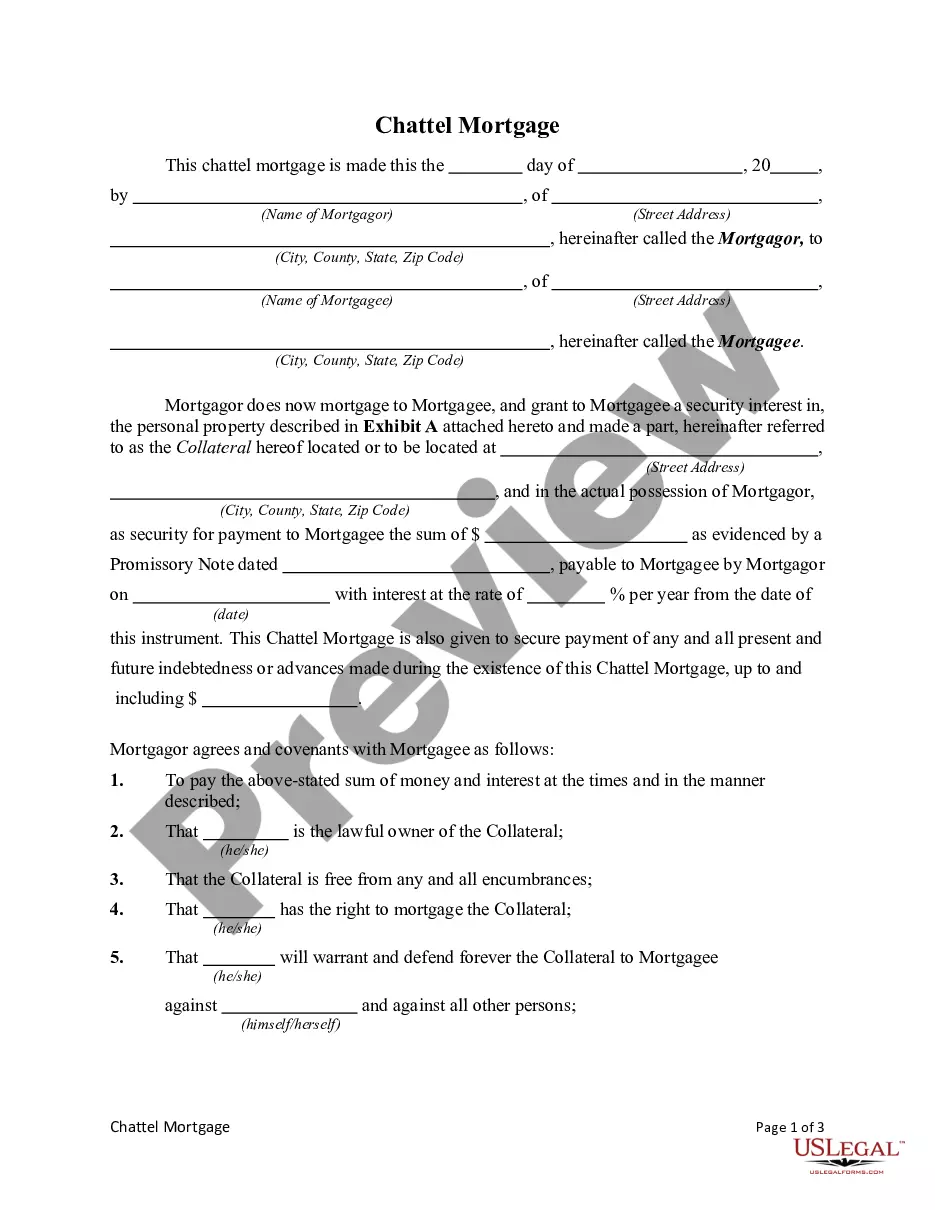

Broken Arrow, Oklahoma Chattel Mortgage: A Comprehensive Guide In Broken Arrow, Oklahoma, chattel mortgage refers to a type of loan secured by movable personal property, excluding real estate. It is an agreement between a borrower (the chattel owner) and a lender, where the borrower pledges specific personal belongings as collateral for the loan. The lender retains an interest in the chattel until the debt is repaid in full, acting as security against default. Chattel mortgages are commonly used by individuals and businesses in Broken Arrow, Oklahoma, to access funds while keeping their personal property intact. Types of Chattel Mortgage in Broken Arrow, Oklahoma: 1. Automotive Chattel Mortgage: This form of chattel mortgage pertains to loans secured by movable vehicles, such as cars, motorcycles, trucks, or trailers. In Broken Arrow, Oklahoma, automotive chattel mortgages allow individuals or businesses to acquire funds while retaining possession and use of the financed vehicle. The lender maintains a lien on the vehicle until the loan is fully repaid. 2. Agricultural Chattel Mortgage: Broken Arrow, Oklahoma also offers agricultural chattel mortgages, which are designed to support farmers and agricultural businesses. The loan is secured against movable assets used in farming operations, including livestock, crops, machinery, or equipment. Agricultural chattel mortgages provide essential financing options for Broken Arrow's agricultural sector, enabling farmers to invest in their operations. 3. Equipment Chattel Mortgage: This type of chattel mortgage is specifically tailored for businesses in Broken Arrow, Oklahoma, aiming to finance equipment necessary for their operations. It allows businesses to use their machinery, tools, or other equipment as collateral for the loan, without losing its possession. Such mortgages assist enterprises in acquiring or upgrading essential equipment, bolstering their productivity and growth. 4. Personal Chattel Mortgage: Individuals in Broken Arrow, Oklahoma, can also utilize personal chattel mortgages to obtain loans while pledging movable assets as security. Personal items like jewelry, collectibles, art, or high-value electronics can be used as collateral. These mortgages provide individuals with financial flexibility without selling their valuable possessions. By offering a wide range of chattel mortgages, Broken Arrow, Oklahoma caters to the diverse needs of individuals and businesses alike. Whether it's accessing funds for purchasing a vehicle, expanding farming operations, acquiring equipment, or meeting personal financial requirements, chattel mortgages serve as a convenient financing option for the community. It is important to approach reputable lenders in Broken Arrow who can guide borrowers through the process, ensuring a smooth experience while safeguarding their valuable assets.

