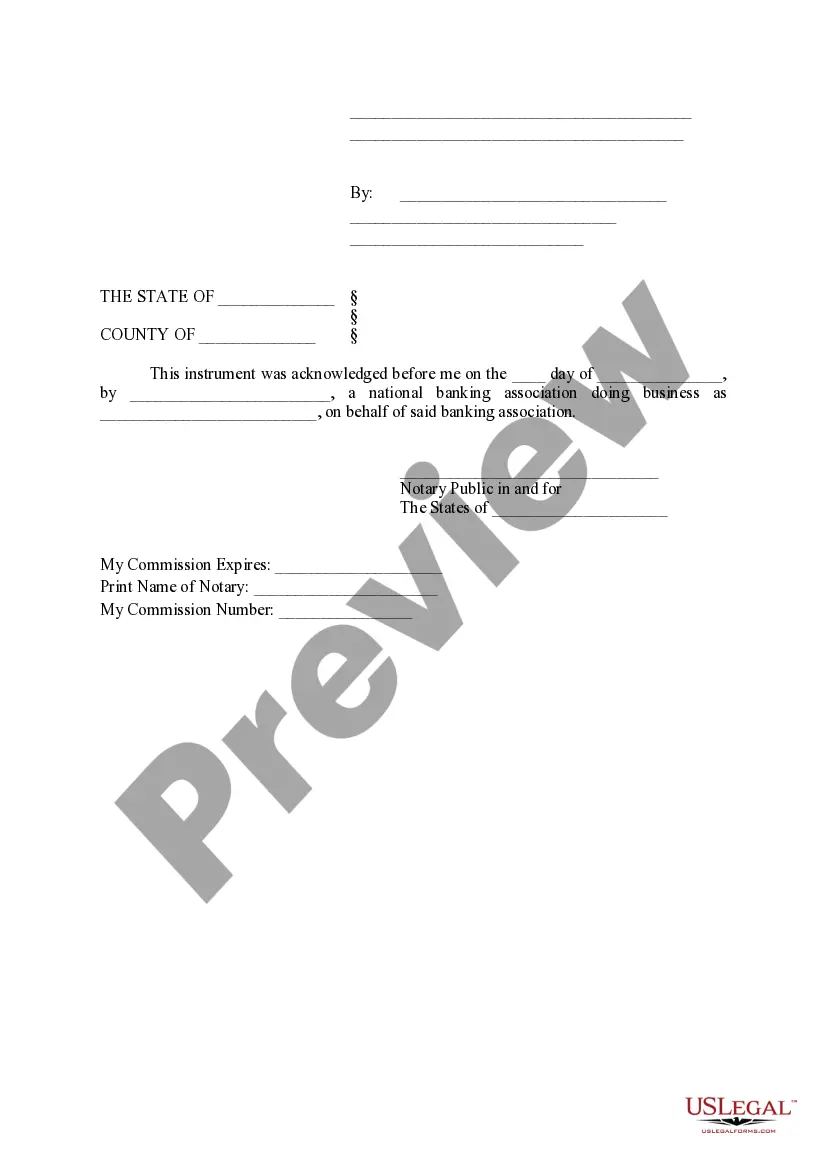

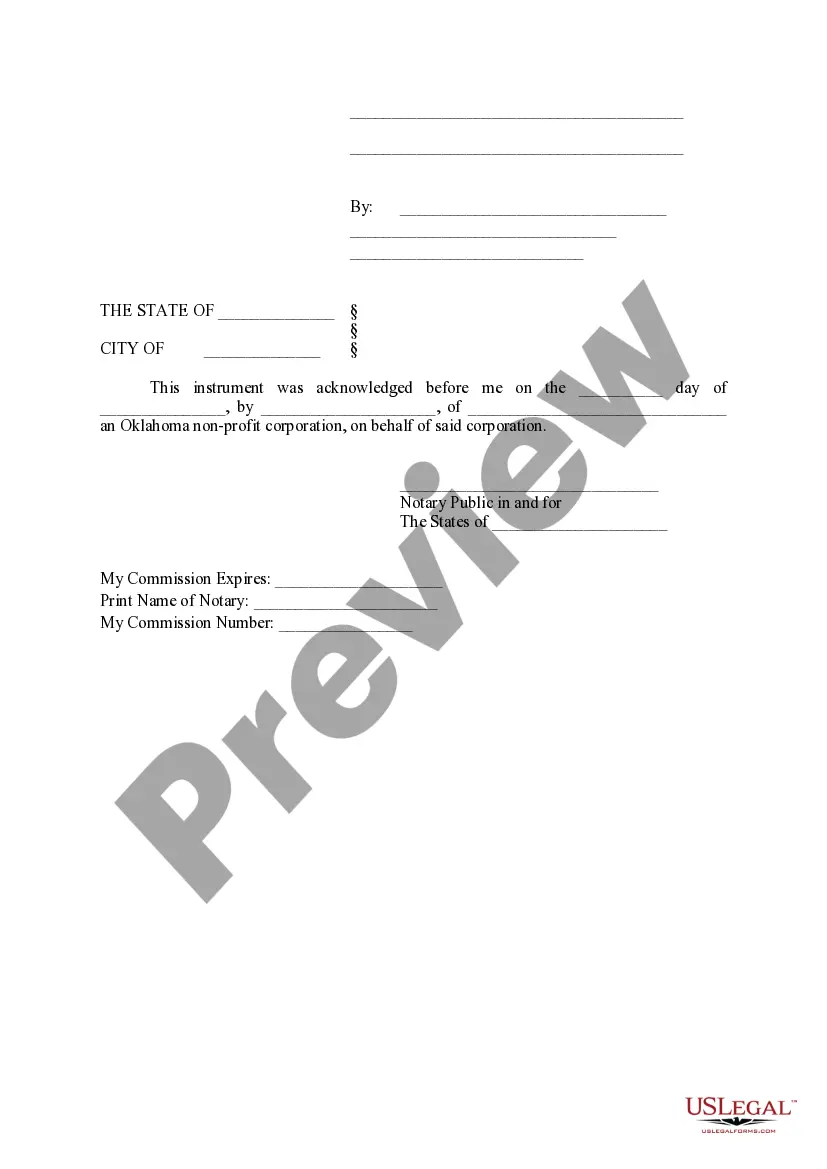

Oklahoma City Oklahoma Intercreditor and Subordination play a crucial role in managing relationships between creditors and borrowers in Oklahoma City, Oklahoma. Intercreditor and Subordination agreements are legal documents that outline the rights and priorities of multiple creditors who have claims against a common debtor. In Oklahoma City, there are two primary types of Intercreditor and Subordination agreements: First Lien Intercreditor and Subordination Agreement and Second Lien Intercreditor and Subordination Agreement. The First Lien Intercreditor and Subordination Agreement involves multiple lenders, where one lender holds the first lien position over a specific asset or collateral. This agreement ensures that the first lien lender has priority over other creditors in case of default or bankruptcy. By entering into this agreement, all other lenders with subsequent liens agree to subordinate their claims to the first lien lender. This provides the first lien lender with the ability to recover its debt before others. On the other hand, the Second Lien Intercreditor and Subordination Agreement applies when there is a second lien lender involved. In this case, the second lien holder acknowledges the priority of the first lien holder's claim in case of default or bankruptcy. The agreement sets out the specific rights and obligations of the parties involved, including restrictions on modifying the terms of the first lien debt or taking any action that could jeopardize the security interest of the first lien holder. These agreements are crucial in establishing a clear hierarchy of creditor rights and can significantly impact the recoverability of debts in the event of default. They are commonly used in financing transactions involving multiple lenders, such as real estate development projects or large corporate financing. In Oklahoma City, lenders, borrowers, and attorneys often rely on experienced legal professionals to draft and negotiate Intercreditor and Subordination agreements. These agreements require careful consideration of various legal and financial aspects to protect the interests of all parties involved. Having well-drafted and comprehensive agreements can help in mitigating risks associated with lending and ensure all parties' rights and obligations are clearly defined. In summary, Oklahoma City Oklahoma Intercreditor and Subordination agreements are vital tools for managing creditor relationships and establishing priority rights among lenders. They protect lenders' interests and inform the borrowing parties about their position in a debt hierarchy, ensuring a clear and orderly resolution of claims in case of default or bankruptcy. Whether it's establishing a First Lien Intercreditor and Subordination Agreement or a Second Lien Intercreditor and Subordination Agreement, it is crucial to seek legal guidance to draft comprehensive agreements that serve the interests of all stakeholders involved.

