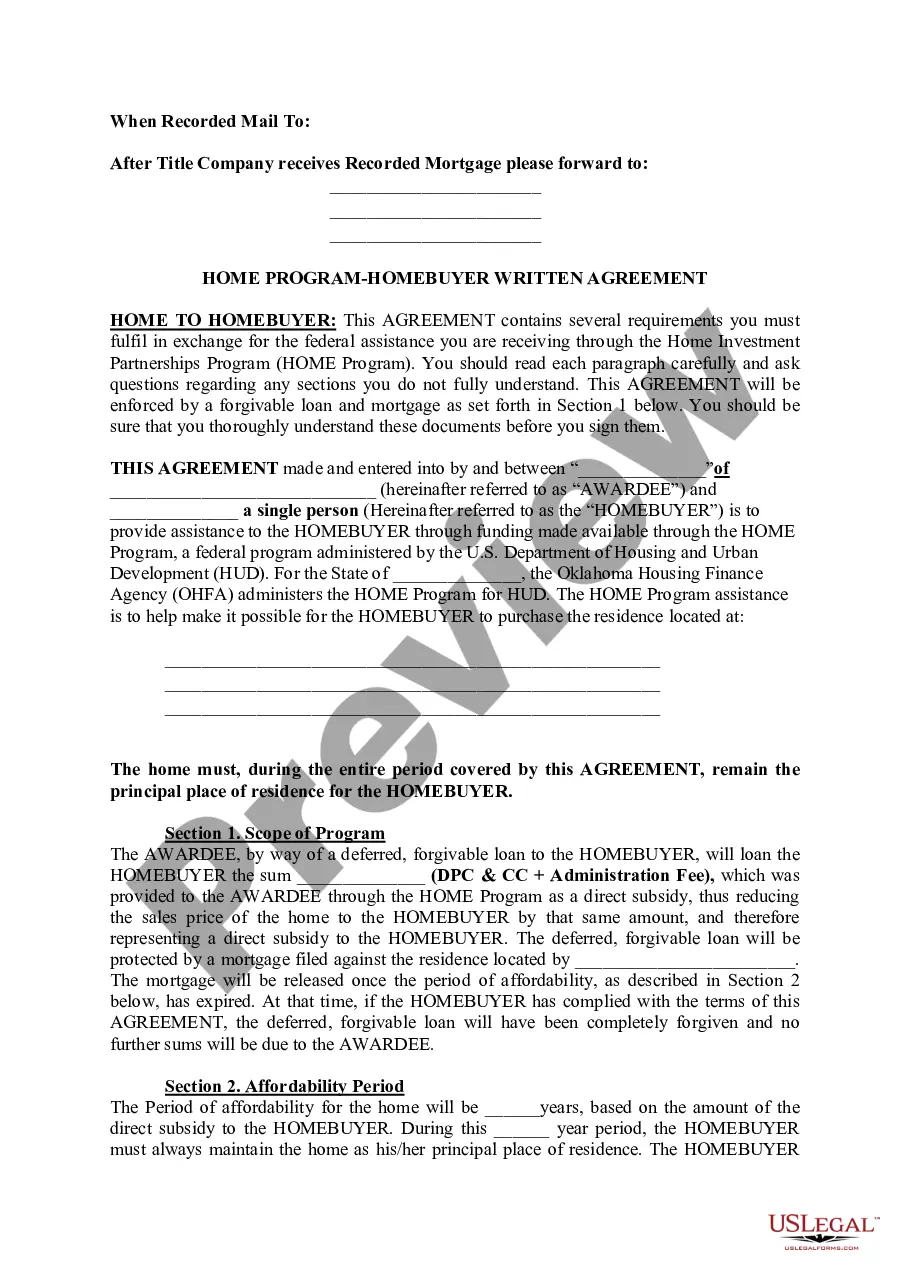

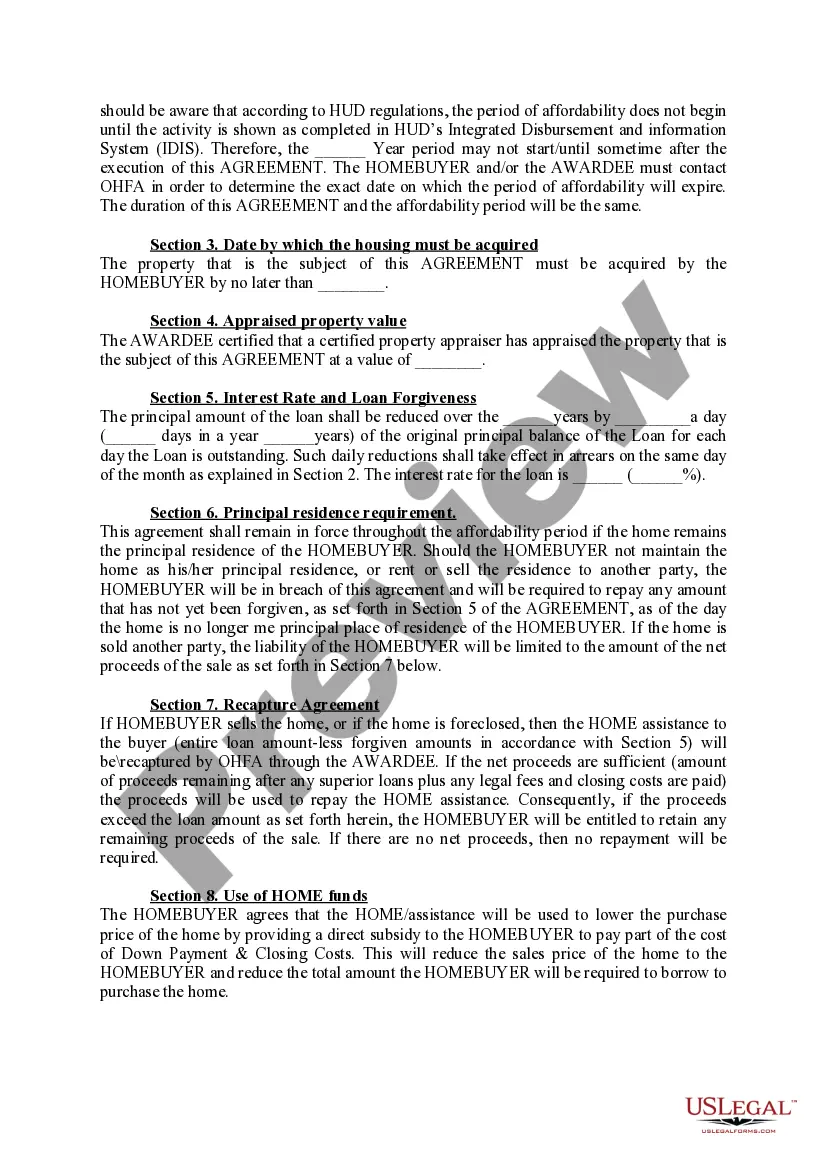

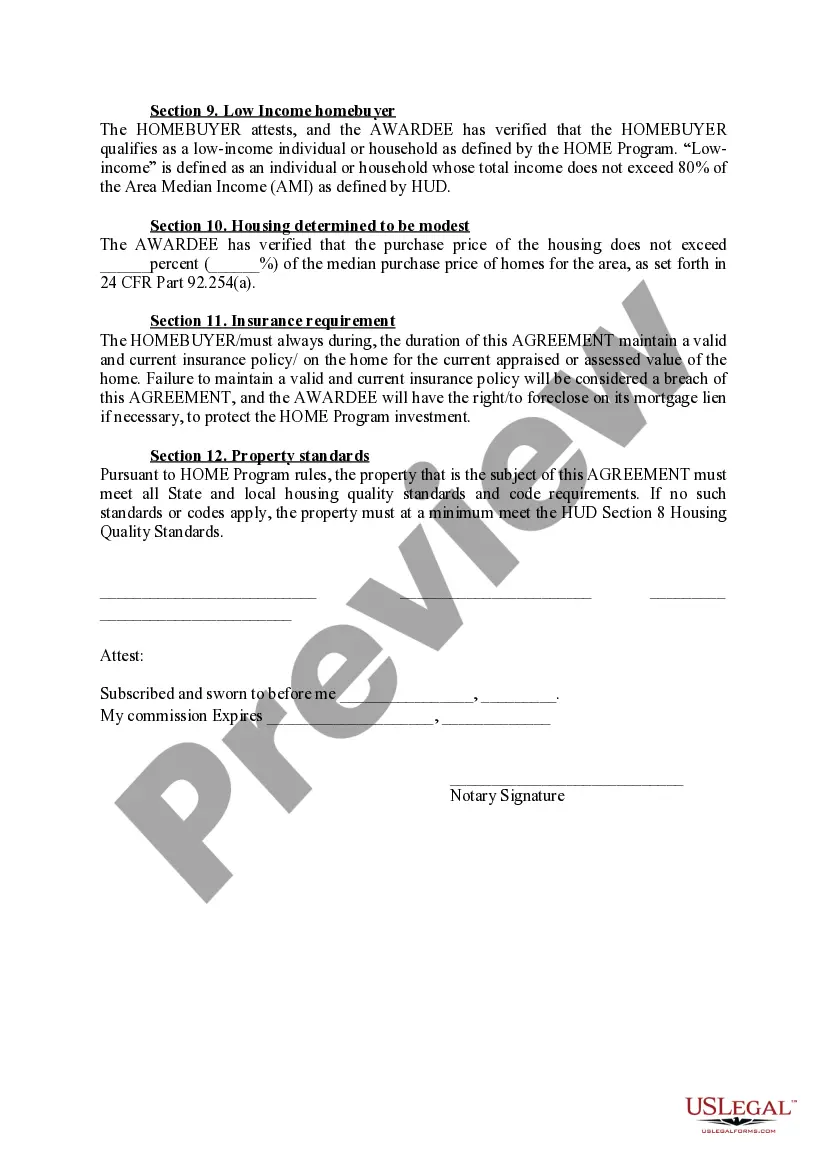

The Oklahoma City Oklahoma Home Program-Homebuyer Written is a comprehensive assistance program aimed at helping potential homebuyers in Oklahoma City achieve their dream of homeownership. This program is specifically designed to provide financial aid and educational resources to low- to moderate-income individuals and families who qualify. Through the program, qualified individuals can access various types of assistance, including down payment and closing cost assistance, mortgage assistance, and rehabilitation loans for home repairs or improvements. The program not only aims to make homeownership more affordable but also offers tools and resources to educate homebuyers on the home buying process, financial management, and overall homeownership responsibilities. Some key features and benefits of the Oklahoma City Oklahoma Home Program-Homebuyer Written include: 1. Down Payment Assistance: Qualified individuals may