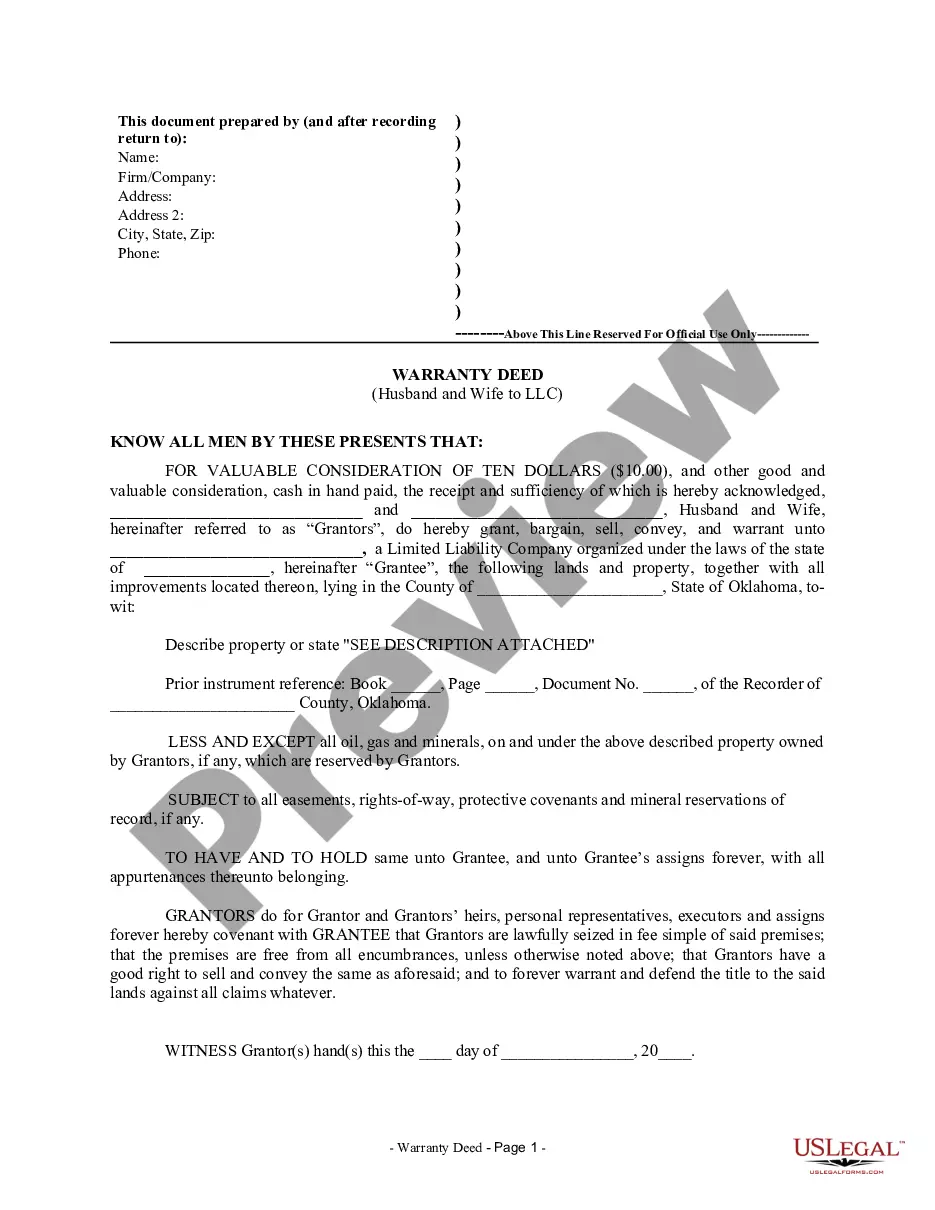

A Broken Arrow Oklahoma Warranty Deed from Husband and Wife to LLC is a legal document that facilitates the transfer of ownership of real property from a married couple to a limited liability company (LLC) in Broken Arrow, Oklahoma. The warranty deed serves as an assurance that the property being transferred is free from any encumbrances or claims, providing the LLC with a clear title to the property. This type of transfer is commonly employed when the couple wants to protect their property by establishing a separate legal entity, the LLC, to oversee its management and operation. There are two main types of Broken Arrow Oklahoma Warranty Deed from Husband and Wife to LLC: 1. General Warranty Deed: A general warranty deed offers the highest level of protection for the LLC. It guarantees that the property is free of defects in title, providing the LLC with full legal ownership and protection against any future claims or disputes. This type of warranty deed provides the LLC with the greatest peace of mind when acquiring the property. 2. Special Warranty Deed: A special warranty deed, also known as a limited warranty deed, offers a more limited level of protection compared to a general warranty deed. It ensures that the property has been free from any defects or claims during the couple's ownership, but it does not cover any previous claims or issues that might have occurred before they acquired the property. As a result, the LLC assumes the risk of any potential pre-existing encumbrances or defects with the property. In both cases, the Broken Arrow Oklahoma Warranty Deed from Husband and Wife to LLC should include the legal names of the transferring couple, the LLC's legal name and address, a detailed description of the property being transferred (including its physical address and legal description), and any additional terms or conditions agreed upon by the parties involved in the transfer. By executing a Broken Arrow Oklahoma Warranty Deed from Husband and Wife to LLC, the transferring couple ensures a legally sound and secure transfer of their property to the LLC, safeguarding their investment and providing the LLC with proper ownership rights.

Broken Arrow Oklahoma Warranty Deed from Husband and Wife to LLC

Description

How to fill out Broken Arrow Oklahoma Warranty Deed From Husband And Wife To LLC?

Finding verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Broken Arrow Oklahoma Warranty Deed from Husband and Wife to LLC becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Broken Arrow Oklahoma Warranty Deed from Husband and Wife to LLC takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few additional actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make sure you’ve picked the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Broken Arrow Oklahoma Warranty Deed from Husband and Wife to LLC. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form popularity

FAQ

To add your spouse to your warranty deed, you must fill out a new deed that includes both names, then file it with the county clerk's office. It's essential to follow the specific regulations of Broken Arrow, Oklahoma. Services like USLegalForms offer easy-to-follow instructions for creating a new warranty deed appropriately.

