Oklahoma City, Oklahoma is well-regulated in terms of its legal processes for post-judgment earnings garnishment. This procedure occurs after a creditor obtains a favorable judgment against a debtor in court. This article will provide a detailed description of Noncontinuing and Continuing Post-Judgment Earnings Garnishment Summons in Oklahoma City, highlighting their differences and pertinent information. Noncontinuing Post-Judgment Earnings Garnishment Summons: In Oklahoma City, Noncontinuing Post-Judgment Earnings Garnishment Summons refers to a one-time action taken by a creditor to garnish a debtor's earnings. Also known as a "Writ of Garnishment," this summons is issued to the debtor's employer, directing them to withhold a portion of the debtor's income and redirect it towards satisfying the debt owed to the creditor. The one-time garnishment is limited to a specific percentage of the debtor's disposable earnings, as defined by federal law. Continuing Post-Judgment Earnings Garnishment Summons: In contrast to the noncontinuing summons, Continuing Post-Judgment Earnings Garnishment Summons allows for a continuous garnishment of the debtor's earnings. This means that after the initial garnishment, subsequent wages can be garnished until the debt is fully satisfied or a court order terminates the garnishment. This type of summons is typically employed when a debtor consistently fails to meet their financial obligations, necessitating ongoing garnishment to ensure repayment. To initiate either type of garnishment, the petitioner (creditor) must obtain a court order or judgment in their favor. They must then file appropriate documents and serve the summons on the debtor's employer, as well as sending copies to the debtor and any other interested parties. It is important to note that both Noncontinuing and Continuing Post-Judgment Earnings Garnishment Summons are subject to certain limitations and exemptions. Federal and state laws protect certain types of income, such as Social Security benefits, child support payments, and unemployment benefits, from garnishment. Once the summons is served, the employer must start withholding the specified amount from the debtor's wages. The withheld funds are then distributed to the creditor to satisfy the debt. In conclusion, Noncontinuing and Continuing Post-Judgment Earnings Garnishment Summons are essential mechanisms for creditors to recover debts in Oklahoma City. The primary distinction between the two lies in the nature of the garnishment, with the noncontinuing summons enforcing a one-time withholding and the continuing summons allowing for ongoing garnishment until the debt is cleared. However, it is crucial for both creditors and debtors to be aware of the legal limitations and exemptions involved in the process in order to ensure fair and lawful execution.

Oklahoma City Oklahoma Noncontinuing and Continuing Post-Judgment Earnings Garnishment Summons

State:

Oklahoma

City:

Oklahoma City

Control #:

OK-54020

Format:

Word;

