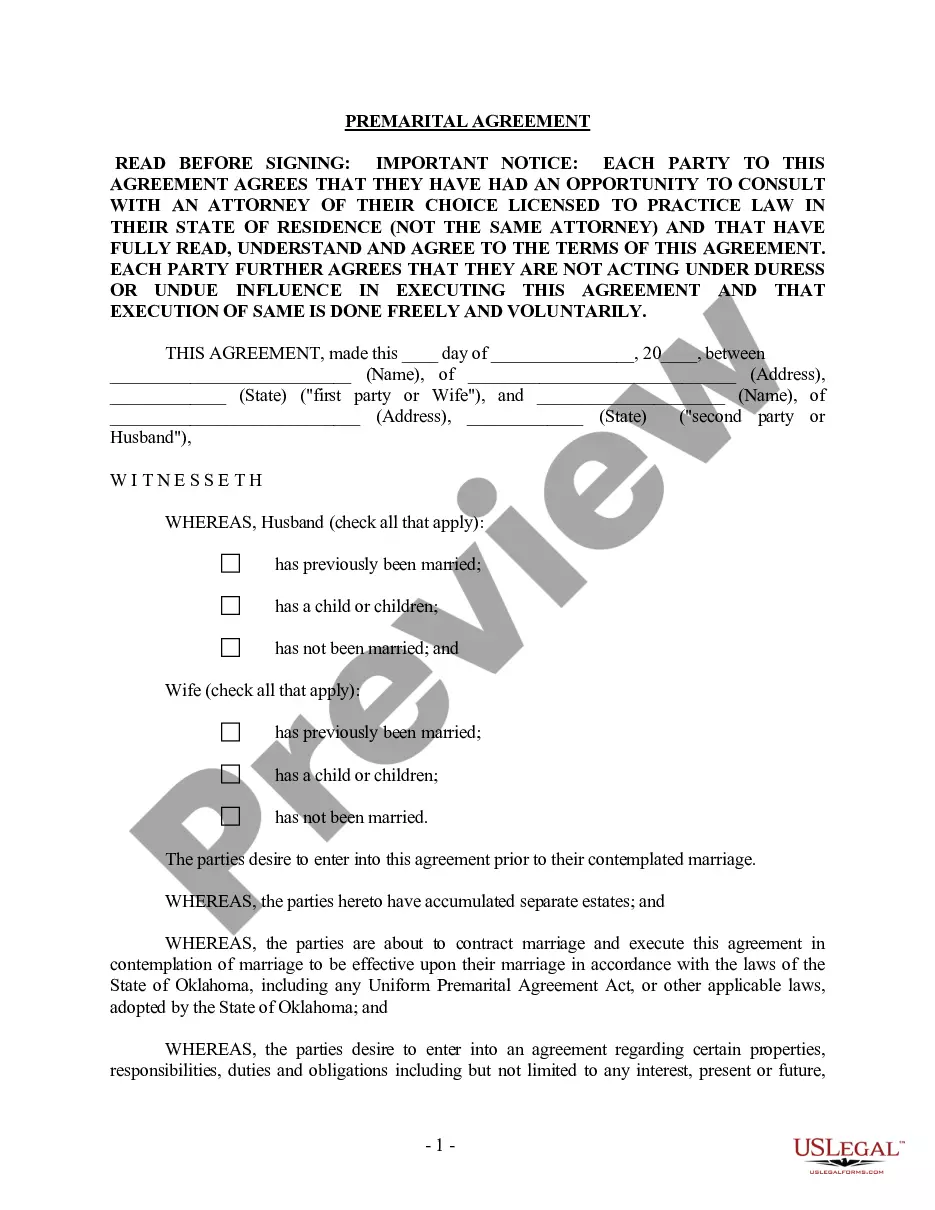

This Prenuptial Premarital Agreement with Financial Statements form package contains a premarital agreement and financial statements for your state. The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce. These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will be disposed of properly.

