of assets and property, such as real estate, investments, and personal belongings. Moreover, it empowers the surviving parent to draft plans for legal guardianship and custodial care of their minor children, ensuring their ongoing protection and well-being. When dealing with minor children, the Akron Ohio Legal Last Will and Testament Form for a Widow or Widower offers options regarding the appointment of a guardian. This guardian will assume responsibility for the upbringing, care, and education of the children, should the surviving parent pass away. The form allows for multiple guardians to be named as contingent options, should the primary guardian be unable or unwilling to fulfill their duties. In summary, the Akron Ohio Legal Last Will and Testament Form for a Widow or Widower with Adult and Minor Children is a crucial legal document that allows widows or widowers in Akron, Ohio, to outline their desires and ensure the proper distribution of their assets while caring for their adult and minor children. By utilizing this form, individuals can provide clarity and peace of mind during a difficult and uncertain time. Different types or variations of Akron Ohio Legal Last Will and Testament Forms for a Widow or Widower with Adult and Minor Children may exist depending on specific circumstances or preferences. These variations might include options for special provisions, such as setting up trust funds for minor children, naming specific individuals or organizations as beneficiaries, or addressing unique considerations related to individual assets, debts, or other stipulations. It is recommended to consult with an estate planning attorney in Akron, Ohio, to ensure the appropriate form is used for one's specific situation.The Akron Ohio Legal Last Will and Testament Form for a Widow or Widower with Adult and Minor Children is a legally binding document that allows individuals in Akron, Ohio, who have lost their spouse and have both adult and minor children to outline their wishes concerning the distribution of their assets and care for their children upon their passing. This form serves as a crucial tool for safeguarding the well-being of both the surviving spouse and their children. The Akron Ohio Legal Last Will and Testament Form for a Widow or Widower with Adult and Minor Children addresses several key aspects that widows or widowers must consider when creating their will. It enables them to designate a trusted executor or personal representative who will be responsible for managing their estate and ensuring that their wishes are carried out accurately. This executor could be a family member, a close friend, or even a professional individual, such as an attorney or a trusted advisor. Additionally, this form allows individuals to specify their beneficiaries, including both adult and minor children. For adult children, the form provides an opportunity to outline the distribution of assets and property, such as real estate, investments, and personal belongings. Moreover, it empowers the surviving parent to draft plans for legal guardianship and custodial care of their minor children, ensuring their ongoing protection and well-being. When dealing with minor children, the Akron Ohio Legal Last Will and Testament Form for a Widow or Widower offers options regarding the appointment of a guardian. This guardian will assume responsibility for the upbringing, care, and education of the children, should the surviving parent pass away. The form allows for multiple guardians to be named as contingent options, should the primary guardian be unable or unwilling to fulfill their duties. In summary, the Akron Ohio Legal Last Will and Testament Form for a Widow or Widower with Adult and Minor Children is a crucial legal document that allows widows or widowers in Akron, Ohio, to outline their desires and ensure the proper distribution of their assets while caring for their adult and minor children. By utilizing this form, individuals can provide clarity and peace of mind during a difficult and uncertain time. Different types or variations of Akron Ohio Legal Last Will and Testament Forms for a Widow or Widower with Adult and Minor Children may exist depending on specific circumstances or preferences. These variations might include options for special provisions, such as setting up trust funds for minor children, naming specific individuals or organizations as beneficiaries, or addressing unique considerations related to individual assets, debts, or other stipulations. It is recommended to consult with an estate planning attorney in Akron, Ohio, to ensure the appropriate form is used for one's specific situation.