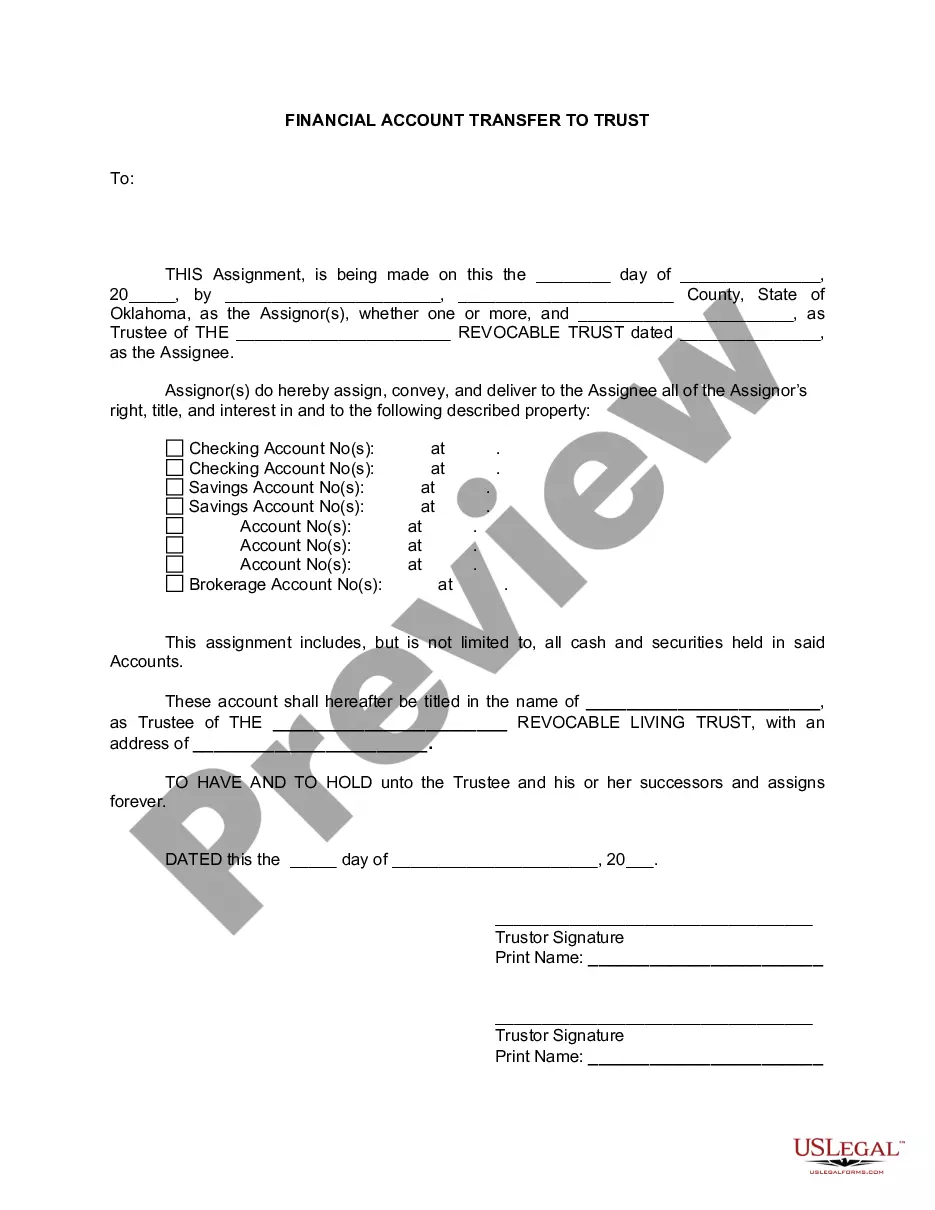

Broken Arrow, Oklahoma Financial Account Transfer to Living Trust: A Comprehensive Guide If you reside in Broken Arrow, Oklahoma, and have been contemplating a financial account transfer to a living trust, you've come to the right place. This detailed description will walk you through the process, offer insights, and address any potential queries you might have regarding this crucial financial decision. The Broken Arrow Financial Account Transfer to Living Trust aims to safeguard your assets while ensuring a smooth transfer of funds to designated beneficiaries. By placing your financial accounts into a living trust, you create an entity to hold and manage your assets during your lifetime and specify how they should be distributed upon your passing. There are a few different types of Broken Arrow Oklahoma Financial Account Transfer to Living Trust, including: 1. Revocable Living Trust: The most common type of trust, a revocable living trust allows you to maintain control over your assets during your lifetime. You can amend or revoke this trust at any time, making it adaptable to changing circumstances. 2. Irrevocable Living Trust: While a revocable living trust provides flexibility, an irrevocable living trust offers additional asset protection and reduces estate taxes. Once established, the terms of this trust are unalterable without the consent of the beneficiaries. The process of transferring your financial accounts to a living trust involves the following steps: 1. Selecting a Trustee: Choose a trustworthy person or institution to assume the role of a trustee. The trustee will manage the trust's assets and ensure your wishes are fulfilled. 2. Drafting the Trust Agreement: Consult with an experienced estate planning attorney who specializes in living trusts. They will help you draft a comprehensive trust agreement that outlines your desires, beneficiaries, and distribution instructions. 3. Funding the Trust: Transfer your financial accounts, such as bank accounts, investment portfolios, retirement accounts, and real estate, into the trust's name. This involves updating the account titling and beneficiary designations. 4. Retitling Financial Accounts: Work closely with your financial institutions to change the ownership of each account to the living trust. This step helps ensure the assets are protected and managed in accordance with your wishes. 5. Updating Beneficiary Designations: Review and revise beneficiary designations, ensuring they align with your trust's instructions. Update the beneficiaries on your accounts to maximize the benefits provided by the trust. 6. Regular Review and Maintenance: Keep your living trust up to date by regularly reviewing its provisions, especially after significant life events like marriages, divorces, births, or changes in financial circumstances. It is important to note that the process of Broken Arrow Oklahoma Financial Account Transfer to Living Trust may involve legal complexities and tax implications. Seeking guidance from a trusted attorney and consulting with financial professionals will help ensure you navigate this process effectively. In conclusion, the Broken Arrow Financial Account Transfer to Living Trust is a powerful estate planning tool that allows you to preserve and control your assets while providing for a seamless transfer to your beneficiaries. By exploring the different types of living trusts available and undertaking the appropriate legal steps, you can secure your financial legacy and ensure that your wishes are fulfilled.

Broken Arrow Oklahoma Financial Account Transfer to Living Trust

Description

How to fill out Broken Arrow Oklahoma Financial Account Transfer To Living Trust?

We always strive to minimize or avoid legal damage when dealing with nuanced legal or financial affairs. To do so, we apply for attorney services that, as a rule, are very expensive. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to an attorney. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Broken Arrow Oklahoma Financial Account Transfer to Living Trust or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Broken Arrow Oklahoma Financial Account Transfer to Living Trust complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Broken Arrow Oklahoma Financial Account Transfer to Living Trust is proper for you, you can select the subscription option and proceed to payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!