Rich Text

Instant download

Public form

Description

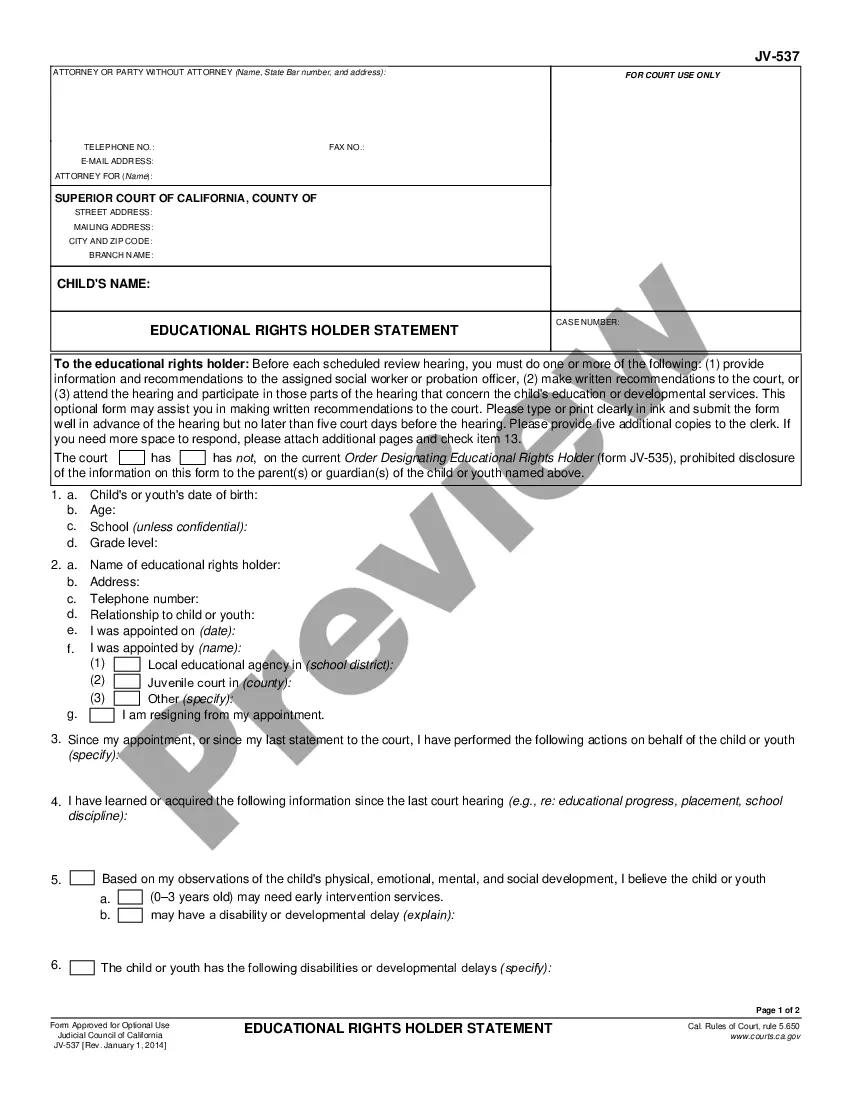

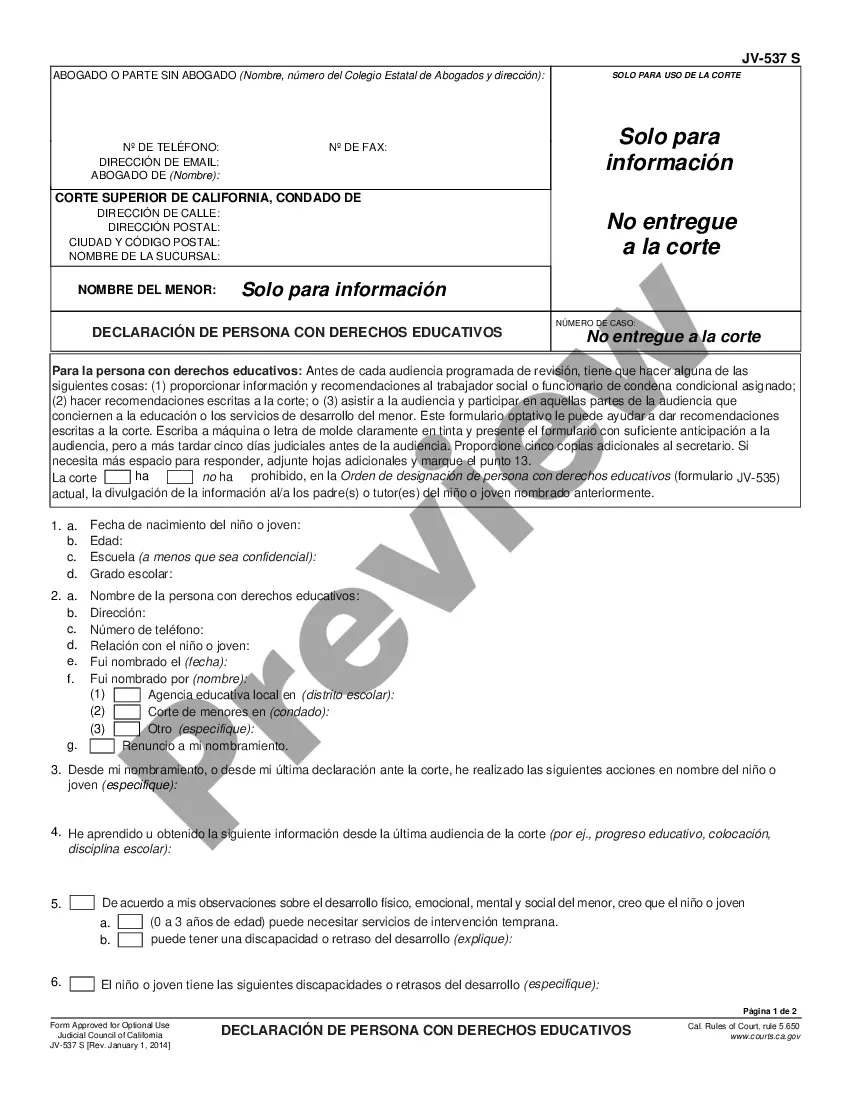

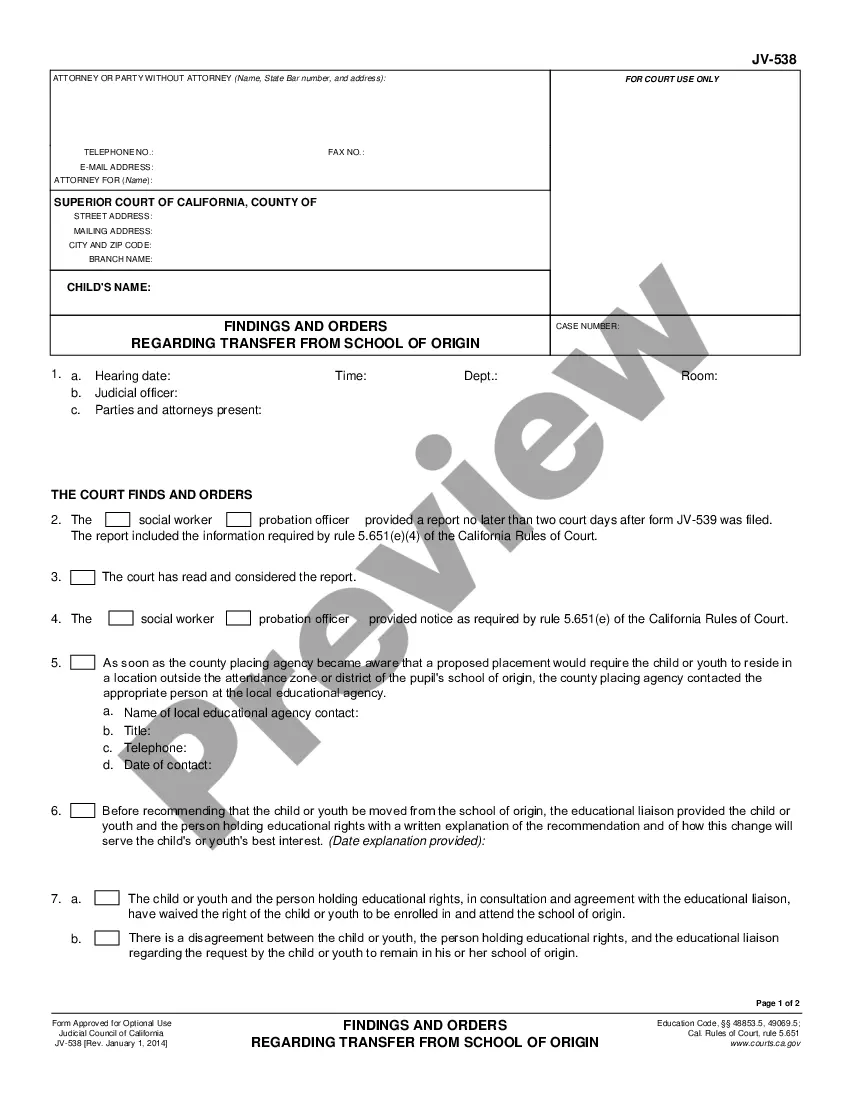

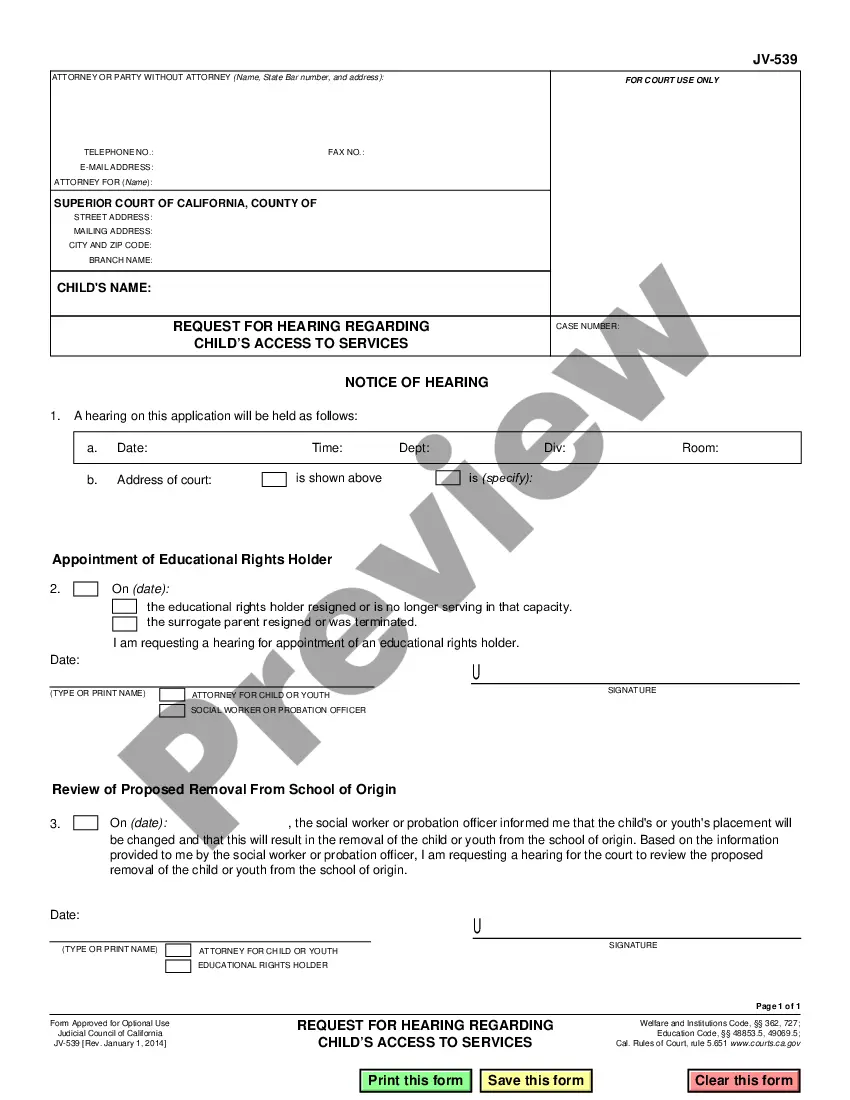

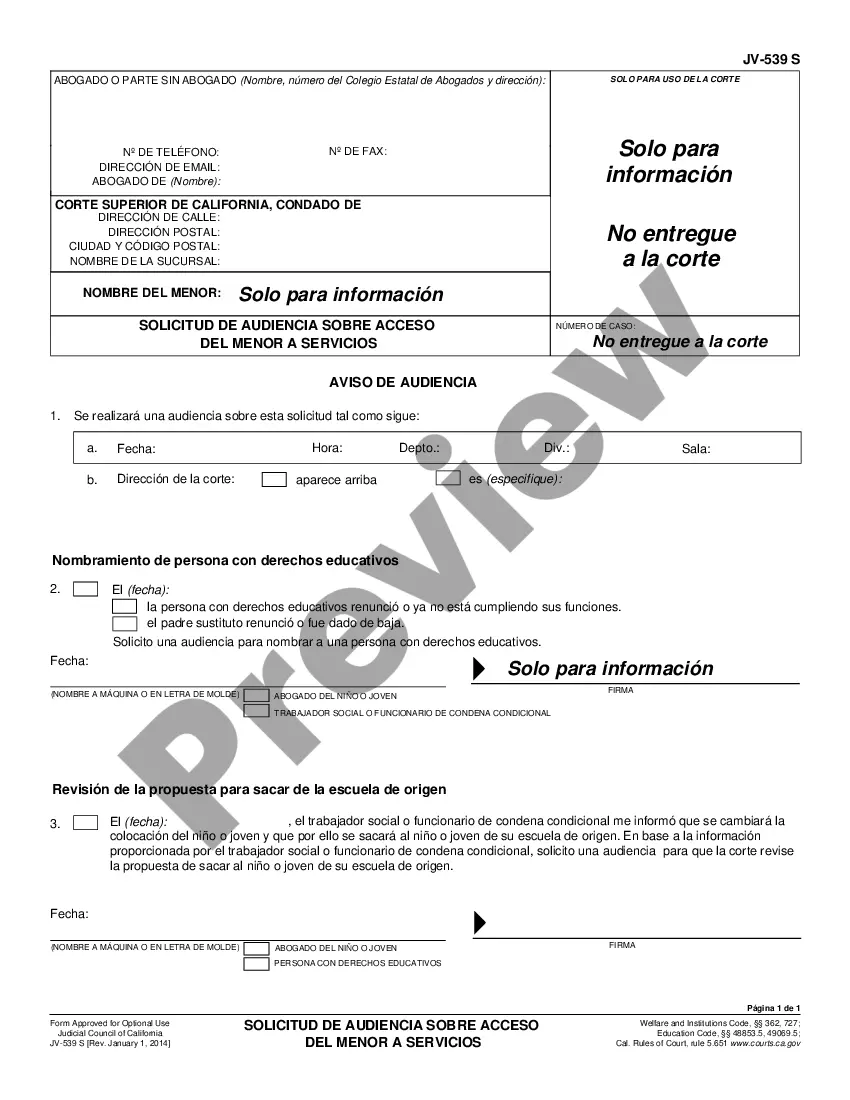

Official Noncontinuing Post-Judgment Earnings Garnishment Summons, Continuing Post-Judgment Garnishment Summons, and Garnishment Summons for Child Support.

Oklahoma City, Oklahoma is well-regulated in terms of its legal processes for post-judgment earnings garnishment. This procedure occurs after a creditor obtains a favorable judgment against a debtor in court. This article will provide a detailed description of Noncontinuing and Continuing Post-Judgment Earnings Garnishment Summons in Oklahoma City, highlighting their differences and pertinent information. Noncontinuing Post-Judgment Earnings Garnishment Summons: In Oklahoma City, Noncontinuing Post-Judgment Earnings Garnishment Summons