This form is a Correction Deed whereby the Grantor and Grantee correct a matter of "mutual" mistake in a prior mineral deed. This deed complies with all state statutory laws.

Oklahoma City Oklahoma Correction Mineral Deed

Description

How to fill out Oklahoma Correction Mineral Deed?

Utilize the US Legal Forms and obtain instant access to any form sample you require.

Our advantageous platform with a vast number of templates simplifies the process of discovering and acquiring nearly any document sample you desire.

You can export, complete, and validate the Oklahoma City Oklahoma Correction Mineral Deed in just a few minutes instead of browsing the Internet for hours searching for an appropriate template.

Employing our catalog is an excellent method to enhance the security of your form submissions.

The Download button will be activated on all the documents you view. Additionally, you can find all the previously saved records in the My documents section.

If you haven't created a profile yet, follow the steps outlined below.

- Our expert legal professionals routinely review all the records to ensure that the forms are pertinent to a specific region and adhere to new laws and regulations.

- How can you acquire the Oklahoma City Oklahoma Correction Mineral Deed.

- If you possess an account, simply Log In to your profile.

Form popularity

FAQ

How do I find mineral rights I own? The only way to determine mineral rights ownership in Oklahoma is to do a title search at the courthouse where the property is located. To do this, you must review all deeds and other legal conveyances pertaining to the subject tract back to 1907.

Mineral rights owners have five years to claim the funds before they are transferred into the state coffers. Therefore, you should always keep mineral rights records updated. If you want to buy or sell Oklahoma mineral rights, you need to first verify ownership.

These rights have not been granted indefinitely, but for a term of years as defined in the Lease. For example, your lease may contain a three year term. This means that if no well to produce your mineral interest is drilled, the lease will expire when three years have passed.

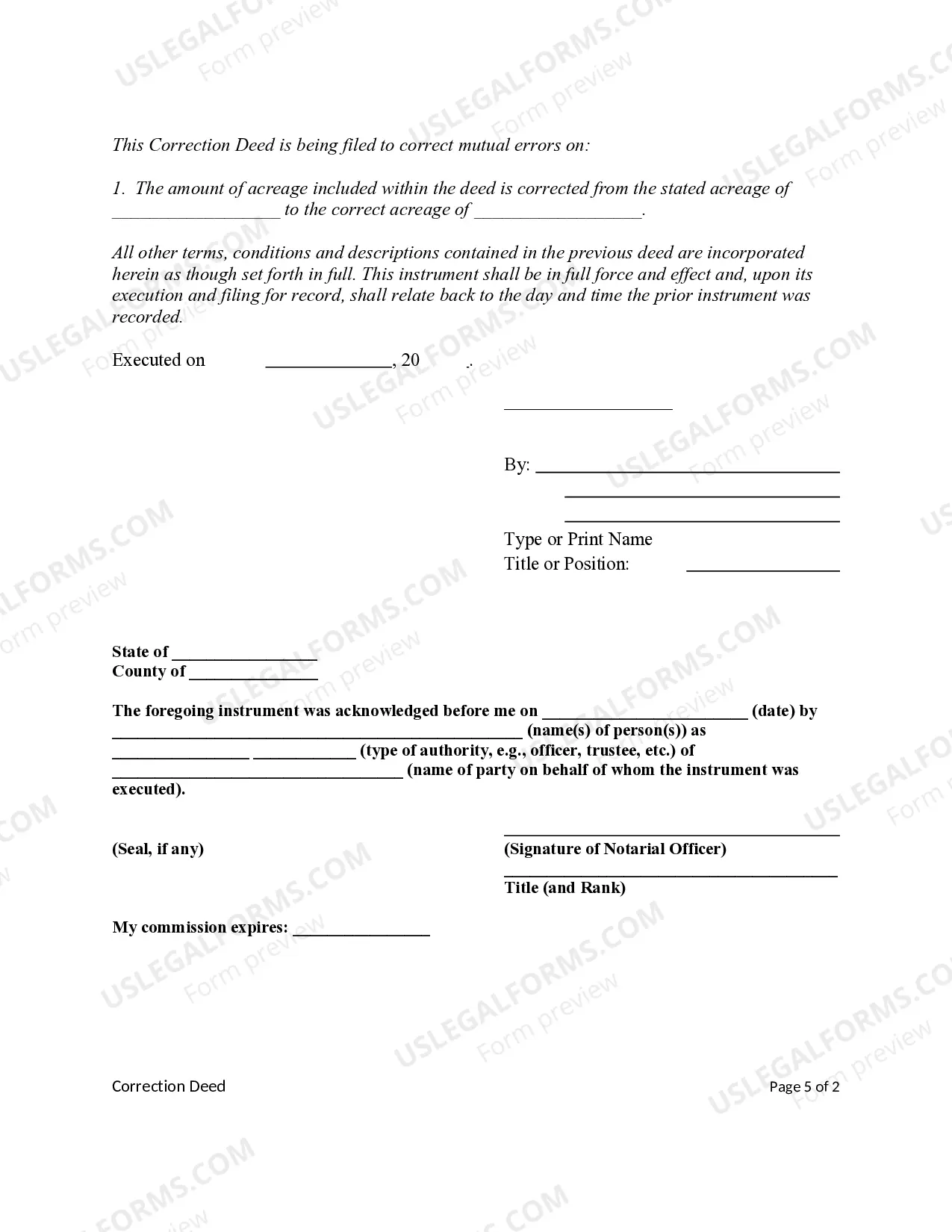

In Oklahoma, use a correction deed to amend a previously recorded deed that contains a minor error. A corrective deed is, in effect, an explanation and correction of an error in a prior instrument. As such, it passes no title and, except for the corrected item, reiterates and confirms the prior conveyance.

After a divorce, mineral rights can be transferred by submitting the divorce decree and conveyances to the county (where the minerals are located) for recording. They usually go to the same agency that records titles and property deeds. The county will return the recorded original documents to the new owner.

Since mineral rights are treated as real estate in Oklahoma, mineral rights in Oklahoma are considered real property.

Oklahoma law allows for certain mineral interests to be transferred by filing an affidavit in the county real estate records.