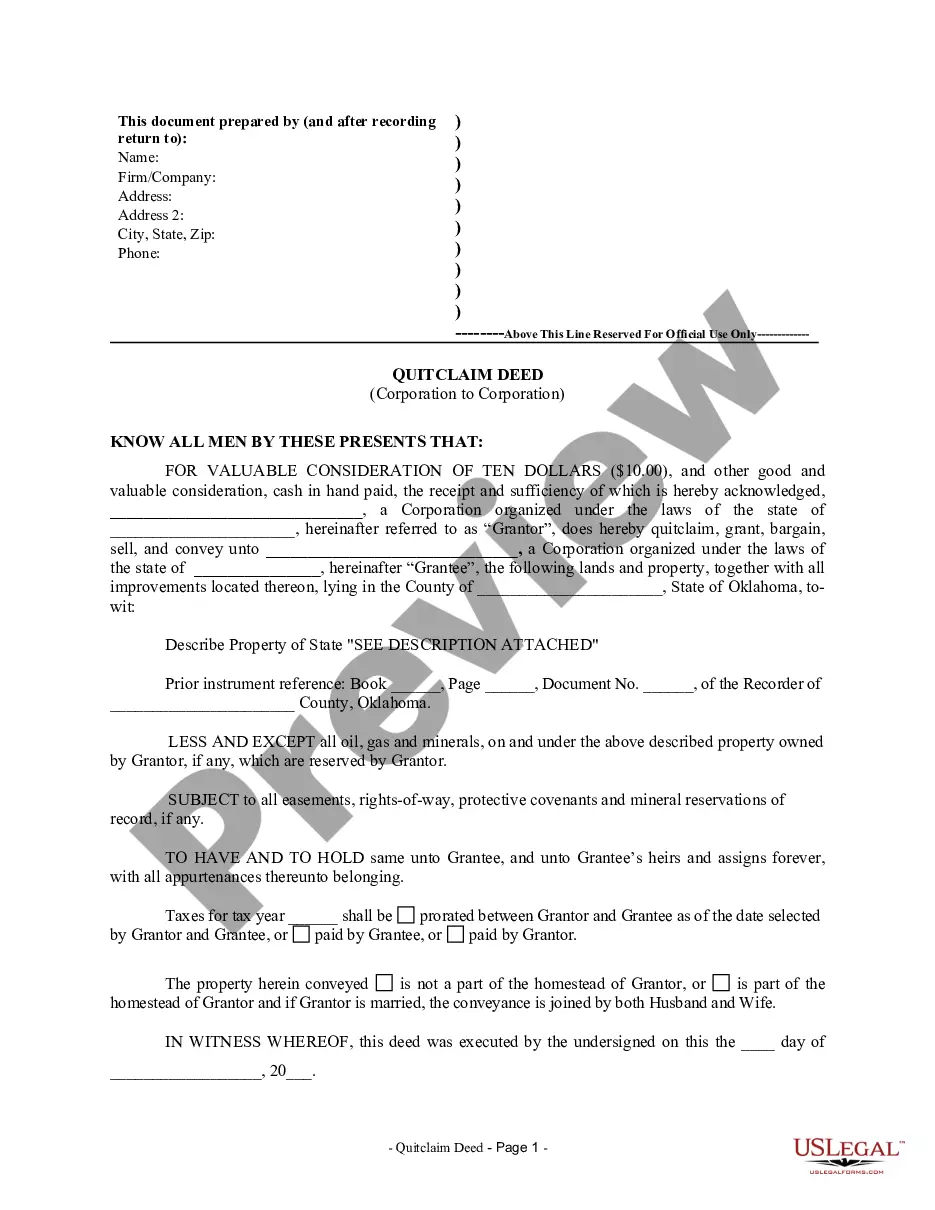

This Quitclaim Deed from Corporation to Corporation form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a corporation. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Broken Arrow Oklahoma quitclaim deed from corporation to corporation is a legal document used to transfer ownership of real estate or property within the city of Broken Arrow from one corporation to another. This type of quitclaim deed is commonly utilized when a corporation wants to transfer its interest in a property to another corporate entity without making any guarantees about the property's title. The Broken Arrow Oklahoma quitclaim deed from corporation to corporation ensures that any interest or rights held by the transferring corporation are passed onto the receiving corporation. However, it does not guarantee that the title is clear or free from any encumbrances. This means that the receiving corporation takes the property as-is, assuming all risks and liabilities associated with the property. When dealing with a Broken Arrow Oklahoma quitclaim deed from corporation to corporation, it's important to distinguish different types based on the purpose of the transfer. Some common variations include: 1. General Quitclaim Deed: This is the most basic type of quitclaim deed used to transfer property ownership between corporations. It conveys the transferring corporation's entire interest in the property to the receiving corporation, without any warranties or guarantees. 2. Quitclaim Deed with Special Conditions: In some cases, additional conditions or stipulations may be added to the quitclaim deed. These conditions can include restrictions on the property's use, obligations regarding maintenance, or specific terms that both corporations agree to abide by. 3. Assumption Quitclaim Deed: This type of quitclaim deed is used when the receiving corporation agrees to assume specific liabilities or obligations associated with the property, such as outstanding mortgages, taxes, or other encumbrances. 4. Partial Quitclaim Deed: A partial quitclaim deed is employed when only a portion of the transferring corporation's interest in a property is being conveyed to the receiving corporation. This could include transferring a specific portion of land or subdividing a property into different parcels. It's essential for both corporations involved in the quitclaim deed transaction to seek legal advice and ensure that the deed is properly drafted and executed. This helps safeguard their respective interests and protects against potential disputes or unforeseen issues down the line.A Broken Arrow Oklahoma quitclaim deed from corporation to corporation is a legal document used to transfer ownership of real estate or property within the city of Broken Arrow from one corporation to another. This type of quitclaim deed is commonly utilized when a corporation wants to transfer its interest in a property to another corporate entity without making any guarantees about the property's title. The Broken Arrow Oklahoma quitclaim deed from corporation to corporation ensures that any interest or rights held by the transferring corporation are passed onto the receiving corporation. However, it does not guarantee that the title is clear or free from any encumbrances. This means that the receiving corporation takes the property as-is, assuming all risks and liabilities associated with the property. When dealing with a Broken Arrow Oklahoma quitclaim deed from corporation to corporation, it's important to distinguish different types based on the purpose of the transfer. Some common variations include: 1. General Quitclaim Deed: This is the most basic type of quitclaim deed used to transfer property ownership between corporations. It conveys the transferring corporation's entire interest in the property to the receiving corporation, without any warranties or guarantees. 2. Quitclaim Deed with Special Conditions: In some cases, additional conditions or stipulations may be added to the quitclaim deed. These conditions can include restrictions on the property's use, obligations regarding maintenance, or specific terms that both corporations agree to abide by. 3. Assumption Quitclaim Deed: This type of quitclaim deed is used when the receiving corporation agrees to assume specific liabilities or obligations associated with the property, such as outstanding mortgages, taxes, or other encumbrances. 4. Partial Quitclaim Deed: A partial quitclaim deed is employed when only a portion of the transferring corporation's interest in a property is being conveyed to the receiving corporation. This could include transferring a specific portion of land or subdividing a property into different parcels. It's essential for both corporations involved in the quitclaim deed transaction to seek legal advice and ensure that the deed is properly drafted and executed. This helps safeguard their respective interests and protects against potential disputes or unforeseen issues down the line.