A collateral access agreement is a legally binding document that outlines the terms and conditions between a lender and a borrower regarding the borrower's collateral. In the context of Broken Arrow, Oklahoma, the Broken Arrow Oklahoma Collateral Access Agreement specifically pertains to the regulations and guidelines that govern the use and access to collateral within the city. One type of Broken Arrow Oklahoma Collateral Access Agreement is the Real Estate Collateral Access Agreement. This agreement involves the use of real estate assets as collateral, such as residential or commercial properties, and outlines the borrower's rights and obligations regarding the access and use of the property during the loan period. Another type is the Vehicle Collateral Access Agreement, which pertains to the use of vehicles as collateral. This agreement specifies the terms and conditions, including restrictions and regulations, for accessing and utilizing the vehicle during the loan period. Additionally, there may be a Business Collateral Access Agreement, which governs the use of business assets as collateral. This agreement outlines the borrower's rights and responsibilities in utilizing the business assets, such as equipment, inventory, or accounts receivable, to secure the loan. The Broken Arrow Oklahoma Collateral Access Agreement helps protect both the lender's and the borrower's interests by clearly defining the terms for accessing and utilizing collateral during the loan period. It ensures that the lender has the necessary access and control over the collateral while providing guidelines for the borrower's used to prevent any misuse or damage. Key considerations in the Broken Arrow Oklahoma Collateral Access Agreement may include provisions for insurance coverage on collateral, maintenance and upkeep responsibilities, restrictions on transferring the collateral, and consequences for default or non-compliance with the agreement. In summary, the Broken Arrow Oklahoma Collateral Access Agreement is a crucial legal document that establishes the framework for the use and access to collateral in various loan scenarios, such as real estate, vehicles, and business assets. It protects the interests of both the lender and borrower, ensuring clear guidelines for accessing and utilizing collateral throughout the loan period.

Broken Arrow Oklahoma Collateral Access Agreement

State:

Oklahoma

City:

Broken Arrow

Control #:

OK-LR078T

Format:

Word;

Rich Text

Instant download

Description

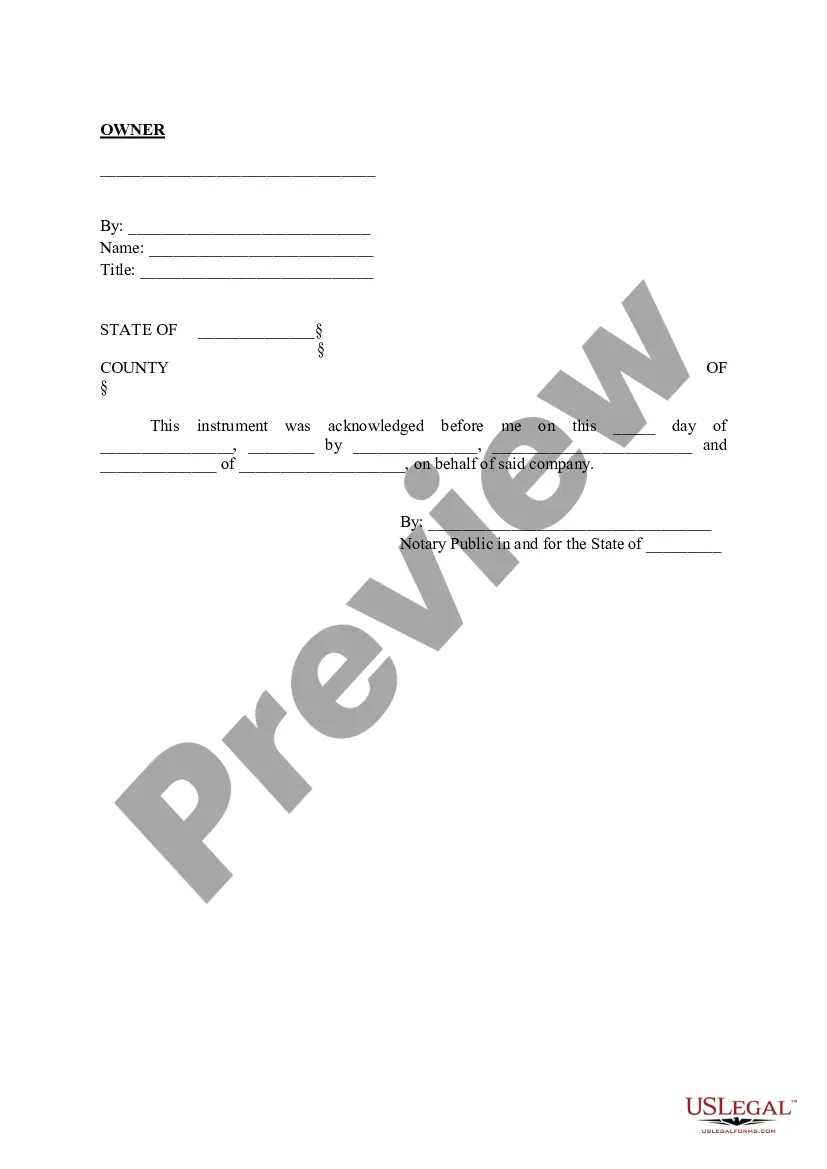

Assignment of Note and Deed of Trust as Security for Debt of Third Party. The collateral is offered as security for a third party's loan when the third party cannot procure the loan based on existing security available, and guarantor wishes to offer security on behalf of third part

A collateral access agreement is a legally binding document that outlines the terms and conditions between a lender and a borrower regarding the borrower's collateral. In the context of Broken Arrow, Oklahoma, the Broken Arrow Oklahoma Collateral Access Agreement specifically pertains to the regulations and guidelines that govern the use and access to collateral within the city. One type of Broken Arrow Oklahoma Collateral Access Agreement is the Real Estate Collateral Access Agreement. This agreement involves the use of real estate assets as collateral, such as residential or commercial properties, and outlines the borrower's rights and obligations regarding the access and use of the property during the loan period. Another type is the Vehicle Collateral Access Agreement, which pertains to the use of vehicles as collateral. This agreement specifies the terms and conditions, including restrictions and regulations, for accessing and utilizing the vehicle during the loan period. Additionally, there may be a Business Collateral Access Agreement, which governs the use of business assets as collateral. This agreement outlines the borrower's rights and responsibilities in utilizing the business assets, such as equipment, inventory, or accounts receivable, to secure the loan. The Broken Arrow Oklahoma Collateral Access Agreement helps protect both the lender's and the borrower's interests by clearly defining the terms for accessing and utilizing collateral during the loan period. It ensures that the lender has the necessary access and control over the collateral while providing guidelines for the borrower's used to prevent any misuse or damage. Key considerations in the Broken Arrow Oklahoma Collateral Access Agreement may include provisions for insurance coverage on collateral, maintenance and upkeep responsibilities, restrictions on transferring the collateral, and consequences for default or non-compliance with the agreement. In summary, the Broken Arrow Oklahoma Collateral Access Agreement is a crucial legal document that establishes the framework for the use and access to collateral in various loan scenarios, such as real estate, vehicles, and business assets. It protects the interests of both the lender and borrower, ensuring clear guidelines for accessing and utilizing collateral throughout the loan period.

Free preview

How to fill out Broken Arrow Oklahoma Collateral Access Agreement?

If you’ve already utilized our service before, log in to your account and save the Broken Arrow Oklahoma Collateral Access Agreement on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Make sure you’ve found a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Broken Arrow Oklahoma Collateral Access Agreement. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!