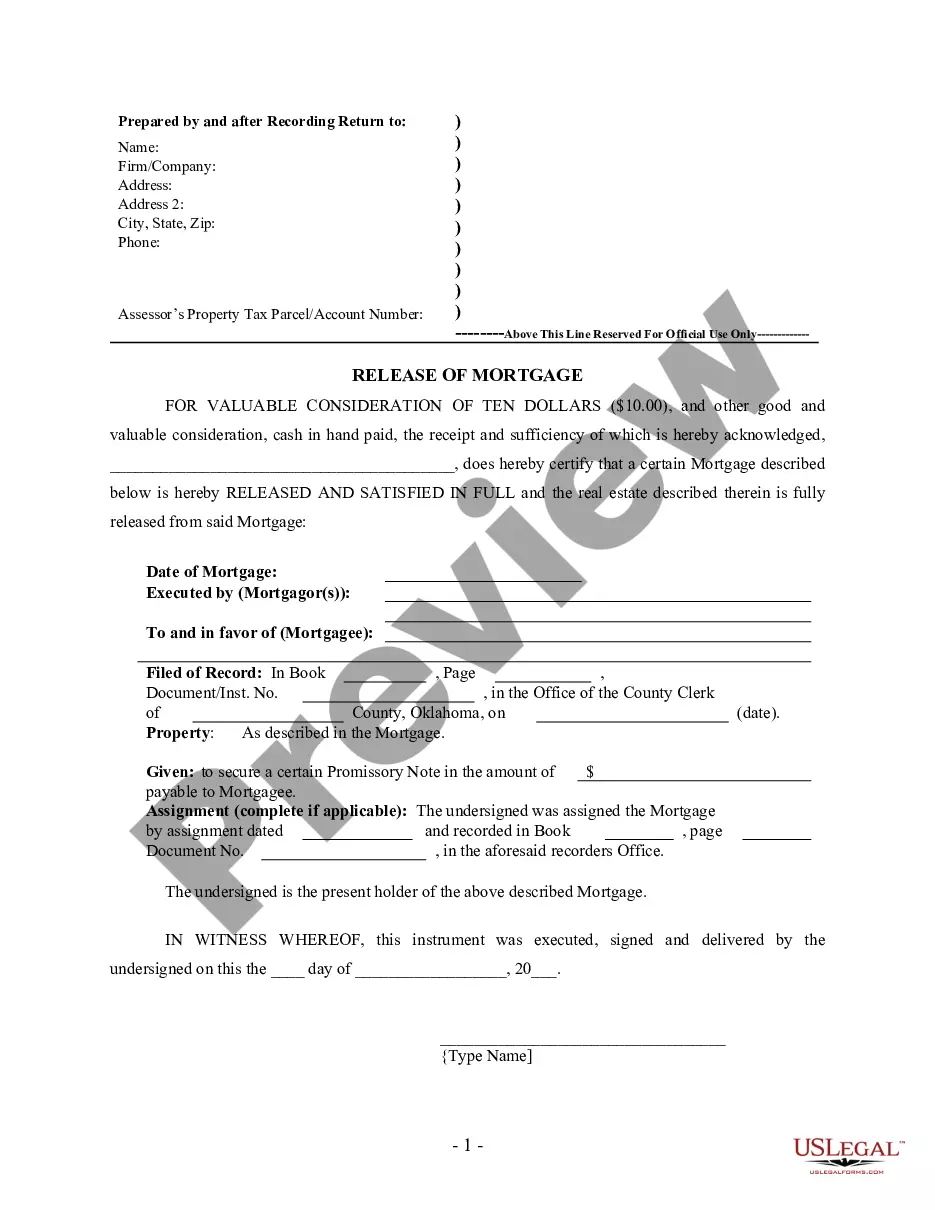

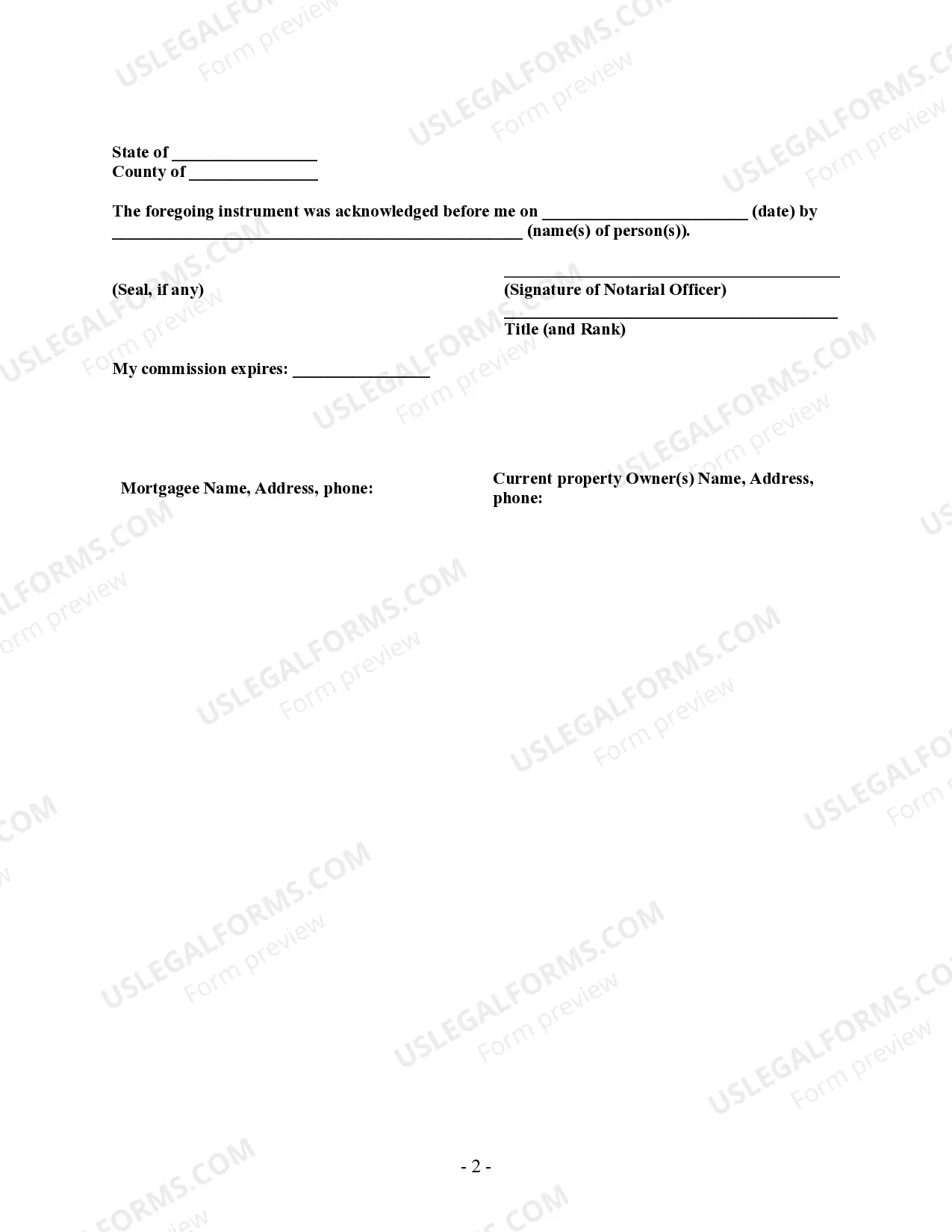

Oklahoma City, Oklahoma Satisfaction Cancellation — Release of Mortgage is a legal document that indicates the complete repayment and satisfaction of a mortgage loan. It serves as proof that the borrower has fulfilled all the financial obligations associated with the mortgage and the lender or holder has released their claim on the property. This document showcases the termination of the mortgage lien on the property and enables the borrower to gain full ownership rights. Keywords: Oklahoma City, Oklahoma Satisfaction Cancellation, Release of Mortgage, Individual Lender, Holder, repayment, satisfaction, mortgage loan, legal document, proof, financial obligations, termination, lien, property, ownership rights. Types of Oklahoma City, Oklahoma Satisfaction Cancellation — Releasmortgageag— - Individual Lender or Holder: 1. Full Satisfaction Cancellation: This type of satisfaction cancellation is issued when the borrower has successfully repaid the entire mortgage loan amount and any associated interest. It signifies that the debt has been fully satisfied, releasing the borrower from any further monetary obligations. 2. Partial Satisfaction Cancellation: This type of satisfaction cancellation is utilized when the borrower repays a portion of the mortgage loan ahead of schedule. It acknowledges the partial discharge of the debt while still maintaining a remaining balance. 3. Prepayment Satisfaction Cancellation: When the borrower decides to pay off the mortgage loan earlier than the agreed-upon term, a prepayment satisfaction cancellation is issued. It confirms the early release of the mortgage lien on the property, providing the borrower with the opportunity to fully own the property without any pending mortgage obligations. 4. Refinance Satisfaction Cancellation: In cases where the borrower refinances their mortgage loan with a new lender, a refinancing satisfaction cancellation is employed. It verifies the full repayment of the existing mortgage loan and the transition of the mortgage lien from the previous lender to the new mortgage holder. 