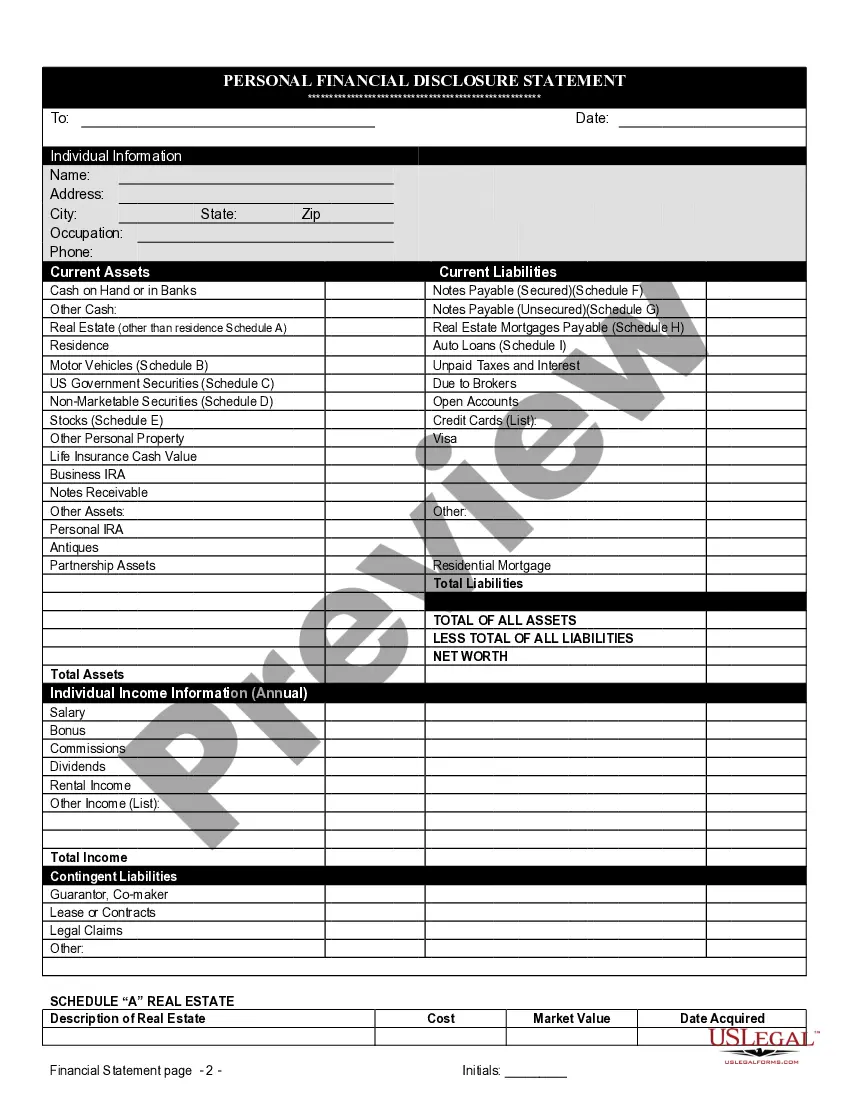

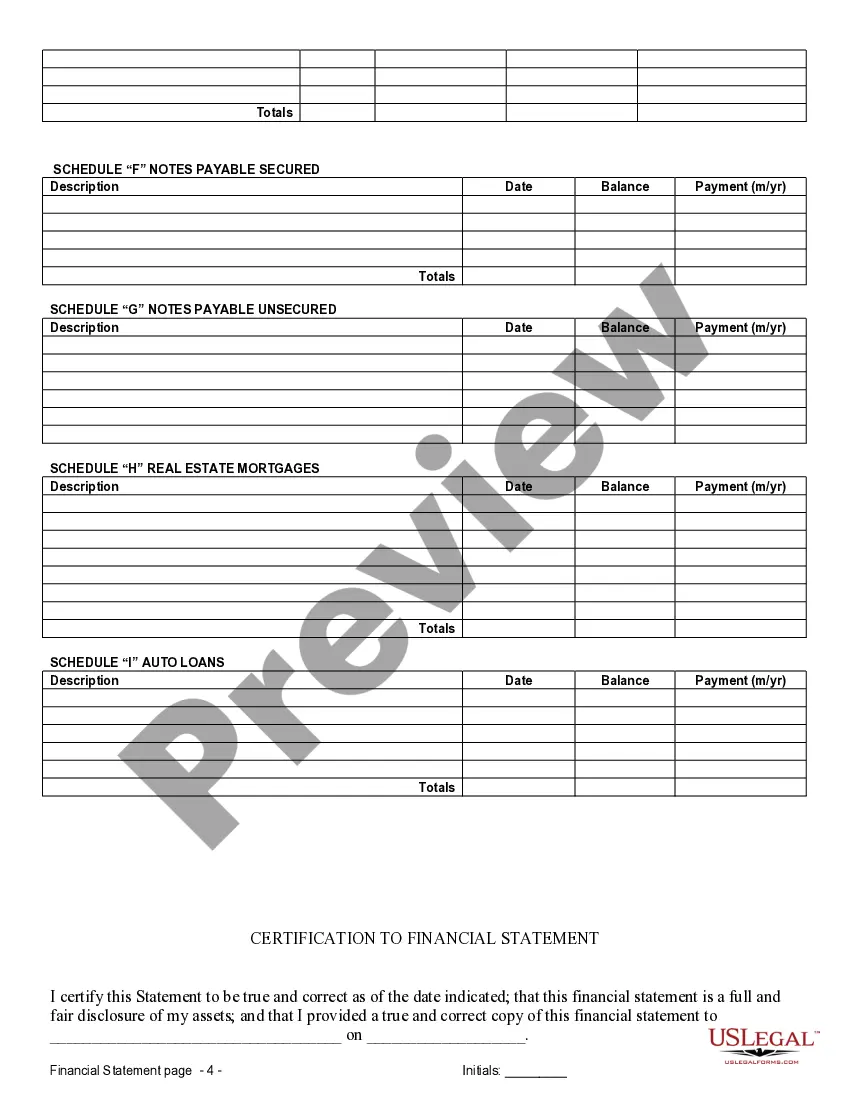

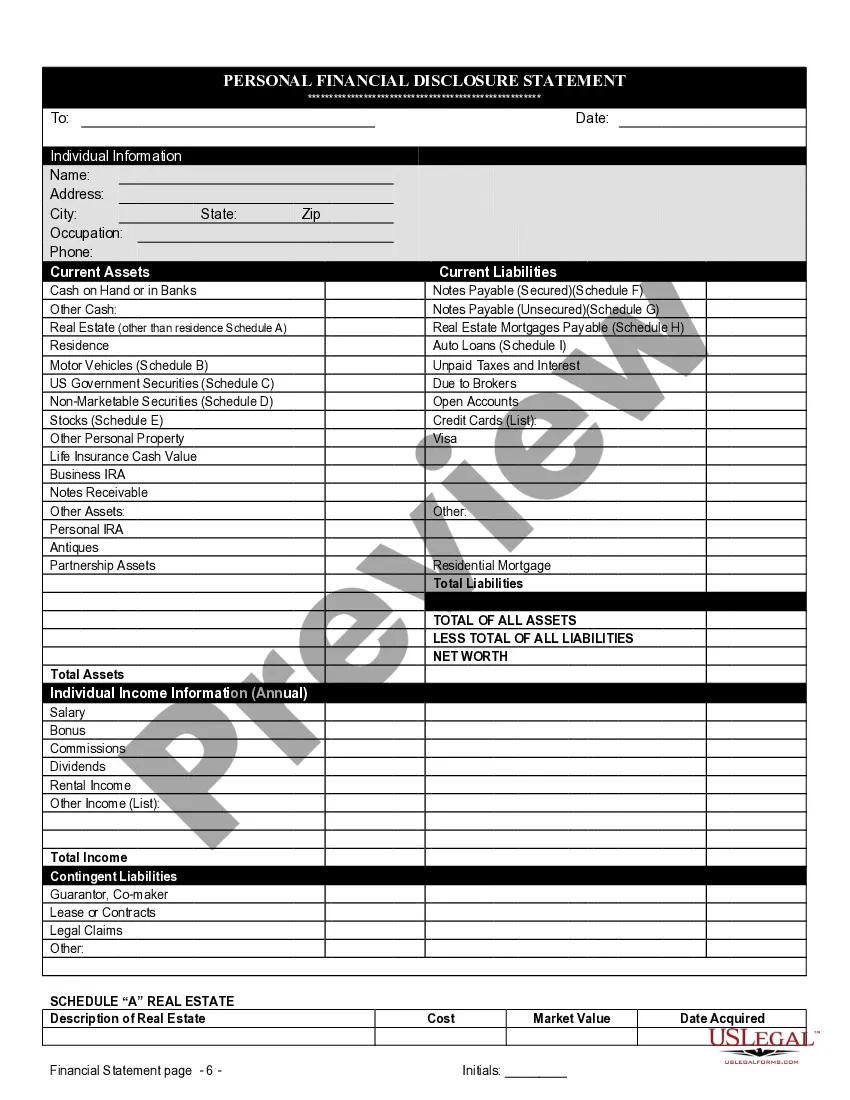

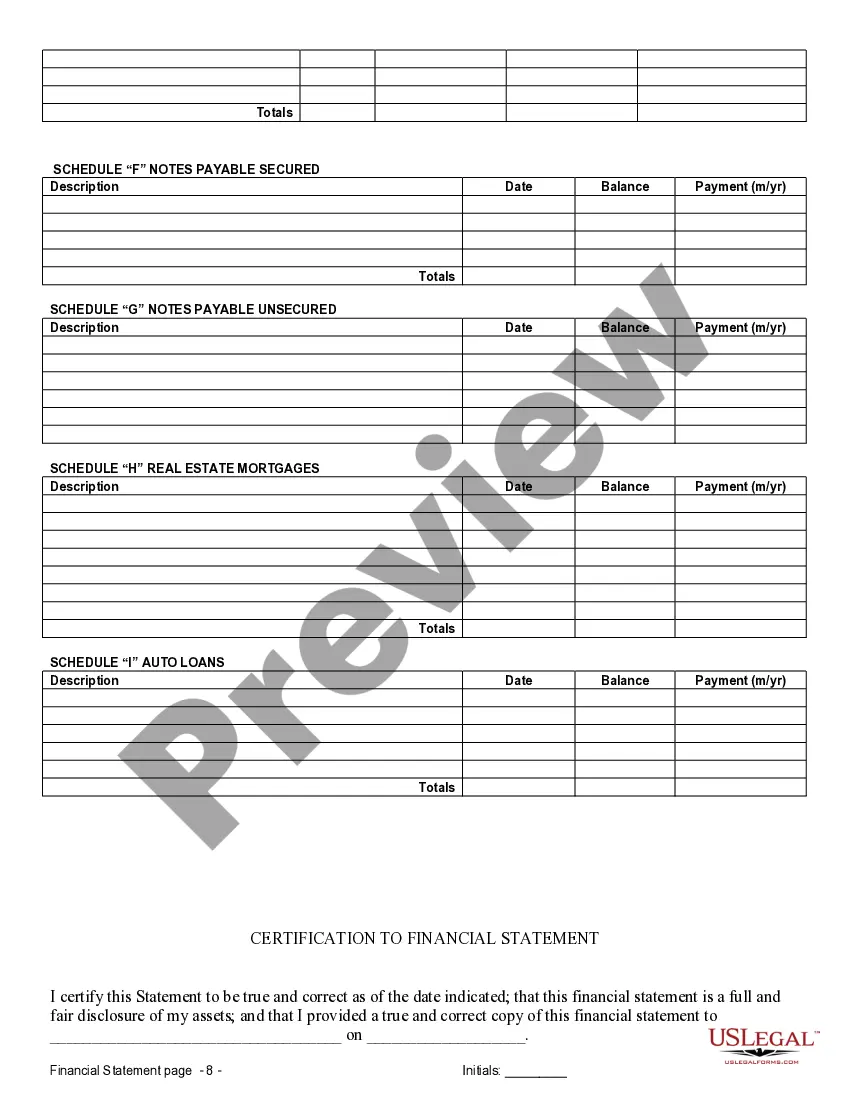

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

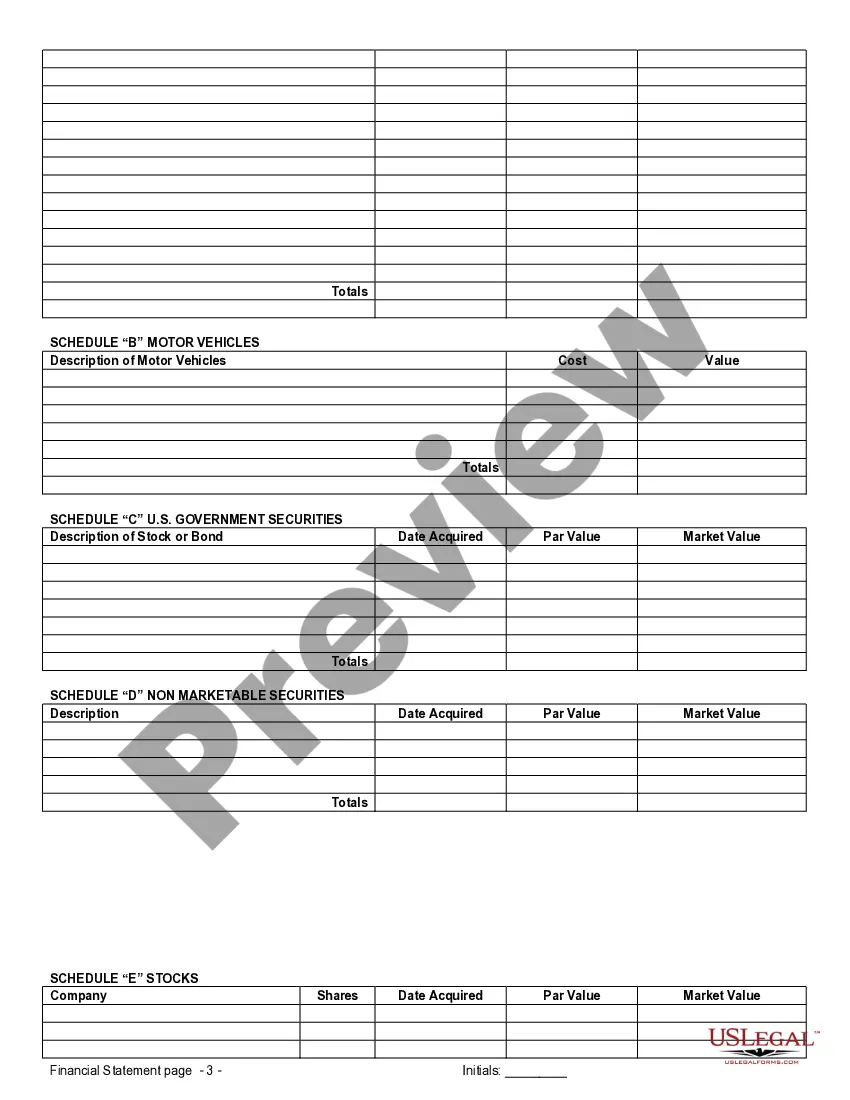

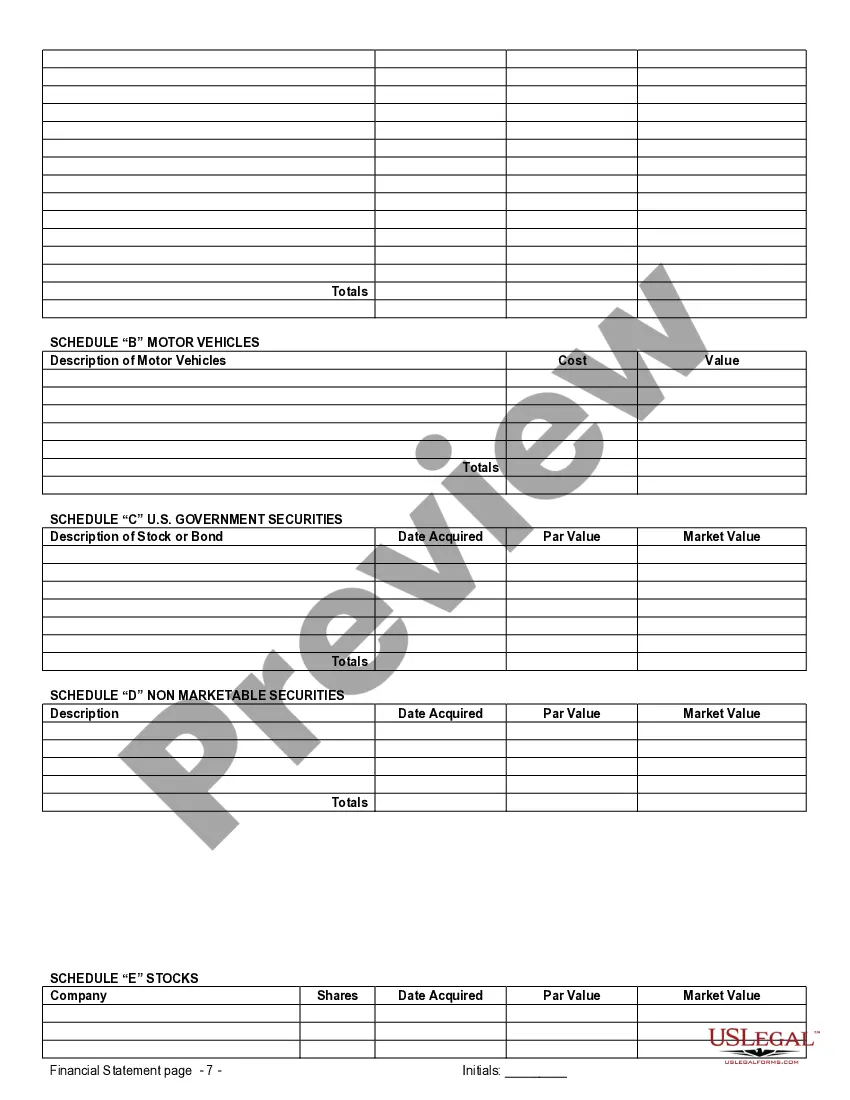

When entering into a prenuptial or premarital agreement in Broken Arrow, Oklahoma, it is crucial for both parties to have a clear understanding of each other's financial standings. Financial statements play an essential role in this process, as they provide a comprehensive snapshot of an individual's assets, liabilities, and overall financial health. In Broken Arrow, there are several types of financial statements that are typically considered when including them in a prenuptial or premarital agreement, each serving a specific purpose. One type of financial statement that may be utilized in connection with a prenuptial or premarital agreement in Broken Arrow, Oklahoma is the personal balance sheet. This statement outlines an individual's financial position, including assets, liabilities, and net worth. It provides a detailed overview of the individual's tangible and intangible assets such as real estate properties, vehicles, investments, bank