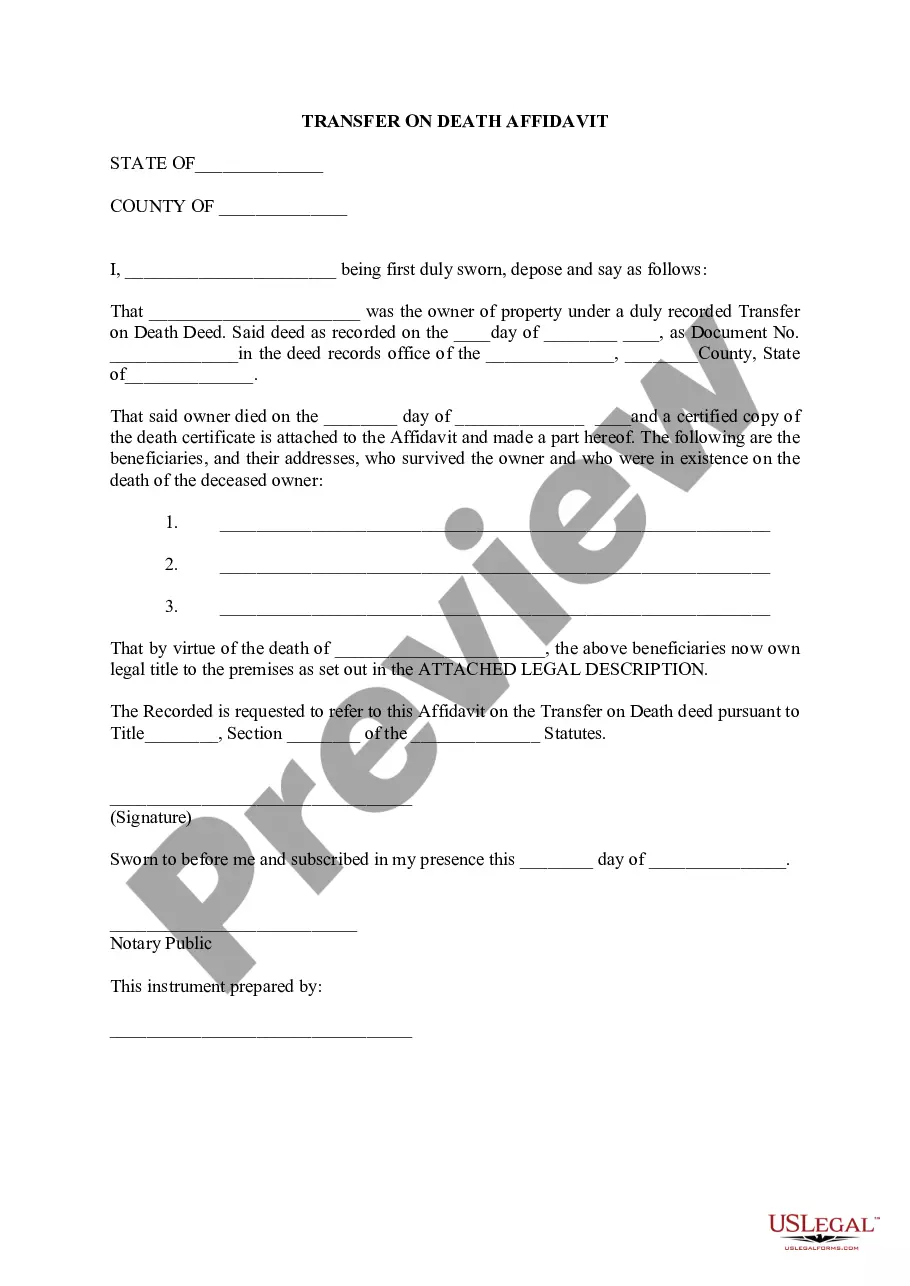

Oklahoma City Oklahoma Transfer on Death Affidavit

Description

How to fill out Oklahoma Transfer On Death Affidavit?

Locating authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal documents for both personal and business requirements and various real-world scenarios.

All the paperwork is accurately categorized by application area and jurisdiction, making it as simple as ABC to search for the Oklahoma City Oklahoma Transfer on Death Affidavit.

Maintaining your documentation organized and in compliance with legal standards is crucial. Utilize the US Legal Forms repository to always have necessary document templates for any requirements readily available!

- Examine the Preview mode and form details.

- Ensure you’ve selected the correct one that fulfills your requirements and fully aligns with your local jurisdiction standards.

- Look for an alternative template if necessary.

- If you spot any discrepancies, use the Search tab above to find the appropriate version.

- If it meets your needs, advance to the subsequent step.

Form popularity

FAQ

In order to remove the name of the deceased, Form DJP (Deceased Joint Proprietor) must be completed and filed along with a copy of the death certificate. There is no requirement to show the Grant of Representation to the Land Registry, which means updating the title deed can be done soon after death.

An Oklahoma small estate affidavit is a document that is used by a person to claim a right to the property of a deceased person, known as a decedent. The filer, known as the ?affiant?, has to file this affidavit with the individual or entity that has control over the property itself.

The only way to change the title to a house is to get an order from a court in a probate case. In Oklahoma, there is, however, another situation where no court order is required: If the house is owned in joint tenancy between two or people, with a right of survivorship.

An Oklahoma deed is a legal form that can be used to transfer interests in real property, or land and buildings, from one owner to another. Deeds are required to list the seller (grantor) and the buyer (grantee), legal description of the property, and a notary acknowledgment.

Living trusts In Oklahoma, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Include the property address and its legal description, and identify by name the grantor(s) and the grantee(s). Make copies of the deed and record the deed transfer with the assessor's office in the county where the property is located.

Most often, a copy of the deceased spouse's death certificate, the notarized death affidavit, and a legal description of the property are required. Once these steps are complete, your deceased spouse will have been removed and you will be the sole owner on the deed.

A quitclaim deed effectively transfers whatever interest the current owner can transfer when signing the deed?including any interest that vests in the future. The new owner, though, cannot sue the current owner for breach of warranty if the transferred interest ends up being invalid or flawed.

You will have to file an application to the land registry. They will require evidence of death, i.e. death certificate or a will. You will have to go to the office of revenue officer and submit an application to transfer title in the surviving co-owners name or surviving heirs name.

All parties just need to sign the transfer deed (TR1 form) and file it with the land registry. This needs to be accompanied by the land registry's AP1 form, and if the value of the transaction amounts to more than £40,000, then a stamp duty land tax certificate may also be required.