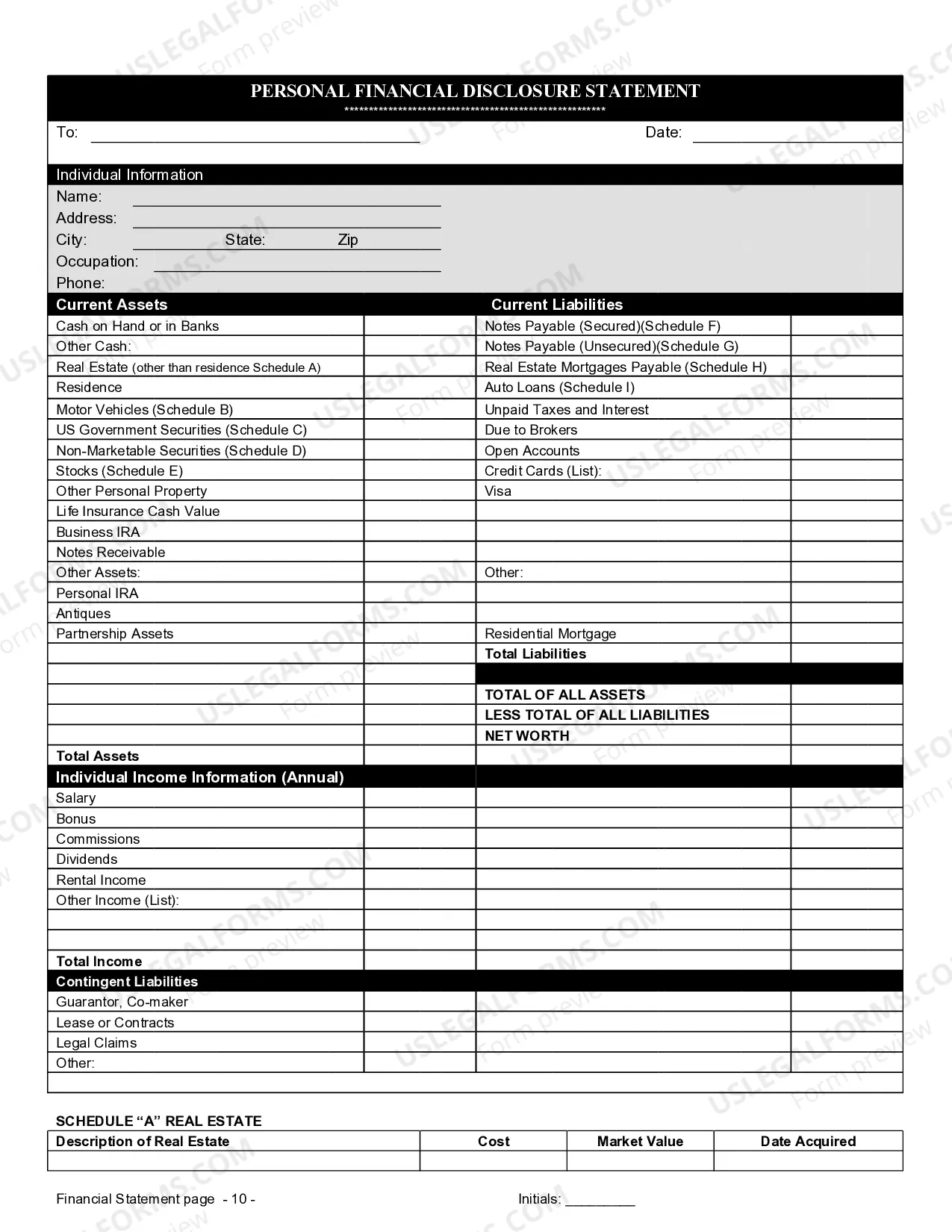

A Broken Arrow Oklahoma prenuptial premarital agreement with financial statements is a legally binding document that helps couples in the city of Broken Arrow, Oklahoma, establish clear and comprehensive guidelines for asset division, debt allocation, and financial responsibilities in the event of a separation, divorce, or death. This agreement serves as a proactive tool to protect both parties' interests and minimize potential disputes, providing a solid foundation for a successful marriage. By outlining the financial rights and obligations of each spouse, it enhances transparency and fosters open communication, ensuring a greater level of trust and understanding between partners. Some key components typically included in a Broken Arrow Oklahoma prenuptial premarital agreement with financial statements are: 1. Asset and debt disclosure: This involves presenting a comprehensive list of all individual and joint assets and debts, including real estate properties, investments, bank accounts, retirement funds, and personal belongings. By disclosing this information, both parties gain a clear understanding of the financial standing of the other partner before entering into the marriage. 2. Asset division: The agreement outlines how assets will be divided in case of separation or divorce. This may include assignation of specific properties to each spouse, establishment of fair criteria for asset valuation, and provisions for the distribution of assets acquired during the marriage. 3. Debt allocation: The prenuptial premarital agreement addresses how debts, including mortgages, loans, and credit card balances, will be divided or assumed by each party. It ensures that one spouse is not burdened with the other's preexisting debts or irresponsible financial behavior during the marriage. 4. Protection of individual property: It is common for couples to have personal assets they wish to protect, such as inheritances, family businesses, or trust funds. A Broken Arrow Oklahoma prenuptial premarital agreement with financial statements can safeguard these assets by clearly stating that they remain the sole property of the individual and will not be subject to division in the event of a divorce. 5. Spousal support/alimony: The agreement may address the issue of spousal support or alimony, specifying whether it will be provided, the amount, and the duration. Including these provisions promotes fairness and prevents potential disputes in the future. 6. Financial responsibilities during the marriage: The agreement can define the financial roles and responsibilities of each spouse during the marriage, clarifying who will be responsible for specific expenses, such as mortgage payments, utilities, healthcare, or child-related costs. Different types of Broken Arrow Oklahoma prenuptial premarital agreements with financial statements can include variations of these components, depending on the specific needs and circumstances of the couple. These may include agreements tailored for couples with substantial assets, for couples with children from previous relationships, or for couples with unique financial considerations. Ultimately, a Broken Arrow Oklahoma prenuptial premarital agreement with financial statements acts as a legal contract, protecting both parties' financial interests and providing them with peace of mind as they embark on their marital journey. Seeking professional legal advice and ensuring full disclosure of all relevant financial information is crucial when drafting and executing