Oklahoma City Oklahoma Intercreditor and Subordination Agreement

Description

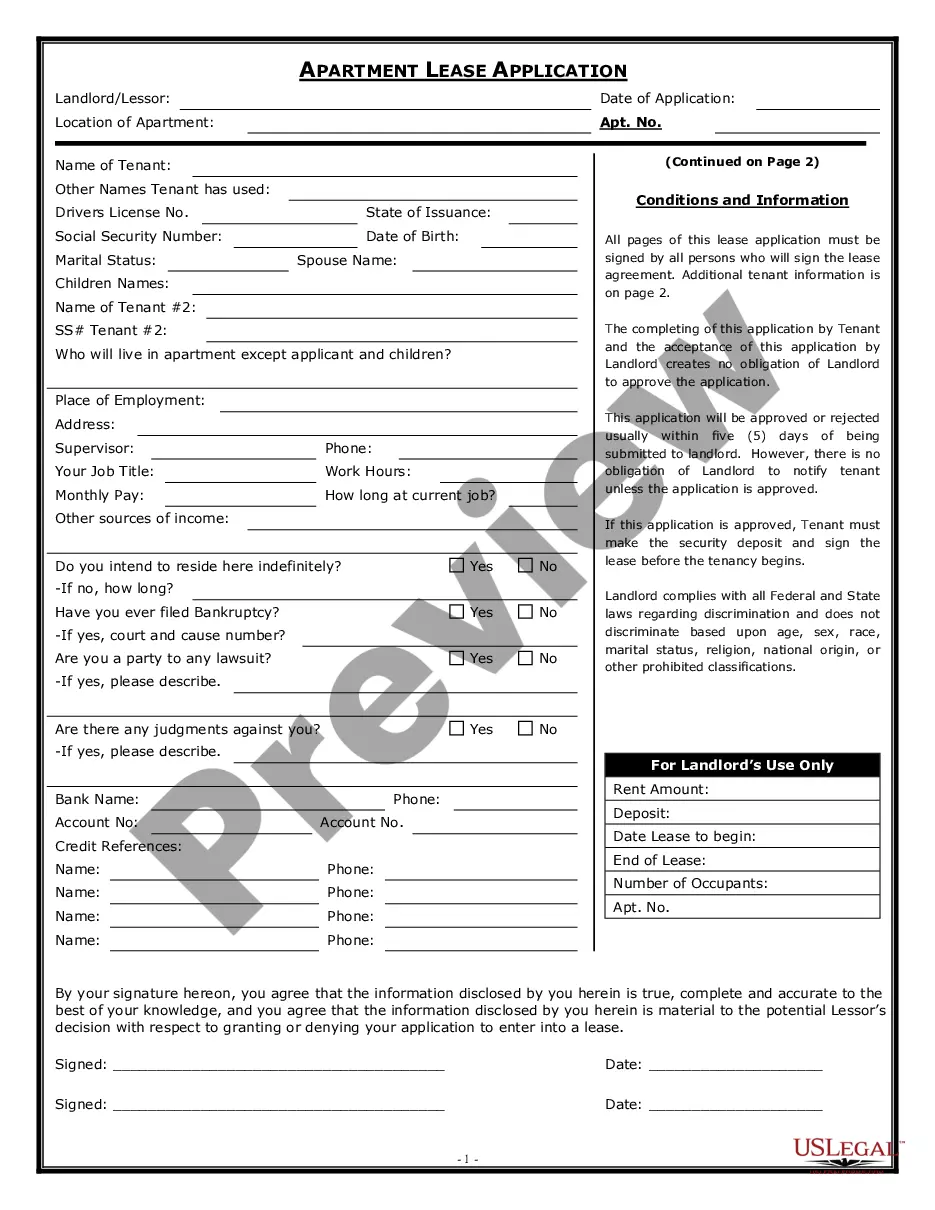

How to fill out Oklahoma City Oklahoma Intercreditor And Subordination Agreement?

Are you looking for a reliable and affordable legal forms provider to get the Oklahoma City Oklahoma Intercreditor and Subordination? US Legal Forms is your go-to solution.

Whether you require a simple arrangement to set rules for cohabitating with your partner or a set of forms to advance your divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed based on the requirements of specific state and area.

To download the document, you need to log in account, locate the required template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Oklahoma City Oklahoma Intercreditor and Subordination conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to learn who and what the document is good for.

- Start the search over in case the template isn’t good for your legal situation.

Now you can register your account. Then pick the subscription plan and proceed to payment. Once the payment is done, download the Oklahoma City Oklahoma Intercreditor and Subordination in any provided format. You can return to the website when you need and redownload the document without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about spending your valuable time learning about legal paperwork online for good.