receive financial aid to cover a portion of the down payment required for purchasing a home. This assistance can significantly reduce the upfront costs and barriers to homeownership. 2. Closing Cost Assistance: The program also provides assistance with closing costs, helping homebuyers with expenses such as loan origination fees, title insurance, and attorney fees. This financial support eases the financial burden associated with closing a real estate transaction. 3. Mortgage Assistance: In certain cases, the program offers mortgage assistance to eligible homebuyers, either in the form of reduced interest rates or lower monthly mortgage payments. This helps make homeownership more affordable over the long term. 4. Rehabilitation Loans: For those who already own a home but require funds for repairs or improvements, the program offers rehabilitation loans. These loans can be utilized to address safety concerns, enhance energy efficiency, or improve overall livability. 5. Homebuyer Education: The Oklahoma City Oklahoma Home Program-Homebuyer Written takes pride in providing thorough educational resources to potential homebuyers. This includes workshops, seminars, and online tools designed to equip individuals with the knowledge and skills necessary to navigate the home buying process successfully. Topics covered may include budgeting, credit management, finding the right home, and understanding loan options. Different types of the Oklahoma City Oklahoma Home Program-Homebuyer Written may vary in terms of eligibility criteria, assistance amounts, and specific program requirements. It is advisable to consult the program's official website or contact their representatives for detailed information on specific types of assistance available and any specific requirements associated with each program.

Oklahoma City Oklahoma Home Program-Homebuyer Written Agreement

Category:

State:

Oklahoma

City:

Oklahoma City

Control #:

OK-LR070T

Format:

Word;

Rich Text

Instant download

Description

The Home Program Assistance is to help make it possible for the Homebuyer to purchase the residence.

