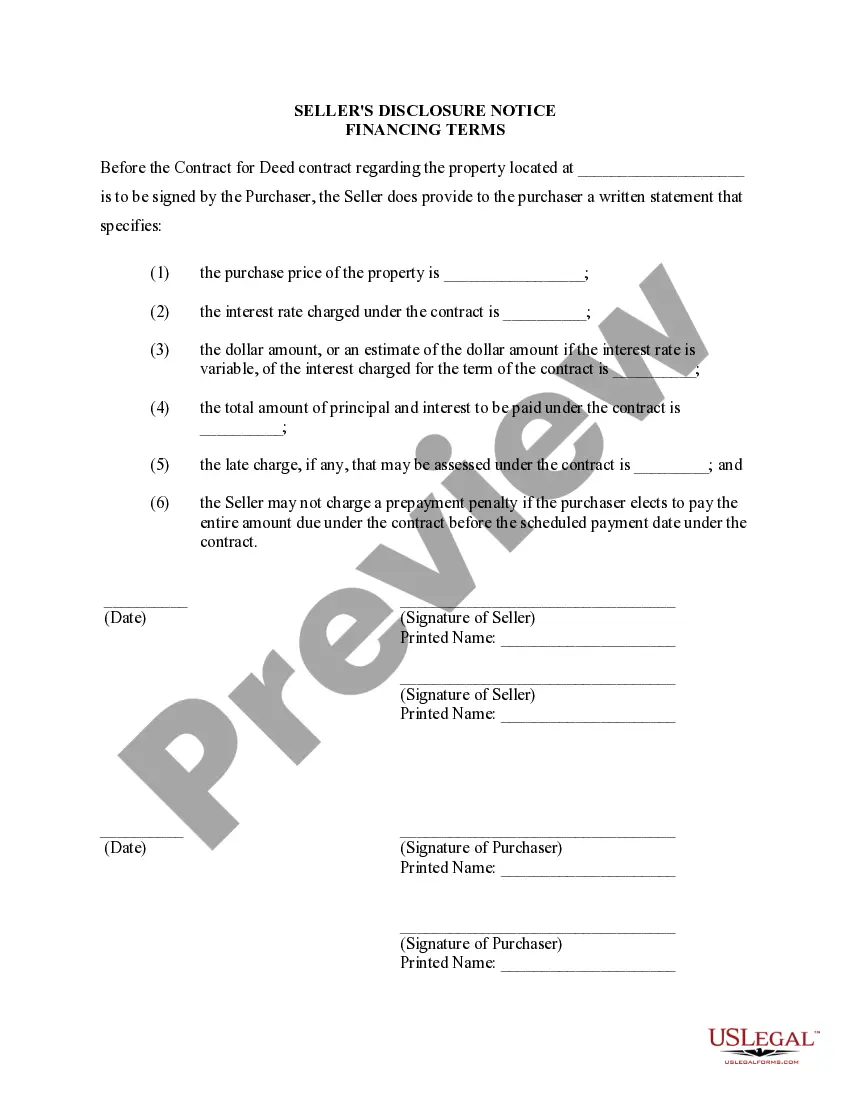

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Title: Understanding Oklahoma City's Seller's Disclosure of Financing Terms for Residential Property in Connection with Contract or Agreement for Deed Keywords: Oklahoma City, Seller's Disclosure, Financing Terms, Residential Property, Contract for Deed, Agreement for Deed, Land Contract. Introduction: In Oklahoma City, when entering into a Contract or Agreement for Deed (also known as Land Contract), sellers are required to provide a Seller's Disclosure of Financing Terms for Residential Property. This document is designed to inform buyers about the specific financing terms and conditions connected to the property purchase, ensuring transparency and protecting both parties involved in the transaction. Let's explore the details and types of Seller's Disclosure in Oklahoma City. 1. Oklahoma City Seller's Disclosure of Financing Terms for Residential Property: This disclosure form provides comprehensive information about the financial aspects of the property sale, enabling buyers to make an informed decision. It covers various key elements, such as the purchase price, any down payment requirements, interest rates, payment plans, and consequences of default. 2. Contract for Deed Seller's Disclosure: If the contract involves a Contract for Deed, the Seller's Disclosure of Financing Terms will outline the specific terms related to this type of agreement. It will explain how the purchase price will be financed, the duration of the agreement, and rights and responsibilities of both parties. 3. Agreement for Deed Seller's Disclosure: Similarly, when using an Agreement for Deed, the Seller's Disclosure of Financing Terms will contain information specific to this type of contract. It will include details regarding the financing arrangement, any escrow requirements, and the rights of the buyer and seller during the term of the agreement. 4. Financing Terms and Conditions: The Seller's Disclosure will outline the financing terms and conditions, particularly focusing on elements such as the interest rate, payment schedule, and the presence of a balloon payment. It aims to give the buyer a clear understanding of the financial obligations associated with the purchase. 5. Default and Remedies: The Seller's Disclosure will also specify what happens in the event of default by the buyer or seller. It may include information about late fees, grace periods, and possible remedies such as termination of the contract or reclaiming the property. 6. Legal Compliance: To ensure adherence to local laws and regulations, the Seller's Disclosure of Financing Terms for Residential Property will mention any state-specific requirements or restrictions, such as those set by the Oklahoma City Real Estate Commission. Conclusion: The Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed is a crucial document ensuring transparency and clarity between buyers and sellers. It provides detailed information about the financing terms, conditions, and consequences of default, helping both parties make informed decisions. By utilizing the appropriate Seller's Disclosure form, Oklahoma City residents can enter into a