such an agreement.A Broken Arrow Oklahoma prenuptial premarital agreement with financial statements is a legally binding document that helps couples in the city of Broken Arrow, Oklahoma, establish clear and comprehensive guidelines for asset division, debt allocation, and financial responsibilities in the event of a separation, divorce, or death. This agreement serves as a proactive tool to protect both parties' interests and minimize potential disputes, providing a solid foundation for a successful marriage. By outlining the financial rights and obligations of each spouse, it enhances transparency and fosters open communication, ensuring a greater level of trust and understanding between partners. Some key components typically included in a Broken Arrow Oklahoma prenuptial premarital agreement with financial statements are: 1. Asset and debt disclosure: This involves presenting a comprehensive list of all individual and joint assets and debts, including real estate properties, investments, bank accounts, retirement funds, and personal belongings. By disclosing this information, both parties gain a clear understanding of the financial standing of the other partner before entering into the marriage. 2. Asset division: The agreement outlines how assets will be divided in case of separation or divorce. This may include assignation of specific properties to each spouse, establishment of fair criteria for asset valuation, and provisions for the distribution of assets acquired during the marriage. 3. Debt allocation: The prenuptial premarital agreement addresses how debts, including mortgages, loans, and credit card balances, will be divided or assumed by each party. It ensures that one spouse is not burdened with the other's preexisting debts or irresponsible financial behavior during the marriage. 4. Protection of individual property: It is common for couples to have personal assets they wish to protect, such as inheritances, family businesses, or trust funds. A Broken Arrow Oklahoma prenuptial premarital agreement with financial statements can safeguard these assets by clearly stating that they remain the sole property of the individual and will not be subject to division in the event of a divorce. 5. Spousal support/alimony: The agreement may address the issue of spousal support or alimony, specifying whether it will be provided, the amount, and the duration. Including these provisions promotes fairness and prevents potential disputes in the future. 6. Financial responsibilities during the marriage: The agreement can define the financial roles and responsibilities of each spouse during the marriage, clarifying who will be responsible for specific expenses, such as mortgage payments, utilities, healthcare, or child-related costs. Different types of Broken Arrow Oklahoma prenuptial premarital agreements with financial statements can include variations of these components, depending on the specific needs and circumstances of the couple. These may include agreements tailored for couples with substantial assets, for couples with children from previous relationships, or for couples with unique financial considerations. Ultimately, a Broken Arrow Oklahoma prenuptial premarital agreement with financial statements acts as a legal contract, protecting both parties' financial interests and providing them with peace of mind as they embark on their marital journey. Seeking professional legal advice and ensuring full disclosure of all relevant financial information is crucial when drafting and executing such an agreement.