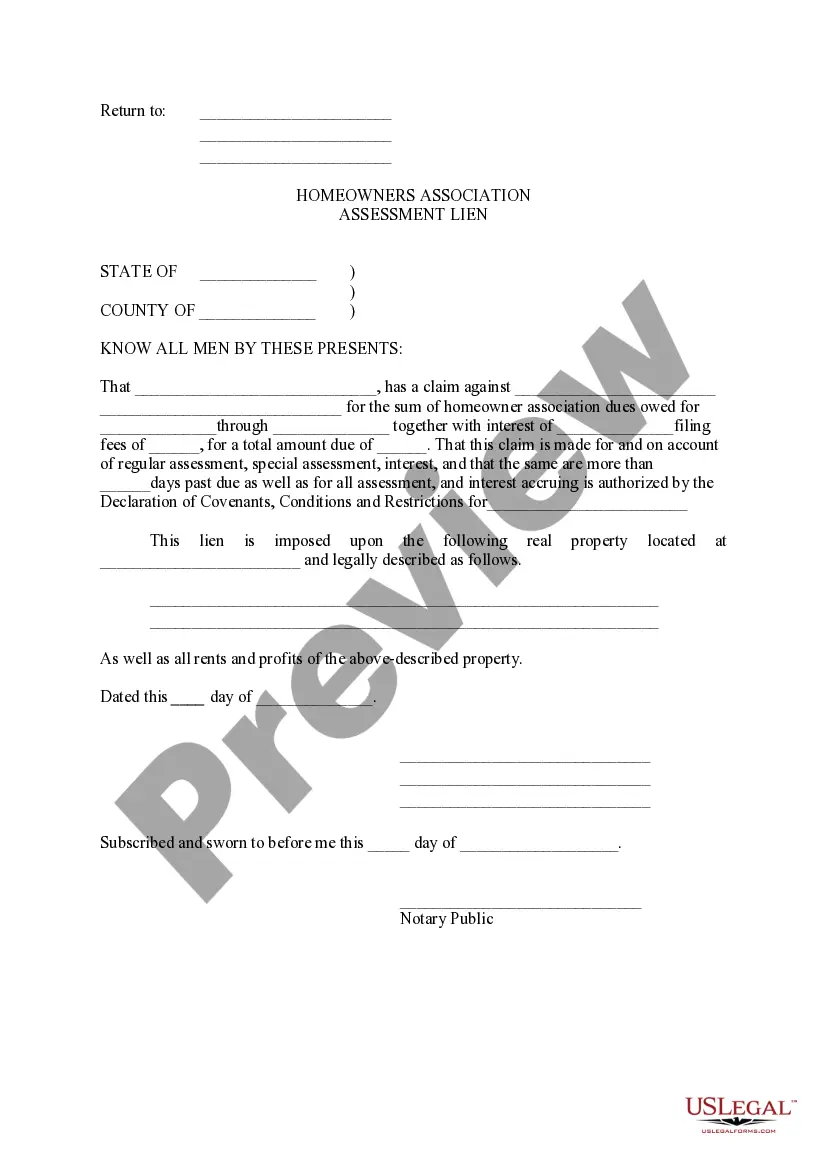

A Broken Arrow Oklahoma homeowners association assessment lien is a legal claim that a homeowners' association (HOA) in Broken Arrow, Oklahoma can enforce against a property owner who fails to pay their required assessments or dues. This lien is designed to ensure that all homeowners fulfill their financial obligations towards the HOA for the maintenance, management, and improvement of the common areas and amenities within a community. The purpose of an assessment lien is to provide the HOA with the means to collect unpaid assessments and protect the interests of the community as a whole. When an HOA places a lien on a property, it essentially becomes a legal claim against the property until the outstanding assessments are paid in full. This lien will typically be filed with the county recorder's office to establish a public record of the debt. There can be different types of assessment liens that an HOA can have in Broken Arrow, Oklahoma. Firstly, there is the regular or general assessment lien that may be placed on a property when the homeowner fails to pay their monthly, quarterly, or annual assessments. These assessments are typically used to cover expenses related to common area maintenance, landscaping, utilities, insurance, and other necessary services. In addition to regular assessments, there may also be special assessment liens. These are one-time charges imposed by the HOA for unexpected or extraordinary expenses, such as major repairs, renovations, or legal actions. Special assessments are usually levied when the reserve funds of the HOA are insufficient to cover the costs of these unforeseen expenditures. Furthermore, an HOA may also have what is called a statutory lien, which is based on laws enacted by the state of Oklahoma. Under the Oklahoma Statutes, an HOA has the authority to place a lien on a property if the homeowner fails to pay any assessment or monetary obligation within 30 days of the due date. It's important for homeowners to understand that if they fail to pay their assessments and a lien is placed on their property, the HOA may take legal action to enforce the lien. This can include foreclosure proceedings, which could result in the sale of the property to satisfy the outstanding debt. In conclusion, a Broken Arrow Oklahoma homeowners association assessment lien is a legal claim that an HOA can impose on a property when a homeowner fails to pay their assessments or dues. Different types of liens include regular assessments, special assessments, and statutory liens. It's crucial for homeowners to fulfill their financial obligations to avoid the potential consequences of an assessment lien.

Broken Arrow Oklahoma Homeowners Association Assessment Lien

Description

How to fill out Broken Arrow Oklahoma Homeowners Association Assessment Lien?

Take advantage of the US Legal Forms and obtain immediate access to any form sample you need. Our helpful website with thousands of documents allows you to find and obtain almost any document sample you need. You are able to download, fill, and certify the Broken Arrow Oklahoma Homeowners Association Assessment Lien in just a few minutes instead of browsing the web for many hours searching for a proper template.

Using our catalog is a great strategy to increase the safety of your form submissions. Our experienced lawyers on a regular basis review all the records to make sure that the templates are relevant for a particular state and compliant with new acts and regulations.

How do you get the Broken Arrow Oklahoma Homeowners Association Assessment Lien? If you already have a profile, just log in to the account. The Download button will appear on all the documents you look at. Moreover, you can get all the earlier saved files in the My Forms menu.

If you don’t have a profile yet, stick to the tips below:

- Open the page with the form you need. Make sure that it is the form you were seeking: examine its headline and description, and make use of the Preview feature when it is available. Otherwise, use the Search field to look for the needed one.

- Start the saving procedure. Select Buy Now and select the pricing plan you prefer. Then, sign up for an account and process your order using a credit card or PayPal.

- Download the document. Pick the format to obtain the Broken Arrow Oklahoma Homeowners Association Assessment Lien and revise and fill, or sign it according to your requirements.

US Legal Forms is probably the most considerable and reliable form libraries on the internet. Our company is always ready to assist you in any legal process, even if it is just downloading the Broken Arrow Oklahoma Homeowners Association Assessment Lien.

Feel free to make the most of our service and make your document experience as efficient as possible!