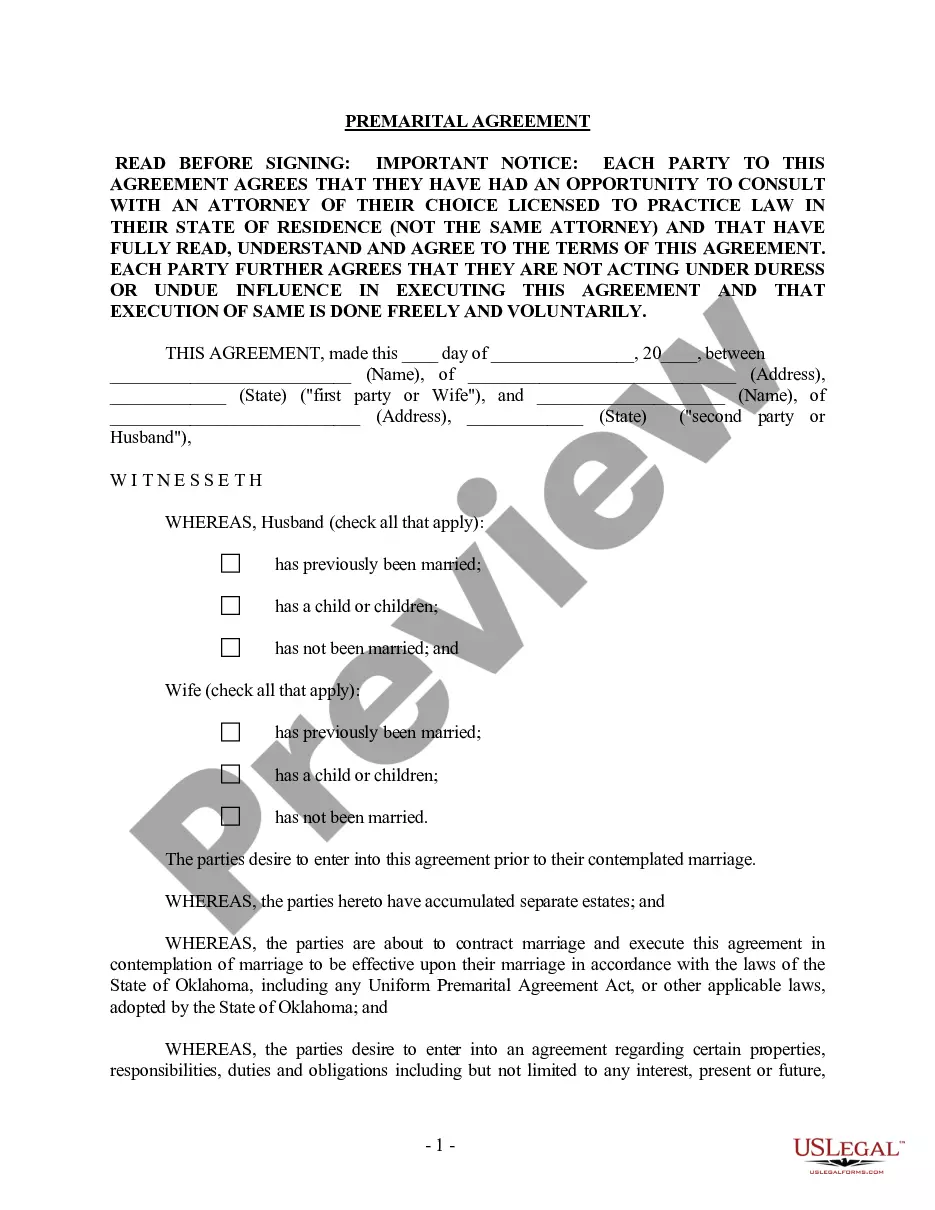

This Prenuptial Premarital Agreement with Financial Statements form package contains a premarital agreement and financial statements for your state. The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce. These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will be disposed of properly.

