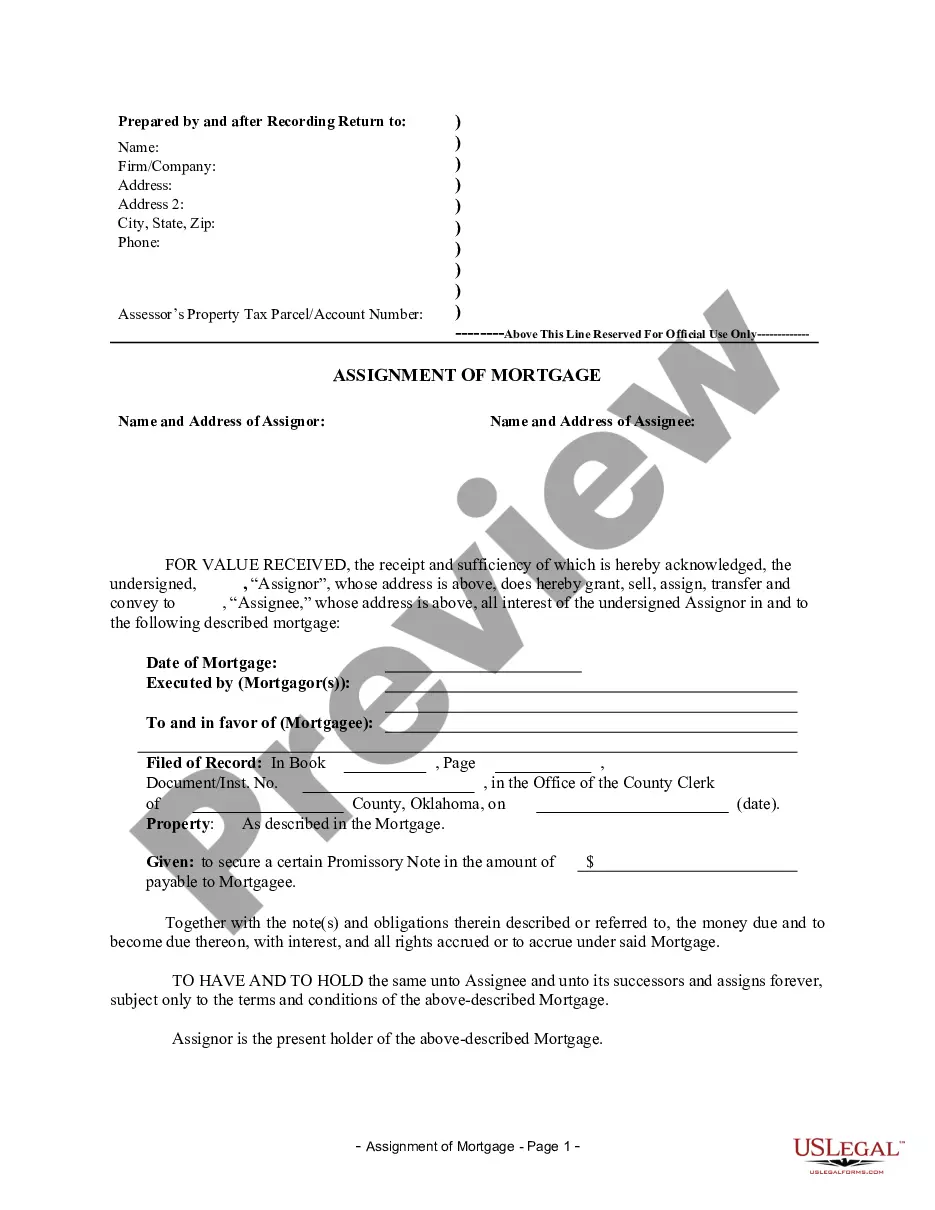

The Broken Arrow Oklahoma Assignment of Mortgage by Individual Mortgage Holder is a legal document used when a mortgage holder transfers their rights and interests in a property to another party. This transfer of rights allows the new party to assume the responsibilities and benefits associated with the mortgage. In Broken Arrow, Oklahoma, there are two main types of Assignment of Mortgage by Individual Mortgage Holder: 1. Voluntary Assignment: This type of assignment occurs when the mortgage holder willingly transfers their interest in the mortgage to another individual or entity. The voluntary assignment is usually done to simplify financial matters, consolidate debts, or in cases where the mortgage holder wants to transfer the mortgage to a family member or a trusted person. 2. Involuntary Assignment: This type of assignment is imposed on the mortgage holder due to unforeseen circumstances, such as bankruptcy, foreclosure, or other legal matters. In these cases, a court may order the assignment of the mortgage to a third party, often a financial institution or a government entity, to facilitate the resolution of financial obligations or to protect the interests of the involved parties. The Broken Arrow Oklahoma Assignment of Mortgage by Individual Mortgage Holder includes essential information related to the transfer of the mortgage rights. This information typically includes: 1. Parties Involved: The names and contact information of the original mortgage holder (assignor) and the party assuming the mortgage rights (assignee). 2. Property Description: Detailed information about the property being mortgaged, such as the address, legal description, and any other pertinent details. 3. Mortgage Details: The exact terms of the mortgage, including the principal amount, interest rate, repayment schedule, and any other relevant contractual obligations. 4. Consideration: The agreed-upon consideration or payment exchanged between the assignor and the assignee for the transfer of the mortgage rights. 5. Acknowledgments: The document may include statements acknowledging that both the assignor and assignee understand the consequences of the assignment and agree to abide by its terms. The Broken Arrow Oklahoma Assignment of Mortgage by Individual Mortgage Holder is crucial in ensuring the smooth transfer of mortgage rights between parties involved. It serves as a legal record that outlines the rights, obligations, and responsibilities of both the assignor and the assignee. Keywords: Broken Arrow Oklahoma, Assignment of Mortgage, Individual Mortgage Holder, voluntary assignment, involuntary assignment, legal document, transfer of rights, financial obligations, property description, mortgage details, consideration, acknowledgments, legal record.

