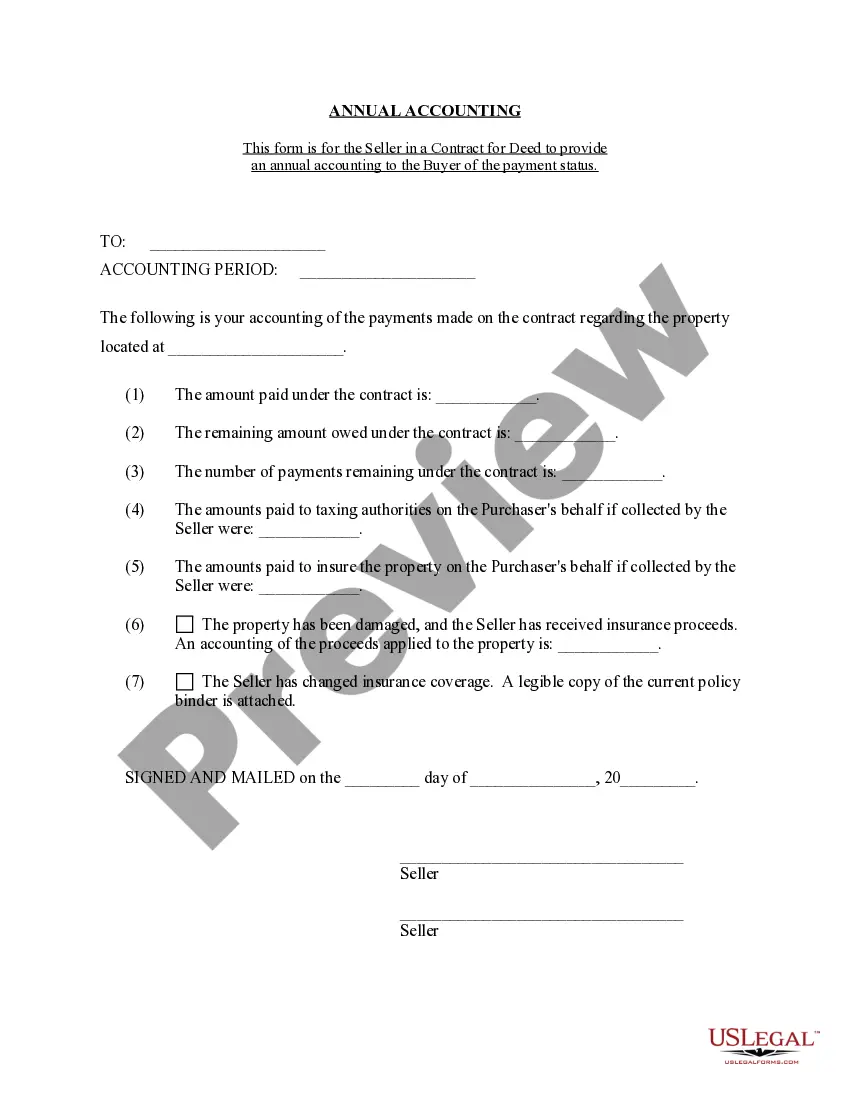

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Oklahoma City Oklahoma Contract for Deed Seller's Annual Accounting Statement is a crucial document that outlines the financial transactions and records related to a property purchased through a contract for deed arrangement in Oklahoma City. This statement serves as a comprehensive summary of the seller's financial activities, ensuring transparency and accountability between the seller and the buyer. Keywords: Oklahoma City, Oklahoma, Contract for Deed, Seller's Annual Accounting Statement, financial transactions, records, property, transparency, accountability. Types of Oklahoma City Oklahoma Contract for Deed Seller's Annual Accounting Statement: 1. Standard Seller's Annual Accounting Statement: This type of accounting statement provides a detailed breakdown of all financial transactions made by the seller in relation to the property purchased through a contract for deed. It includes information such as the total amount paid by the buyer, any principal payments made, interest accrued, taxes paid, insurance expenses, and other relevant financial data. 2. Itemized Seller's Annual Accounting Statement: An itemized accounting statement offers a more granular breakdown of the seller's financial activities throughout the year. It specifies individual expenses, such as maintenance costs, repairs, improvements, and any other relevant charges related to the property. This statement provides a more comprehensive overview of the property's financial status. 3. Tax-Related Seller's Annual Accounting Statement: This type of accounting statement focuses specifically on the tax-related transactions associated with the contract for deed property. It includes details about property tax payments made by the seller on behalf of the buyer, the allocation of tax deductions, and any adjustments made during the year. This statement aims to ensure that both parties are aware of their tax obligations and benefits. 4. Legal Compliance Seller's Annual Accounting Statement: For legal purposes, this accounting statement outlines the seller's adherence to legal requirements concerning the contract for deed property. It includes information about any necessary permits, licenses, or certifications, ensuring that the property's ownership and operation comply with applicable laws and regulations. Overall, the various types of Oklahoma City Oklahoma Contract for Deed Seller's Annual Accounting Statements help maintain financial transparency and safeguard the interests of both the seller and the buyer in these unique real estate transactions.