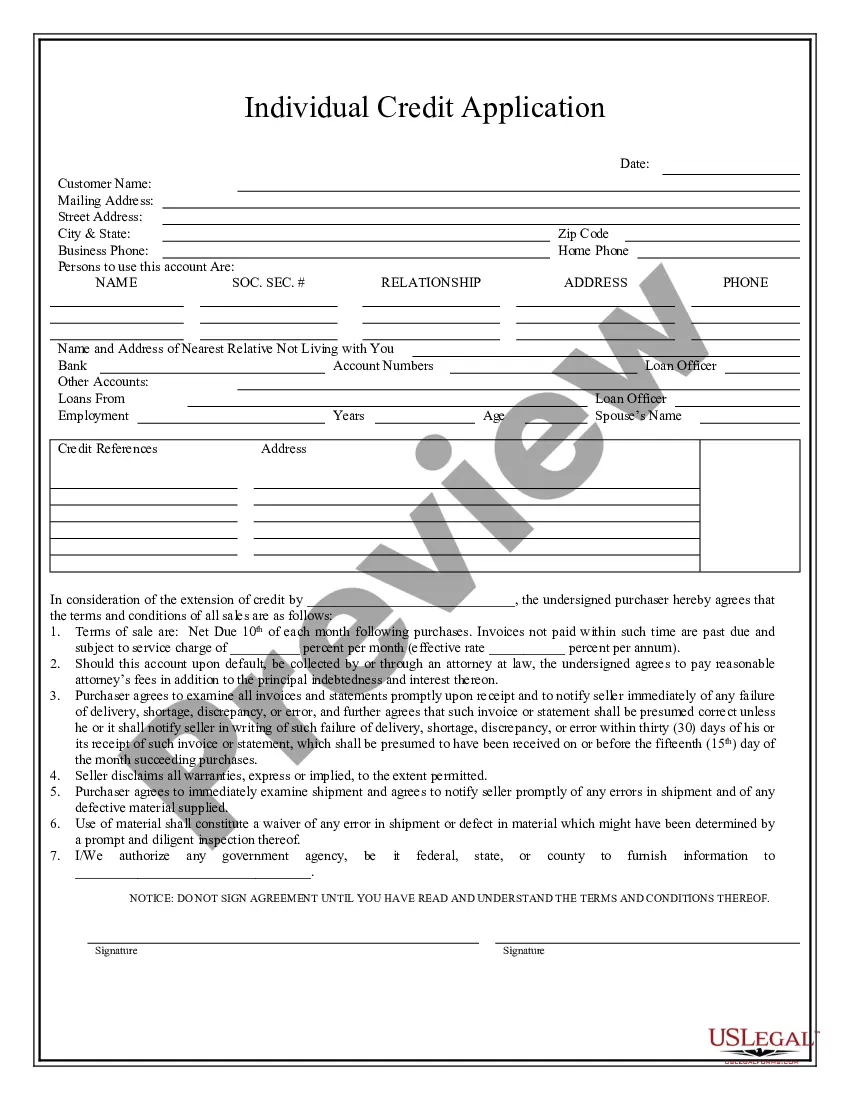

Broken Arrow Oklahoma Individual Credit Application is a comprehensive and detailed form that individuals in Broken Arrow, Oklahoma can fill out to apply for credit. This application is designed to assess an individual's creditworthiness and evaluate their ability to repay borrowed funds responsibly. Keywords: Broken Arrow, Oklahoma, Individual Credit Application, creditworthiness, borrowed funds, responsible repayment, financial assessment, personal information, employment details, credit history. The Broken Arrow Oklahoma Individual Credit Application consists of various sections that require applicants to provide their personal information, employment details, and complete a comprehensive credit history. This information is crucial for lenders as it helps them evaluate the applicant's financial standing and determine their eligibility for obtaining credit. Applicants are required to provide their full name, contact information (including address, phone number, and email address), date of birth, and social security number. They must also disclose their employment status, current employer details, job title, and the length of employment. Furthermore, the credit application requires applicants to provide their monthly income and expenses, including housing costs, transportation expenses, and other financial obligations. This helps lenders gauge the applicant's income-to-debt ratio and determine if they can comfortably handle additional credit. Applicants are also required to furnish details about their previous credit history, including existing loans, mortgages, credit cards, and any bankruptcies or late payments. This information allows lenders to assess the applicant's repayment history and evaluate their creditworthiness. Different types of Broken Arrow Oklahoma Individual Credit Application may include specialized applications for specific types of credit, such as auto loans or home mortgages. These specific applications may have additional sections that require information related to the purpose of the loan, property details, or vehicle specifications. In conclusion, the Broken Arrow Oklahoma Individual Credit Application is a detailed form that serves as a crucial tool for lenders to assess an individual's creditworthiness and determine their eligibility for credit. By providing accurate and complete information, applicants increase their chances of obtaining credit and securing favorable loan terms.

