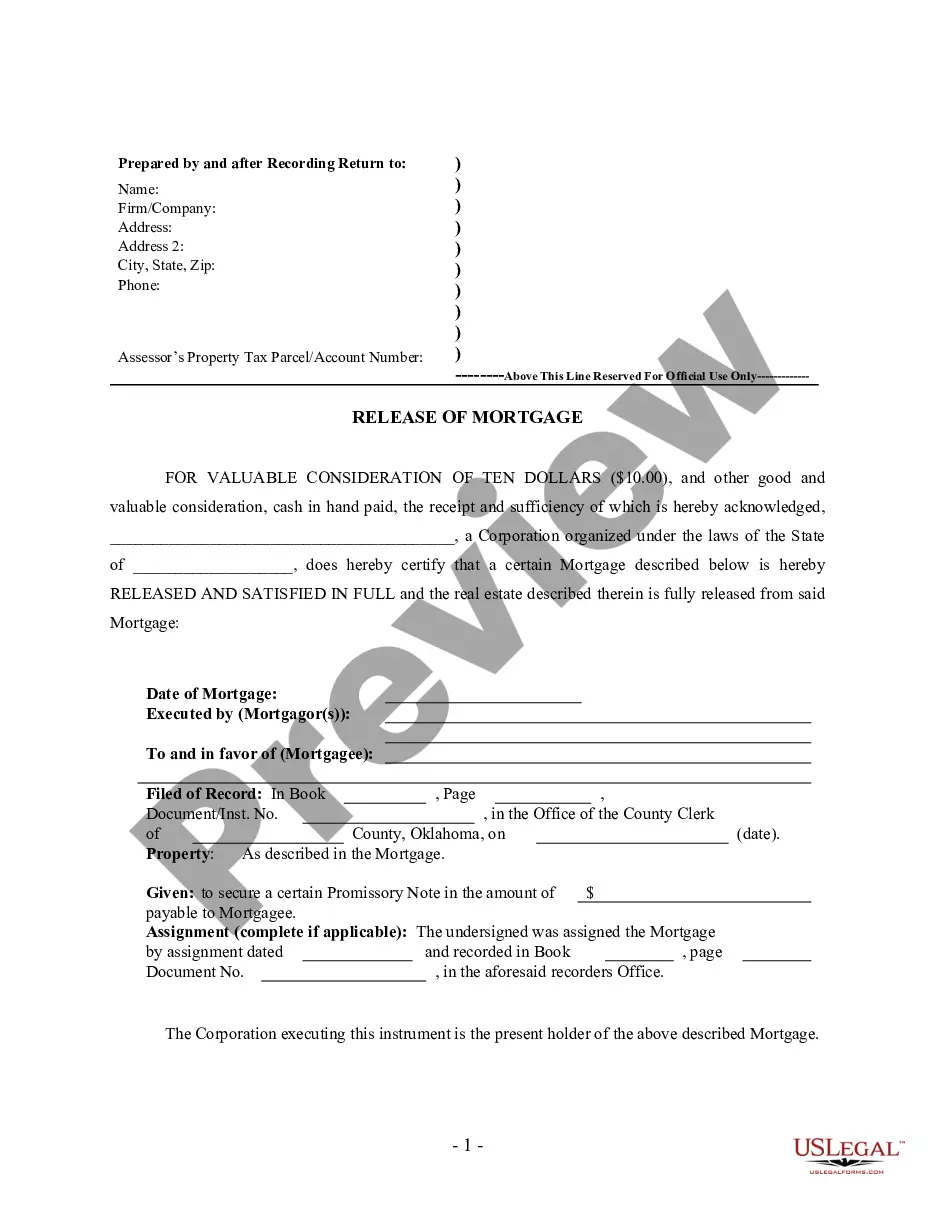

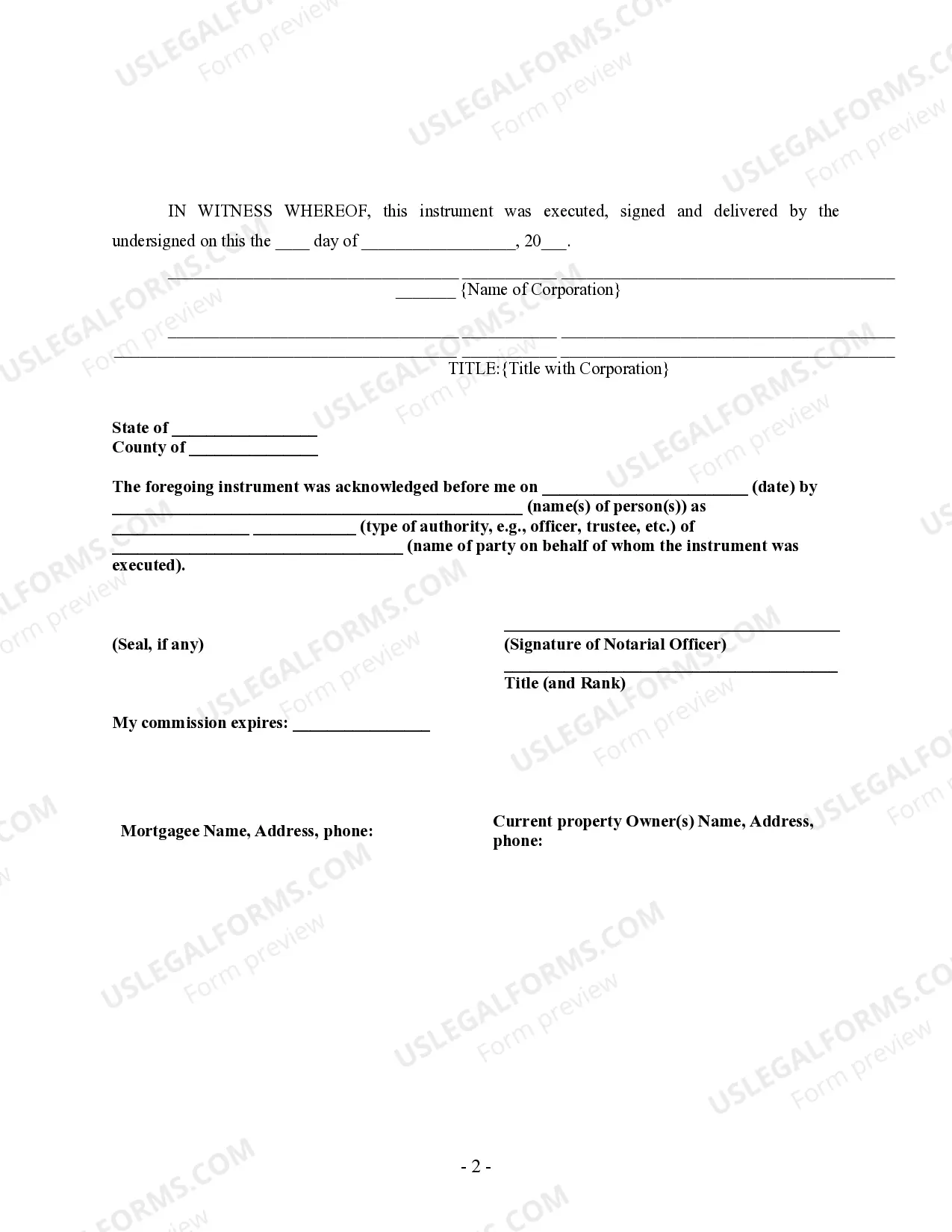

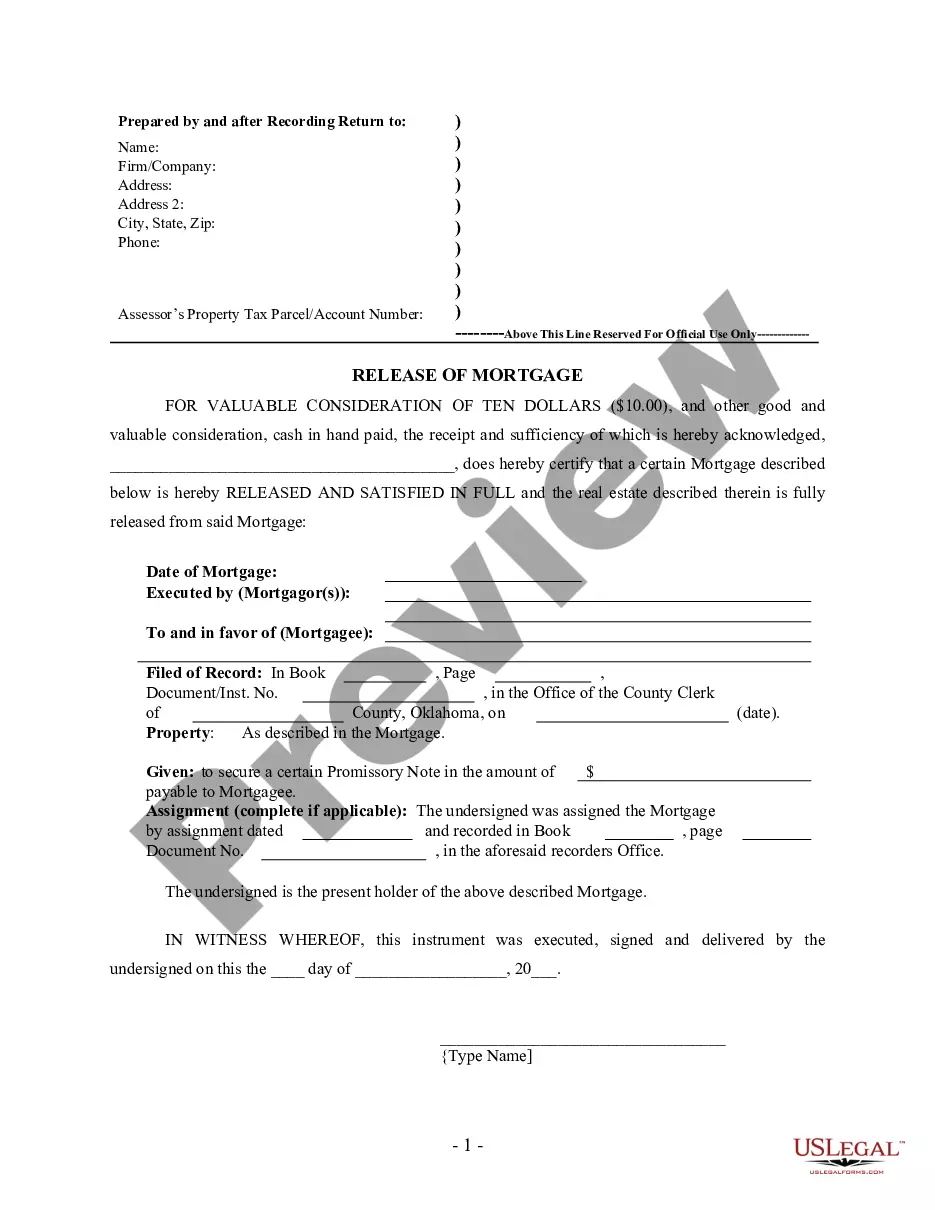

Title: Exploring Broken Arrow, Oklahoma Satisfaction Cancellation — Releasmortgageag— - by Corporate Lender Introduction: In Broken Arrow, Oklahoma, homeowners may encounter the need for a Satisfaction Cancellation — Releasmortgageag— - by Corporate Lender. This legal document plays a key role in releasing a property from its mortgage obligations. In this article, we will discuss what this document entails, its significance, and potential types of Satisfaction Cancellation — Releasmortgageag— - by Corporate Lender that exist in Broken Arrow. 1. Understanding the Satisfaction Cancellation — Releasmortgageag— - by Corporate Lender: The Satisfaction Cancellation — Releasmortgageag— - by Corporate Lender is a document issued by a corporate lender to acknowledge that the mortgage loan has been paid in full, releasing the property and any associated liens. This document signifies the completion of mortgage obligations and provides legal proof of the borrower's satisfaction of their debt. 2. Importance of Satisfaction Cancellation — Releasmortgageag— - by Corporate Lender: Obtaining a Satisfaction Cancellation — Releasmortgageag— - by Corporate Lender is crucial for homeowners as it serves as proof that their property is no longer encumbered by the mortgage. This document is vital when selling a property, applying for a new mortgage, or seeking future financial transactions using the property as collateral. 