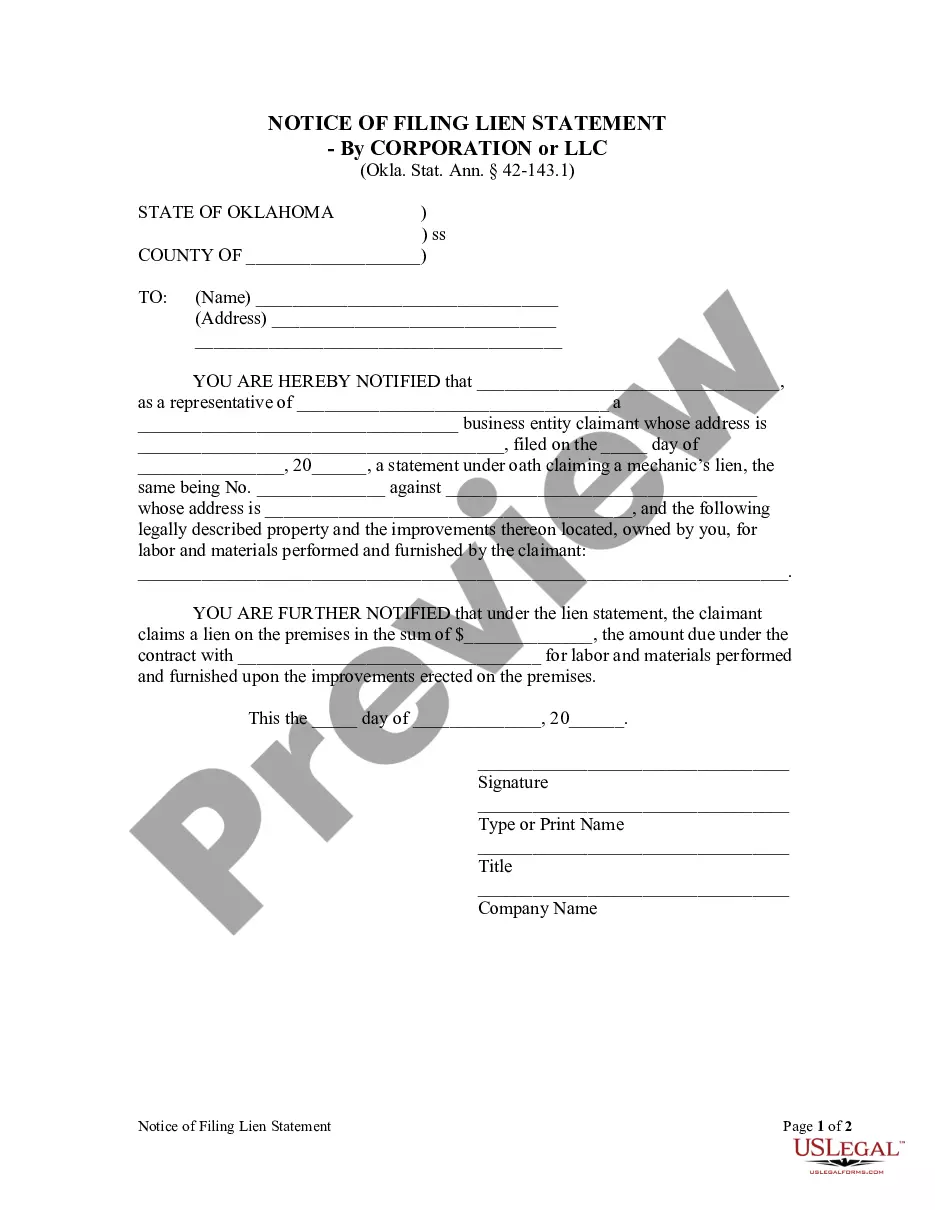

This Notice of Filing Lien Statement form is to be mailed by the county clerk within one business day after the date of filing of the lien statement to the owner of the property on which a lien attaches. This notice provides the claimant's name and address, date of filing, name and address of the person against whom the claim is made, legal description of the property, and the amount claimed.