The Oklahoma City Oklahoma Home Program-Homebuyer Written is a comprehensive assistance program aimed at helping potential homebuyers in Oklahoma City achieve their dream of homeownership. This program is specifically designed to provide financial aid and educational resources to low- to moderate-income individuals and families who qualify. Through the program, qualified individuals can access various types of assistance, including down payment and closing cost assistance, mortgage assistance, and rehabilitation loans for home repairs or improvements. The program not only aims to make homeownership more affordable but also offers tools and resources to educate homebuyers on the home buying process, financial management, and overall homeownership responsibilities. Some key features and benefits of the Oklahoma City Oklahoma Home Program-Homebuyer Written include: 1. Down Payment Assistance: Qualified individuals may receive financial aid to cover a portion of the down payment required for purchasing a home. This assistance can significantly reduce the upfront costs and barriers to homeownership. 2. Closing Cost Assistance: The program also provides assistance with closing costs, helping homebuyers with expenses such as loan origination fees, title insurance, and attorney fees. This financial support eases the financial burden associated with closing a real estate transaction. 3. Mortgage Assistance: In certain cases, the program offers mortgage assistance to eligible homebuyers, either in the form of reduced interest rates or lower monthly mortgage payments. This helps make homeownership more affordable over the long term. 4. Rehabilitation Loans: For those who already own a home but require funds for repairs or improvements, the program offers rehabilitation loans. These loans can be utilized to address safety concerns, enhance energy efficiency, or improve overall livability. 5. Homebuyer Education: The Oklahoma City Oklahoma Home Program-Homebuyer Written takes pride in providing thorough educational resources to potential homebuyers. This includes workshops, seminars, and online tools designed to equip individuals with the knowledge and skills necessary to navigate the home buying process successfully. Topics covered may include budgeting, credit management, finding the right home, and understanding loan options. Different types of the Oklahoma City Oklahoma Home Program-Homebuyer Written may vary in terms of eligibility criteria, assistance amounts, and specific program requirements. It is advisable to consult the program's official website or contact their representatives for detailed information on specific types of assistance available and any specific requirements associated with each program.

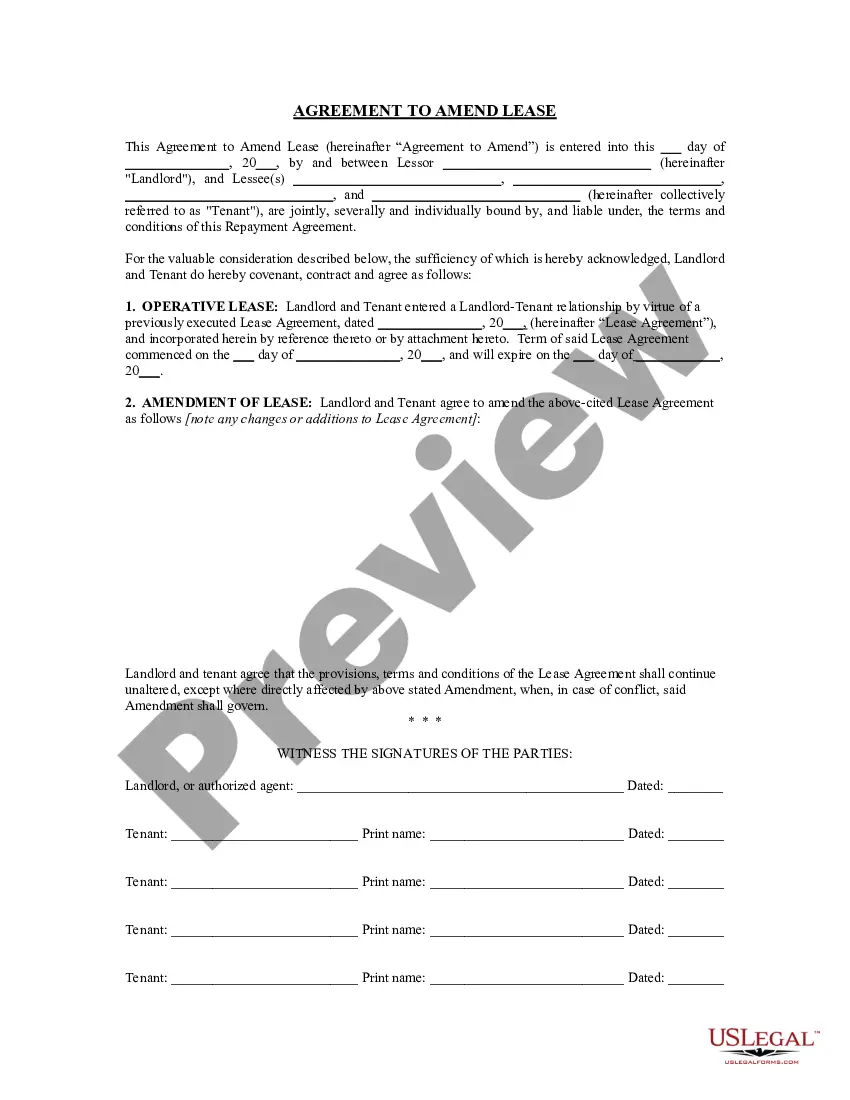

Free preview

How to fill out Oklahoma City Oklahoma Home Program-Homebuyer Written Agreement?

If you’ve already used our service before, log in to your account and save the Oklahoma City Oklahoma Home Program-Homebuyer Written on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Make certain you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Oklahoma City Oklahoma Home Program-Homebuyer Written. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!