Broken Arrow Oklahoma Individual Credit Application

Description

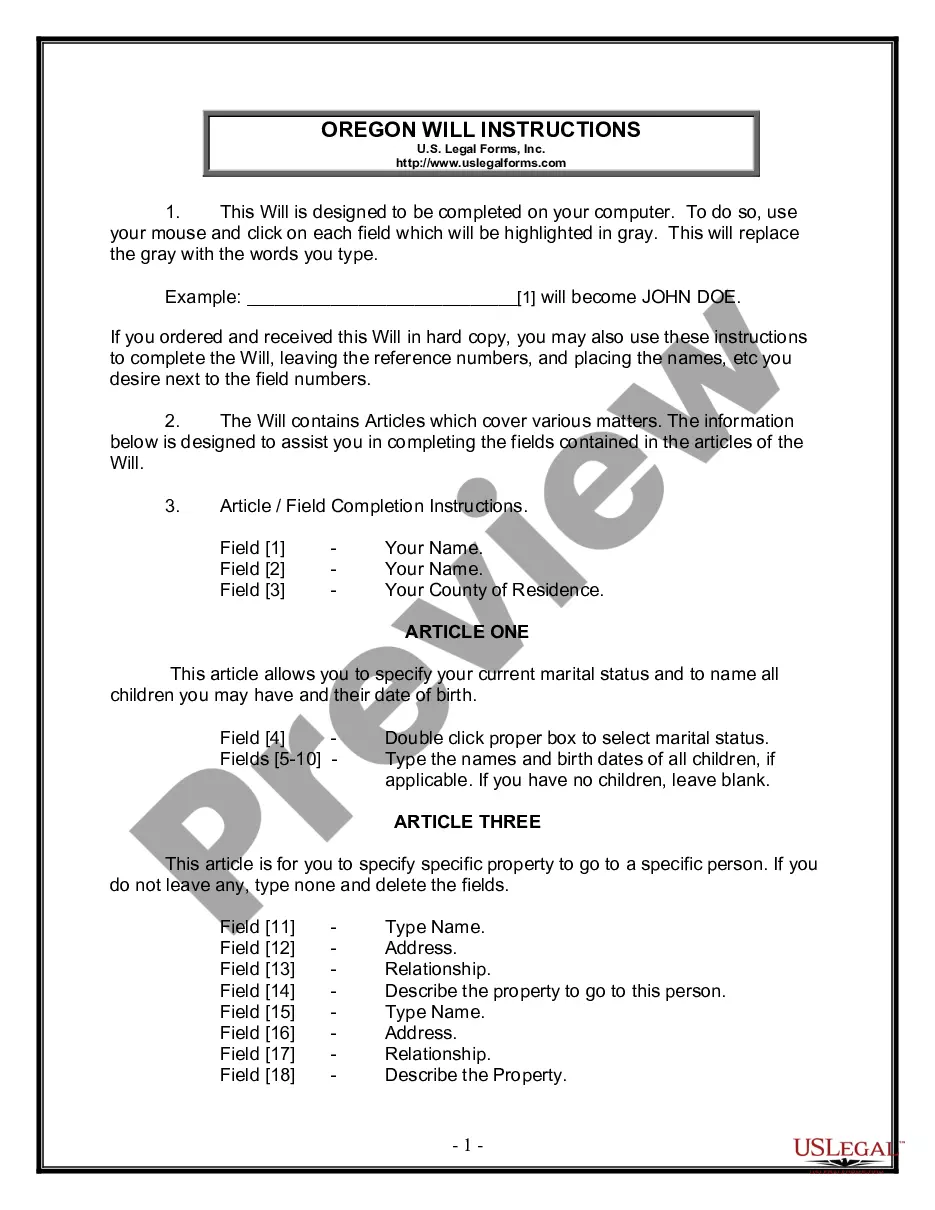

How to fill out Broken Arrow Oklahoma Individual Credit Application?

Are you looking for a trustworthy and inexpensive legal forms provider to buy the Broken Arrow Oklahoma Individual Credit Application? US Legal Forms is your go-to choice.

No matter if you require a simple agreement to set rules for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed in accordance with the requirements of particular state and county.

To download the form, you need to log in account, find the required template, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates at any time in the My Forms tab.

Are you new to our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Broken Arrow Oklahoma Individual Credit Application conforms to the laws of your state and local area.

- Go through the form’s description (if available) to learn who and what the form is intended for.

- Restart the search in case the template isn’t suitable for your specific scenario.

Now you can create your account. Then choose the subscription option and proceed to payment. Once the payment is done, download the Broken Arrow Oklahoma Individual Credit Application in any available format. You can return to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending hours researching legal paperwork online once and for all.

Form popularity

FAQ

Strictly speaking, there is no minimum credit score for you to be approved a personal loan. However, if you have a credit score rated 'very poor' or 'poor', your chances of getting a personal loan are minimal.

Banks may approve you for a loan and give you the money within the same day, but the entire process of applying and getting funding could take several business days. Some credit unions offer same-day (or very fast) options. Alliant Credit Union, for example, may offer funding the same day you apply online.