Broken Arrow Oklahoma Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out Broken Arrow Oklahoma Assignment Of Mortgage By Individual Mortgage Holder?

Take advantage of the US Legal Forms and have immediate access to any form sample you want. Our beneficial platform with thousands of templates makes it easy to find and get almost any document sample you will need. You are able to export, complete, and certify the Broken Arrow Oklahoma Assignment of Mortgage by Individual Mortgage Holder in just a couple of minutes instead of surfing the Net for hours seeking a proper template.

Using our catalog is a wonderful strategy to increase the safety of your record filing. Our experienced lawyers regularly review all the documents to make sure that the forms are relevant for a particular region and compliant with new laws and regulations.

How do you get the Broken Arrow Oklahoma Assignment of Mortgage by Individual Mortgage Holder? If you already have a profile, just log in to the account. The Download option will be enabled on all the documents you view. In addition, you can find all the earlier saved documents in the My Forms menu.

If you don’t have a profile yet, stick to the instructions listed below:

- Open the page with the form you require. Make certain that it is the template you were hoping to find: examine its headline and description, and use the Preview feature when it is available. Otherwise, make use of the Search field to find the appropriate one.

- Launch the saving procedure. Click Buy Now and choose the pricing plan that suits you best. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Download the file. Select the format to obtain the Broken Arrow Oklahoma Assignment of Mortgage by Individual Mortgage Holder and revise and complete, or sign it according to your requirements.

US Legal Forms is probably the most extensive and reliable document libraries on the internet. Our company is always happy to assist you in any legal case, even if it is just downloading the Broken Arrow Oklahoma Assignment of Mortgage by Individual Mortgage Holder.

Feel free to make the most of our form catalog and make your document experience as efficient as possible!