accounts, stocks, and retirement savings. Additionally, it also includes any debts or liabilities such as mortgages, car loans, credit card debts, or outstanding taxes owed. Another essential financial statement that may be considered in relation to prenuptial or premarital agreements in Broken Arrow is the income statement. This document presents an individual's earnings, expenses, and overall income on a monthly or yearly basis. It includes details regarding the individual's employment income, business profits, rental income, or any other sources of revenue. Moreover, it outlines all regular expenses like rent or mortgage payments, utilities, insurance premiums, and living costs, giving the other party insight into the individual's spending habits and financial commitments. In addition to personal balance sheets and income statements, it is also important to consider bank statements in connection with prenuptial or premarital agreements. These statements provide a detailed record of an individual's financial activities, including account balances, transactions, and any unusual financial behavior. Examining bank statements allows for a thorough analysis of an individual's income, expenditure, savings, and provides transparency in terms of their financial management. When preparing financial statements in connection with a prenuptial or premarital agreement in Broken Arrow, it is crucial to ensure accuracy and full disclosure of all financial information. Transparency in this process helps foster open communication and trust between the parties involved, ensuring a fair and equitable agreement. In summary, when it comes to prenuptial or premarital agreements in Broken Arrow, Oklahoma, financial statements play a fundamental role. Personal balance sheets, income statements, and bank statements are the primary types of financial statements typically considered. By providing a clear and comprehensive overview of an individual's financial status, these statements offer transparency and facilitate an informed decision-making process.When entering into a prenuptial or premarital agreement in Broken Arrow, Oklahoma, it is crucial for both parties to have a clear understanding of each other's financial standings. Financial statements play an essential role in this process, as they provide a comprehensive snapshot of an individual's assets, liabilities, and overall financial health. In Broken Arrow, there are several types of financial statements that are typically considered when including them in a prenuptial