Contract or Agreement for Deed with confidence.Title: Understanding Oklahoma City's Seller's Disclosure of Financing Terms for Residential Property in Connection with Contract or Agreement for Deed Keywords: Oklahoma City, Seller's Disclosure, Financing Terms, Residential Property, Contract for Deed, Agreement for Deed, Land Contract. Introduction: In Oklahoma City, when entering into a Contract or Agreement for Deed (also known as Land Contract), sellers are required to provide a Seller's Disclosure of Financing Terms for Residential Property. This document is designed to inform buyers about the specific financing terms and conditions connected to the property purchase, ensuring transparency and protecting both parties involved in the transaction. Let's explore the details and types of Seller's Disclosure in Oklahoma City. 1. Oklahoma City Seller's Disclosure of Financing Terms for Residential Property: This disclosure form provides comprehensive information about the financial aspects of the property sale, enabling buyers to make an informed decision. It covers various key elements, such as the purchase price, any down payment requirements, interest rates, payment plans, and consequences of default. 2. Contract for Deed Seller's Disclosure: If the contract involves a Contract for Deed, the Seller's Disclosure of Financing Terms will outline the specific terms related to this type of agreement. It will explain how the purchase price will be financed, the duration of the agreement, and rights and responsibilities of both parties. 3. Agreement for Deed Seller's Disclosure: Similarly, when using an Agreement for Deed, the Seller's Disclosure of Financing Terms will contain information specific to this type of contract. It will include details regarding the financing arrangement, any escrow requirements, and the rights of the buyer and seller during the term of the agreement. 4. Financing Terms and Conditions: The Seller's Disclosure will outline the financing terms and conditions, particularly focusing on elements such as the interest rate, payment schedule, and the presence of a balloon payment. It aims to give the buyer a clear understanding of the financial obligations associated with the purchase. 5. Default and Remedies: The Seller's Disclosure will also specify what happens in the event of default by the buyer or seller. It may include information about late fees, grace periods, and possible remedies such as termination of the contract or reclaiming the property. 6. Legal Compliance: To ensure adherence to local laws and regulations, the Seller's Disclosure of Financing Terms for Residential Property will mention any state-specific requirements or restrictions, such as those set by the Oklahoma City Real Estate Commission. Conclusion: The Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed is a crucial document ensuring transparency and clarity between buyers and sellers. It provides detailed information about the financing terms, conditions, and consequences of default, helping both parties make informed decisions. By utilizing the appropriate Seller's Disclosure form, Oklahoma City residents can enter into a Contract or Agreement for Deed with confidence.