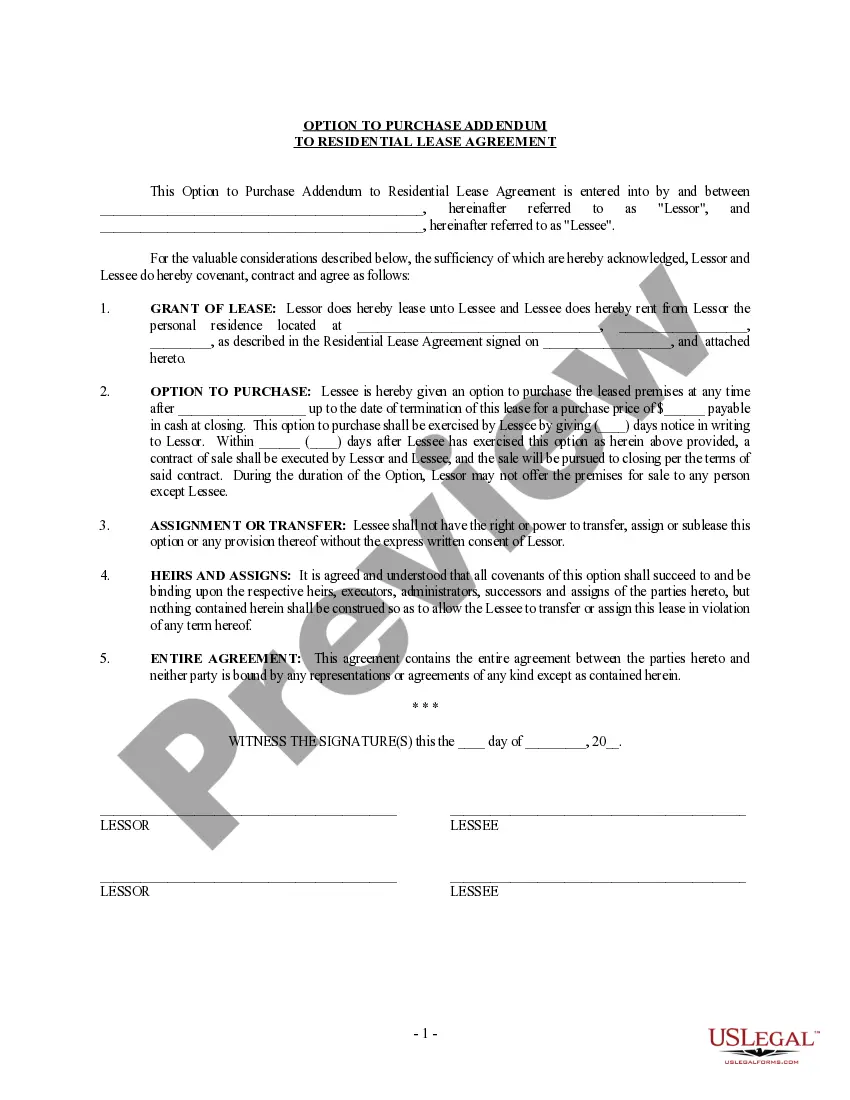

Yes, you can transfer a warranty deed as part of property ownership change. This process typically involves drafting a new warranty deed, which identifies the new owner. Utilizing resources like USLegalForms can ensure your Broken Arrow Oklahoma Warranty Deed from Husband and Wife to LLC is handled correctly.

The disadvantages of putting your house in an LLC include potential loss of homestead tax exemptions and increased costs for maintenance and filing fees. Additionally, obtaining financing might become more complex. It’s essential to weigh these factors carefully, especially when completing a Broken Arrow Oklahoma Warranty Deed from Husband and Wife to LLC.

People often place their property in an LLC to protect personal assets from liability and enjoy potential tax benefits. An LLC separates personal ownership from business ownership, providing a layer of legal protection. If you are considering this for a Broken Arrow Oklahoma Warranty Deed from Husband and Wife to LLC, it can be a smart financial strategy.

In Oklahoma, a spouse does not have to be on the deed, but there are implications for property rights. If property is acquired during marriage, it's considered marital property. For a Broken Arrow Oklahoma Warranty Deed from Husband and Wife to LLC, having both spouses on the deed can protect both parties' interests.

To transfer a deed from personal ownership to an LLC, you need to complete and file the appropriate paperwork. This includes a warranty deed that names the LLC as the new owner. Services like USLegalForms can help streamline this process, ensuring your Broken Arrow Oklahoma Warranty Deed from Husband and Wife to LLC is correctly drafted.

Yes, you can transfer a deed without an attorney in Broken Arrow, Oklahoma. However, it is highly recommended to seek legal guidance to ensure all requirements are met. Using platforms like USLegalForms can simplify the process, providing you with the necessary forms and instructions.

Some disadvantages of placing a property in an LLC include ongoing costs for maintaining the business entity and potential complications in obtaining mortgages. You may also face challenges with transferring property if the LLC is complex. Moreover, while a Broken Arrow Oklahoma Warranty Deed from Husband and Wife to LLC can offer protection, it may complicate your tax situation depending on local regulations.

Placing land in an LLC can provide various benefits, including liability protection and ease of ownership transfer. For instance, a Broken Arrow Oklahoma Warranty Deed from Husband and Wife to LLC offers a structured way to manage property while shielding personal assets. Additionally, having land in an LLC can simplify the process for heirs, making estate planning more straightforward.

Transferring a warranty deed involves creating a new deed that expressly states the transfer of ownership. When you prepare a Broken Arrow Oklahoma Warranty Deed from Husband and Wife to LLC, include all necessary information about both the current owners and the LLC. Ensure you sign the new deed and submit it to the county clerk, who will record the transfer in public records.