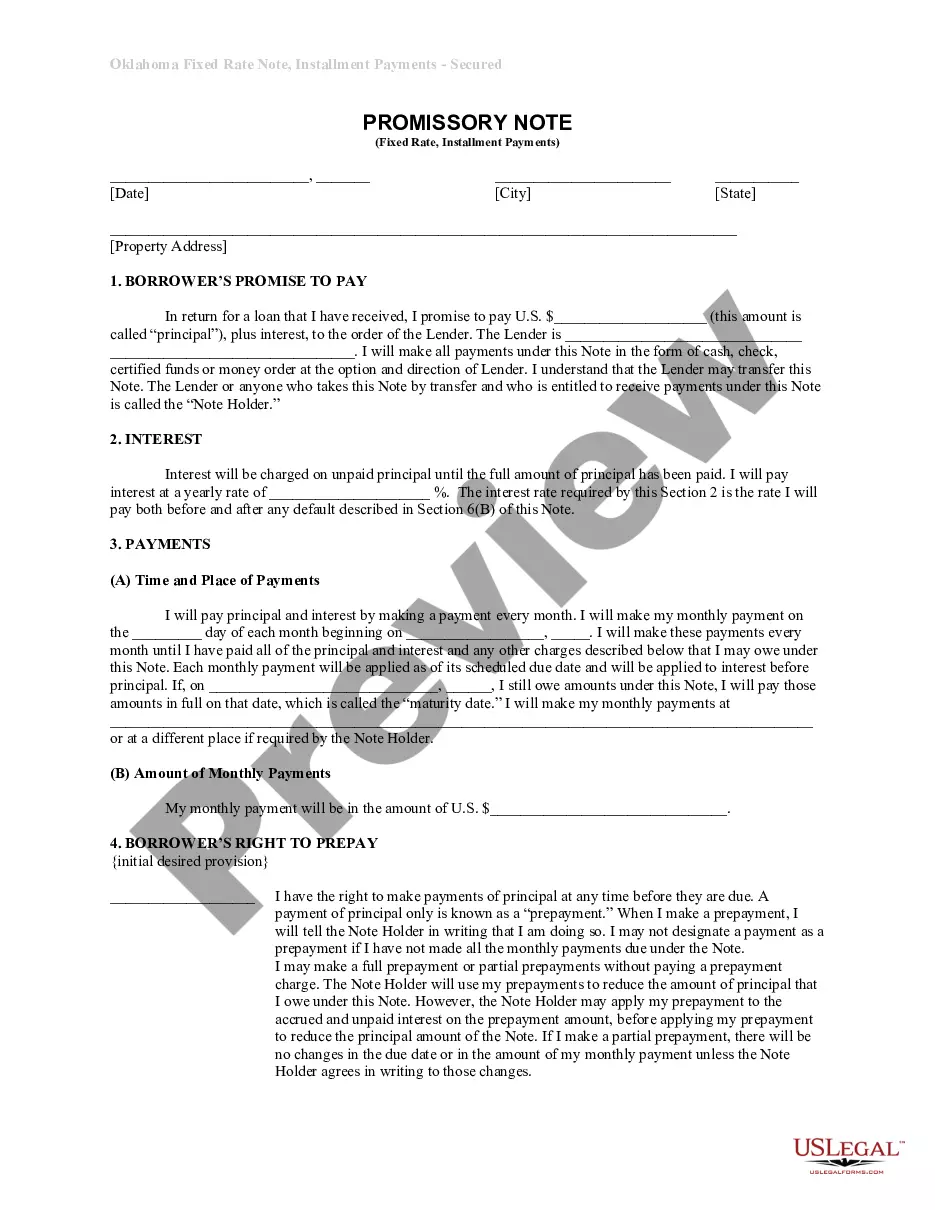

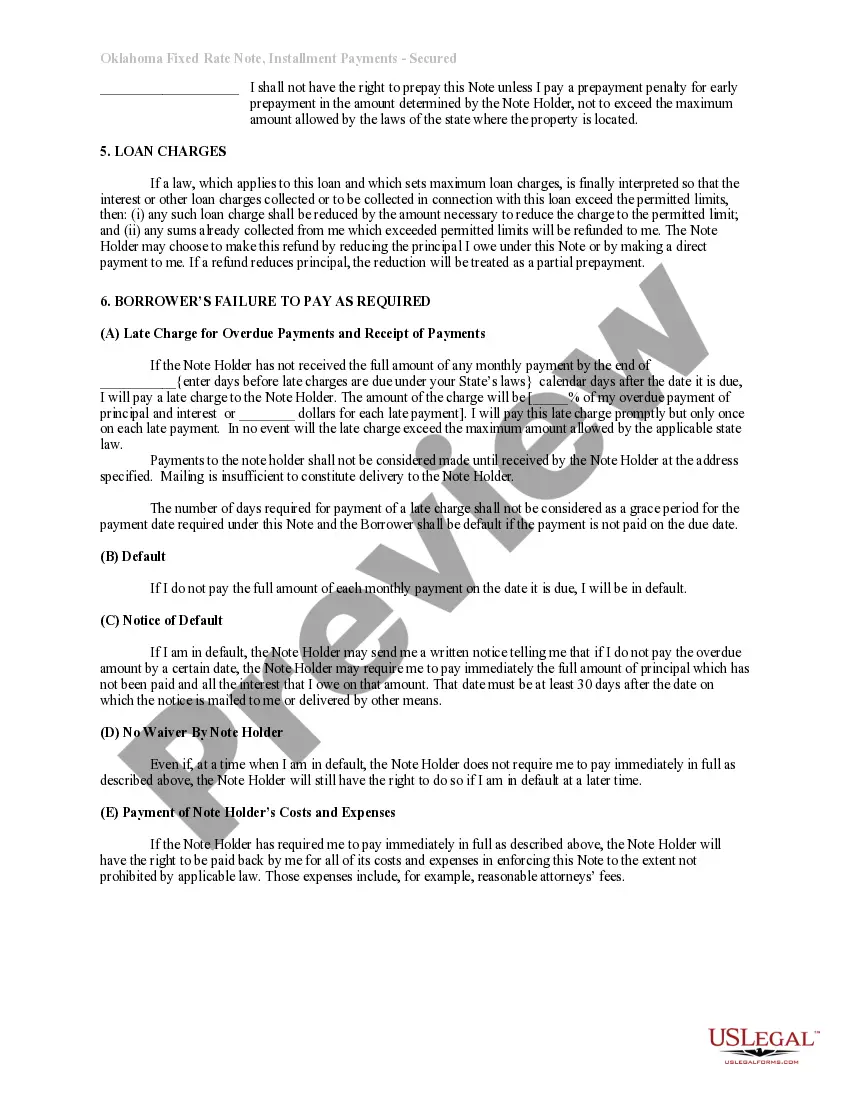

A Broken Arrow Oklahoma Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that establishes a binding agreement between a borrower and a lender in Broken Arrow, Oklahoma. It outlines the terms and conditions of a loan agreement where the borrower agrees to repay the loan amount in regular installments over a fixed period, with the loan being secured by residential real estate property. These promissory notes serve as a form of collateral to the lender, ensuring repayment of the loan. The terms of the promissory note typically include the loan amount, interest rate, repayment schedule, late payment penalties, and default provisions. By having the note secured by residential real estate, the lender can claim ownership of the property if the borrower fails to fulfill their loan repayment obligations. Different types of Broken Arrow Oklahoma Installments Fixed Rate Promissory Notes Secured by Residential Real Estate may include: 1. Residential Mortgage Promissory Note: This kind of promissory note is used when the loan is specifically meant for residential real estate, such as a single-family home, townhouse, or condominium. The borrower agrees to repay the loan according to the terms set forth in the note, with the residential property serving as collateral. 2. Home Equity Loan Promissory Note: In this type of promissory note, the borrower uses their existing residential real estate property as collateral to secure the loan. It is commonly used when individuals need funds for home improvements, debt consolidation, or other personal expenses. 3. Construction Loan Promissory Note: This particular promissory note applies when borrowers seek financing for the construction of a residential property. The note establishes the terms for the loan, which may include scheduled disbursements, interest rates, and repayment periods, with the property acting as collateral until the construction is complete. 4. Refinance Promissory Note: When borrowers choose to refinance their existing loan on a residential property in Broken Arrow, they will enter into a refinancing promissory note. This note replaces the original loan agreement, often featuring more favorable terms such as a lower interest rate or longer repayment period. In conclusion, Broken Arrow Oklahoma Installments Fixed Rate Promissory Notes Secured by Residential Real Estate are legally binding agreements that dictate the terms of a loan between a borrower and lender. They help ensure repayment by using residential real estate property as collateral. Various types of these promissory notes exist, including residential mortgage notes, home equity loan notes, construction loan notes, and refinance notes.

