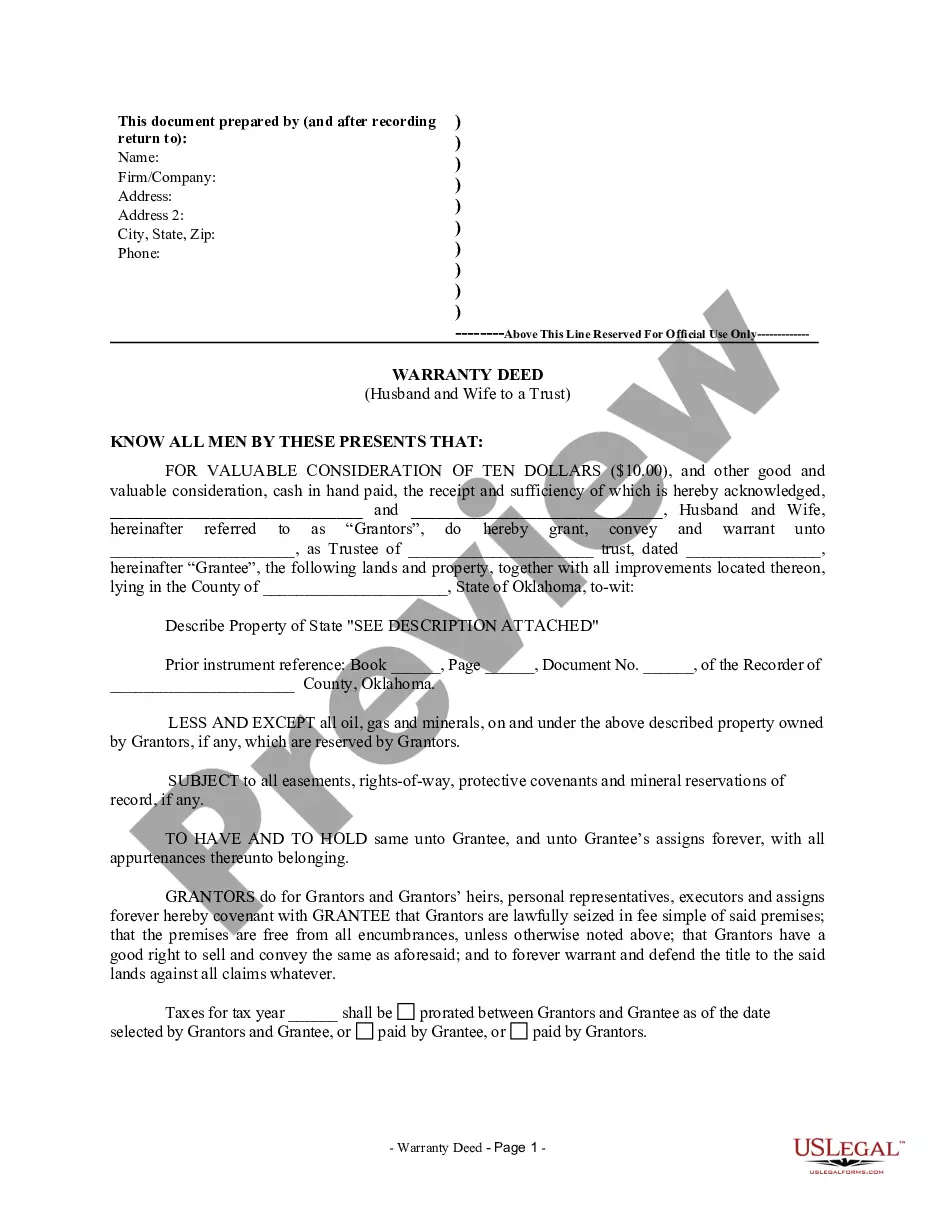

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A warranty deed is a legal document used in real estate transactions to transfer ownership of a property from one party to another. In Oklahoma City, Oklahoma, a husband and wife may use a warranty deed to transfer their property to a trust, which can provide various benefits in terms of estate planning and asset protection. This type of transfer is commonly executed when individuals want to protect their property for future generations or streamline the transfer of assets upon their passing. The Oklahoma City Oklahoma Warranty Deed from Husband and Wife to a Trust comes in different variations depending on the specific circumstances and objectives of the parties involved. Some notable types include: 1. Revocable Living Trust Warranty Deed: This deed is commonly used when a husband and wife want to transfer their property into a revocable living trust, also known as a family trust or inter vivos trust. By transferring ownership into the trust, the property can be managed and controlled by the trust's terms during the granters' lifetime. This allows for easy transfer of ownership to beneficiaries upon the granters' death, avoiding probate. 2. Irrevocable Trust Warranty Deed: An irrevocable trust is established when the granters want to relinquish ownership and control of the property. This type of trust can offer additional asset protection and tax advantages; however, it also means that the granters cannot change or revoke the trust once it is established. 3. Special Needs Trust Warranty Deed: If a husband and wife have a child with special needs, they may consider transferring their property into a special needs trust. This type of trust aims to protect the child's eligibility for government benefits while still providing for their supplemental needs. The warranty deed used in this case will specifically reference the creation of a special needs trust. 4. Charitable Remainder Trust Warranty Deed: In situations where a husband and wife wish to donate their property to charity while retaining income during their lifetime, they can establish a charitable remainder trust. The property transfer is done through a warranty deed, indicating the granters' intention to contribute the property to the trust and receive an income stream from the trust's assets. Regardless of the specific type, an Oklahoma City Oklahoma Warranty Deed from Husband and Wife to a Trust will typically contain essential information such as the names and addresses of the granters and trustees, a detailed legal description of the property being transferred, any specific conditions or restrictions imposed on the trust, and the signatures of all parties involved, which must be notarized for the deed to be legally binding. Executing a warranty deed transferring property to a trust is a strategic decision that should be made in consultation with legal and financial professionals. Properly completing and recording the deed is vital to ensure a smooth and valid transfer of ownership and to benefit from the intended