refers to a one-time action taken by a creditor to garnish a debtor's earnings. Also known as a "Writ of Garnishment," this summons is issued to the debtor's employer, directing them to withhold a portion of the debtor's income and redirect it towards satisfying the debt owed to the creditor. The one-time garnishment is limited to a specific percentage of the debtor's disposable earnings, as defined by federal law. Continuing Post-Judgment Earnings Garnishment Summons: In contrast to the noncontinuing summons, Continuing Post-Judgment Earnings Garnishment Summons allows for a continuous garnishment of the debtor's earnings. This means that after the initial garnishment, subsequent wages can be garnished until the debt is fully satisfied or a court order terminates the garnishment. This type of summons is typically employed when a debtor consistently fails to meet their financial obligations, necessitating ongoing garnishment to ensure repayment. To initiate either type of garnishment, the petitioner (creditor) must obtain a court order or judgment in their favor. They must then file appropriate documents and serve the summons on the debtor's employer, as well as sending copies to the debtor and any other interested parties. It is important to note that both Noncontinuing and Continuing Post-Judgment Earnings Garnishment Summons are subject to certain limitations and exemptions. Federal and state laws protect certain types of income, such as Social Security benefits, child support payments, and unemployment benefits, from garnishment. Once the summons is served, the employer must start withholding the specified amount from the debtor's wages. The withheld funds are then distributed to the creditor to satisfy the debt. In conclusion, Noncontinuing and Continuing Post-Judgment Earnings Garnishment Summons are essential mechanisms for creditors to recover debts in Oklahoma City. The primary distinction between the two lies in the nature of the garnishment, with the noncontinuing summons enforcing a one-time withholding and the continuing summons allowing for ongoing garnishment until the debt is cleared. However, it is crucial for both creditors and debtors to be aware of the legal limitations and exemptions involved in the process in order to ensure fair and lawful execution.

How to fill out Oklahoma City Oklahoma Noncontinuing And Continuing Post-Judgment Earnings Garnishment Summons?

If you’ve already utilized our service before, log in to your account and download the Oklahoma City Oklahoma Noncontinuing and Continuing Post-Judgment Earnings Garnishment Summons on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Ensure you’ve located an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Oklahoma City Oklahoma Noncontinuing and Continuing Post-Judgment Earnings Garnishment Summons. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!