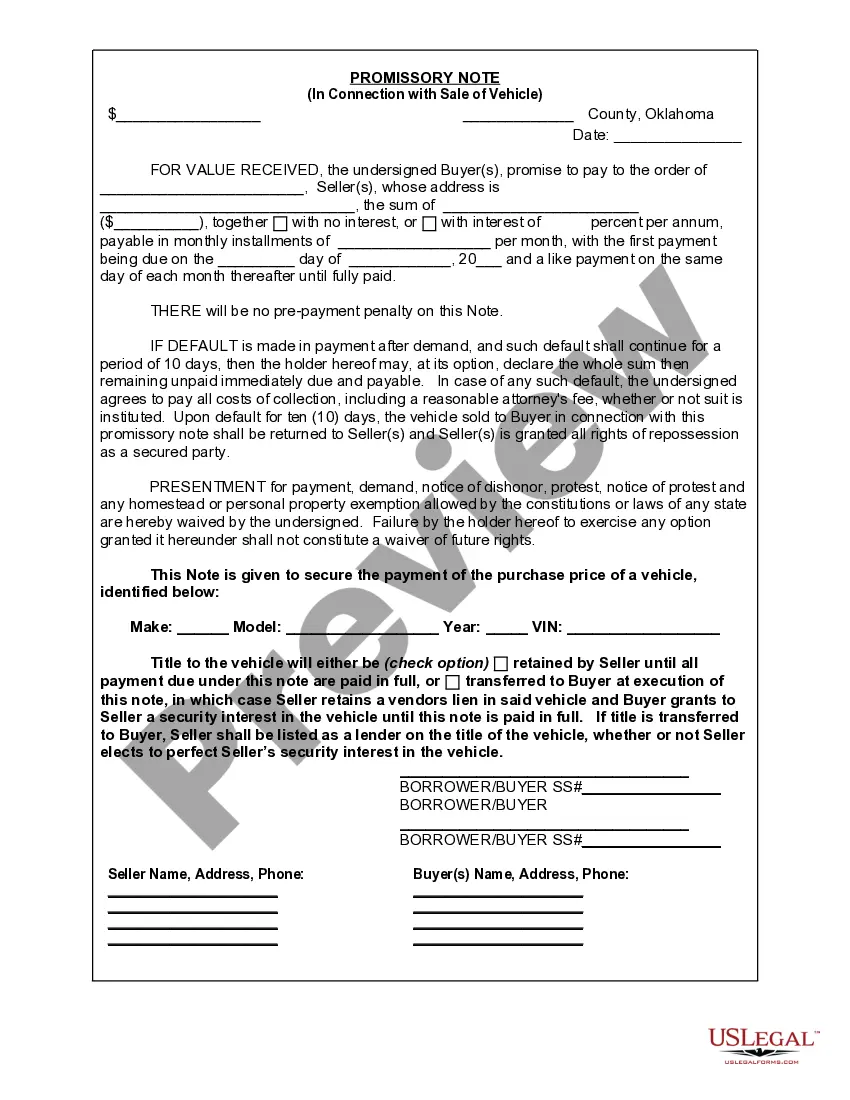

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Oklahoma City Oklahoma Promissory Note in Connection with Sale of Vehicle or Automobile