advantages associated with the trust structure.A warranty deed is a legal document used in real estate transactions to transfer ownership of a property from one party to another. In Oklahoma City, Oklahoma, a husband and wife may use a warranty deed to transfer their property to a trust, which can provide various benefits in terms of estate planning and asset protection. This type of transfer is commonly executed when individuals want to protect their property for future generations or streamline the transfer of assets upon their passing. The Oklahoma City Oklahoma Warranty Deed from Husband and Wife to a Trust comes in different variations depending on the specific circumstances and objectives of the parties involved. Some notable types include: 1. Revocable Living Trust Warranty Deed: This deed is commonly used when a husband and wife want to transfer their property into a revocable living trust, also known as a family trust or inter vivos trust. By transferring ownership into the trust, the property can be managed and controlled by the trust's terms during the granters' lifetime. This allows for easy transfer of ownership to beneficiaries upon the granters' death, avoiding probate. 2. Irrevocable Trust Warranty Deed: An irrevocable trust is established when the granters want to relinquish ownership and control of the property. This type of trust can offer additional asset protection and tax advantages; however, it also means that the granters cannot change or revoke the trust once it is established. 3. Special Needs Trust Warranty Deed: If a husband and wife have a child with special needs, they may consider transferring their property into a special needs trust. This type of trust aims to protect the child's eligibility for government benefits while still providing for their supplemental needs. The warranty deed used in this case will specifically reference the creation of a special needs trust. 4. Charitable Remainder Trust Warranty Deed: In situations where a husband and wife wish to donate their property to charity while retaining income during their lifetime, they can establish a charitable remainder trust. The property transfer is done through a warranty deed, indicating the granters' intention to contribute the property to the trust and receive an income stream from the trust's assets. Regardless of the specific type, an Oklahoma City Oklahoma Warranty Deed from Husband and Wife to a Trust will typically contain essential information such as the names and addresses of the granters and trustees, a detailed legal description of the property being transferred, any specific conditions or restrictions imposed on the trust, and the signatures of all parties involved, which must be notarized for the deed to be legally binding. Executing a warranty deed transferring property to a trust is a strategic decision that should be made in consultation with legal and financial professionals. Properly completing and recording the deed is vital to ensure a smooth and valid transfer of ownership and to benefit from the intended advantages associated with the trust structure.