Here are five tips to boost your chances of qualifying for a personal loan. Clean up your credit. Credit scores are major considerations on personal loan applications.Rebalance your debts and income.Don't ask for too much cash.Consider a co-signer.Find the right lender.

How Long Does It Take To Get a Loan? Online LendersTraditional Banks or Credit UnionsApplication TimePlan for 15 minutes or soPlan for 15 to 60 minutesApproval TimeThree to seven daysSame day to several daysFunding After ApprovalOne to seven business daysSame day to several days1 more row

How Long Does It Take To Get a Loan? Online LendersTraditional Banks or Credit UnionsApplication TimePlan for 15 minutes or soPlan for 15 to 60 minutesApproval TimeThree to seven daysSame day to several daysFunding After ApprovalOne to seven business daysSame day to several days1 more row ?

4 easy approval tips for a Personal Loan Check and try to better credit score. In today's times, almost all credit agencies and lenders hold sway over information relating to your spending and overall financial behaviour.Manage your money well.Apply for only what you need.One application at a time.

Advance America installment loans offer easy applications that can be completed in less than 10 minutes, instant approval decisions, and funding that can be delivered the same day when you apply before AM EST or within 24 hours of your application.

No prepayment penalty: If you want a shorter repayment term, you can pay off your financing early without any extra fee. No credit reporting: Green Arrow doesn't typically report payment history to the three major credit bureaus, so this loan likely won't help you build credit.

6 Actions to Take If You Were Declined for a Personal Loan Review your decline notice. The very first thing you should do is understand why you were declined for a personal loan.Review your credit report.Boost your credit score.Find a co-signer.Apply for a smaller loan amount.Shop around.