Description

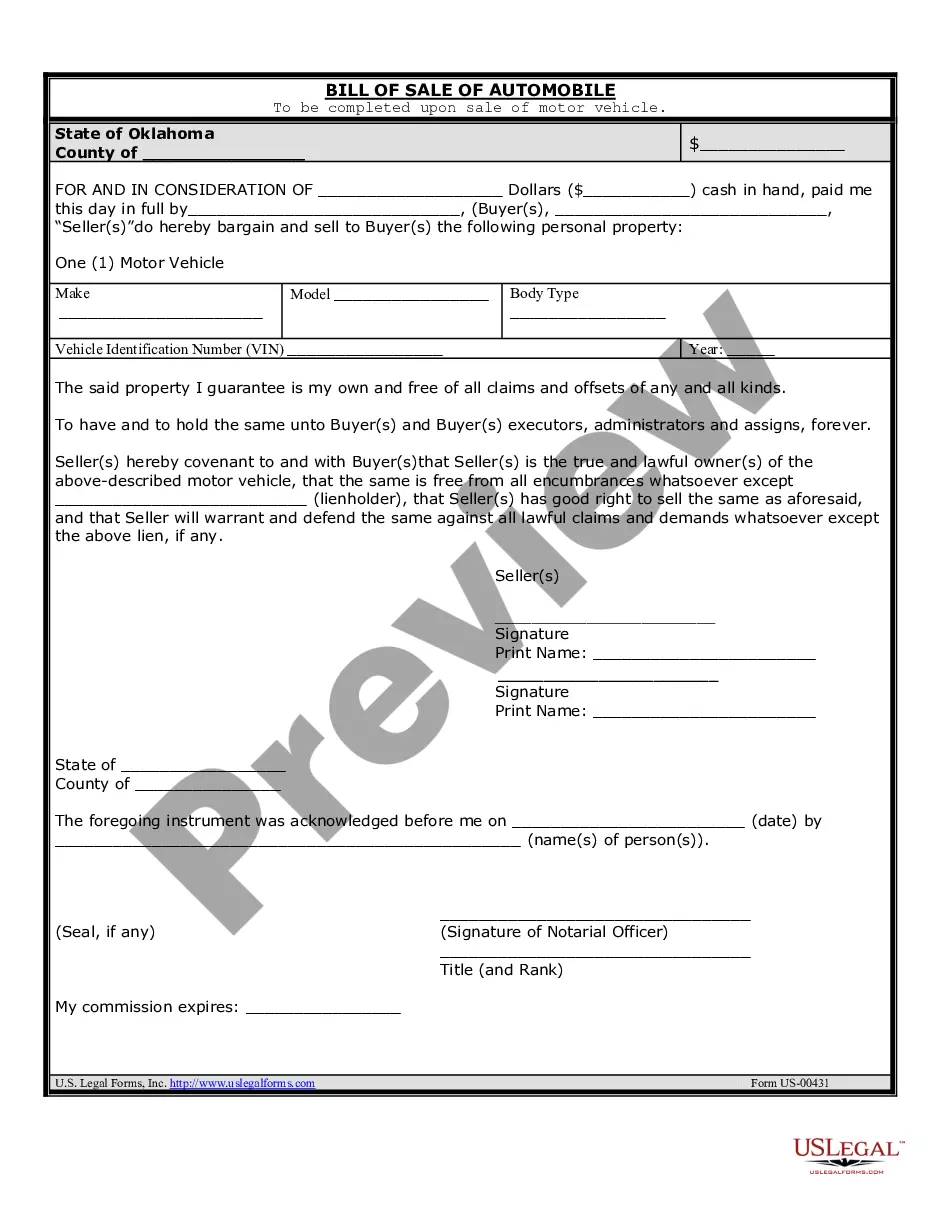

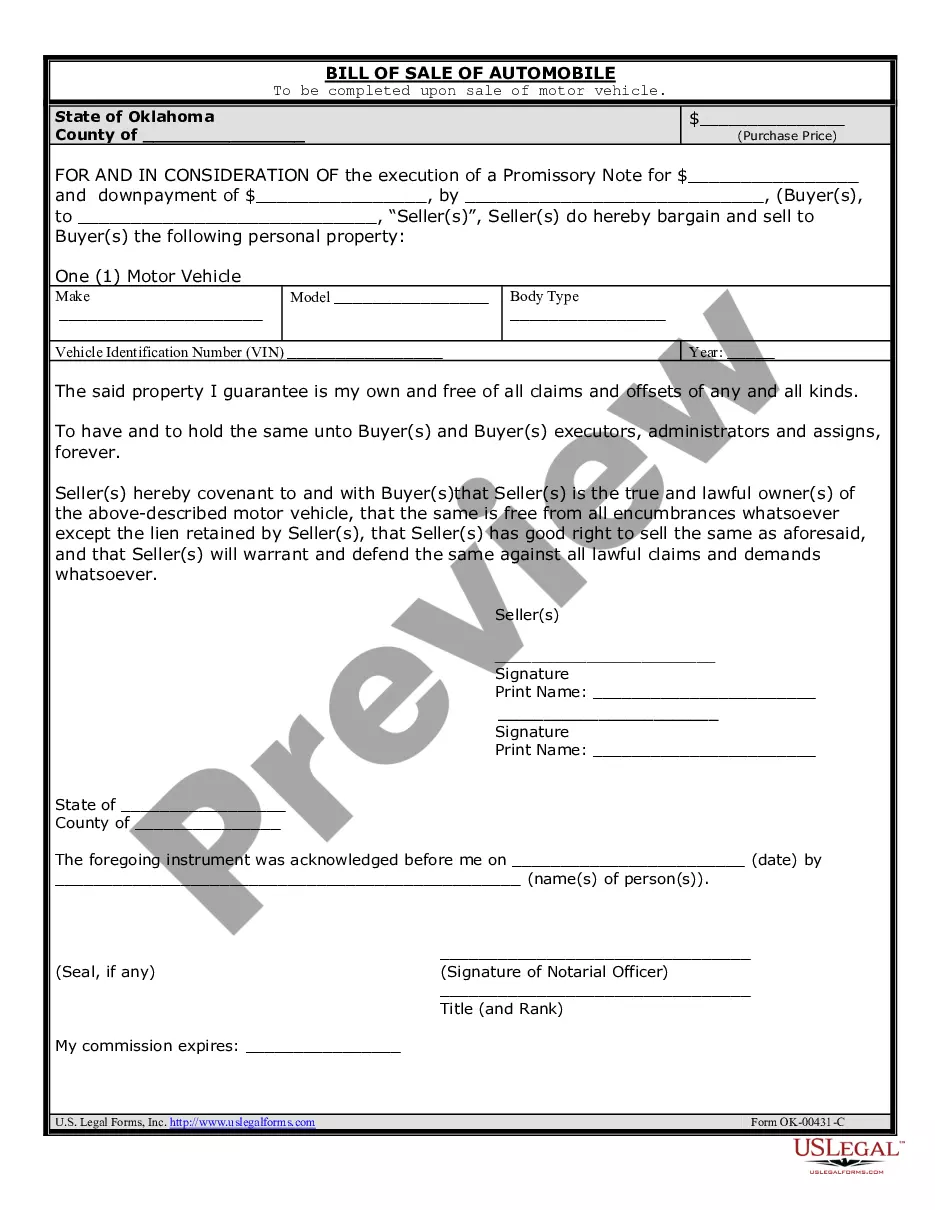

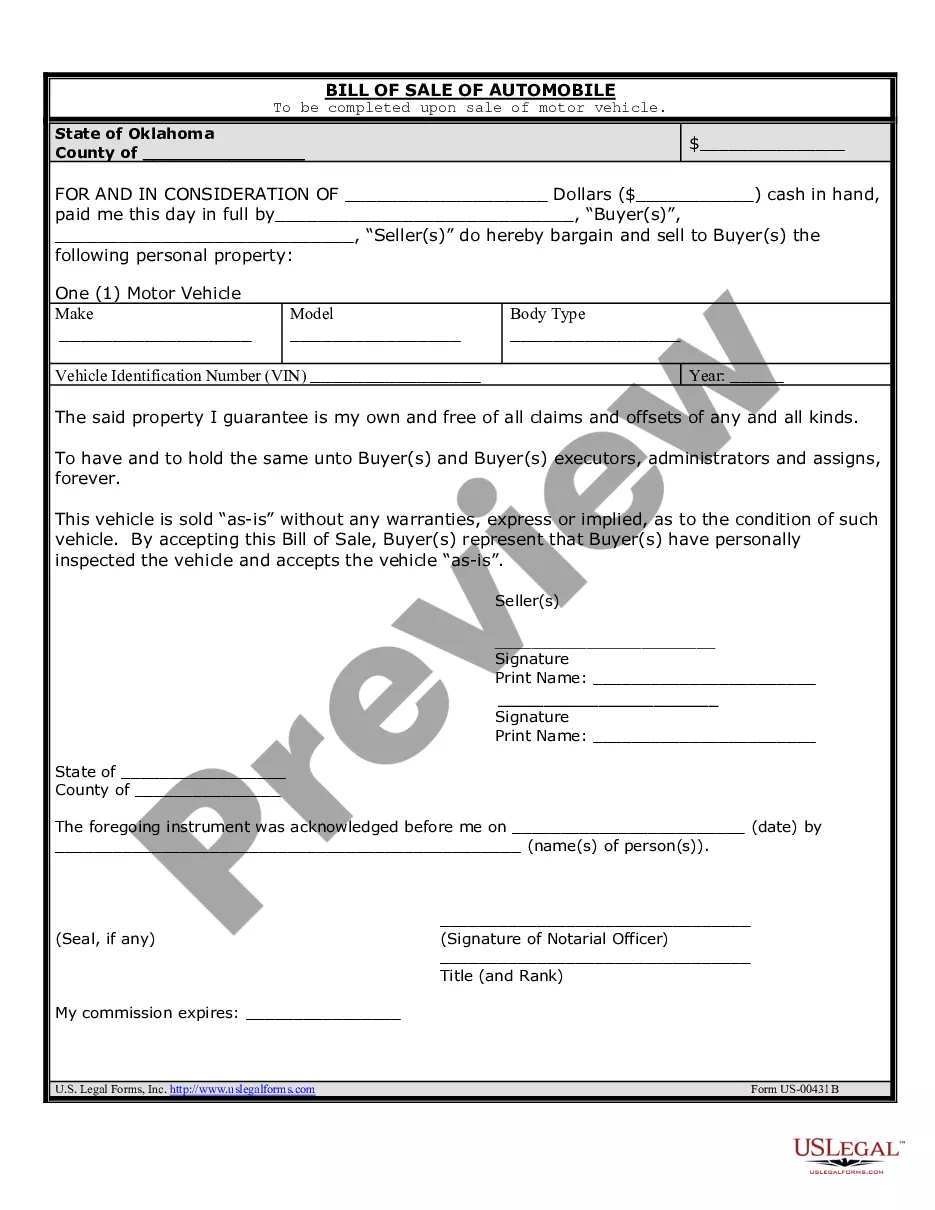

How to fill out Oklahoma Promissory Note In Connection With Sale Of Vehicle Or Automobile?

If you are seeking an appropriate form, it’s hard to find a superior location than the US Legal Forms site – one of the most substantial libraries on the internet.

With this collection, you can locate a vast array of templates for commercial and personal purposes by categories and states, or keywords.

Employing our high-grade search tool, locating the most recent Oklahoma City Oklahoma Promissory Note in Relation to Sale of Vehicle or Automobile is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose the format and store it on your device.

- Moreover, the applicability of each document is verified by a group of proficient attorneys who routinely review the templates on our site and update them according to the latest state and county laws.

- If you are already familiar with our platform and possess a registered account, all you need to obtain the Oklahoma City Oklahoma Promissory Note in Relation to Sale of Vehicle or Automobile is to Log In to your user account and select the Download option.