Broken Arrow Oklahoma Chattel Mortgage

Description

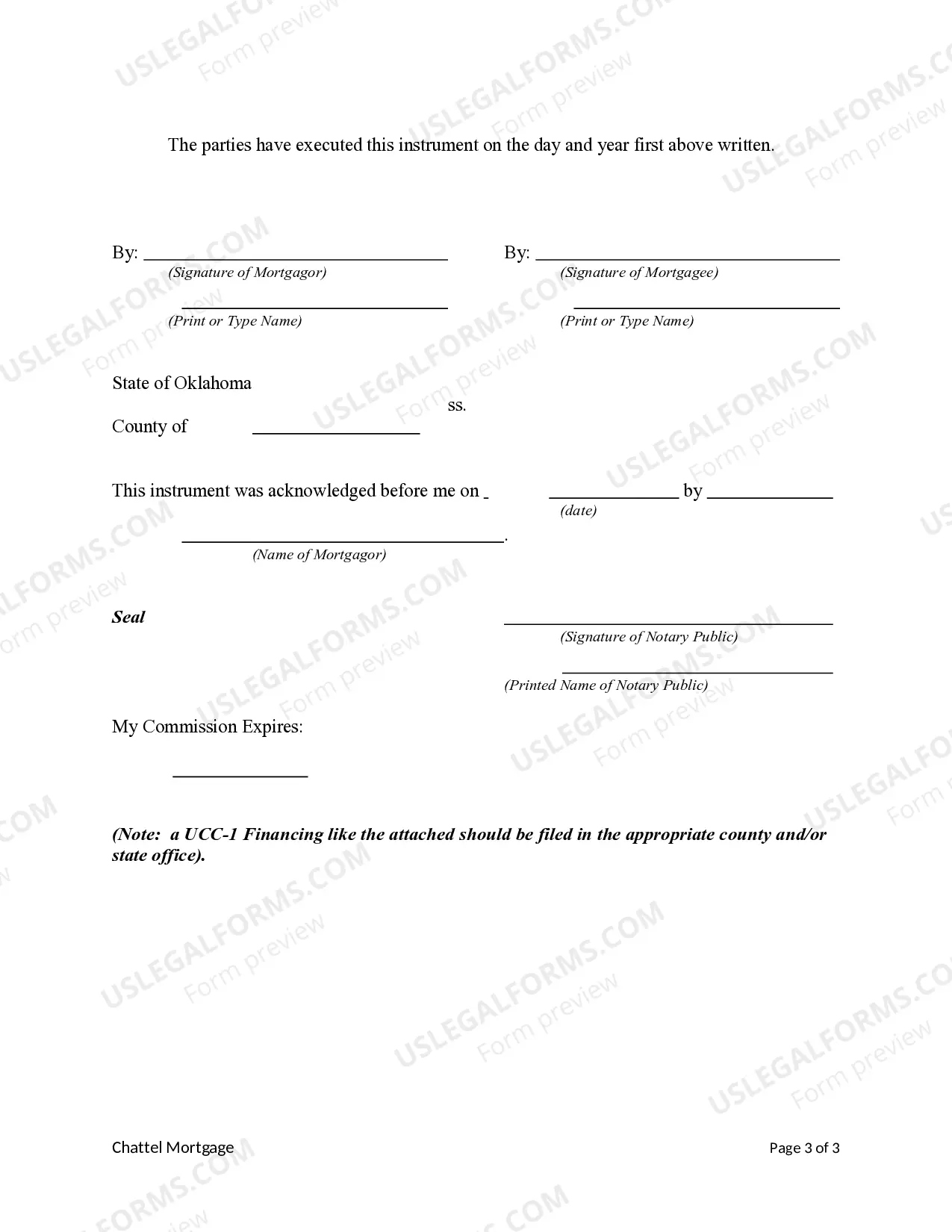

How to fill out Broken Arrow Oklahoma Chattel Mortgage?

Make use of the US Legal Forms and get instant access to any form template you need. Our beneficial platform with a large number of templates makes it simple to find and get almost any document sample you want. It is possible to export, complete, and certify the Broken Arrow Oklahoma Chattel Mortgage in just a few minutes instead of surfing the Net for many hours searching for an appropriate template.

Utilizing our catalog is a great way to improve the safety of your form filing. Our professional lawyers on a regular basis review all the records to make certain that the forms are relevant for a particular state and compliant with new laws and regulations.

How can you obtain the Broken Arrow Oklahoma Chattel Mortgage? If you already have a subscription, just log in to the account. The Download button will appear on all the documents you view. Moreover, you can get all the earlier saved records in the My Forms menu.

If you don’t have an account yet, follow the instructions listed below:

- Open the page with the template you need. Make certain that it is the form you were looking for: examine its name and description, and utilize the Preview option when it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Start the saving procedure. Select Buy Now and select the pricing plan you like. Then, sign up for an account and process your order using a credit card or PayPal.

- Save the document. Pick the format to get the Broken Arrow Oklahoma Chattel Mortgage and revise and complete, or sign it for your needs.

US Legal Forms is among the most extensive and trustworthy template libraries on the web. Our company is always ready to help you in virtually any legal process, even if it is just downloading the Broken Arrow Oklahoma Chattel Mortgage.

Feel free to benefit from our platform and make your document experience as straightforward as possible!