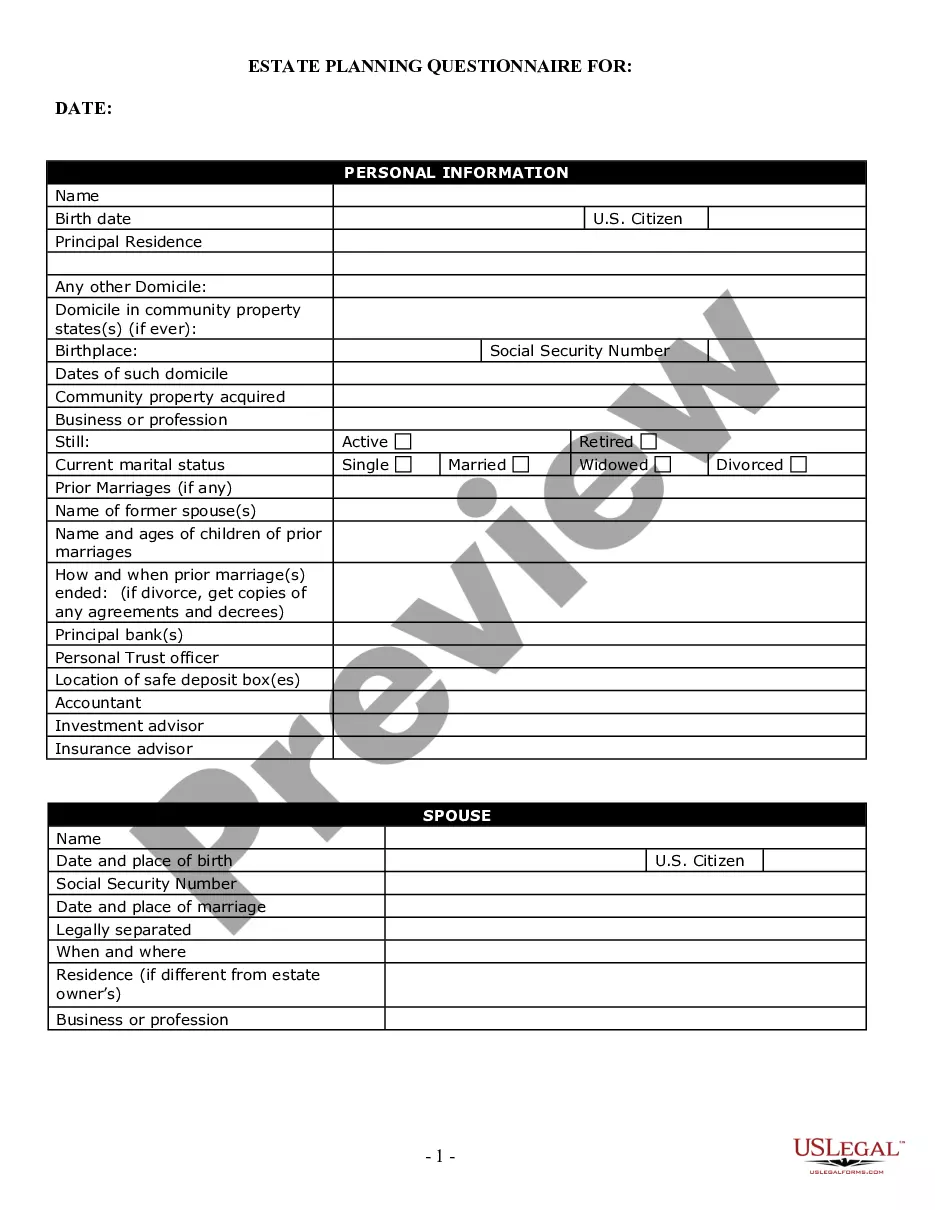

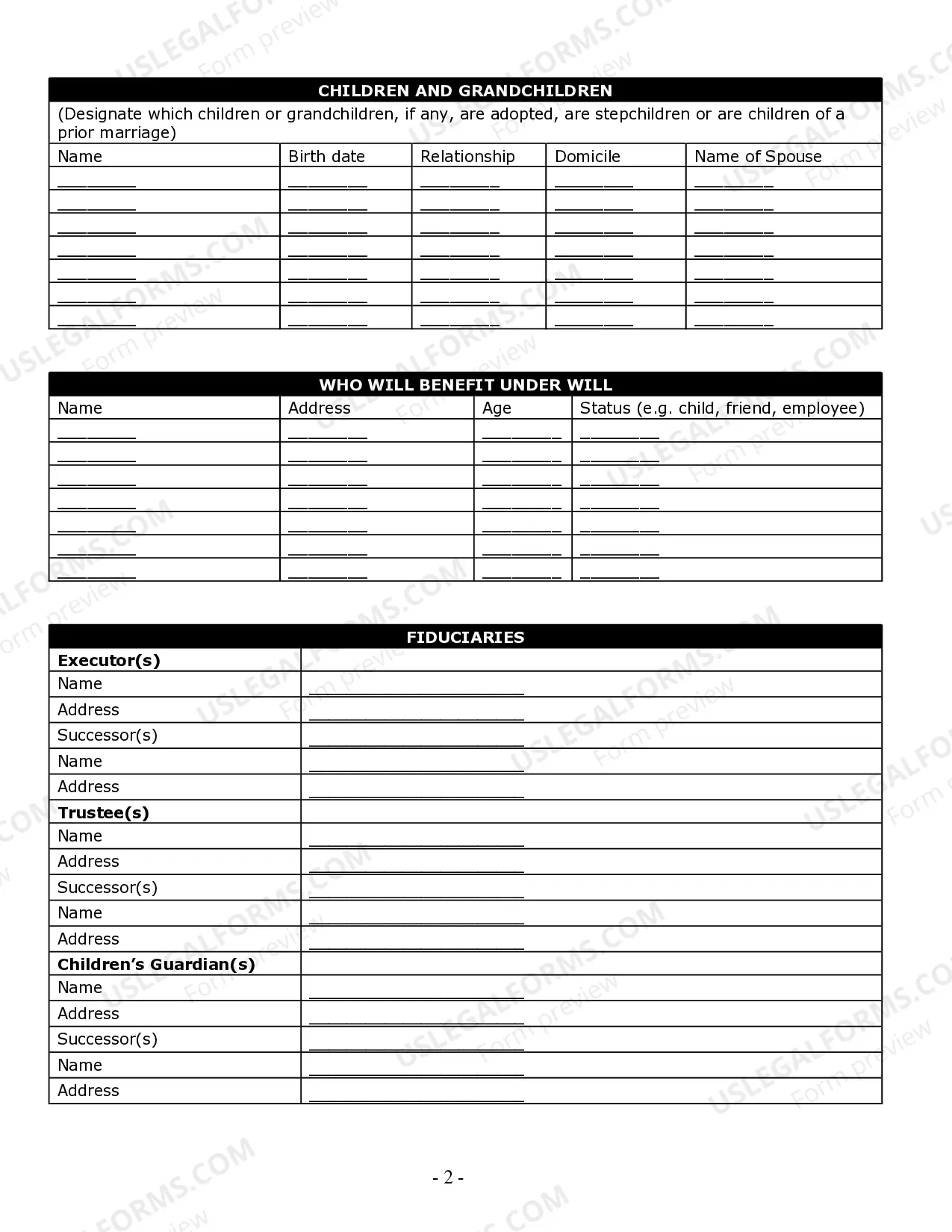

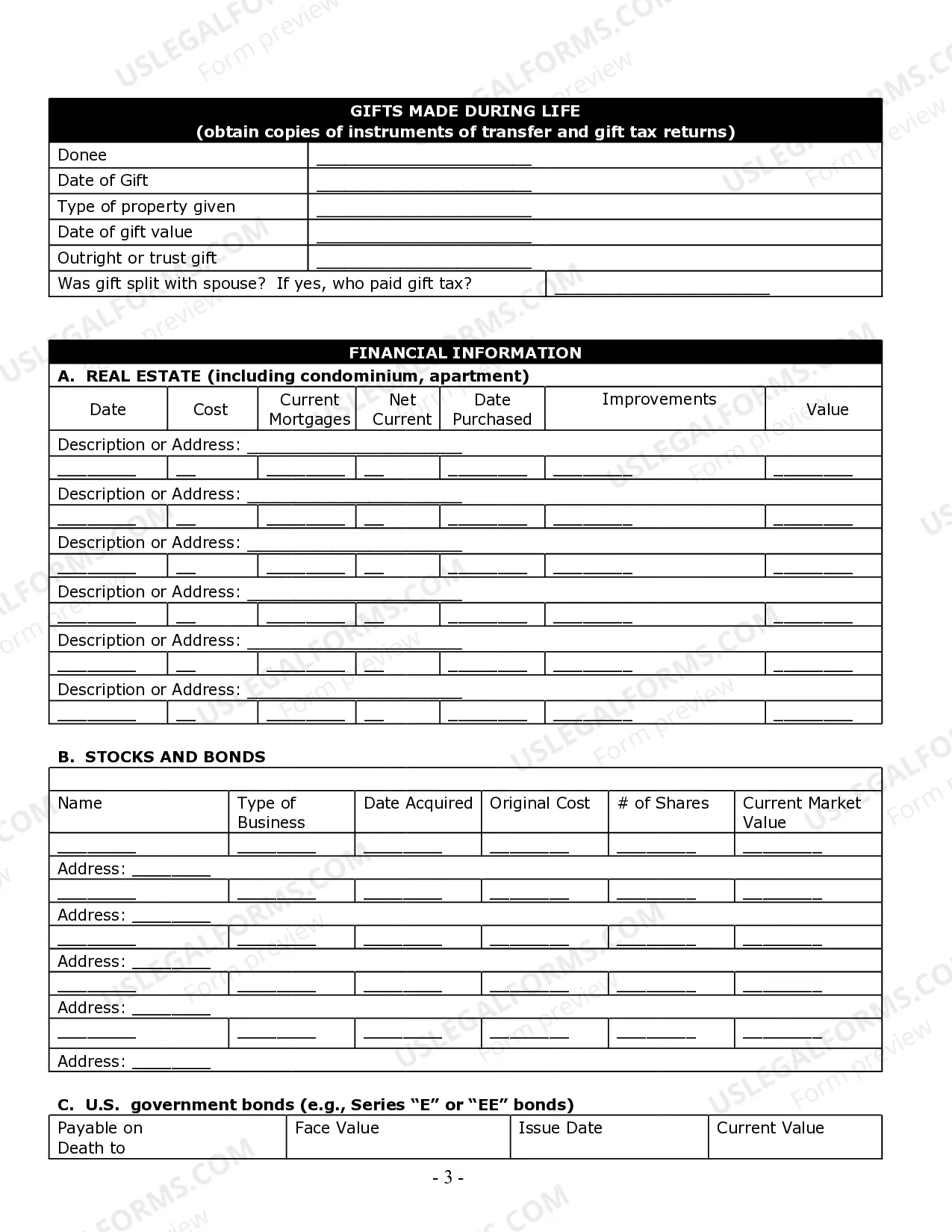

