A Broken Arrow Oklahoma Quitclaim Deed by Two Individuals to LLC refers to a legal document that allows two individuals to transfer their ownership rights, interests, and claims in a property located in Broken Arrow, Oklahoma, to a Limited Liability Company (LLC). This type of deed offers a quick and uncomplicated way for individuals to transfer their property rights without making any warranties or guarantees about the property's title or condition. The Broken Arrow Oklahoma Quitclaim Deed by Two Individuals to LLC is commonly used in scenarios such as partnerships or joint ventures where two individuals decide to transfer the property to an LLC they both established. By doing so, they consolidate their property interests under the legal framework of the LLC, which often provides various advantages, including liability protection, tax benefits, and ease of management. There may be several types of Broken Arrow Oklahoma Quitclaim Deed by Two Individuals to LLC, depending on specific circumstances or additional requirements. Some of these variations may include: 1. Voluntary Transfer: This refers to a situation where the two individuals willingly choose to transfer their property rights to the LLC, with mutual consent and understanding. This type of deed is commonly used when individuals decide to convert their personal property into a business asset under the LLC's ownership. 2. Inheritance Transfer: In the case of inherited property, if two individuals become co-owners and decide to establish an LLC to oversee the management or development of the property, they may use a quitclaim deed to transfer their respective ownership interests to the LLC. 3. Domestic Partnership Conversion: When two individuals in a domestic partnership decide to transition their jointly owned property into an LLC-owned asset, they can utilize a quitclaim deed to transfer their interests. This type of transfer may be beneficial for estate planning, tax purposes, or simplifying property management. 4. Divorce Settlement: In the event of a divorce, if both parties agree to transfer their shared property to an LLC as part of a divorce settlement agreement, a quitclaim deed can be employed. This deed facilitates the division of property rights and the dissolution of a jointly owned asset. It is important for individuals considering a Broken Arrow Oklahoma Quitclaim Deed by Two Individuals to LLC to seek legal advice or consult with a real estate professional to understand the specific legal requirements and implications associated with this type of property transfer.

Broken Arrow Oklahoma Quitclaim Deed by Two Individuals to LLC

State:

Oklahoma

City:

Broken Arrow

Control #:

OK-04-77

Format:

Word;

