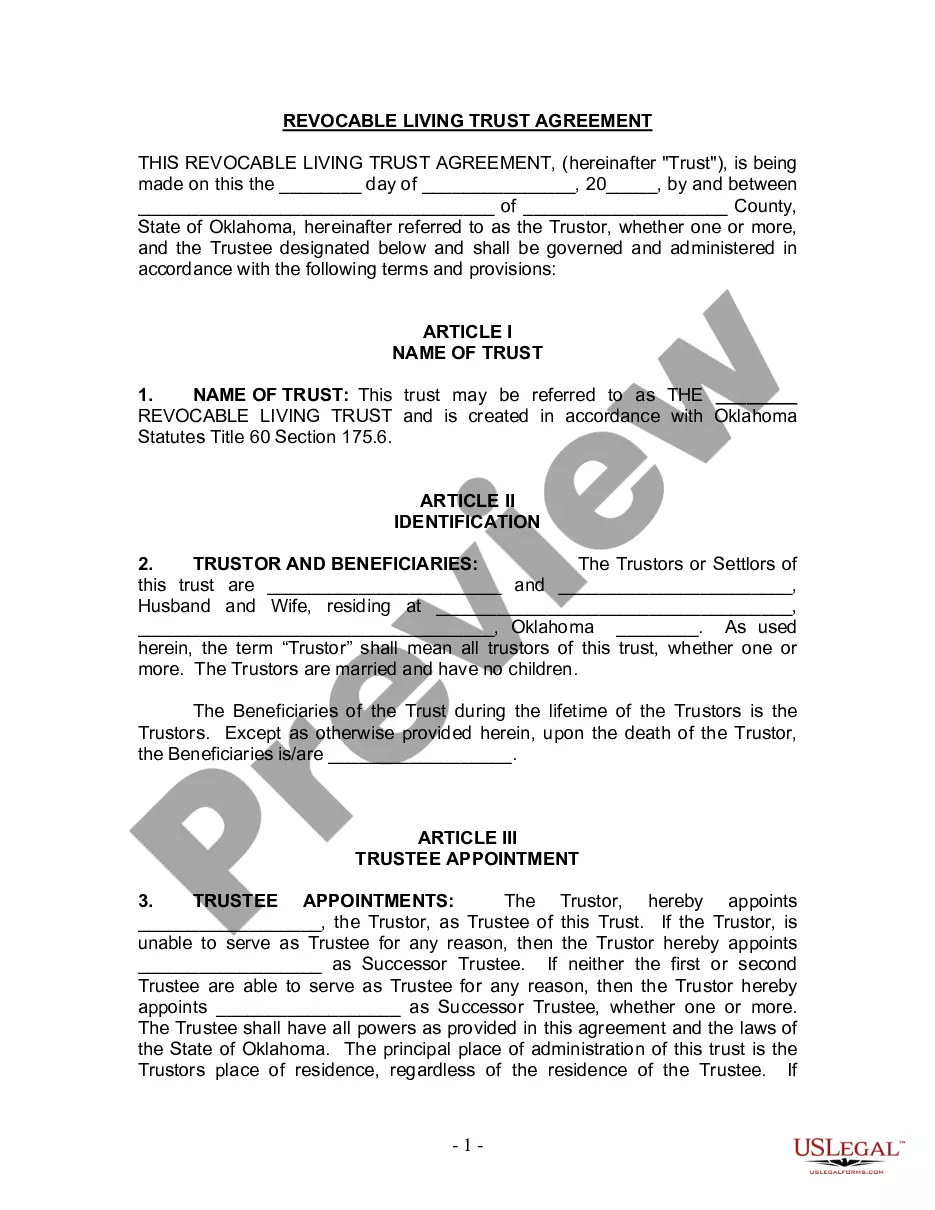

Broken Arrow Oklahoma Living Trust for Husband and Wife with No Children

Description

How to fill out Oklahoma Living Trust For Husband And Wife With No Children?

Regardless of one's social or occupational level, filling out legal documents is a regrettable requirement in the present-day society.

Frequently, it’s nearly unfeasible for an individual lacking any legal education to create this type of documentation from scratch, largely due to the intricate terminology and legal nuances they entail.

This is where US Legal Forms provides assistance.