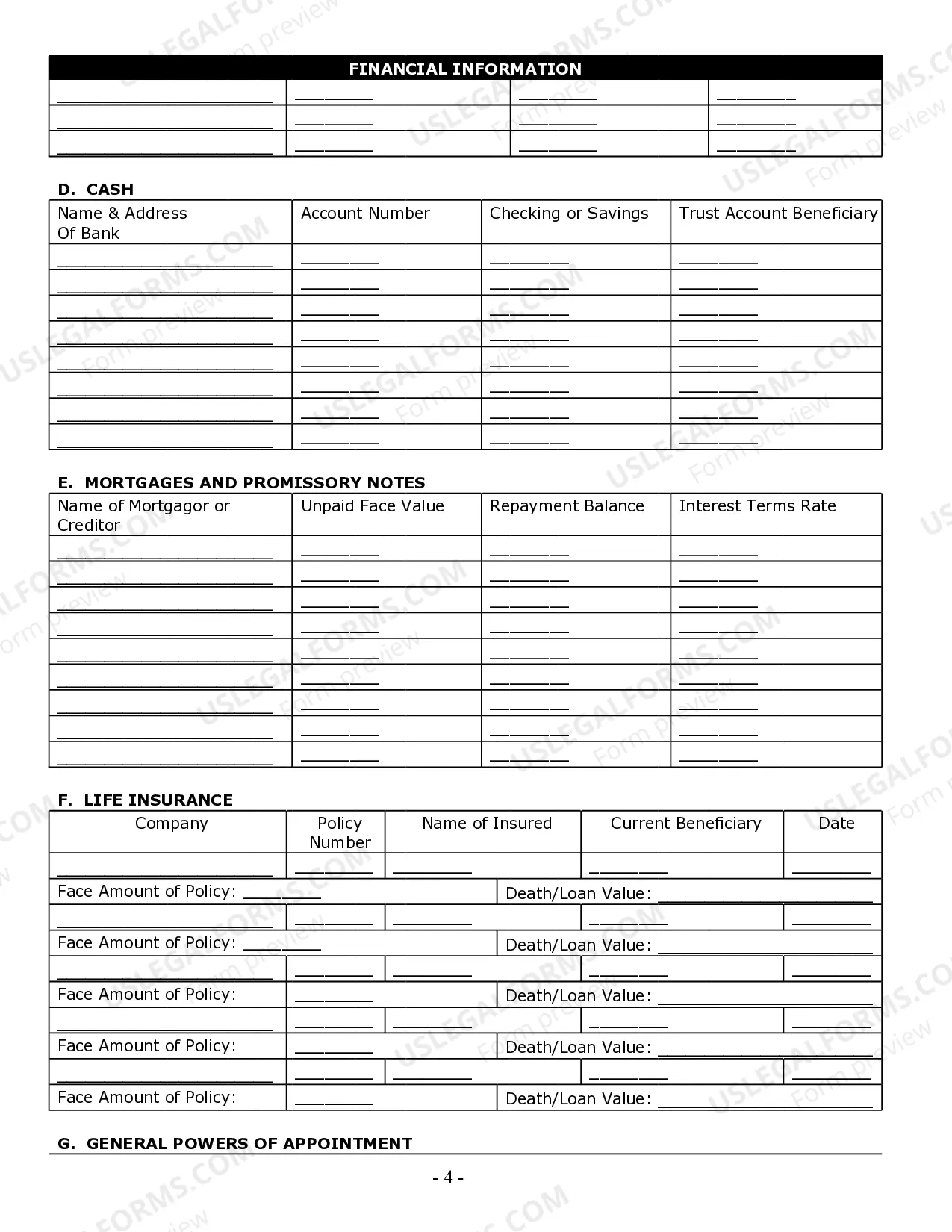

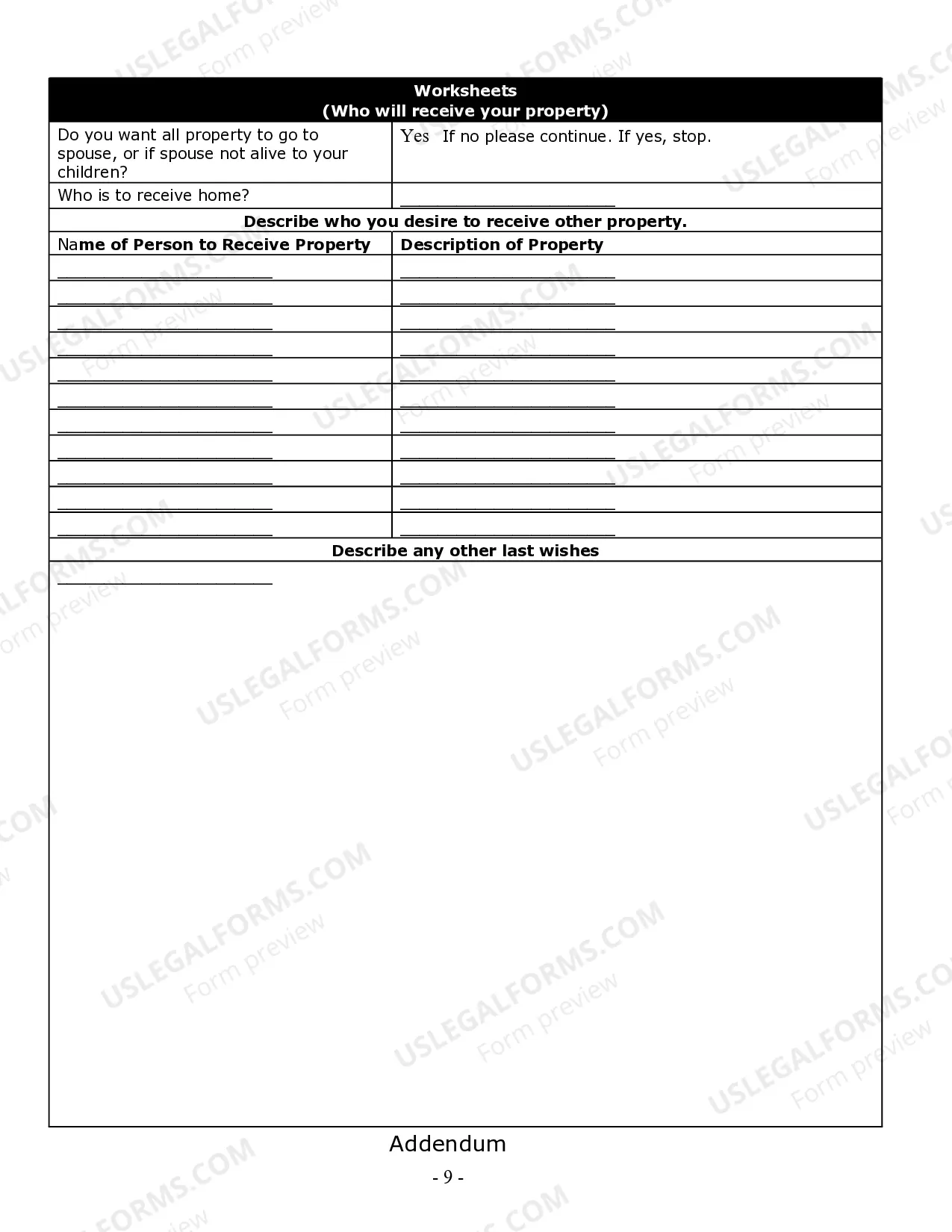

This Estate Planning Questionnaire and Worksheet is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client interviews. It is also ideal for a person to complete to view their overall financial situation for estate planning purposes.

