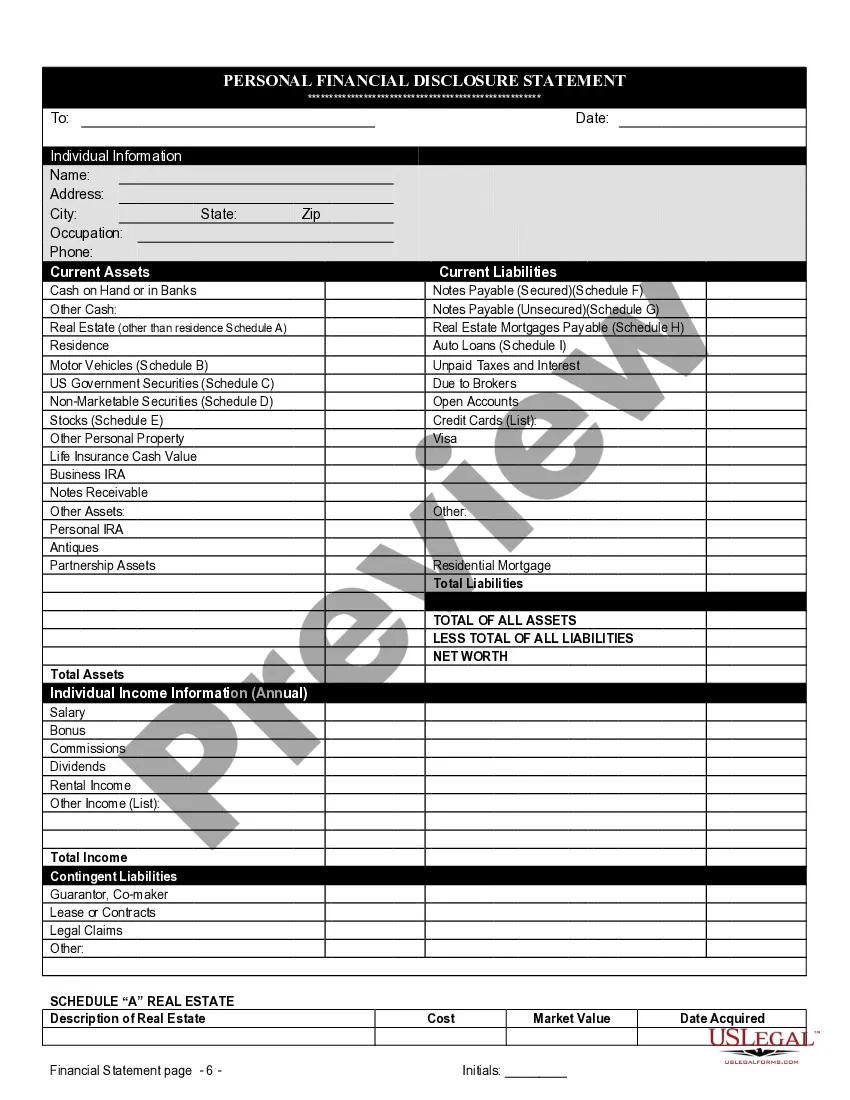

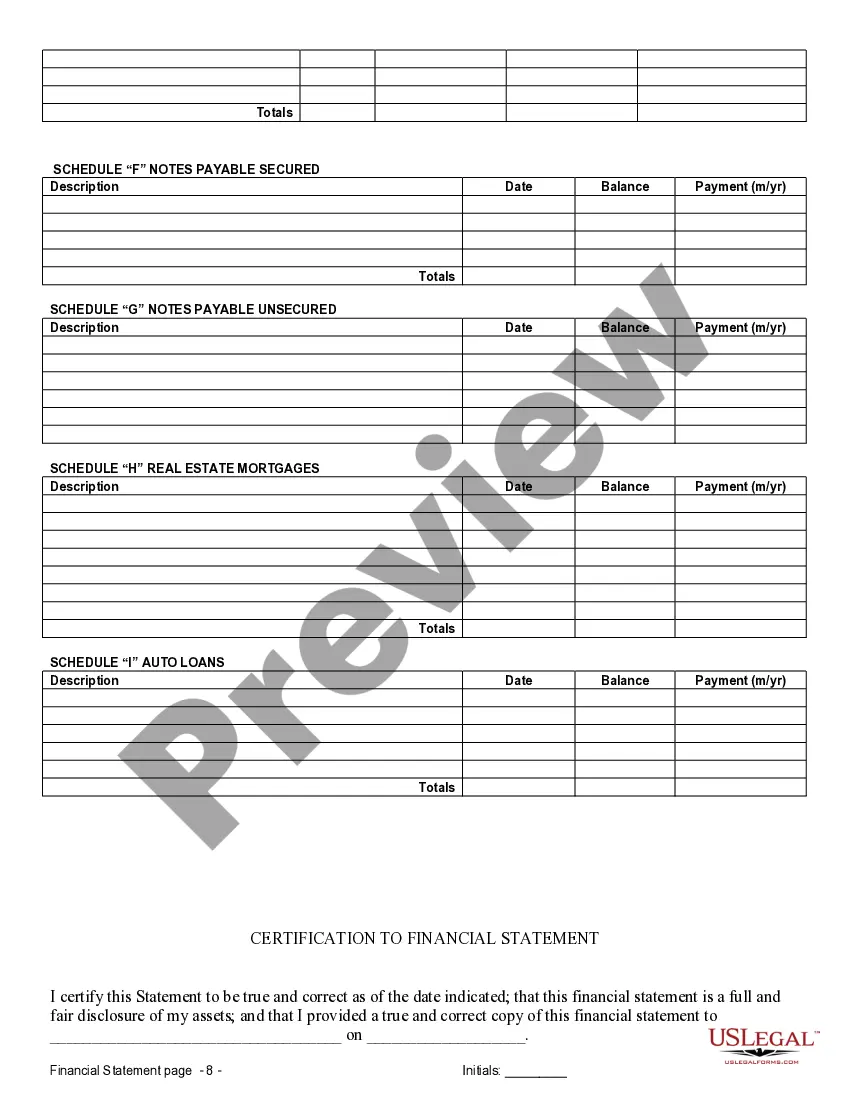

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

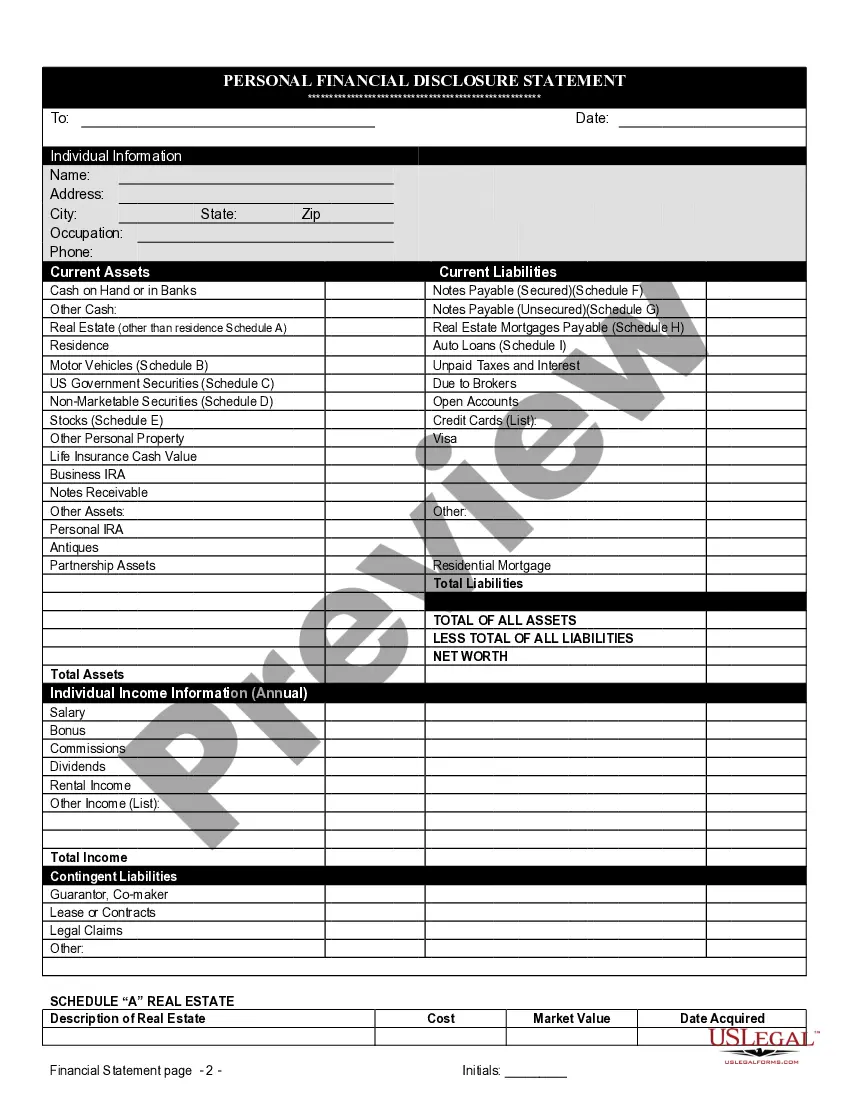

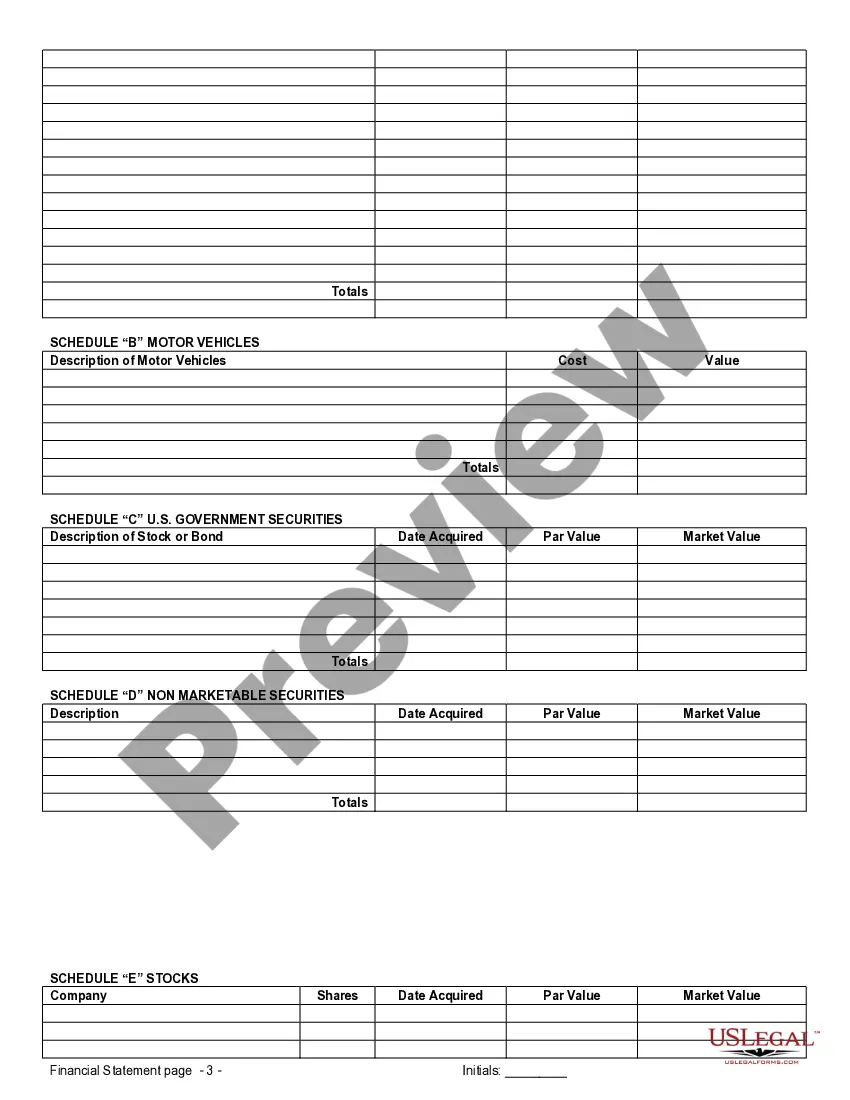

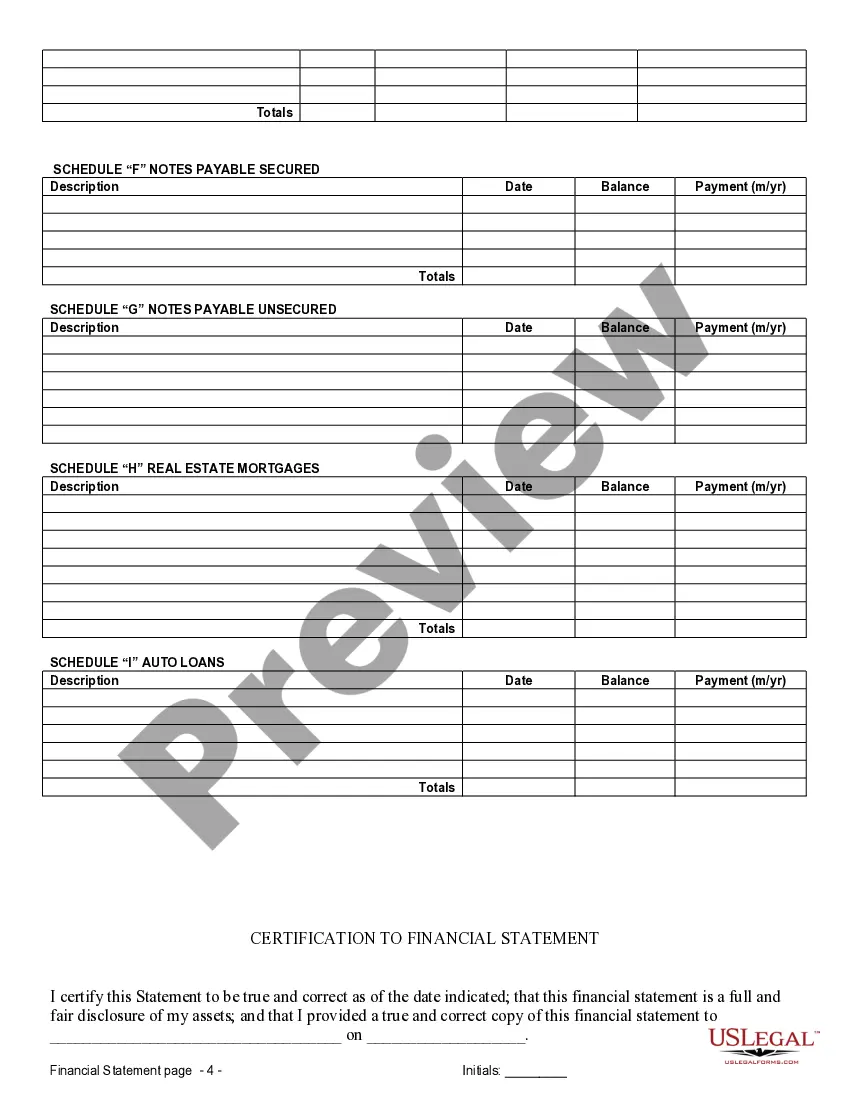

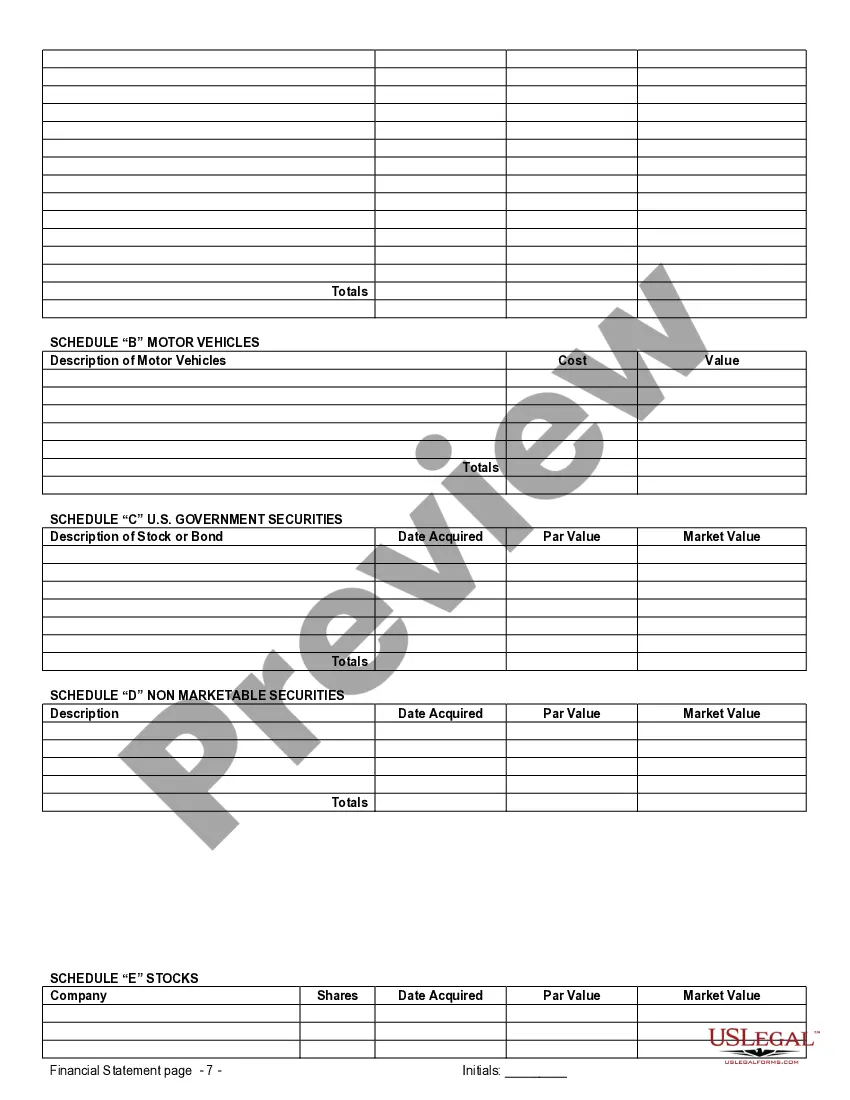

Oklahoma City Oklahoma Financial Statements only in Connection with Prenuptial Premarital Agreement serve as critical documents when couples are entering into a legal agreement before getting married. These statements reveal the financial positions, assets, debts, and income of each party, providing transparency and clarity regarding their individual financial situations. By including these statements in a prenuptial agreement, couples can outline how their finances will be managed during the marriage and in the event of a divorce or separation. There are various types of Oklahoma City Oklahoma Financial Statements that individuals may use in connection with a prenuptial agreement. Some of these types include: 1. Personal Balance Sheet: This financial statement details an individual's