5. Individual Lender Satisfaction Cancellation: Sometimes, an individual or private lender provides the mortgage loan instead of a financial institution. In such cases, an individual lender satisfaction cancellation is used to release the mortgage lien and confirm the satisfaction of the debt between the borrower and the individual lender. 6. Holder Satisfaction Cancellation: Similar to the individual lender satisfaction cancellation, the holder satisfaction cancellation is used when the mortgage loan is held by an entity other than a financial institution. It represents the release of the mortgage lien held by the designated mortgage holder, confirming the satisfaction of the debt. Whether it is a full satisfaction cancellation, partial satisfaction cancellation, prepayment satisfaction cancellation, refinance satisfaction cancellation, individual lender satisfaction cancellation, or holder satisfaction cancellation, each of these variations signifies the release of mortgage obligations and the restoration of full property ownership rights to the borrower.

Oklahoma City Oklahoma Satisfaction Cancellation - Release of Mortgage - Individual Lender or Holder

Description

How to fill out Oklahoma City Oklahoma Satisfaction Cancellation - Release Of Mortgage - Individual Lender Or Holder?

We always strive to reduce or avoid legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we apply for legal services that, as a rule, are very costly. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of an attorney. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Oklahoma City Oklahoma Satisfaction Cancellation - Release of Mortgage - Individual Lender or Holder or any other document easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is just as easy if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Oklahoma City Oklahoma Satisfaction Cancellation - Release of Mortgage - Individual Lender or Holder adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Oklahoma City Oklahoma Satisfaction Cancellation - Release of Mortgage - Individual Lender or Holder would work for you, you can choose the subscription plan and make a payment.

- Then you can download the document in any available format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!