3. Types of Satisfaction Cancellation — Releasmortgageag— - by Corporate Lender: While specific types of Satisfaction Cancellation — Releasmortgageag— - by Corporate Lender may vary, depending on individual cases, the following are some common types one may find in Broken Arrow, Oklahoma: a. Voluntary Satisfaction Cancellation — Release of Mortgage: This type occurs when a borrower has successfully repaid the mortgage loan by fulfilling all the agreed-upon terms, resulting in the lender issuing the release document. Homeowners who complete their mortgage payments on time can expect voluntary Satisfaction Cancellation — Release of Mortgage from the corporate lender. b. Paid-in-Full Satisfaction Cancellation — Release of Mortgage: This type is issued when the borrower has fully paid off the loan balance, including principal, interest, and any accrued fees. A paid-in-full Satisfaction Cancellation — Release of Mortgage provides homeowners with the evidence they need to show their property is free from any mortgage obligations. c. Refinance Satisfaction Cancellation — Release of Mortgage: When a borrower refinances their mortgage with a new lender, the corporate lender of the previous loan will issue a refinancing Satisfaction Cancellation — Release of Mortgage. This document acknowledges the payoff of the previous loan and the replacement of the mortgage lien with a new lender's lien. Conclusion: Obtaining a Satisfaction Cancellation — Releasmortgageag— - by Corporate Lender is crucial for homeowners in Broken Arrow, Oklahoma, as it confirms the successful completion of mortgage obligations and releases the property from any encumbrances. Understanding the different types of satisfaction cancellations empowers homeowners with the necessary knowledge when dealing with mortgage-related transactions.

Broken Arrow Oklahoma Satisfaction Cancellation - Release of Mortgage - by Corporate Lender

Description

How to fill out Broken Arrow Oklahoma Satisfaction Cancellation - Release Of Mortgage - By Corporate Lender?

No matter the social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Too often, it’s practically impossible for a person with no law education to create such papers from scratch, mainly because of the convoluted jargon and legal nuances they come with. This is where US Legal Forms comes in handy. Our service offers a massive library with more than 85,000 ready-to-use state-specific forms that work for almost any legal case. US Legal Forms also is an excellent resource for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you require the Broken Arrow Oklahoma Satisfaction Cancellation - Release of Mortgage - by Corporate Lender or any other document that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Broken Arrow Oklahoma Satisfaction Cancellation - Release of Mortgage - by Corporate Lender quickly using our reliable service. In case you are presently a subscriber, you can go ahead and log in to your account to get the appropriate form.

Nevertheless, in case you are new to our library, make sure to follow these steps before obtaining the Broken Arrow Oklahoma Satisfaction Cancellation - Release of Mortgage - by Corporate Lender:

- Ensure the template you have chosen is specific to your location since the regulations of one state or area do not work for another state or area.

- Review the document and go through a brief description (if provided) of scenarios the paper can be used for.

- In case the one you chosen doesn’t meet your requirements, you can start over and search for the suitable form.

- Click Buy now and pick the subscription plan that suits you the best.

- with your login information or create one from scratch.

- Select the payment gateway and proceed to download the Broken Arrow Oklahoma Satisfaction Cancellation - Release of Mortgage - by Corporate Lender once the payment is through.

You’re good to go! Now you can go ahead and print the document or complete it online. In case you have any issues locating your purchased forms, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.