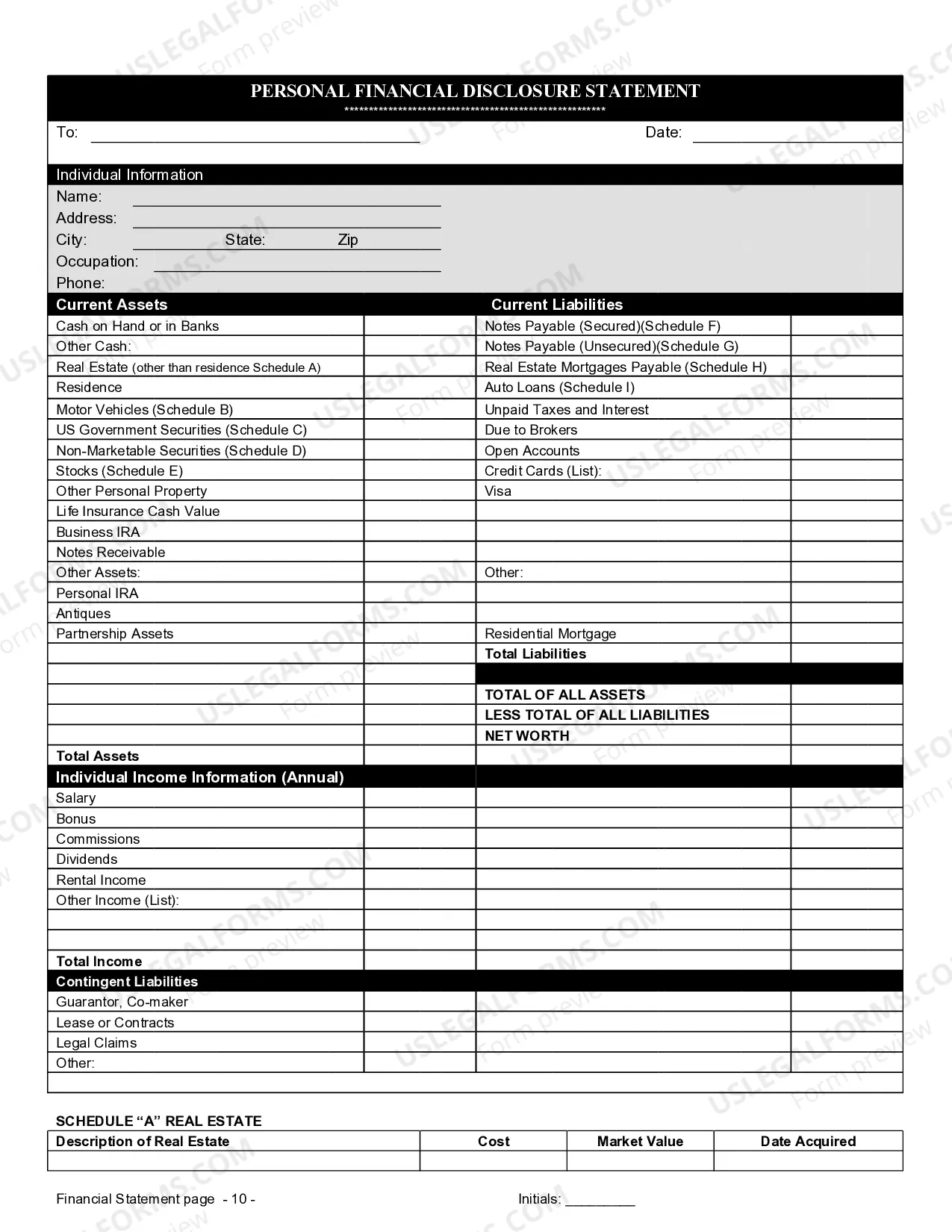

Oklahoma City, Oklahoma Prenuptial Premarital Agreement with Financial Statements: A Comprehensive Guide to Protecting Your Assets Introduction: A Prenuptial Premarital Agreement with Financial Statements, commonly known as a prenup or premarital agreement, is a legal document that helps protect the financial interests of individuals entering into a marriage or civil partnership. In the vibrant city of Oklahoma City, Oklahoma, prenuptial agreements are of utmost importance due to the diverse population and the need for securing assets. Key Benefits of Prenuptial Premarital Agreements: 1. Asset Protection: A prenuptial agreement allows parties to safeguard their respective assets gained prior to the marriage and specify how any future assets will be divided in case of a divorce or separation. 2. Simplified Division of Property: By outlining the distribution of assets and debts accumulated during the marriage, a prenup can help avoid lengthy legal battles and potential disagreements later on. 3. Protection for Business Owners: If you or your partner owns a business, a prenuptial agreement can provide clarity on how the business will be managed during the marriage and divided in the event of a divorce. 4. Clarity on Financial Responsibilities: Prenuptial agreements can establish financial expectations during the marriage, such as spousal support or the division of household expenses, ensuring fairness and transparency. Types of Prenuptial Premarital Agreements in Oklahoma City: 1. Standard Prenuptial Agreement: This type of premarital agreement covers general provisions regarding the division of assets and debts, spousal support, and the protection of premarital assets. 2. Complex Asset Prenuptial Agreement: If one or both parties have substantial assets, including real estate properties, investments, or valuable collections, a complex asset prenup offers detailed guidelines to address the specific complexities involved. 3. Business-Focused Prenuptial Agreement: Particularly relevant for business owners and entrepreneurs, this type of prenup clearly establishes the roles and responsibilities concerning business ownership, operation, and potential future sale or division in case of a divorce. Including Financial Statements in the Prenuptial Premarital Agreement: Financial statements play a crucial role in a prenuptial agreement as they provide an accurate snapshot of each party's financial standing at the time of marriage. The financial statements may include: 1. Personal Balance Sheets: These provide a comprehensive overview of each party's assets, liabilities, and net worth, including real estate properties, bank accounts, investments, and debts. 2. Income and Expense Statements: These statements outline each party's income sources, monthly expenses, and any other financial obligations or commitments. 3. Business Financial Statements: In situations where one or both parties own businesses, including balance sheets, profit and loss statements, and cash flow statements can help assess the financial health and value of the business. Conclusion: A Prenuptial Premarital Agreement with Financial Statements is a crucial legal tool for individuals in Oklahoma City, Oklahoma, who wish to safeguard their assets and establish clear financial expectations before entering into a marriage or civil partnership. By considering the different types of prenup agreements available and including comprehensive financial statements, couples can address potential disputes, protect their interests, and promote a healthy and secure relationship.