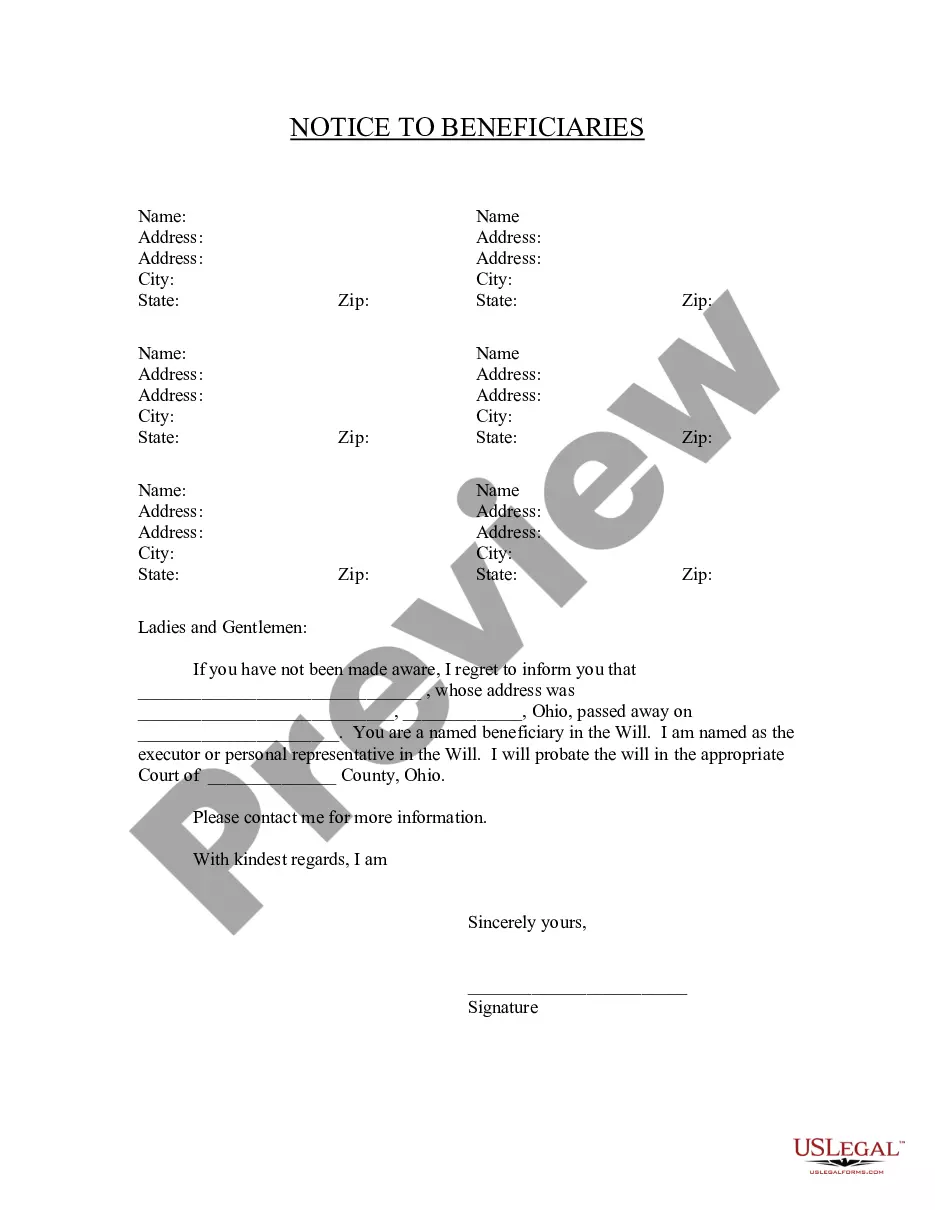

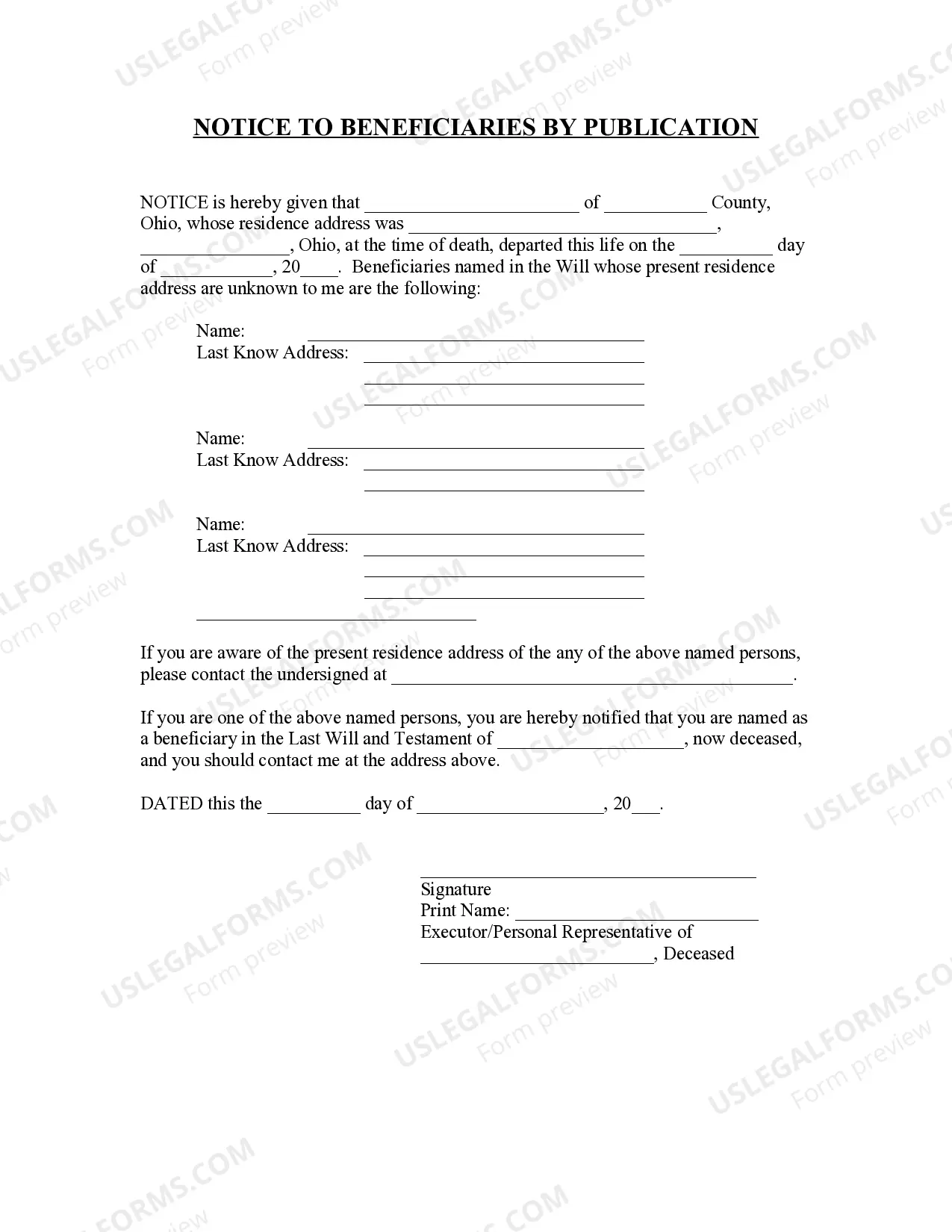

This Notice to Beneficiaries form is for the executor/executrix or personal representative to provide notice to the beneficiaries named in the will of the deceased. A second notice is also provided for publication where the location of the beneficiaries is unknown.