Broken Arrow Oklahoma Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Broken Arrow Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Benefit from the US Legal Forms and get immediate access to any form sample you require. Our useful website with a large number of documents makes it easy to find and get almost any document sample you want. It is possible to export, fill, and certify the Broken Arrow Oklahoma Installments Fixed Rate Promissory Note Secured by Residential Real Estate in a couple of minutes instead of browsing the web for hours looking for an appropriate template.

Using our collection is a superb strategy to improve the safety of your record filing. Our professional attorneys regularly check all the documents to make sure that the templates are appropriate for a particular state and compliant with new acts and regulations.

How do you get the Broken Arrow Oklahoma Installments Fixed Rate Promissory Note Secured by Residential Real Estate? If you have a profile, just log in to the account. The Download option will appear on all the samples you view. Moreover, you can find all the previously saved files in the My Forms menu.

If you haven’t registered an account yet, follow the tips below:

- Open the page with the form you need. Make certain that it is the template you were hoping to find: verify its title and description, and make use of the Preview feature if it is available. Otherwise, use the Search field to find the appropriate one.

- Launch the downloading process. Click Buy Now and choose the pricing plan you prefer. Then, create an account and pay for your order with a credit card or PayPal.

- Export the document. Indicate the format to obtain the Broken Arrow Oklahoma Installments Fixed Rate Promissory Note Secured by Residential Real Estate and modify and fill, or sign it for your needs.

US Legal Forms is among the most considerable and trustworthy form libraries on the internet. Our company is always ready to assist you in virtually any legal case, even if it is just downloading the Broken Arrow Oklahoma Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

Feel free to make the most of our form catalog and make your document experience as straightforward as possible!