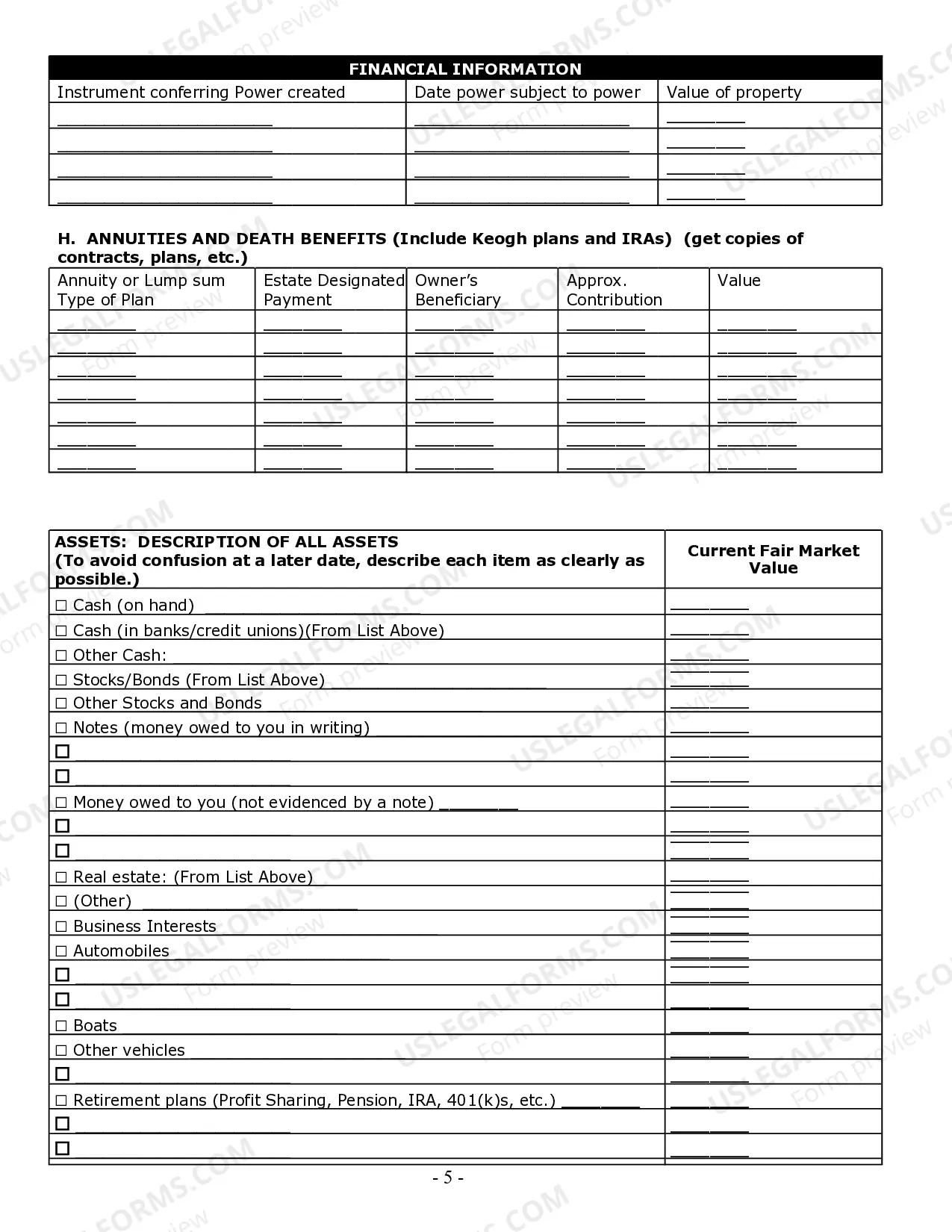

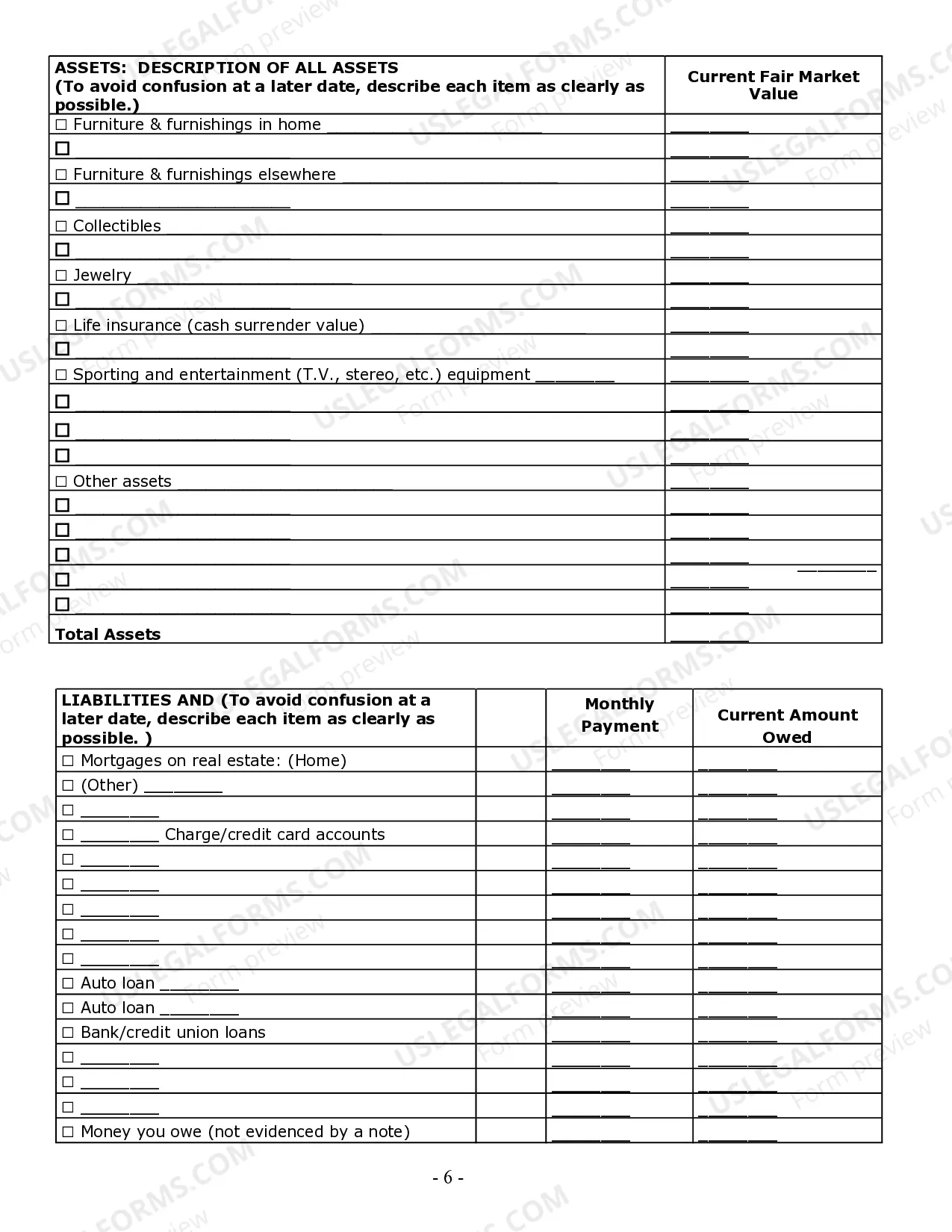

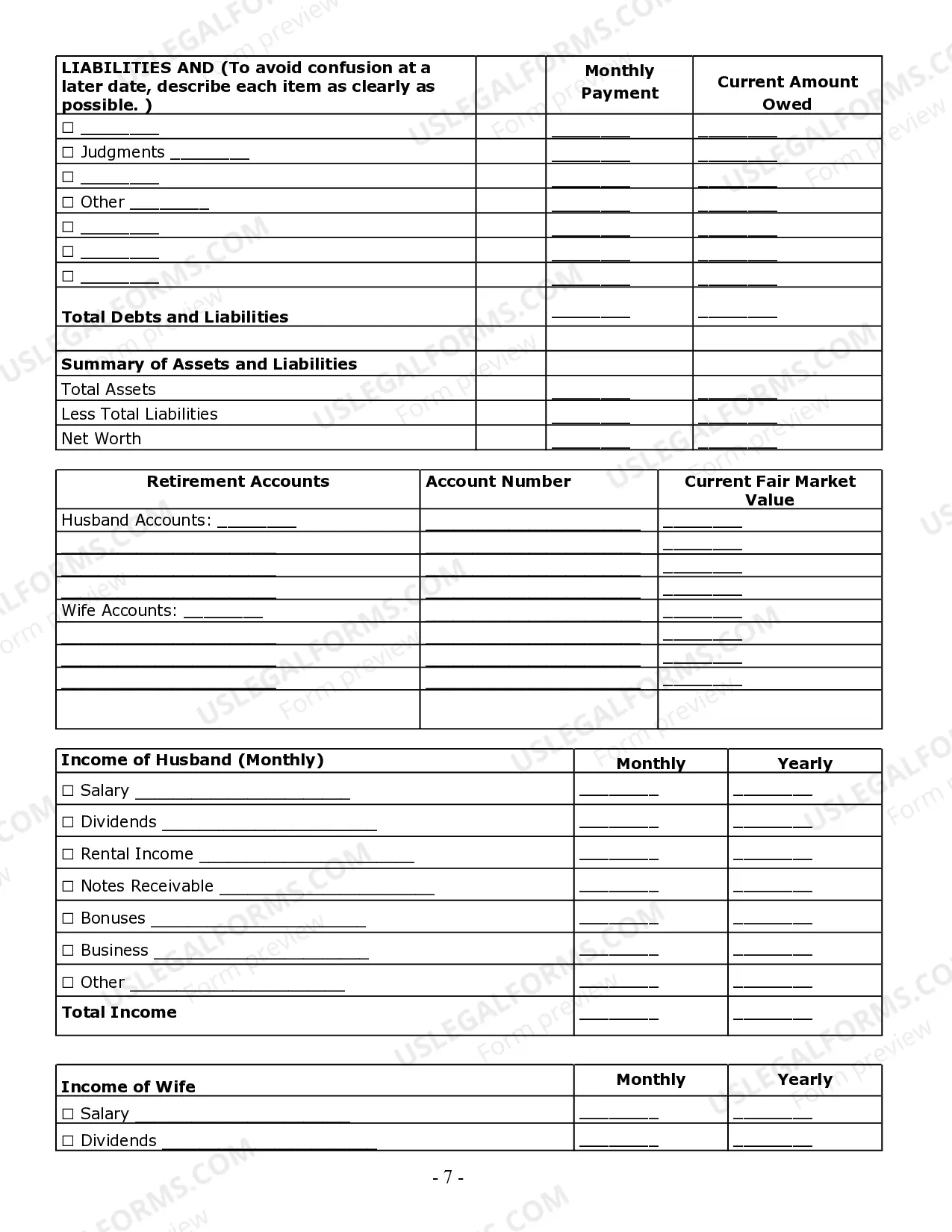

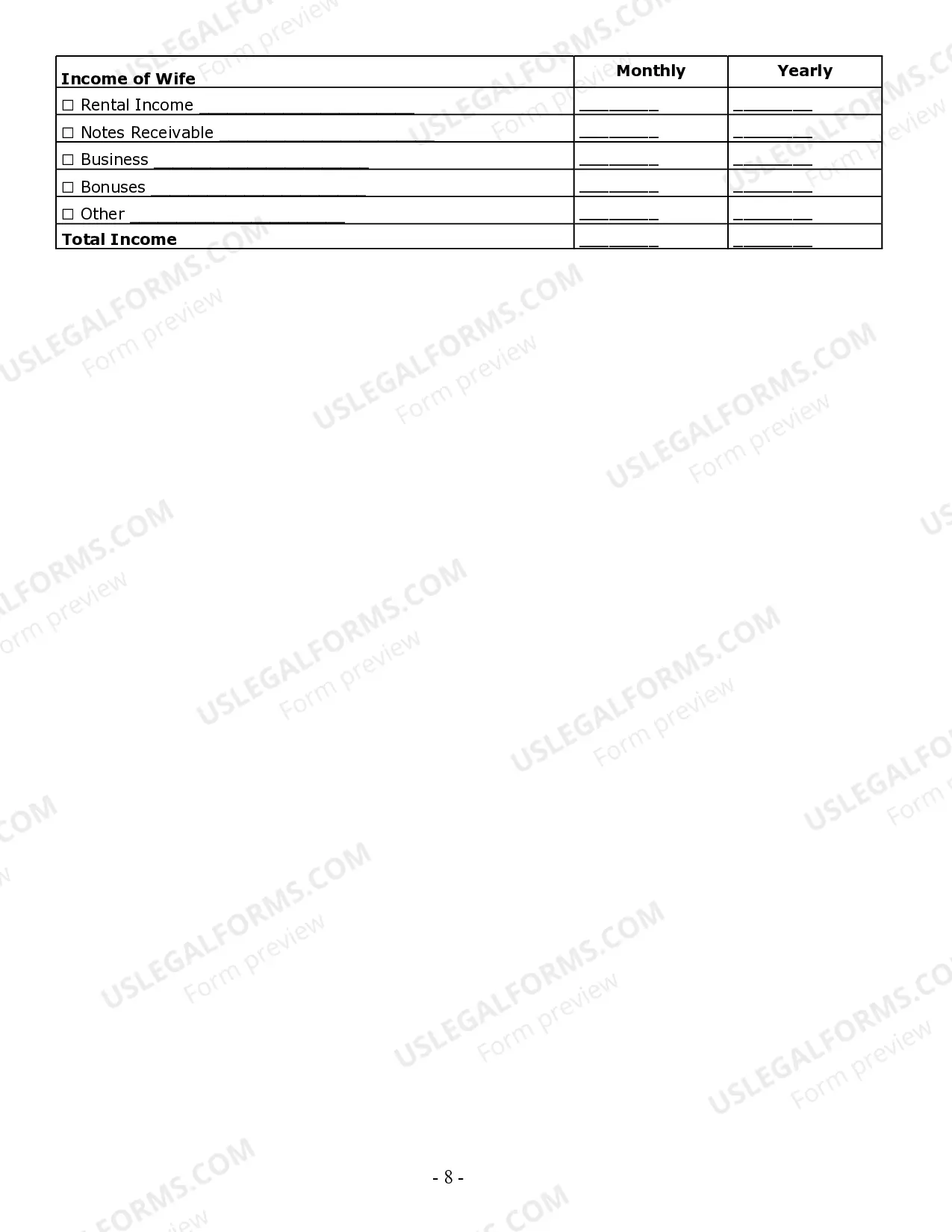

Cincinnati Ohio Estate Planning Questionnaire and Worksheets are comprehensive tools designed to facilitate estate planning processes specific to the residents of Cincinnati, Ohio. These forms comprise various sections and questions that assist individuals in organizing their financial, legal, and personal affairs to plan for the disposition of their assets upon death or incapacity. The Cincinnati Ohio Estate Planning Questionnaire and Worksheets cover a wide range of areas, including but not limited to: 1. Personal Information: This section captures essential details such as name, address, contact information, and marital status of the individual seeking estate planning assistance. 2. Family and Beneficiary Information: These worksheets prompt individuals to provide information about their immediate family members, beneficiaries, and potential beneficiaries, ensuring their estate plan suits their familial circumstances. 3. Assets and Liabilities: These questionnaires prompt individuals to list and describe their assets, such as real estate properties, financial accounts, investments, personal belongings, and insurance policies. Additionally, they help individuals account for any outstanding debts, mortgages, or liabilities. 