Title: Franklin Ohio Notice to Beneficiaries: Comprehensive Guide for Being Named in a Will Introduction: The Franklin Ohio Notice to Beneficiaries serves as a formal communication to individuals who have been named as beneficiaries in a will within the state of Ohio. This notice is crucial to inform beneficiaries about their inclusion in the will and provide necessary information and instructions regarding their rights, obligations, and inheritance. This article aims to offer a detailed description of the Franklin Ohio Notice to Beneficiaries, outlining its key aspects and implications. Key Points: 1. Definition and Purpose: — The Franklin Ohio Notice to Beneficiaries is a legal document that alerts individuals about their designation as beneficiaries in a will. — It serves to inform beneficiaries of their rights, responsibilities, and the upcoming probate process. 2. Types of Franklin Ohio Notice to Beneficiaries: — There are three primary types of Franklin Ohio Notice to Beneficiaries: standard, shortened, and informal. — Standard Notice: Typically sent to beneficiaries named in a formal will, providing a comprehensive overview of their inheritance rights and obligations. — Shortened Notice: Utilized when the estate assets are less than $35,000, providing a condensed version of the standard notice. — Informal Notice: Used in certain circumstances, primarily when the estate is managed through a small estate procedure. 3. Key Contents and Information: — Identification and Contact Information: The notice must include the full name and contact information of the executor or personal representative responsible for administering the estate. — Probate Court Details: The notice should outline the specific probate court where the will has been filed and provide any pertinent case or docket numbers. — Inheritance Details: Beneficiaries should be informed about the assets, properties, or specific bequests they are entitled to under the will. — Probate Process: The notice should explain the expected timeline for the probate process and provide an overview of critical steps beneficiaries might need to take. — Contact Instructions: Beneficiaries should be advised on the process to address any questions or concerns, including contacting the executor or their legal representative. 4. Legal Obligations and Rights: — Debts and Claims: Beneficiaries must be aware that the deceased person's debts and claims against the estate may affect their inheritance. — Fair Distribution: The notice should emphasize the obligation of the executor to distribute the assets fairly among the beneficiaries, adhering to the terms outlined in the will. — Inheritance Taxes: Beneficiaries may need to be informed about potential inheritance tax implications and how they may need to handle them. Conclusion: Receiving the Franklin Ohio Notice to Beneficiaries is a significant event for individuals named in a will. Understanding the document's purpose, types, and key contents can help beneficiaries navigate the probate process smoothly while ensuring their inheritance rights are protected. It is advisable for beneficiaries to seek legal guidance to address any uncertainties or queries regarding their role, obligations, or potential challenges in the inheritance procedure.Title: Franklin Ohio Notice to Beneficiaries: Comprehensive Guide for Being Named in a Will Introduction: The Franklin Ohio Notice to Beneficiaries serves as a formal communication to individuals who have been named as beneficiaries in a will within the state of Ohio. This notice is crucial to inform beneficiaries about their inclusion in the will and provide necessary information and instructions regarding their rights, obligations, and inheritance. This article aims to offer a detailed description of the Franklin Ohio Notice to Beneficiaries, outlining its key aspects and implications. Key Points: 1. Definition and Purpose: — The Franklin Ohio Notice to Beneficiaries is a legal document that alerts individuals about their designation as beneficiaries in a will. — It serves to inform beneficiaries of their rights, responsibilities, and the upcoming probate process. 2. Types of Franklin Ohio Notice to Beneficiaries: — There are three primary types of Franklin Ohio Notice to Beneficiaries: standard, shortened, and informal. — Standard Notice: Typically sent to beneficiaries named in a formal will, providing a comprehensive overview of their inheritance rights and obligations. — Shortened Notice: Utilized when the estate assets are less than $35,000, providing a condensed version of the standard notice. — Informal Notice: Used in certain circumstances, primarily when the estate is managed through a small estate procedure. 3. Key Contents and Information: — Identification and Contact Information: The notice must include the full name and contact information of the executor or personal representative responsible for administering the estate. — Probate Court Details: The notice should outline the specific probate court where the will has been filed and provide any pertinent case or docket numbers. — Inheritance Details: Beneficiaries should be informed about the assets, properties, or specific bequests they are entitled to under the will. — Probate Process: The notice should explain the expected timeline for the probate process and provide an overview of critical steps beneficiaries might need to take. — Contact Instructions: Beneficiaries should be advised on the process to address any questions or concerns, including contacting the executor or their legal representative. 4. Legal Obligations and Rights: — Debts and Claims: Beneficiaries must be aware that the deceased person's debts and claims against the estate may affect their inheritance. — Fair Distribution: The notice should emphasize the obligation of the executor to distribute the assets fairly among the beneficiaries, adhering to the terms outlined in the will. — Inheritance Taxes: Beneficiaries may need to be informed about potential inheritance tax implications and how they may need to handle them. Conclusion: Receiving the Franklin Ohio Notice to Beneficiaries is a significant event for individuals named in a will. Understanding the document's purpose, types, and key contents can help beneficiaries navigate the probate process smoothly while ensuring their inheritance rights are protected. It is advisable for beneficiaries to seek legal guidance to address any uncertainties or queries regarding their role, obligations, or potential challenges in the inheritance procedure.