assets and liabilities. It includes information on real estate properties, investments, bank accounts, vehicles, personal belongings, credit card debts, student loans, and mortgages. By disclosing this information, both parties understand the financial standing of each other before entering into the marriage. 2. Income Statement: An income statement showcases an individual's income and expenses over a specified period. It outlines details such as salary, bonuses, dividends, rental income, and any other sources of revenue. Expenses listed might include rent or mortgage payments, utilities, insurance premiums, and other regular expenditures. This statement helps in understanding each party's financial capacity to contribute or manage their finances during the marriage. 3. Business Financial Statements: If one or both parties own a business, additional financial statements related to the business might be required. These statements may include profit and loss statements, balance sheets, cash flow statements, and tax returns for the business. It allows for a comprehensive understanding of the business's value, profitability, and any associated debts or obligations. 4. Retirement Account Statements: Parties may need to disclose information regarding their retirement accounts, such as 401(k), individual retirement accounts (IRAs), pensions, or other retirement savings plans. By evaluating these statements, couples can determine how these funds will be treated during the marriage, including potential division in the event of a divorce or separation. 5. Tax Returns: Providing copies of tax returns for recent years offers insights into each party's income, deductions, and overall financial health. It helps in gauging the financial stability and compliance with tax laws. In conclusion, Oklahoma City Oklahoma Financial Statements only in Connection with Prenuptial Premarital Agreement are critical in clarifying the financial aspects of the parties involved. These statements create transparency and allow couples to make informed decisions concerning their finances and how they will be managed both during the marriage and in the case of a divorce or separation. By including these