4. Business Interests: For individuals who own businesses or have affiliated interests, these worksheets offer specific sections to record information related to their business ventures, including partnership agreements, contracts, and succession plans. 5. Guardianship and Minors: For parents with young children, these forms include sections dedicated to nominating legal guardians and outlining instructions regarding the care and upbringing of minor children. 6. Healthcare Directives: Individuals can provide their healthcare preferences, including the appointment of a healthcare proxy or Power of Attorney, instructions on life-sustaining treatments, and organ donation preferences. 7. Legal Representation: These questionnaires inquire about an individual's chosen legal representative or attorney-in-fact who will act on their behalf in legal matters. 8. Special Instructions: This section provides space for individuals to express any personalized wishes or specific instructions concerning their estate, burial arrangements, or charitable contributions. Different types of Cincinnati Ohio Estate Planning Questionnaire and Worksheets may include variations tailored to specific needs. For example, some forms may focus on more complex financial portfolios or cater to unique family structures. Additionally, specialized versions may be available for business owners or individuals with extensive investments. The flexibility of these resources allows individuals to adapt the questionnaires and worksheets to their individual circumstances while ensuring compliance with the specific estate planning laws and regulations of Cincinnati, Ohio.Cincinnati Ohio Estate Planning Questionnaire and Worksheets are comprehensive tools designed to facilitate estate planning processes specific to the residents of Cincinnati, Ohio. These forms comprise various sections and questions that assist individuals in organizing their financial, legal, and personal affairs to plan for the disposition of their assets upon death or incapacity. The Cincinnati Ohio Estate Planning Questionnaire and Worksheets cover a wide range of areas, including but not limited to: 1. Personal Information: This section captures essential details such as name, address, contact information, and marital status of the individual seeking estate planning assistance. 2. Family and Beneficiary Information: These worksheets prompt individuals to provide information about their immediate family members, beneficiaries, and potential beneficiaries, ensuring their estate plan suits their familial circumstances. 3. Assets and Liabilities: These questionnaires prompt individuals to list and describe their assets, such as real estate properties, financial accounts, investments, personal belongings, and insurance policies. Additionally, they help individuals account for any outstanding debts, mortgages, or liabilities. 4. Business Interests: For individuals who own businesses or have affiliated interests, these worksheets offer specific sections to record information related to their business ventures, including partnership agreements, contracts, and succession plans. 5. Guardianship and Minors: For parents with young children, these forms include sections dedicated to nominating legal guardians and outlining instructions regarding the care and upbringing of minor children. 6. Healthcare Directives: Individuals can provide their healthcare preferences, including the appointment of a healthcare proxy or Power of Attorney, instructions on life-sustaining treatments, and organ donation preferences. 7. Legal Representation: These questionnaires inquire about an individual's chosen legal representative or attorney-in-fact who will act on their behalf in legal matters. 8. Special Instructions: This section provides space for individuals to express any personalized wishes or specific instructions concerning their estate, burial arrangements, or charitable contributions. Different types of Cincinnati Ohio Estate Planning Questionnaire and Worksheets may include variations tailored to specific needs. For example, some forms may focus on more complex financial portfolios or cater to unique family structures. Additionally, specialized versions may be available for business owners or individuals with extensive investments. The flexibility of these resources allows individuals to adapt the questionnaires and worksheets to their individual circumstances while ensuring compliance with the specific estate planning laws and regulations of Cincinnati, Ohio.