Confirm that the form you found is appropriate for your location, considering that the regulations of one state or county may not apply to another state or county.

Review the document and examine a brief overview (if available) of the situations the document can be applied to.

- Our platform features an extensive assortment with over 85,000 ready-to-use forms specific to each state that cater to almost any legal matter.

- US Legal Forms is also an outstanding resource for associates or legal advisors aiming to enhance their efficiency by leveraging our DIY documents.

- Whether you require the Broken Arrow Oklahoma Living Trust for Husband and Wife with No Children or any other document applicable in your state or county, US Legal Forms has everything readily available.

- Here’s the method to swiftly obtain the Broken Arrow Oklahoma Living Trust for Husband and Wife with No Children using our reliable platform.

- If you are already a member, you can go ahead and Log In to your account to download the needed form.

- However, if you are unfamiliar with our collection, make sure to follow these steps before downloading the Broken Arrow Oklahoma Living Trust for Husband and Wife with No Children.

Form popularity

FAQ

Whether your parents should place their assets in a trust depends on their specific financial goals. A Broken Arrow Oklahoma Living Trust for Husband and Wife with No Children may provide advantages such as avoiding probate and safeguarding assets from creditors. However, it is crucial for them to consult with an estate planning attorney to discuss their unique situation and make an informed decision.

Yes, you can write your own trust in Oklahoma, but it requires careful attention to legal requirements. Creating a proper Broken Arrow Oklahoma Living Trust for Husband and Wife with No Children means ensuring that it complies with state laws. However, it is often beneficial to seek help from professionals to avoid mistakes that might undermine the effectiveness of your trust.

The primary downfall of having a trust lies in the potential for mismanagement. A Broken Arrow Oklahoma Living Trust for Husband and Wife with No Children requires regular updates and careful record-keeping. If trustees fail to act in accordance with the trust terms, it can lead to disputes among beneficiaries. Thus, choosing a trustworthy trustee is crucial for the smooth operation of your trust.

While a trust can protect assets, there are downsides to consider. For instance, transferring assets into a Broken Arrow Oklahoma Living Trust for Husband and Wife with No Children can entail upfront costs and potential tax implications. This can also limit your immediate access to those assets. Be sure to evaluate both the benefits and the drawbacks when making your decision.

A family trust can have disadvantages, particularly related to complexity and administration. Setting up a Broken Arrow Oklahoma Living Trust for Husband and Wife with No Children often involves legal fees and necessary ongoing management. Additionally, if not properly maintained, family trusts can create confusion for beneficiaries in the future. Therefore, it’s essential to consider these factors when deciding if this type of trust is right for you.

There is technically no set minimum for establishing a trust fund; however, practically speaking, the amount should be sufficient to justify the costs of creating and managing the trust. Many experts recommend having at least $50,000 to make a trust viable. If you are considering a Broken Arrow Oklahoma Living Trust for Husband and Wife with No Children, it's essential to evaluate what assets you wish to include and their overall value.

To start a living trust in Oklahoma, you should first outline your assets and decide which ones you want to place in the trust. It's helpful to consult an attorney who specializes in estate planning to draft the trust document. After drafting, you will need to fund the trust by transferring assets into it. A Broken Arrow Oklahoma Living Trust for Husband and Wife with No Children is an excellent way to simplify your estate management.

One significant mistake parents often make is failing to communicate their intentions clearly to their children. Misunderstandings can lead to conflict and confusion. Additionally, not regularly updating the trust as circumstances change can create issues down the line. By using a Broken Arrow Oklahoma Living Trust for Husband and Wife with No Children, you can clarify your wishes and ensure everyone is on the same page.

The minimum amount to establish a trust varies, but many legal experts suggest having at least $100,000 in assets for it to be worthwhile. However, you can set up a trust with smaller amounts, but the costs and management may outweigh the benefits. Therefore, assessing your personal situation is crucial. A Broken Arrow Oklahoma Living Trust for Husband and Wife with No Children can be tailored to fit different financial levels.

One downside of a living trust is that it does not provide immunity from creditors. If you face financial difficulties, your assets in a trust can still be accessed by creditors. Another consideration is that a living trust can be more expensive to set up than a simple will. However, the benefits often outweigh these costs when considering the advantages of a Broken Arrow Oklahoma Living Trust for Husband and Wife with No Children.