detailed financial statements within the prenuptial agreement, both parties can protect their interests while moving forward into their lives together.Oklahoma City Oklahoma Financial Statements only in Connection with Prenuptial Premarital Agreement serve as critical documents when couples are entering into a legal agreement before getting married. These statements reveal the financial positions, assets, debts, and income of each party, providing transparency and clarity regarding their individual financial situations. By including these statements in a prenuptial agreement, couples can outline how their finances will be managed during the marriage and in the event of a divorce or separation. There are various types of Oklahoma City Oklahoma Financial Statements that individuals may use in connection with a prenuptial agreement. Some of these types include: 1. Personal Balance Sheet: This financial statement details an individual's assets and liabilities. It includes information on real estate properties, investments, bank accounts, vehicles, personal belongings, credit card debts, student loans, and mortgages. By disclosing this information, both parties understand the financial standing of each other before entering into the marriage. 2. Income Statement: An income statement showcases an individual's income and expenses over a specified period. It outlines details such as salary, bonuses, dividends, rental income, and any other sources of revenue. Expenses listed might include rent or mortgage payments, utilities, insurance premiums, and other regular expenditures. This statement helps in understanding each party's financial capacity to contribute or manage their finances during the marriage. 3. Business Financial Statements: If one or both parties own a business, additional financial statements related to the business might be required. These statements may include profit and loss statements, balance sheets, cash flow statements, and tax returns for the business. It allows for a comprehensive understanding of the business's value, profitability, and any associated debts or obligations. 4. Retirement Account Statements: Parties may need to disclose information regarding their retirement accounts, such as 401(k), individual retirement accounts (IRAs), pensions, or other retirement savings plans. By evaluating these statements, couples can determine how these funds will be treated during the marriage, including potential division in the event of a divorce or separation. 5. Tax Returns: Providing copies of tax returns for recent years offers insights into each party's income, deductions, and overall financial health. It helps in gauging the financial stability and compliance with tax laws. In conclusion, Oklahoma City Oklahoma Financial Statements only in Connection with Prenuptial Premarital Agreement are critical in clarifying the financial aspects of the parties involved. These statements create transparency and allow couples to make informed decisions concerning their finances and how they will be managed both during the marriage and in the case of a divorce or separation. By including these detailed financial statements within the prenuptial agreement, both parties can protect their interests while moving forward into their lives together.