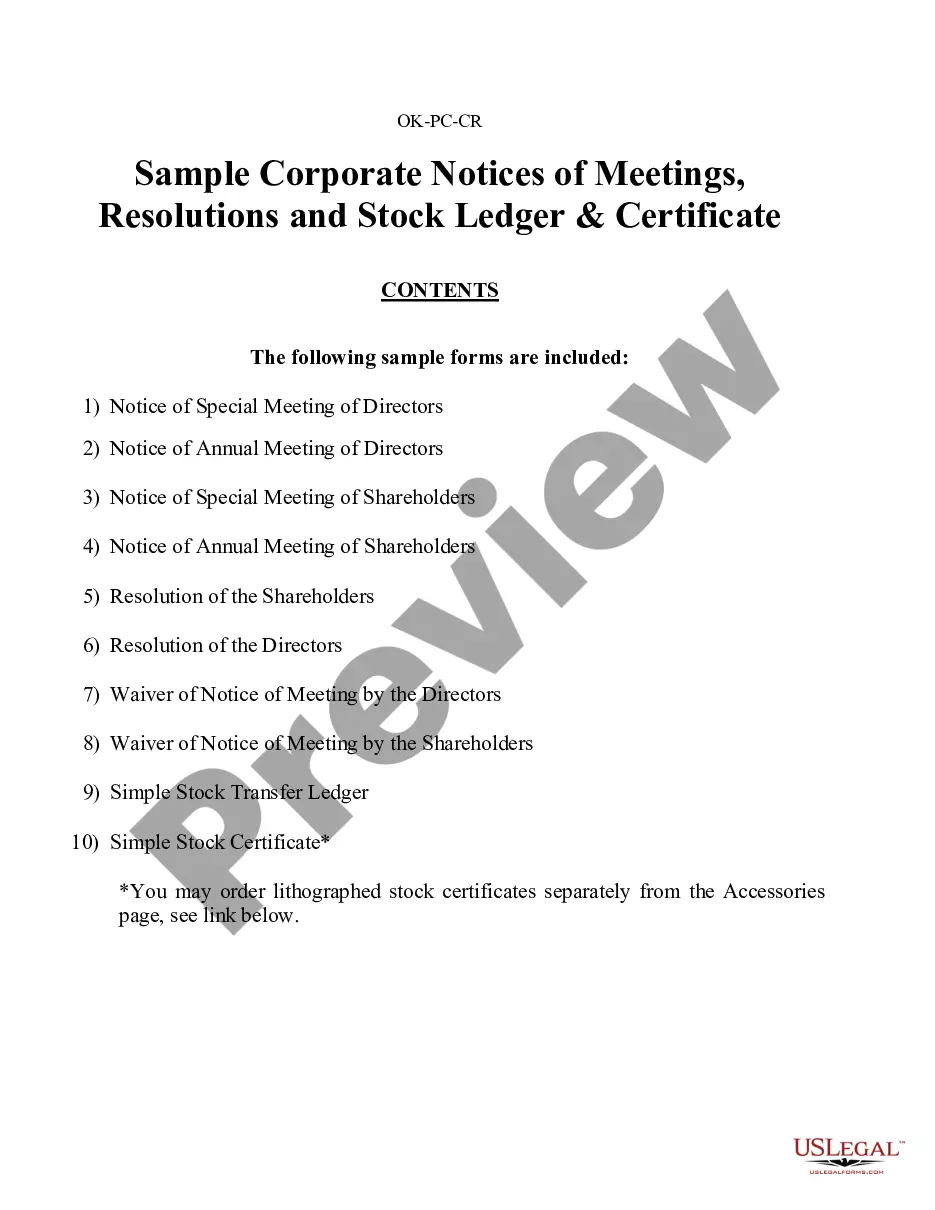

Oklahoma City Sample Corporate Records for an Oklahoma Professional Corporation

Description

How to fill out Sample Corporate Records For An Oklahoma Professional Corporation?

We continually aim to diminish or avert legal harm when addressing intricate legal or financial issues.

To achieve this, we enroll in legal services that, typically, are exceedingly costly.

However, not all legal matters are as complicated.

Many of them can be handled by ourselves.

Utilize US Legal Forms whenever you require to locate and download the Oklahoma City Sample Corporate Records for an Oklahoma Professional Corporation or any other document swiftly and securely.

- US Legal Forms is an online repository of current DIY legal documents ranging from wills and powers of attorney to incorporation articles and dissolution petitions.

- Our platform enables you to take control of your matters without the necessity of using legal agent services.

- We provide access to legal document templates that aren’t always readily accessible.

- Our templates are specific to states and regions, which greatly simplifies the search process.

Form popularity

FAQ

The Oklahoma Secretary of State charges a $100 fee to file the Articles of Organization. You can reserve your business name by filing an LLC name reservation for $10. Oklahoma LLCs are also required to file an Annual Certificate each year, the fee for which is $25.

You can find information on any corporation or business entity in Oklahoma or another state by performing a search on the Secretary of State website of the state or territory where that corporation is registered.

Oklahoma. To obtain copies of your company's articles of incorporation or articles of organization, visit Oklahoma's Secretary of State's website.

How to Form a Corporation in 11 Steps Choose a Business Name. Register a DBA. Appoint Directors. File Your Articles of Incorporation. Write Your Corporate Bylaws. Draft a Shareholder Agreement. Hold Initial Board of Directors Meeting. Issue Stock.

Business Licensing + Operating Requirements. In Oklahoma, there is no general license required to start or own a business. However, for specific types of businesses and occupations, licenses, permits, or special registrations and filings may be required before opening or operating.

Articles of organization are part of a formal legal document used to establish a limited liability company (LLC) at the state level. The materials are also used to create the rights, powers, duties, liabilities, and other obligations between each member of an LLC and also between the LLC and its members.

You can download the Oklahoma Certificate of Incorporation form from the Oklahoma Secretary of State website....Online Under ?Domestic Organizations,? select ?Domestic Profit Corporation.? Enter your name and email address. Complete the Oklahoma Certificate of Incorporation. Submit and pay the filing fee.

To start a corporation in Oklahoma, you'll need to do three things: appoint a registered agent, choose a name for your business, and file a Certificate of Incorporation with the Secretary of State. You can file this document online, by mail, or in person. The certificate costs a minimum of $50 to file.

An articles of organization form is the document that one must complete and submit to the state to establish the creation of an LLC within Oklahoma. It sets forth the name of the proposed company and contact information for its registered agent, among other details.

Option 1: File online with the Oklahoma Secretary of State. Then, fill out the required fields and submit. Option 2: Download and mail in the Articles of Organization PDF to the Oklahoma Secretary of State or submit it in-person.