- If you are using US Legal Forms for the first time, simply follow the steps outlined below.

- Ensure you have found the sample you require. Review its details and utilize the Preview option to examine its content. If it doesn’t meet your requirements, employ the Search box at the top of the page to discover the needed document.

- Confirm your choice. Click on the Buy now option. Then, choose the desired pricing plan and provide the necessary information to create an account.

Form popularity

FAQ

A car promissory note is an agreement where a borrower promises to make payments in exchange for a vehicle. It typically has even terms throughout the loan, but often also includes a lump sum down payment at the beginning of the loan term. It also should include information about the make and model of the vehicle.

A seller note is a form of debt financing structured as an interest-bearing loan. In this case, the seller pays a portion of the purchase price as a promissory note, which is effectively a binding IOU. The note is a commitment that as the borrower, you will pay the amount owed through a series of debt payments.

A promissory note is a specific form of a bill of exchange with the essential difference being that a promissory note is a promise by the maker to pay whereas an 'ordinary' bill of exchange is an order to someone else to pay.

Promissory Notes: An Overview. Bills of exchange and promissory notes are written commitments between two parties that confirm a financial transaction has been agreed upon. Bills of exchange are more often used in international trade, whereas promissory notes are used most often in domestic trade.

When a loan changes hands, the promissory note is endorsed (signed over) to the new owner of the loan. In some cases, the note is endorsed in blank, which makes it a bearer instrument under Article 3 of the Uniform Commercial Code. So, any party that possesses the note has the legal authority to enforce it.

The promissory note should only be used if the buyer intends to make a down payment at the time of purchase and pay the remainder over time.

What paperwork do I need to privately sell a car in Oklahoma? Current maintenance and vehicle records. A Declaration of Vehicle Purchase Price Form 722-1. An Odometer Disclosure Statement Form 729 (if applicable) The vehicle's original certificate of title or completed application for replacement certificate title.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame.