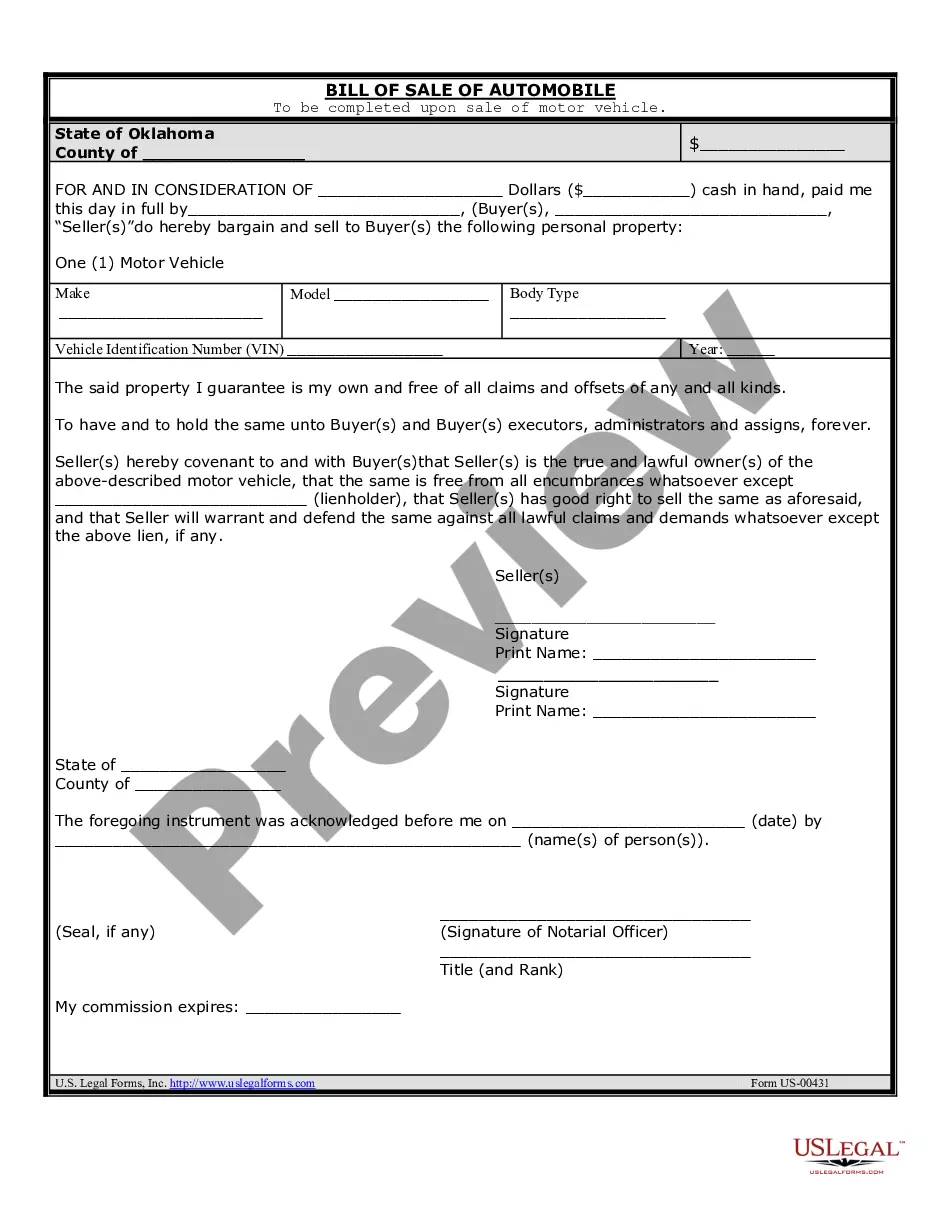

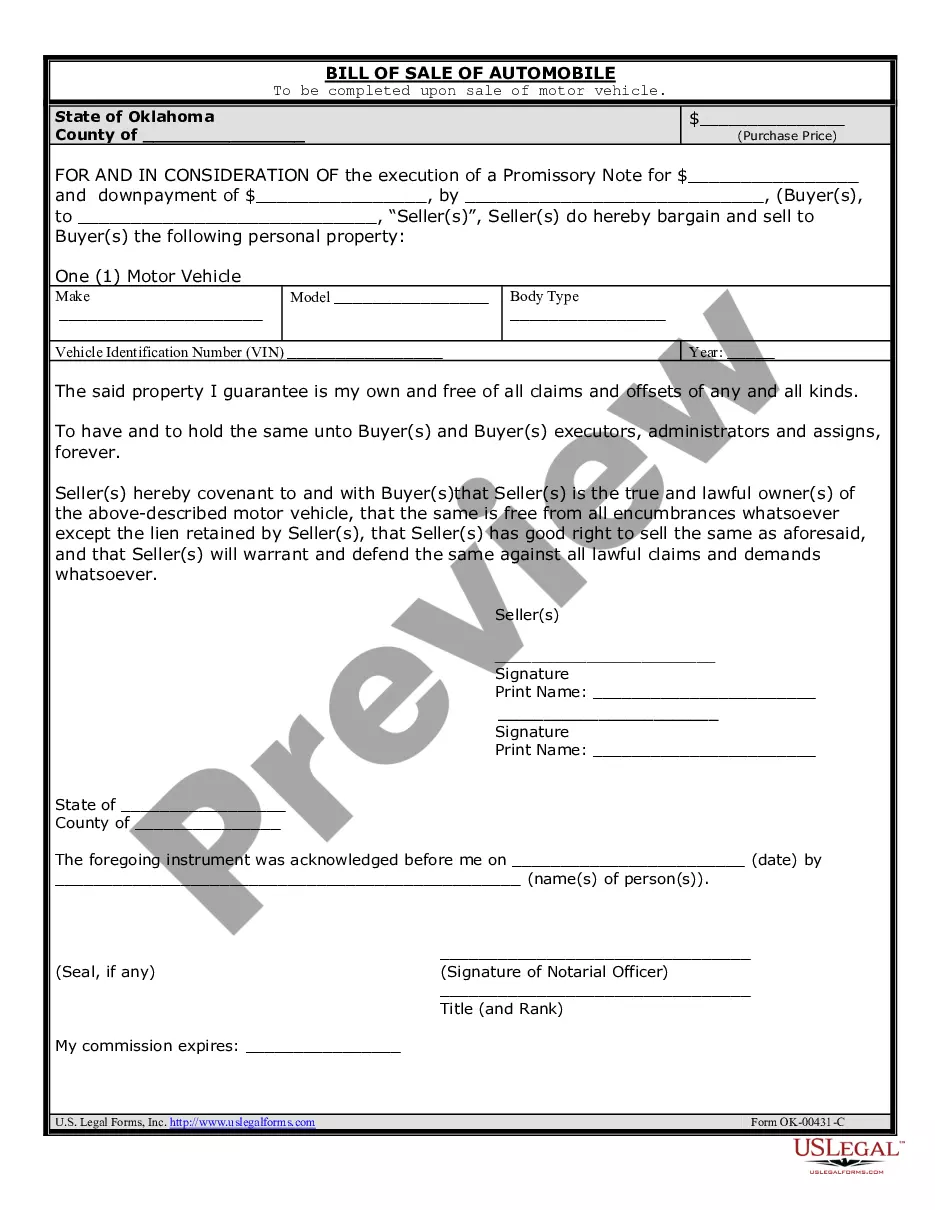

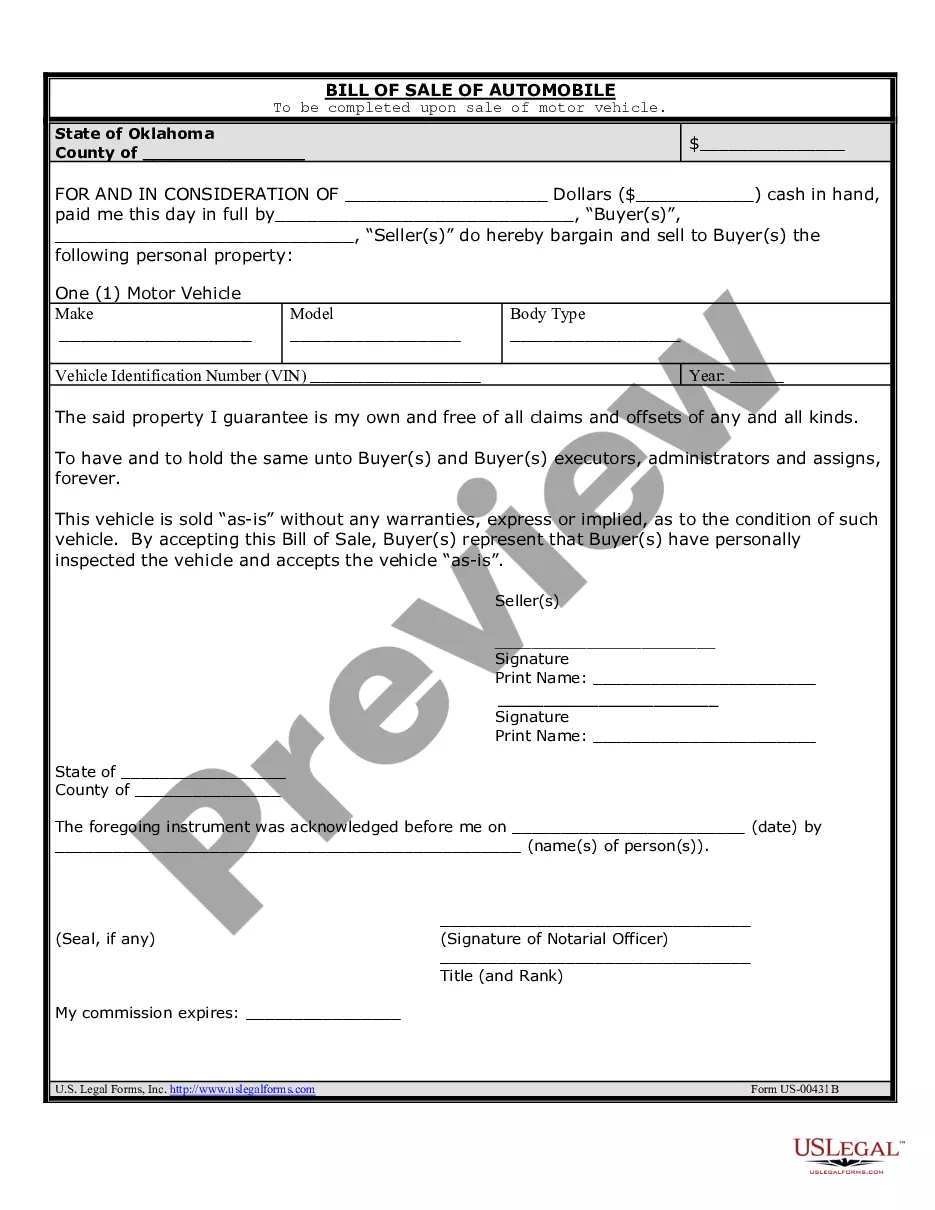

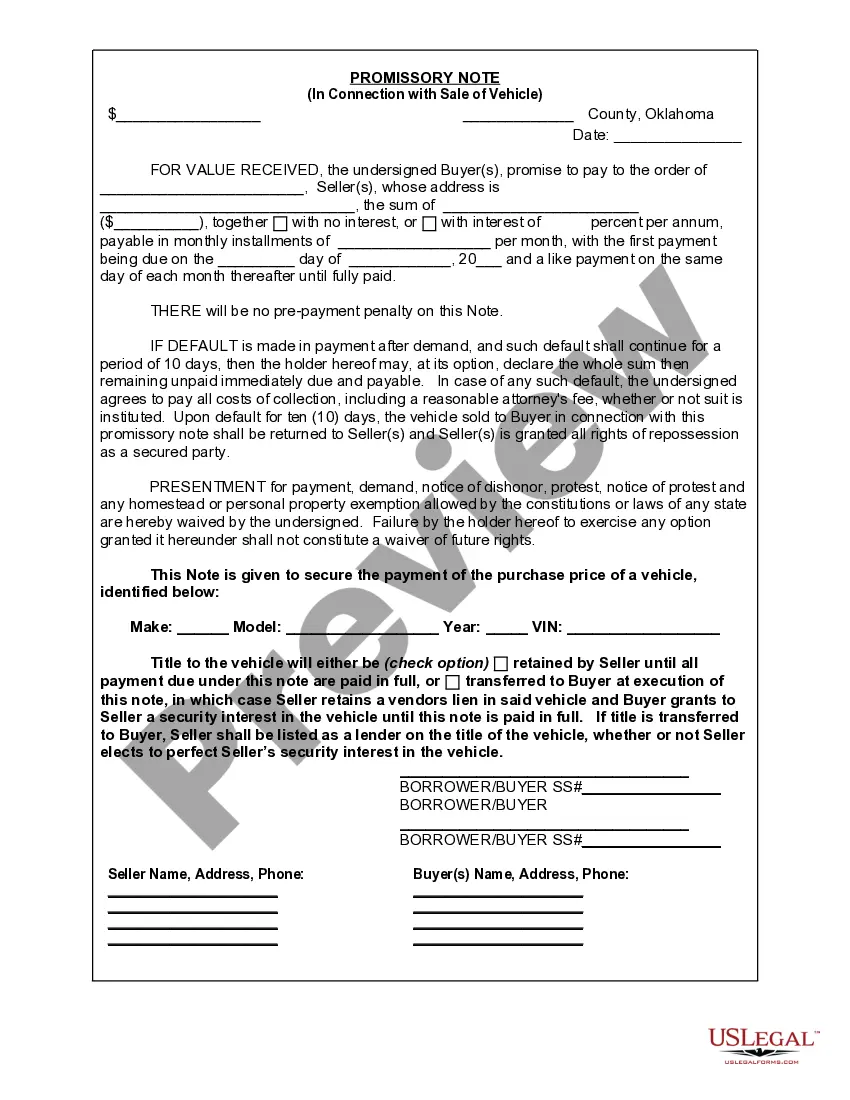

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Broken Arrow Oklahoma Promissory Note in connection with the sale of a vehicle or automobile refers to a legal document that outlines the terms and conditions of a loan agreement between the buyer and the seller. This note provides the details regarding the loan amount, interest rate, repayment schedule, and other crucial information. By signing this note, both parties acknowledge their responsibilities, rights, and obligations associated with the purchase and loan transaction. Here are some relevant keywords to include in the description: 1. Broken Arrow Oklahoma Promissory Note: This refers to the legal document specific to the state of Oklahoma and more specifically, Broken Arrow, which outlines the terms of the loan agreement for a vehicle or automobile sale. 2. Sale of Vehicle or Automobile: This emphasizes that the promissory note is related to the purchase and financing of a specific vehicle or automobile. 3. Loan Agreement: This highlights that the promissory note serves as a formal agreement between the buyer and the seller, specifying the terms and conditions of the loan. 4. Loan Amount: This indicates the principal amount provided by the seller to the buyer for the purchase of the vehicle. 5. Interest Rate: This states the percentage at which the loan is charged with interest, detailing how much the buyer will need to repay in addition to the principal amount. 6. Repayment Schedule: This outlines the timeline and frequency (monthly, quarterly, etc.) at which the buyer needs to make payments to the seller to repay the loan. 7. Terms and Conditions: This covers additional information, such as penalties for late payments, prepayment options, or other specific clauses agreed upon by both parties. Different types/names of Broken Arrow Oklahoma Promissory Note in connection with the sale of a vehicle or automobile may include: 1. Secured Promissory Note: This type of promissory note uses the vehicle or automobile being sold as collateral, ensuring that the lender has a legal claim to the asset until the loan is repaid. 2. Unsecured Promissory Note: When a promissory note is unsecured, it means that no specific collateral has been pledged, making it a riskier option for the lender. However, it doesn't involve any lien on the vehicle or automobile. 3. Installment Promissory Note: This type of note allows the buyer to repay the loan amount in fixed monthly installments over a predefined period, offering a structured repayment plan. 4. Balloon Promissory Note: Balloon notes involve fixed monthly payments for a certain period, with the remaining balance due as one lump sum, typically at the end of the loan term. This type of note often features lower monthly payments, but the buyer should be aware of the substantial final payment. In conclusion, a Broken Arrow Oklahoma Promissory Note in connection with the sale of a vehicle or automobile is a legal document that formalizes the terms of a loan agreement between the buyer and the seller. It covers essential details like the loan amount, interest rate, repayment schedule, and additional terms and conditions. Different variations of such promissory notes include secured, unsecured, installment, and balloon notes, each offering distinct features catered to specific buyer and seller requirements.A Broken Arrow Oklahoma Promissory Note in connection with the sale of a vehicle or automobile refers to a legal document that outlines the terms and conditions of a loan agreement between the buyer and the seller. This note provides the details regarding the loan amount, interest rate, repayment schedule, and other crucial information. By signing this note, both parties acknowledge their responsibilities, rights, and obligations associated with the purchase and loan transaction. Here are some relevant keywords to include in the description: 1. Broken Arrow Oklahoma Promissory Note: This refers to the legal document specific to the state of Oklahoma and more specifically, Broken Arrow, which outlines the terms of the loan agreement for a vehicle or automobile sale. 2. Sale of Vehicle or Automobile: This emphasizes that the promissory note is related to the purchase and financing of a specific vehicle or automobile. 3. Loan Agreement: This highlights that the promissory note serves as a formal agreement between the buyer and the seller, specifying the terms and conditions of the loan. 4. Loan Amount: This indicates the principal amount provided by the seller to the buyer for the purchase of the vehicle. 5. Interest Rate: This states the percentage at which the loan is charged with interest, detailing how much the buyer will need to repay in addition to the principal amount. 6. Repayment Schedule: This outlines the timeline and frequency (monthly, quarterly, etc.) at which the buyer needs to make payments to the seller to repay the loan. 7. Terms and Conditions: This covers additional information, such as penalties for late payments, prepayment options, or other specific clauses agreed upon by both parties. Different types/names of Broken Arrow Oklahoma Promissory Note in connection with the sale of a vehicle or automobile may include: 1. Secured Promissory Note: This type of promissory note uses the vehicle or automobile being sold as collateral, ensuring that the lender has a legal claim to the asset until the loan is repaid. 2. Unsecured Promissory Note: When a promissory note is unsecured, it means that no specific collateral has been pledged, making it a riskier option for the lender. However, it doesn't involve any lien on the vehicle or automobile. 3. Installment Promissory Note: This type of note allows the buyer to repay the loan amount in fixed monthly installments over a predefined period, offering a structured repayment plan. 4. Balloon Promissory Note: Balloon notes involve fixed monthly payments for a certain period, with the remaining balance due as one lump sum, typically at the end of the loan term. This type of note often features lower monthly payments, but the buyer should be aware of the substantial final payment. In conclusion, a Broken Arrow Oklahoma Promissory Note in connection with the sale of a vehicle or automobile is a legal document that formalizes the terms of a loan agreement between the buyer and the seller. It covers essential details like the loan amount, interest rate, repayment schedule, and additional terms and conditions. Different variations of such promissory notes include secured, unsecured, installment, and balloon notes, each offering distinct features catered to specific buyer and seller requirements.