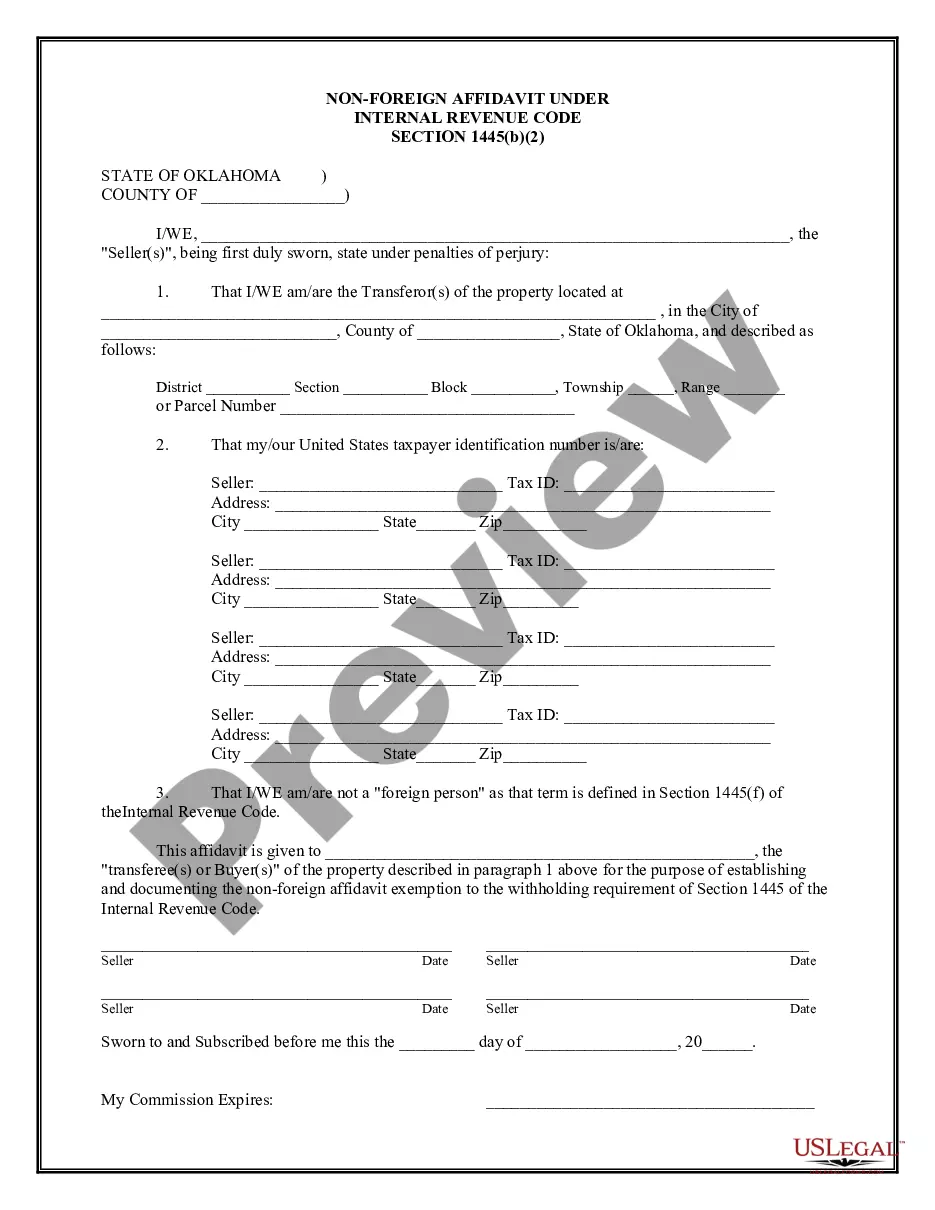

The Broken Arrow Oklahoma Non-Foreign Affidavit Under IRC 1445 is a legal document that is used during real estate transactions to determine the foreign status of the seller. This affidavit helps ensure compliance with the requirements set forth by the Internal Revenue Code (IRC) Section 1445, which deals with withholding tax on dispositions of U.S. real property interests by non-resident aliens. In Broken Arrow, Oklahoma, real estate transactions involving non-foreign individuals or entities require the completion of a Non-Foreign Affidavit Under IRC 1445. This document is crucial in determining whether the seller is a foreign person, as it affects the application of withholding taxes on the transaction. The Broken Arrow Non-Foreign Affidavit Under IRC 1445 typically requires specific information, including the name, address, and tax identification number (TIN) of the seller. Moreover, it may require a certification of a U.S. citizenship or residency status, and whether the seller claims a treaty exemption from withholding tax. Different types or variations of the Broken Arrow Oklahoma Non-Foreign Affidavit Under IRC 1445 may exist, depending on the complexity or unique circumstances of the real estate transaction. These variations may include specific additional statements or provisions required by the closing entity, title company, or municipality. It is essential to consult with an experienced real estate attorney or a qualified professional to ensure the accuracy and compliance of the Non-Foreign Affidavit Under IRC 1445 in Broken Arrow, Oklahoma. Failing to properly complete this affidavit may result in legal repercussions or delays in the real estate transaction. Overall, the Broken Arrow Oklahoma Non-Foreign Affidavit Under IRC 1445 serves as a crucial document in real estate transactions involving non-foreign individuals or entities. It helps confirm the seller's status and ensures compliance with tax laws established by the Internal Revenue Code.

Broken Arrow Oklahoma Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Broken Arrow Oklahoma Non-Foreign Affidavit Under IRC 1445?

If you are looking for a relevant form, it’s impossible to find a better service than the US Legal Forms website – probably the most considerable online libraries. With this library, you can get a huge number of form samples for company and individual purposes by categories and regions, or keywords. Using our advanced search option, discovering the most up-to-date Broken Arrow Oklahoma Non-Foreign Affidavit Under IRC 1445 is as elementary as 1-2-3. Additionally, the relevance of every file is confirmed by a group of professional lawyers that regularly check the templates on our platform and revise them according to the latest state and county requirements.

If you already know about our platform and have a registered account, all you need to get the Broken Arrow Oklahoma Non-Foreign Affidavit Under IRC 1445 is to log in to your profile and click the Download button.

If you utilize US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have opened the form you require. Read its description and make use of the Preview function (if available) to explore its content. If it doesn’t suit your needs, use the Search option at the top of the screen to find the needed record.

- Affirm your decision. Select the Buy now button. Next, choose your preferred pricing plan and provide credentials to register an account.

- Process the financial transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Receive the template. Pick the format and download it on your device.

- Make changes. Fill out, edit, print, and sign the acquired Broken Arrow Oklahoma Non-Foreign Affidavit Under IRC 1445.

Every single template you save in your profile does not have an expiry date and is yours forever. You can easily gain access to them using the My Forms menu, so if you need to receive an additional version for modifying or printing, you can return and save it once again anytime.

Make use of the US Legal Forms professional library to get access to the Broken Arrow Oklahoma Non-Foreign Affidavit Under IRC 1445 you were seeking and a huge number of other professional and state-specific templates on a single platform!