or premarital agreement, each serving a specific purpose. One type of financial statement that may be utilized in connection with a prenuptial or premarital agreement in Broken Arrow, Oklahoma is the personal balance sheet. This statement outlines an individual's financial position, including assets, liabilities, and net worth. It provides a detailed overview of the individual's tangible and intangible assets such as real estate properties, vehicles, investments, bank accounts, stocks, and retirement savings. Additionally, it also includes any debts or liabilities such as mortgages, car loans, credit card debts, or outstanding taxes owed. Another essential financial statement that may be considered in relation to prenuptial or premarital agreements in Broken Arrow is the income statement. This document presents an individual's earnings, expenses, and overall income on a monthly or yearly basis. It includes details regarding the individual's employment income, business profits, rental income, or any other sources of revenue. Moreover, it outlines all regular expenses like rent or mortgage payments, utilities, insurance premiums, and living costs, giving the other party insight into the individual's spending habits and financial commitments. In addition to personal balance sheets and income statements, it is also important to consider bank statements in connection with prenuptial or premarital agreements. These statements provide a detailed record of an individual's financial activities, including account balances, transactions, and any unusual financial behavior. Examining bank statements allows for a thorough analysis of an individual's income, expenditure, savings, and provides transparency in terms of their financial management. When preparing financial statements in connection with a prenuptial or premarital agreement in Broken Arrow, it is crucial to ensure accuracy and full disclosure of all financial information. Transparency in this process helps foster open communication and trust between the parties involved, ensuring a fair and equitable agreement. In summary, when it comes to prenuptial or premarital agreements in Broken Arrow, Oklahoma, financial statements play a fundamental role. Personal balance sheets, income statements, and bank statements are the primary types of financial statements typically considered. By providing a clear and comprehensive overview of an individual's financial status, these statements offer transparency and facilitate an informed decision-making process.