Rich Text

Instant download

Description

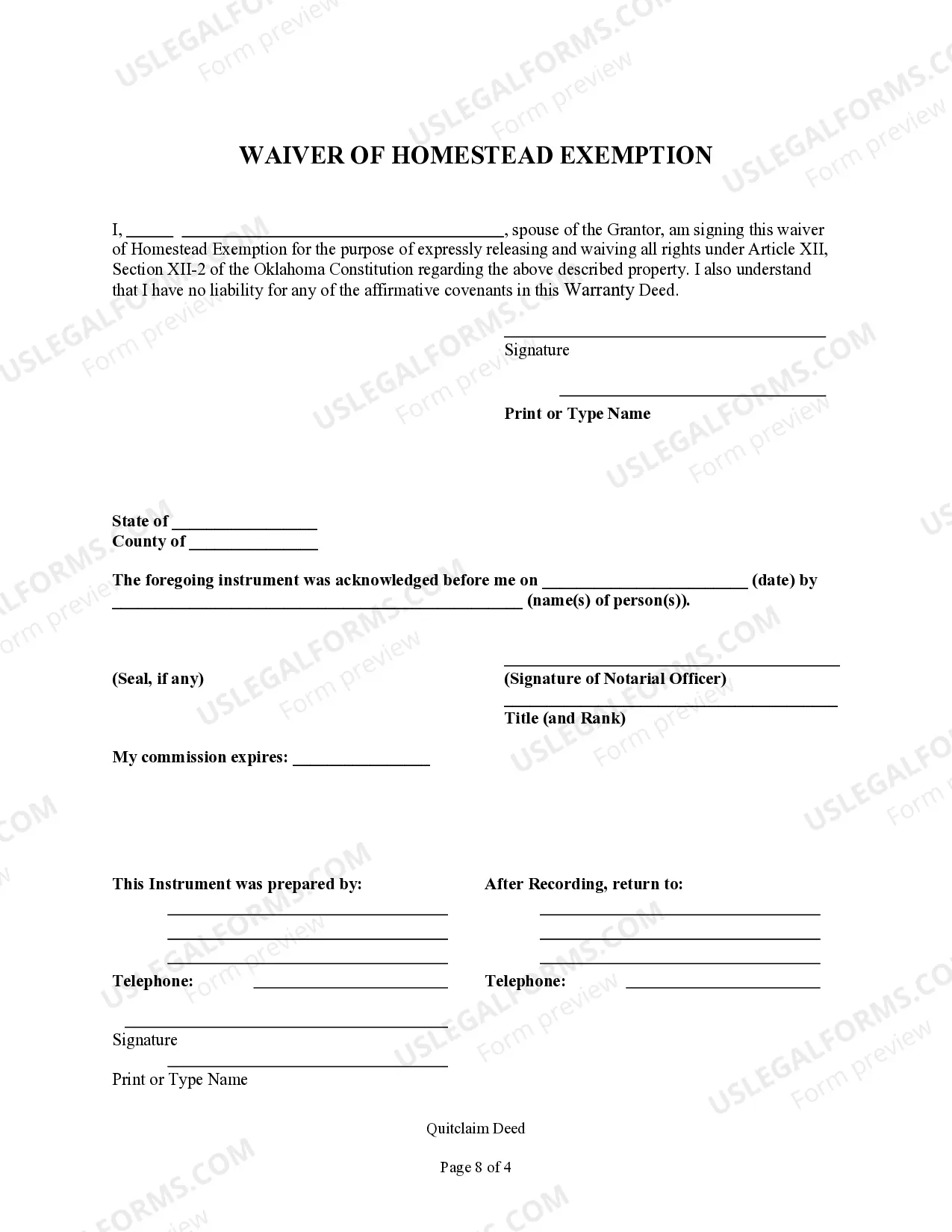

This Quitclaim Deed is used where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and quitclaim the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This form complies with all state statutory laws.

A Broken Arrow Oklahoma Quitclaim Deed by Two Individuals to LLC refers to a legal document that allows two individuals to transfer their ownership rights, interests, and claims in a property located in Broken Arrow, Oklahoma, to a Limited Liability Company (LLC). This type of deed offers a quick and uncomplicated way for individuals to transfer their property rights without making any warranties or guarantees about the property's title or condition. The Broken Arrow Oklahoma Quitclaim Deed by Two Individuals to LLC is commonly used in scenarios such as partnerships or joint ventures where two individuals decide to transfer the property to an LLC they both established. By doing so, they consolidate their property interests under the legal framework of the LLC, which often provides various advantages, including liability protection, tax benefits, and ease of management. There may be several types of Broken Arrow Oklahoma Quitclaim Deed by Two Individuals to LLC, depending on specific circumstances or additional requirements. Some of these variations may include: 1. Voluntary Transfer: This refers to a situation where the two individuals willingly choose to transfer their property rights to the LLC, with mutual consent and understanding. This type of deed is commonly used when individuals decide to convert their personal property into a business asset under the LLC's ownership. 2. Inheritance Transfer: In the case of inherited property, if two individuals become co-owners and decide to establish an LLC to oversee the management or development of the property, they may use a quitclaim deed to transfer their respective ownership interests to the LLC. 3. Domestic Partnership Conversion: When two individuals in a domestic partnership decide to transition their jointly owned property into an LLC-owned asset, they can utilize a quitclaim deed to transfer their interests. This type of transfer may be beneficial for estate planning, tax purposes, or simplifying property management. 4. Divorce Settlement: In the event of a divorce, if both parties agree to transfer their shared property to an LLC as part of a divorce settlement agreement, a quitclaim deed can be employed. This deed facilitates the division of property rights and the dissolution of a jointly owned asset. It is important for individuals considering a Broken Arrow Oklahoma Quitclaim Deed by Two Individuals to LLC to seek legal advice or consult with a real estate professional to understand the specific legal requirements and implications associated with this type of property transfer.

Free preview

How to fill out Broken Arrow Oklahoma Quitclaim Deed By Two Individuals To LLC?

If you’ve already used our service before, log in to your account and download the Broken Arrow Oklahoma Quitclaim Deed by Two Individuals to LLC on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Ensure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Broken Arrow Oklahoma Quitclaim Deed by Two Individuals to LLC. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!