A Broken Arrow Oklahoma Notice of Filing Lien Statement — Corporation or LLC is a legal document that serves as official notice of a lien being filed against a corporation or limited liability company (LLC) in Broken Arrow, Oklahoma. This document is crucial in protecting the rights and interests of creditors or individuals seeking to recover debts owed by these business entities. When a creditor is unable to collect outstanding debts and believes that a corporation or LLC has the necessary assets to satisfy the debt, they may choose to file a lien statement with the appropriate legal authorities in Broken Arrow, Oklahoma. This lien statement acts as a public record and provides notice to other potential creditors that the corporation or LLC has existing debt obligations. The Broken Arrow Oklahoma Notice of Filing Lien Statement — Corporation or LLC contains vital information to identify both the debtor and the creditor. This includes the legal names and addresses of both parties involved, the amount of debt owed, the date the lien was filed, and any supporting documentation validating the debt. The document further states the specific assets or property against which the lien is being claimed, providing clarity on what the lien encumbers. There are different types of Broken Arrow Oklahoma Notice of Filing Lien Statement — Corporation or LLC, depending on the purpose for which the lien is being filed. Some common types of liens include: 1. Mechanic's Lien: When contractors, subcontractors, or suppliers provide labor, materials, or services for construction projects involving corporations or LCS and remain unpaid, they can file a mechanic's lien to secure their rights to seek payment from the value of the improved property. 2. Judgment Lien: If a creditor successfully obtains a legal judgment against a corporation or LLC through litigation or court proceedings, they can file a judgment lien to ensure the debt is satisfied. 3. Tax Lien: When a corporation or LLC fails to pay their federal or state taxes, the respective tax agency can file a tax lien to secure the outstanding tax debt. This lien takes priority over most other liens, making it of the utmost importance to be resolved. 4. UCC Lien: Under the Uniform Commercial Code (UCC), a creditor who extends credit to a corporation or LLC may file a UCC lien against the debtor's assets as collateral for the debt. This type of lien provides notice to other creditors and ensures priority in the event of bankruptcy or default. It is essential for creditors to follow the proper procedures and adhere to the legal requirements when filing a Broken Arrow Oklahoma Notice of Filing Lien Statement — Corporation or LLC. Working with an experienced attorney or legal professional familiar with the processes and regulations is highly recommended ensuring accuracy and maximize the chances of realizing the debts owed.A Broken Arrow Oklahoma Notice of Filing Lien Statement — Corporation or LLC is a legal document that serves as official notice of a lien being filed against a corporation or limited liability company (LLC) in Broken Arrow, Oklahoma. This document is crucial in protecting the rights and interests of creditors or individuals seeking to recover debts owed by these business entities. When a creditor is unable to collect outstanding debts and believes that a corporation or LLC has the necessary assets to satisfy the debt, they may choose to file a lien statement with the appropriate legal authorities in Broken Arrow, Oklahoma. This lien statement acts as a public record and provides notice to other potential creditors that the corporation or LLC has existing debt obligations. The Broken Arrow Oklahoma Notice of Filing Lien Statement — Corporation or LLC contains vital information to identify both the debtor and the creditor. This includes the legal names and addresses of both parties involved, the amount of debt owed, the date the lien was filed, and any supporting documentation validating the debt. The document further states the specific assets or property against which the lien is being claimed, providing clarity on what the lien encumbers. There are different types of Broken Arrow Oklahoma Notice of Filing Lien Statement — Corporation or LLC, depending on the purpose for which the lien is being filed. Some common types of liens include: 1. Mechanic's Lien: When contractors, subcontractors, or suppliers provide labor, materials, or services for construction projects involving corporations or LCS and remain unpaid, they can file a mechanic's lien to secure their rights to seek payment from the value of the improved property. 2. Judgment Lien: If a creditor successfully obtains a legal judgment against a corporation or LLC through litigation or court proceedings, they can file a judgment lien to ensure the debt is satisfied. 3. Tax Lien: When a corporation or LLC fails to pay their federal or state taxes, the respective tax agency can file a tax lien to secure the outstanding tax debt. This lien takes priority over most other liens, making it of the utmost importance to be resolved. 4. UCC Lien: Under the Uniform Commercial Code (UCC), a creditor who extends credit to a corporation or LLC may file a UCC lien against the debtor's assets as collateral for the debt. This type of lien provides notice to other creditors and ensures priority in the event of bankruptcy or default. It is essential for creditors to follow the proper procedures and adhere to the legal requirements when filing a Broken Arrow Oklahoma Notice of Filing Lien Statement — Corporation or LLC. Working with an experienced attorney or legal professional familiar with the processes and regulations is highly recommended ensuring accuracy and maximize the chances of realizing the debts owed.